Press release

, François-Xavier Branthôme

EU trade balance for the tomato paste sector: is there any justification for the request submitted by the Netherlands to open a zero-duty quota? According to TomatoEurope, "an unjustified tariff quota could cause great damage to the European tomato processing industry."

The Netherlands have asked the European Commission to grant a tariff quota to allow the import of tomato paste on a duty-free basis. In order to consent to this request, the European Commission must validate the existence of two conditions: the products covered by the request are not produced in sufficient quantities within the European Union and, secondly, they must be intended for further processing operations prior to being re-exported outside the EU.

This would be a quota of more than 23,000 tonnes of tomato paste per year, for which the Netherlands have applied on the grounds that EU production is not considered sufficient to meet demand. The European association of tomato processors TomatoEurope and the Coldiretti have opposed this request (see additional information at the end of this article), on the grounds that there is no shortage of processing tomato production within the Union sufficient to justify the granting of a zero-duty import quota. It should also be taken into account that the price of imported product, even if it is subject to a duty, is significantly lower than the price of European production.

If the EU accepts this request, the Coldiretti believes that a "very dangerous precedent" would be set that could open the door to systematic and unjustified use of this procedure. The difference in price cannot be considered a valid reason for deviating from the pre-established limits. If the European industry is able to meet the needs of the internal market – regardless of possible price increases – the option of requesting a tariff quota automatically lapses.

The requested quota represents a quantity of 23,340 mT of tomato paste (under product identification code CN 2002903100):

Tomato paste with a dry matter content of 25% or more, but not more than 30%,

Tomato paste with a dry matter content of 25% or more, but not more than 30%, with a Brix value of 27 or more but not more than 29 (according to EU Reg. 974/2014),

with a Brix value of 27 or more but not more than 29 (according to EU Reg. 974/2014), with a Bostwick viscosity of 1.0 cm or more, but not more than 3.0 cm (measured at 12.5°Brix for 30 seconds, at 20°C),

with a Bostwick viscosity of 1.0 cm or more, but not more than 3.0 cm (measured at 12.5°Brix for 30 seconds, at 20°C), with a serum viscosity of 4.0 cSt or more,

with a serum viscosity of 4.0 cSt or more, in immediate bulk packaging of 1250 kg or more, but not more than 1350 kg, for use in the production of tomato ketchup.

in immediate bulk packaging of 1250 kg or more, but not more than 1350 kg, for use in the production of tomato ketchup.

According to the information provided by TomatoEurope, the Member States can approve the suspension of the tariff only by consensus of all 27. Otherwise, the request is rejected.

