“Grower’s revenue needs to increase to cover the cost and risk of the crop”

On June 26, the CTGA published a long press release in which the association analyzes and comments on the commercial situation and the Californian agricultural context of the moment. The CTGA thus poses the various arguments which advocate for a significant revaluation of the reference price of the tomato "raw material" for the 2020 season, still in negotiation at the date of publication of this overview of the situation of the Californian tomato processing industry.

“As we get closer to the start of this year’s tomato harvest, CTGA continues to negotiate with processors to reach a fair price for the 2020 season. The price we are seeking must recognize the obvious fact that the cost of growing tomatoes in California has increased more than what is considered normal Ag inflation. California tomato growers have been battered with an onslaught of new regulations and laws as well as COVID-19 policies which severely restrict how farming is conducted in 2020. Unique to California growers is the fact more governmental requirements and increased costs are coming. Due to these mandated cost pressures, the grower’s gross revenue needs to increase to cover the cost and risk of the crop they are producing. For proof, review the following summary of the current market conditions and the rising costs required of California tomato growers: Below references the report done by ERA Economics. If you have not already received a copy of the full report, please contact our office.

“As we get closer to the start of this year’s tomato harvest, CTGA continues to negotiate with processors to reach a fair price for the 2020 season. The price we are seeking must recognize the obvious fact that the cost of growing tomatoes in California has increased more than what is considered normal Ag inflation. California tomato growers have been battered with an onslaught of new regulations and laws as well as COVID-19 policies which severely restrict how farming is conducted in 2020. Unique to California growers is the fact more governmental requirements and increased costs are coming. Due to these mandated cost pressures, the grower’s gross revenue needs to increase to cover the cost and risk of the crop they are producing. For proof, review the following summary of the current market conditions and the rising costs required of California tomato growers: Below references the report done by ERA Economics. If you have not already received a copy of the full report, please contact our office.

Prices

Recent softer market conditions are a result of slowing global demand for processed tomato products, decreased California exports, and increasing processing capacity.

California tomato exports increased from 8% of total annual movement in 2009 to more than 17% in 2014. California production and processor capacity also expanded. Since 2014, California exports have fallen by 30 percent, and are now around 12% of total annual movement. Over the same period, per capita tomato consumption and global demand has been flat. As a result, California processing capacity utilization has decreased. This put downward pressure on price.

While exports do have an impact on processor capacity utilization, we know 90% of California tomato production is currently sold within the domestic market. By comparison, the EU export market comprises less than 10 percent of overall demand making the EU a very small piece of the overall supply demand equation. It is important to understand we have a very strong domestic market which does not experience the same import pressures as other commodities. Comparing what growers are being paid in the EU does not correctly reflect our domestic markets, of which California grown processed tomatoes comprise 96% of total market share. We strongly believe there is room in the marketplace to provide a fair return for both growers and processors.

Prices/margins for other crops are not a significant driver of California farm-gate processing tomato prices. The current state of the industry illustrates this point. Processors currently have excess capacity. There is more acreage available for planting to processing tomatoes, but processors are not contracting for additional acreage, choosing instead to leave capacity underutilized. This is a result of the key drivers of the market (demand, exports, and inventories) described above, not the price of alternative crops.

