Total turnover drops 16% against 2016 results

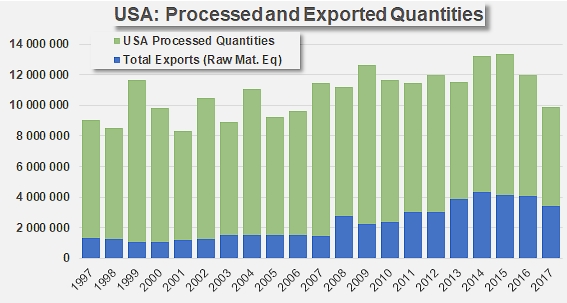

With early December inventories reportedly less than satisfactory, annual US results for the trade in tomato products cannot really be considered as good news. Except for a slight improvement in the canned products sector, the quantities of tomato products exported from January to December 2017 recorded a marked drop compared to the previous calendar year (2016), but also aggravated the apparent slowdown that has been holding back US foreign trade for the past four years.

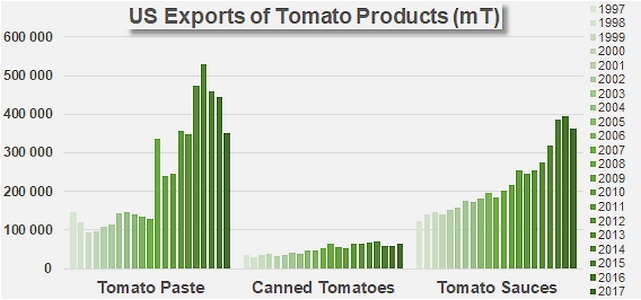

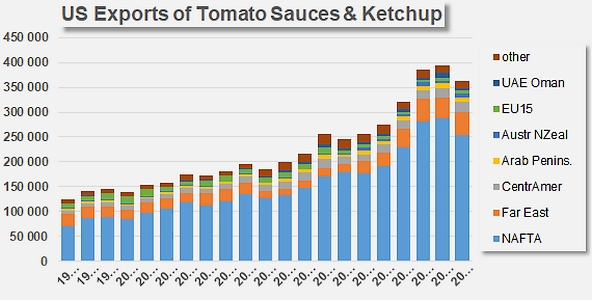

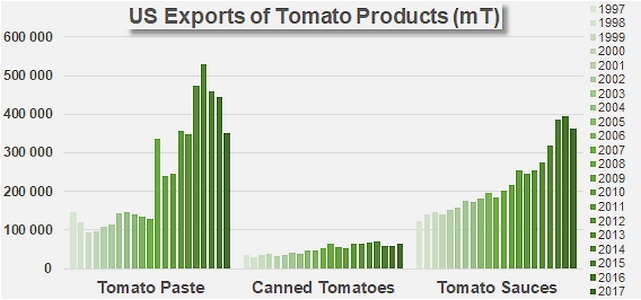

Considered on its own, each product category has been affected to a different extent by the drop in volumes absorbed by foreign markets: with 351 000 metric tonnes (mT) of paste and 363 000 mT of sauces and ketchup exported last year, the performances of the US industry in these categories respectively decreased by 21% and 8% against 2016 results, whereas the 66 000 mT of canned tomatoes shipped abroad increased by 13% compared to the same year's results.

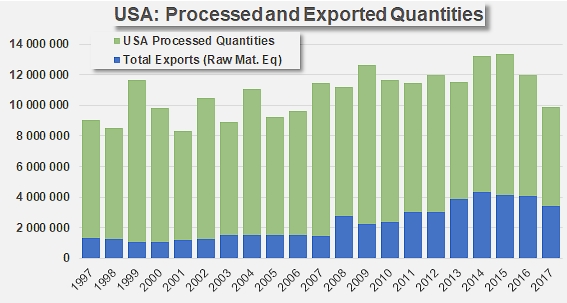

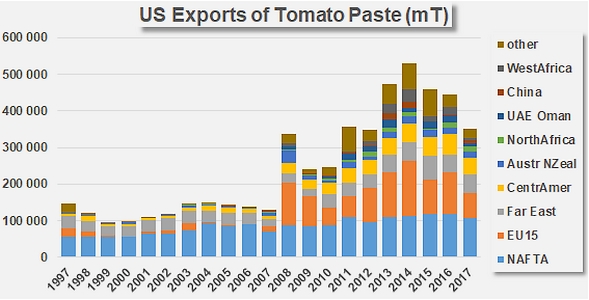

More worrying is the drop in the levels of trade for both of the flagship categories of the US industry compared to the three previous years (2014, 2015 and 2016). Having dropped for the third year running, export volumes in the paste category in 2017 were 27% lower (-127 000 mT of finished products) than the average of the three previous years (478 000 mT). Sauce exports started by resisting fairly well to the difficulties encountered on foreign markets, notably thanks to the relative strength of the US dollar against the euro or the renminbi, but ended up also slowing down last year (-3 800 mT) and decreased significantly for the first time in many years. And despite a slight improvement in the canned products category (+3 400 mT), the quantities exported were not sufficient to compensate for the sharp slowdown in US export activities overall. Overall, US exports of tomato products (estimated, and in farm weight equivalent) "only" absorbed in 2017 the equivalent of 3.4 million mT of raw tomatoes, whereas average volumes absorbed by foreign sales over the 2014-2016 period involved some 4.2 million mT, which is approximately 775 000 mT (19%) more than last year.