Statistical data

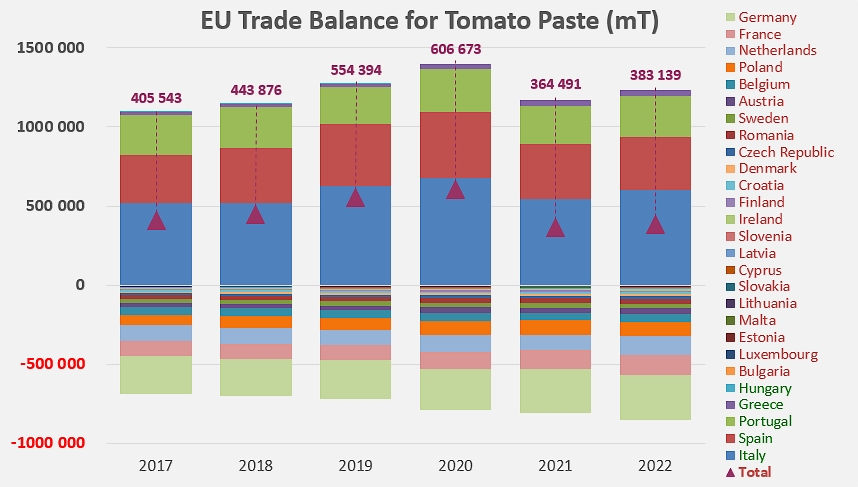

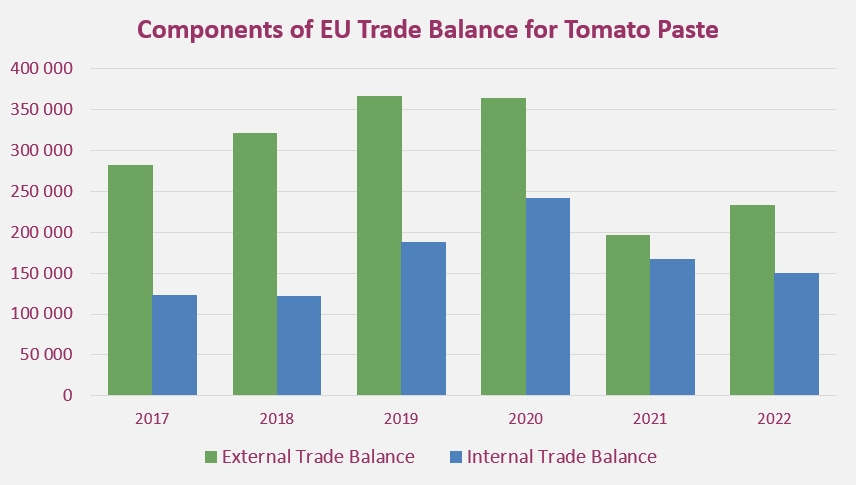

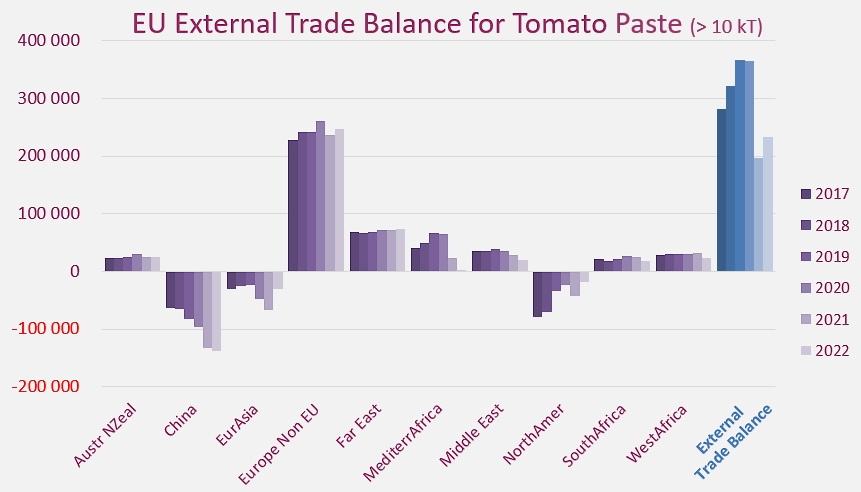

According to trade data provided by the customs services of the countries concerned, the trade balance (exports/imports) of all 27 EU Member States for tomato pastes has been recording in large surplus for a long time. Over the last five years, this surplus, which includes intra- and extra-EU trade, has averaged 470,000 metric tonnes (mT) of finished products, the production of which has absorbed approximately 2.8 million tonnes of raw tomatoes.

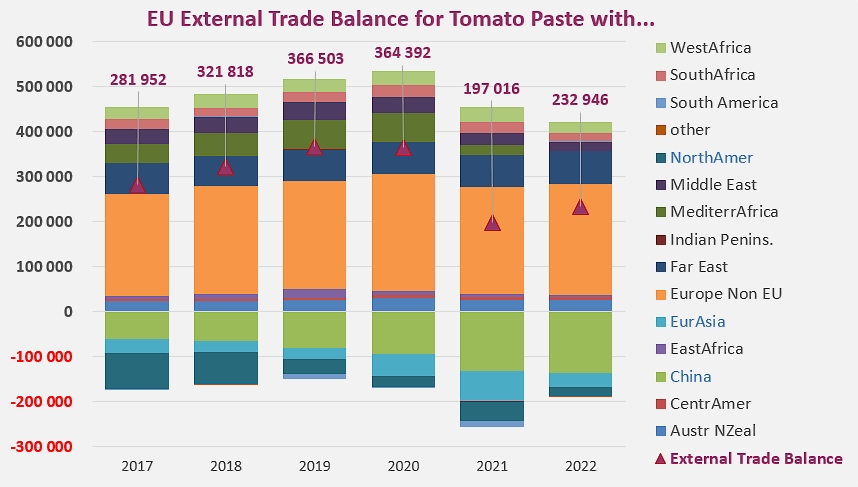

Over this five-year period, the foreign component of the surplus, i.e. the EU trade balance for tomato pastes (CN codes 200290) with third-party countries, has been very largely positive, since the net quantities exported annually in this sector have amounted to more than 300,000 mT of finished products, equivalent to about 1.8 million mT of raw tomato (or, roughly, the combined annual production of the Portuguese and Greek industries between 2018 and 2022).

Over the reference period, only four countries exported more to the EU than they imported from the EU: China, with an average of more than 100,000 mT of finished products per year and a net increase in recent years; Turkey and Ukraine with an average yearly total of a little less than 40,000 mT of products; and the USA with an annual average of around 38,000 mT but in very sharp decline since 2018.