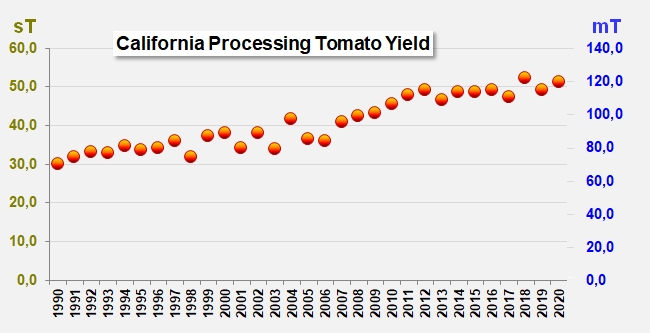

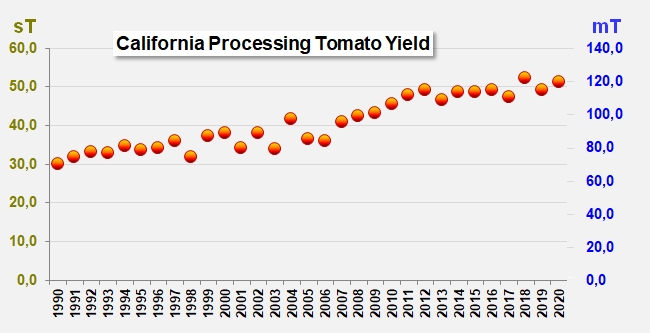

Yields

Growers invested in irrigation, production, and harvest technology increasing statewide average yields through 2012. These are efficiencies growers have and continue to invest in to become more competitive with the hope of increasing their returns. For example, the switch from direct seeding to transplanting to establish fields starting in the 1990s has increased crop yields and consistency. Since 2012, growth in statewide average yield has been flat. The year-over-year change in yield between 2013 and 2017 has been between +0.8% and -3.9%. Statewide average yields steadily increased through 2012. Since then, the average yield has stayed largely flat. The variability in yields has stayed about the same, so the risk to any individual grower is the same. For example, extreme weather events in 2017 and 2019 resulted in substantial crop damage. Growers continue to incur the cost of risk from these types of events.

Costs

Production costs are increasing. The main drivers of higher costs over the next 3 to 5 years include SB 3, AB 1066, and the Sustainable Groundwater Management Act (SGMA).

Labor costs are increasing under AB 1066 and SB 3. AB-1066 changes the compensation and work hour requirements for agricultural employees. The bill requires farm workers to be paid overtime pay (1.5 times normal wage) after working 8 hours in a day, or 40 hours in a work week by 2022 (for 2020 the bill requirement is 9 hours a day or 50 hours in a work week). In addition to AB-1066, growers are required to comply with SB-3, which gradually increases the California minimum wage. Increasing uncertainty of the labor supply also pushes wages up. Currently these laws are unique to California growers, as many states still do not require overtime to be paid to Ag employees. The net effect on harvest labor (not including any other labor costs) is an increase of USD 30 to USD 40 per acre (Euro 77 per hectare), or approximately 20% to 35% over current baseline harvest costs. This is compounded in the current COVID-19 pandemic environment.

SGMA is currently being implemented in critically over drafted subbasins across the state. Non-critically over drafted subbasins are currently developing Groundwater Sustainability Plans (GSPs) that will be implemented in 2022. GSPs increase farming costs through: (i) increased water rates to pay for GSP administration, (ii) increased water rates to pay for new water supply projects, and (iii) costs to remove land from production in subbasins that do not have sufficient groundwater supply. These are real costs that are affecting farming costs across the state. Variable operating costs increase by USD 75 to USD 235 per acre (Euro 165 to 515 per hectare), or 3% to 7%. This analysis does not consider the additional cost of GSA management (staff time, reporting, regulatory compliance), which will likely be passed on to growers in the form of higher water costs for existing and new sources of water supply.

Other regulations increasing farming costs include air emissions, land, water quality, material, and equipment restrictions. These additional regulations increase farming costs for tomato growers.

Returns/Outlook

Overall, farming costs are estimated to increase by 4-6% per year due to these regulations and policy changes.

Statewide average yields are stable and equally as variable as in the past. As a result, expected net revenue is decreasing. Prices would need to rise above the 4-6% rate to offset the cost increase and keep grower return on investment margins constant. California tomato growers have proven over time to be the most efficient in the world at producing high yields and outstanding quality, but the challenges facing all growers in 2020 continue to mount. The numbers do not lie.

The rising cost to the grower, due to the mandated increases for overtime, minimum wage, water and more, plus the upsurge in expenses because of COVID-19, must be reflected through increased prices paid for raw product.

While all growers would like to count on higher average yields, the facts do not support such a belief. As stated earlier, there is no evidence of recent average yield increases which would justify using an estimated yield increase to offset the 2020 growing costs increase of processed tomatoes.

Based on our current economic study, the average operating costs to grow processed tomatoes in California continue to increase. For 2020, those costs amount to USD 3,814 per acre (Euro 8,340 per hectare) Based on the current five-year tons per acre average of approximately 48 tons per acre (107 mT/ha) a price of USD 79.45 per short ton (Euro 77.5/mT) would be required just to break even.

