Enough to cover demand until January 2018

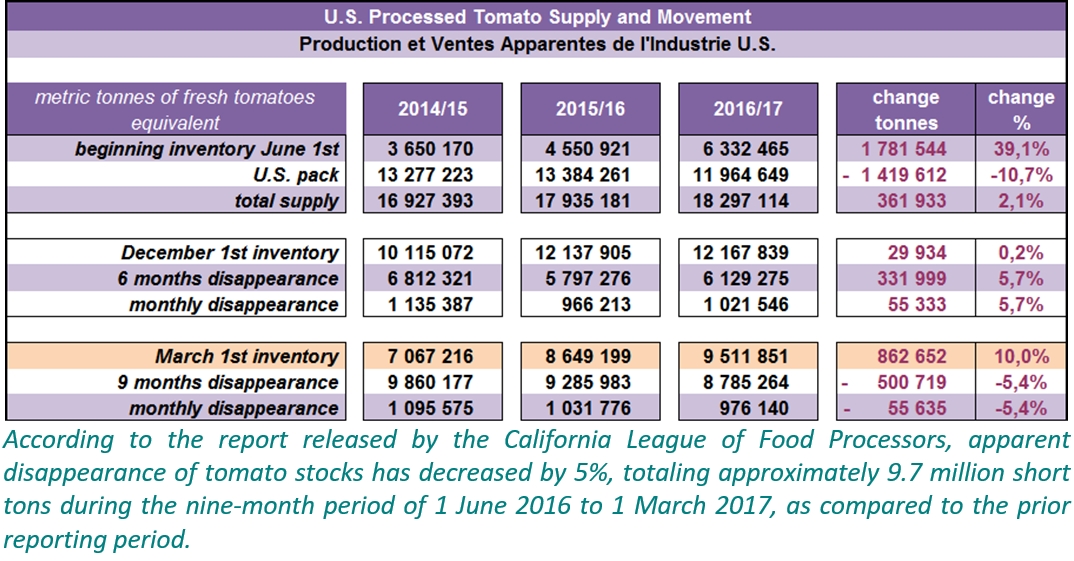

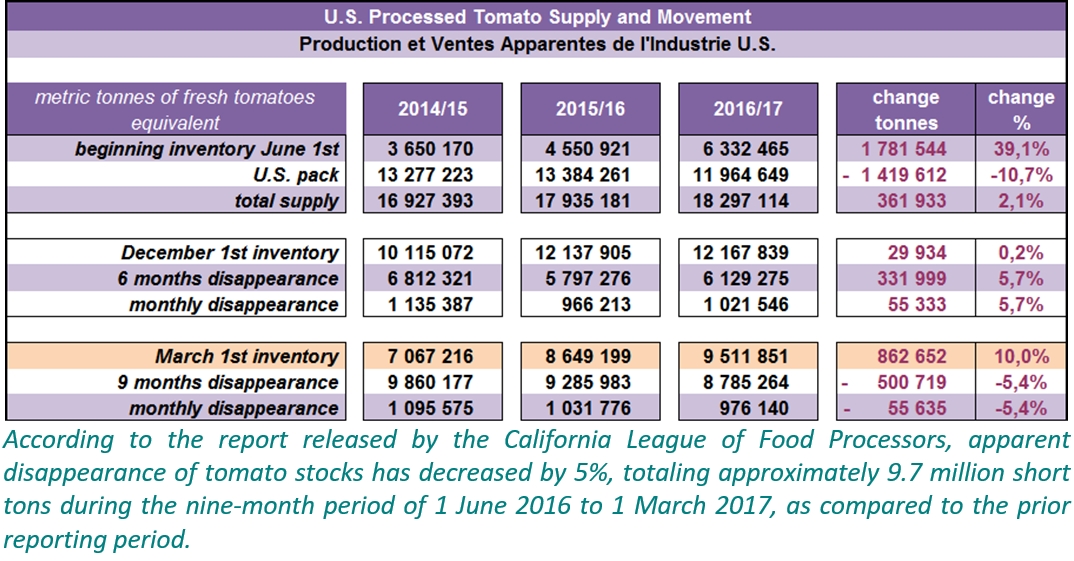

Despite efforts over the past two years to reduce operations, the US tomato processing industry has not really been able to deal with the situation of stocks. As of 1 March, the volumes still available in storage amounted to approximately 10.5 million short tons (sT), or 9.51 million mT (farm weight equivalent). Even if part of these products have already been sold, the situation remains critical. This quantity is 10% higher than it was on 1 March 2016 and, at the average monthly disappearance rate of the past twelve months, it is sufficient to cover demand (exports and domestic consumption) until the beginning of January 2018.

This situation is not new for the US industry, particularly in California, as it has already had to deal with large carryover inventories in the past. However, the volumes of finished products still available at the beginning of March, representing some 20 to 21 kg of raw tomato per person – a previously unseen level – present a new challenge for US operators. Furthermore, they must now find solutions to the situation in an unfamiliar financial context, due to a US currency that is too strong and penalizes exports, a constraint that had until 2015 weighed more heavily on European processors, and which the Trump administration is currently trying to address.