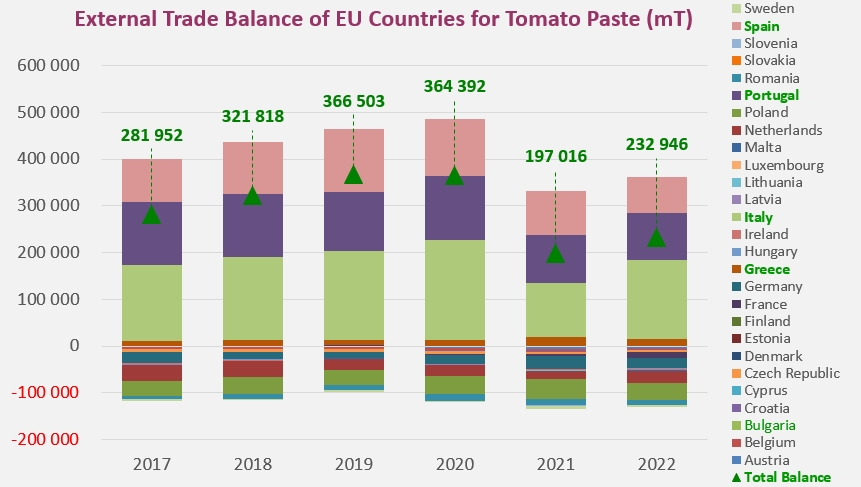

The main players in this success outside the EU's borders are, unsurprisingly, the Italian, Portuguese, Spanish and Greek industries and, very occasionally, to a much lesser extent, Bulgarian operators, even Cypriot and French ones.

In a context of slow growth recorded by the processing sector at the European level, the significant drop in the foreign trade balance of "tomato pastes" observed over the last two years is the result of the combined effects of the sudden increase in domestic demand and the reorientation of sales of European products towards this increasingly demanding domestic market, particularly during the health crisis (see additional information at the end of this article).

Some complementary data

Brussels, 7 May 2023

Brussels, 7 May 2023

"TomatoEurope opposition to tariff suspension for CN2002903100

TomatoEurope Processors Association would like to raise our serious concerns regarding the tariff quota request for 23.340t of tomato paste (product identification code CN 2002903100) which has recently been published on the EC tariff quota website. We are surprised to see that this possibility is even considered as the European Union tomato processing industry is sound and competitive and has more than enough capacity to produce those volumes of the indicated product.

1. Technical comments in support to the opposition to the to the tariff suspension

From the product description included in the tariff quota request (working number 1049, reference mail 2025394/2023) we understand that the request is for a tomato paste produced by a hot break process (breaking temperature 98°C or higher) with a high viscosity (Bostwick not more than 3 cm) that requires the use of tomato varieties with serum viscosity of 4.0 cSt or more.

To be able to produce this high viscosity hot break tomato paste you need to use tomato varieties with the mentioned features. It is convenient also to have a special equipment for sterilization and cooling called “flash cooler” to be able to pump considerable amounts of the product in short periods of time (Due to the high viscosity it is difficult to pump the product once cooled after sterilization). One can also produce this kind of product in traditional sterilization equipment but at much lower rates, which limit the quantities produced.

Regarding the special varieties specifically developed to produce this kind of high viscosity tomato paste, there are two seeds companies that sell them in the European market, being Heinz the most relevant one, and sometimes they are not so easy to obtain in the market. In this sense, it is noteworthy that the company asking for the tariff quota is the main supplier of the seeds needed to produce this special product.

In any case, even if it’s convenient to use these special varieties with high levels of pectin to produce this product, it is also feasible to produce it with varieties not so specific, adding another stage to the production process where the tomato juice is centrifugated (using a decanter usual in most factories) to separate the phase with higher proportion of insoluble solids (and therefore pectin) to be further concentrated (But some clients require the use of the special varieties in their orders).

Regarding the bulk packaging of 1250 kg or more, but not more than 1350 kg, there is a broad offer of this kind of packaging in the European market so it shouldn’t be a limitation.

Regarding the production capacity, just in Spain there are at least 6 factories with flash coolers that produce this product regularly, with a production capacity of 120 t/h, that can produce more than 130.000 t of this product per year. To these volumes we can add the more limited production that could be produced with traditional equipment by other factories which have also produced this kind of product in the past. We estimate that at least 230.000 t of this product could be produced just in Spain.

In summary, almost every existing factory in Europe producing tomato paste can produce this product. It is easier to produce it with “flash cooler” and planting special varieties, but it can also be produced with traditional equipment and using not so specific varieties, but in these cases, the production rates are lower. There is plenty of production capacity in Europe with experience in producing this product.