Four countries "weighed" more heavily than the others in these dynamics, all of them major importers at a global level, including three that are part of the EU. Italian, Dutch and British purchases of Californian paste respectively dropped by 29 200 mT, 15 300 mT and 3 100 mT between 2016 and 2017, further compounding an overall trend that has seen US sales to the EU drop by more than 52 000 mT (-44%) in recent years.

Sales to Nigeria, where imports have been banned, dropped last year by close on 9 000 mT compared to 2016 and by more than 14 000 mT against the average for the period running 2014-2016. Quantities imported by Canada also dropped significantly, as did those imported by the United Arab Emirates and several countries of Central America and the Far East.

Canada also played a decisive role in the recent erosion of foreign US sales of sauces. In 2017, 218 100 mT of US sauces were imported by Canada, which remains highly dependent on its big neighbor for supplies in this category, against 254 600 mT in 2016 (-14%) and 236 800 mT over the period running 2014-2016 (-8%). But most of the more important regions (Far East, Central America) for this sector of US foreign sales have on the other hand increased their purchases, meaning that final annual results for 2017 only varied slightly compared to results of previous years.

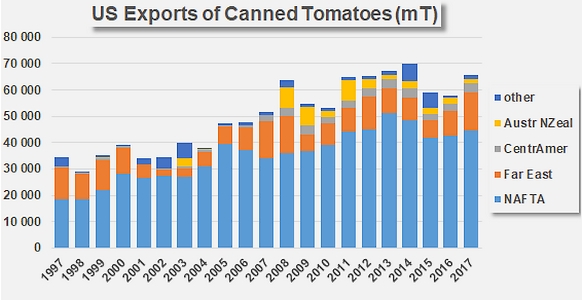

Whilst not being unimportant, exports in the canned tomato category, for which the USA occupy a modest third-place worldwide behind Italy and Spain, absorbed far smaller quantities of finished products (and therefore of raw materials). Last year, US processors exported 65 500 mT of canned tomatoes, 13% more than in 2016 and 5% more than the average of the period running 2014-2016. As for the other product categories, the main outlets are found on the North American continent, but these have only recorded slight variations in recent years. Most of the growth in exports of US canned tomatoes can be attributed to an increase in purchases from South Korea and Japan.

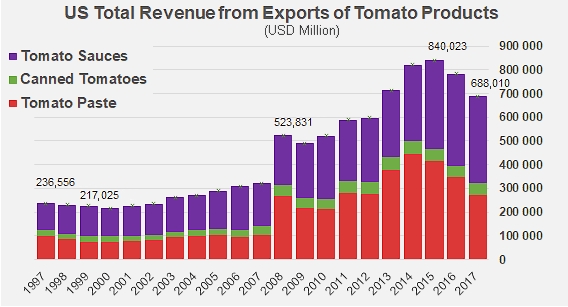

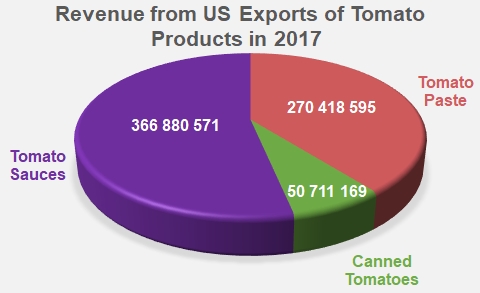

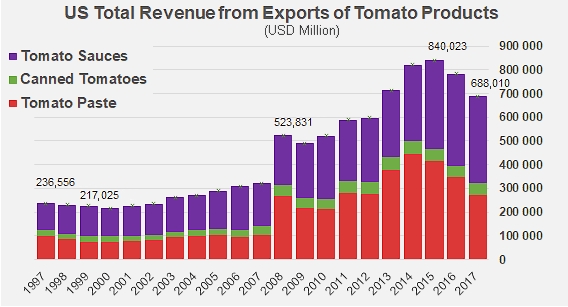

This slowdown in quantities has led to a drastic reduction in the turnover from US exports of tomato products. The total value of foreign sales recorded in 2017 amounted to USD 688 million, which is 12% less than in 2016 (USD 784 million), but more importantly 16% lower than the average results for the period running 2014-2016 (USD 815 million).

Almost all of the drop in income (approximately USD 127 million) can be attributed to paste exports, whose 2017 results were one third lower than the average results for the period running 2014-2016. The turnover generated by exports of canned tomatoes and of sauces has remained practically the same (respectively +0.5% and +1.3%). Due to the growing proportion of the total US turnover that can be attributed to sauces (close on 50% over the past three years), to the good stability of the proportion stemming from canned tomatoes, and to the relative cancellation of revenue stemming from foreign sales of paste, the impact of the slowdown in trade has been limited to the paste category, whilst it may not have been completely "compensated".

In the current context of narrower outlets, the US industry is facing a foreign market that is not particularly attractive, due to the extremely low prices of recent years for the paste category. This explains why Californian operators are aiming to shift their focus away from cold-break pastes intended for the export market this year. According to professional sources, price levels on the US domestic market remain quite low, due to the volumes of stocks that have remained high over the first few months of this year. 2018 production prospects, which currently stand at approximately 10.9 million mT, have largely taken account of this situation and of the observable rate of apparent disappearance.

Some complementary data

Source: IHS, Tomato News