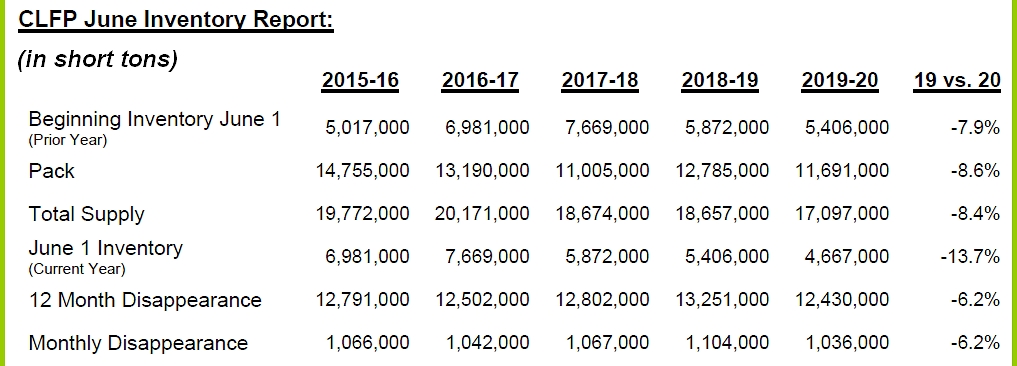

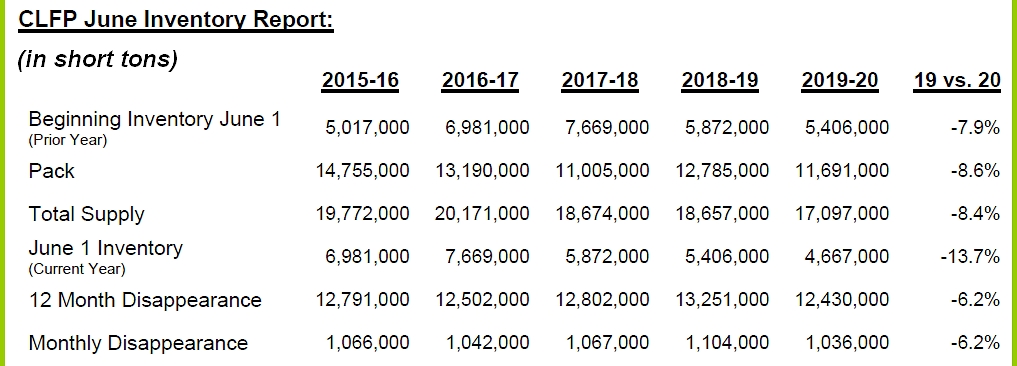

• Inventories continue to decrease and we are 13.7% lower than prior year

• Lower than expected crops in 2017 and 2019 were a major factor in lowering inventories.

• It should be noted that the reported inventory does not necessarily mean that there is currently that amount for “sale”. Some of this volume has been contacted/committed to customers. This report reflects inventory on hand that is owned by the processors. Product moves out of inventory when it is actually paid for by the customer and it is not on the processor’s books.

In conclusion, we do not believe growers should be forced to leave the industry because processors refuse to pay a fair and just price which would offset these alarming cost increases. During these troubled times, we will remain committed to working with all processors towards achieving a fair and equitable price for the 2020 crop. "

Source: www.ctga.org

“As we get closer to the start of this year’s tomato harvest, CTGA continues to negotiate with processors to reach a fair price for the 2020 season. The price we are seeking must recognize the obvious fact that the cost of growing tomatoes in California has increased more than what is considered normal Ag inflation. California tomato growers have been battered with an onslaught of new regulations and laws as well as COVID-19 policies which severely restrict how farming is conducted in 2020. Unique to California growers is the fact more governmental requirements and increased costs are coming. Due to these mandated cost pressures, the grower’s gross revenue needs to increase to cover the cost and risk of the crop they are producing. For proof, review the following summary of the current market conditions and the rising costs required of California tomato growers: Below references the report done by ERA Economics. If you have not already received a copy of the full report, please contact our office.

“As we get closer to the start of this year’s tomato harvest, CTGA continues to negotiate with processors to reach a fair price for the 2020 season. The price we are seeking must recognize the obvious fact that the cost of growing tomatoes in California has increased more than what is considered normal Ag inflation. California tomato growers have been battered with an onslaught of new regulations and laws as well as COVID-19 policies which severely restrict how farming is conducted in 2020. Unique to California growers is the fact more governmental requirements and increased costs are coming. Due to these mandated cost pressures, the grower’s gross revenue needs to increase to cover the cost and risk of the crop they are producing. For proof, review the following summary of the current market conditions and the rising costs required of California tomato growers: Below references the report done by ERA Economics. If you have not already received a copy of the full report, please contact our office.