Of course, being a special product, with very particular characteristics, it is only produced on request, and orders must be place with enough time to permit the correct planning of the planting of the special varieties and the factory production (It must be explained to those who are not familiar with the sector, that the processed tomato sector is an industry based on an annual crop and requires advance planning. Transplanting starts usually in producing countries in March-April and harvest and processing take place in August-September. Orders for special products to be delivered in January of the year “n” need to be placed in January of the year “n-1”, and everyone involved in the business is aware of that and needs to plan their purchases taking that into account).

2. Summary of TomatoEurope’s reasoned opposition

The processed tomato sector is an industry based on an annual crop and requires advance planning. Transplanting starts usually in producing countries in March-April and harvest and processing take place in August-September. Orders for special products to be delivered in January of the year “n” need to be placed in January of the year “n-1”, and everyone involved in the business is aware of that and needs to plan their purchases taking that into account.

The product mentioned in the tariff quota request is a superhotbreak high-viscosity paste that is usually produced using special high-viscosity varieties of tomato and special equipment (flash cooler). It can be produced without them but it is more complex and expensive. The seeds of these special high-viscosity varieties of tomato are supplied in Europe by a few seed companies.

The European tomato processing industry can perfectly supply the indicated volumes of the mentioned product, provided, of course, that the orders are placed in due time and that a fair price is paid.

In the very unlikely case that someone might have difficulties to fulfill their needs for tomato products from the European tomato processing industry there are already in place several trade agreements with producing countries that allow importing of tomato products without taxes (Egypt, Ukraine, Chile, etc.).

It is important to take into account, That the European tomato sector is facing a period of very high costs, mainly as a consequence of the Ukrainian war which has had an important impact on all costs (Raw material, energy, packaging, etc.), but also due to the investments in the Green Transitions and the high-costs directly linked to the rules provided by the EU legislation (e.g. European Emissions Trading System). If an unjustified tariff quota is created it could cause great damage to the European tomato processing industry. In summary, we understand that there is no justification at all to open a new tariff quota for tomato products that could have a very negative impact on the European sector, and so we kindly ask you to consider retiring this proposal.”

Evolution of the EU trade balance in tomato pastes with third-party countries

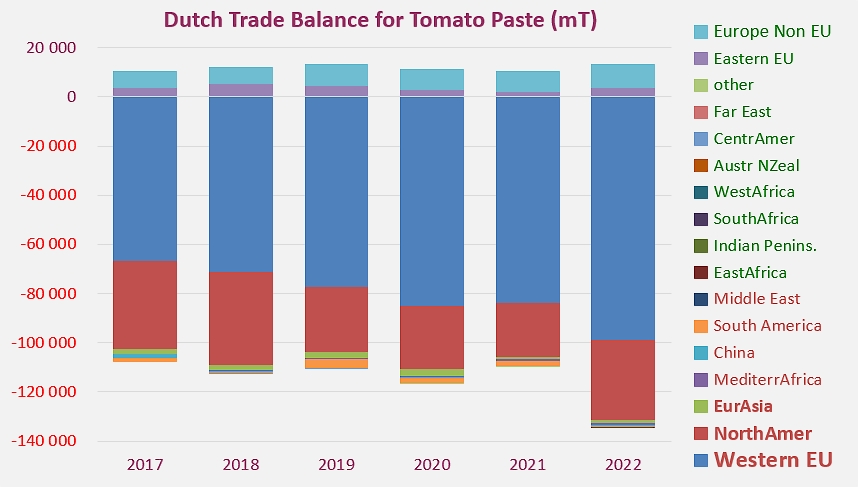

Evolution and details of the Dutch trade balance for tomato pastes

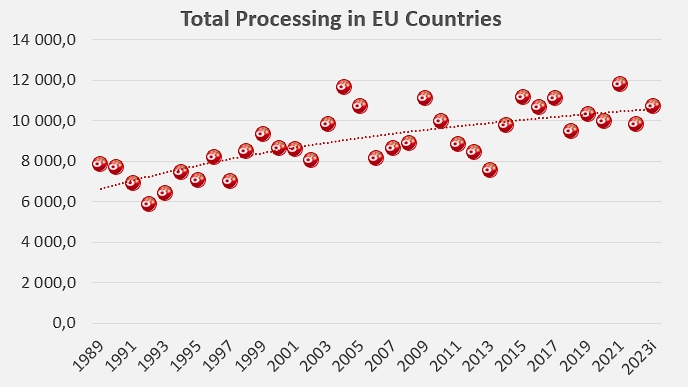

Evolution of the quantities processed by the eleven current EU Member States (Portugal, Spain, France, Italy, Greece, Hungary, Malta, Bulgaria, Czech Republic, Poland and Slovakia)

Sources: TomatoEurope, ec.europa.eu, ilpuntocoldiretti.it, immediato.net