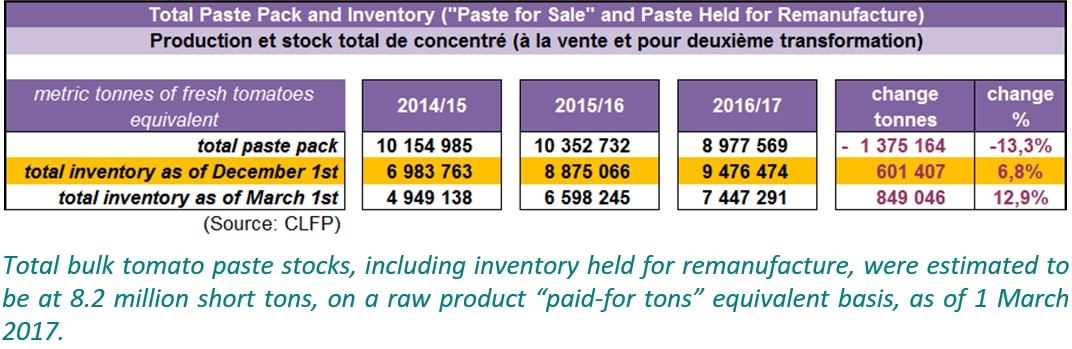

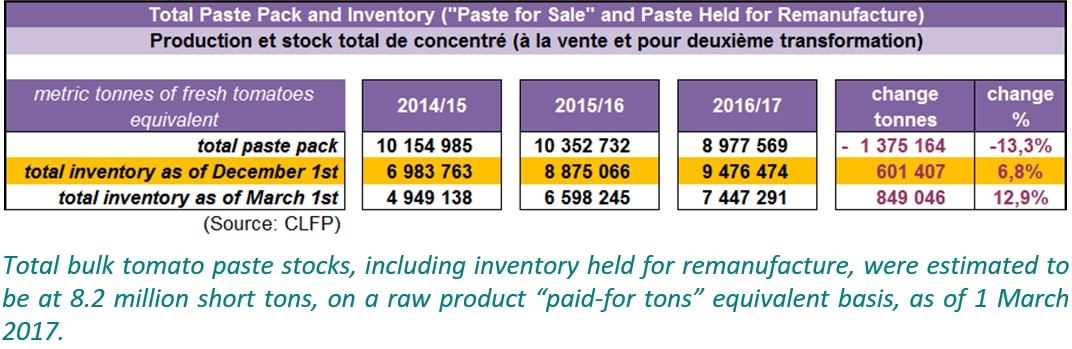

In the paste category (all uses combined), the figures published by the CLFP show that stocks have increased by almost 13% compared to the situation in March 2016, which is at least partly the consequence of a slowdown in sales of almost 7% (March 2016-March 2017).

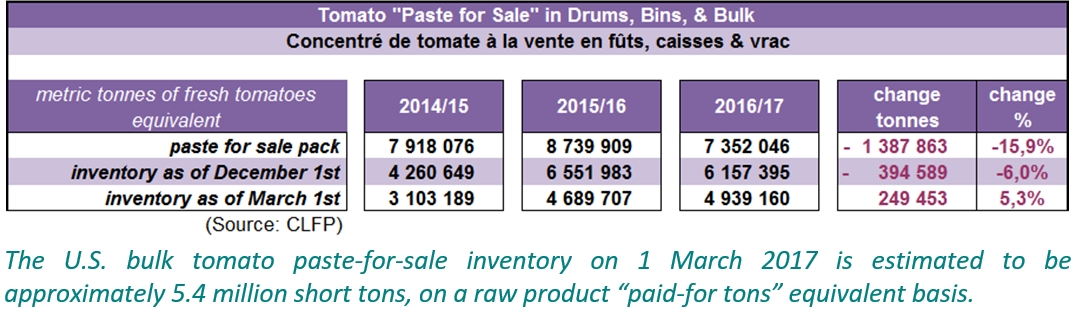

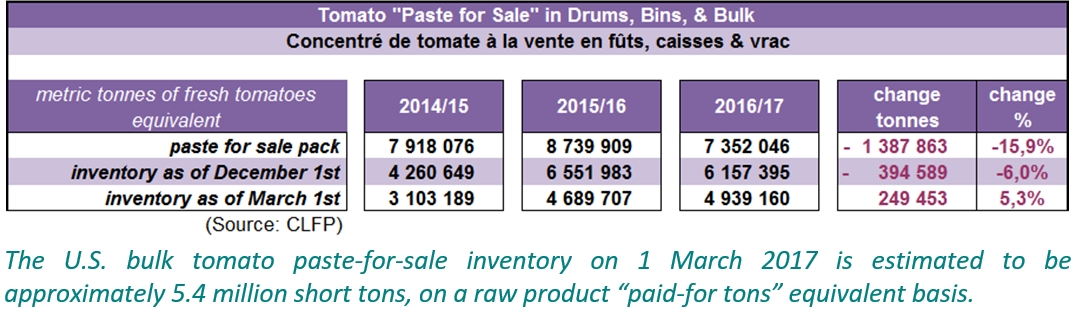

Results published for paste intended exclusively for sale indicate no improvement either. Although customs statistics clearly indicated a slight recovery toward the end of the year, probably linked to a notable drop in prices in the third and fourth quarters of 2016, US paste exports were lower (-2.7%) last year (446 000 mT) than in 2015 (459 000 mT). So stocks of paste-for-sale recorded a further increase (+5.3%) as of 1 March, at close on 4.94 million mT (farm weight equivalent).

(

See also our previous article on US stocks in the February 2017 issue of Tomato News.)

Some complementary data

Available volumes approximately match ten months of apparent consumption at the current disappearance rate, which is about three months more than is required normally for covering US demand.

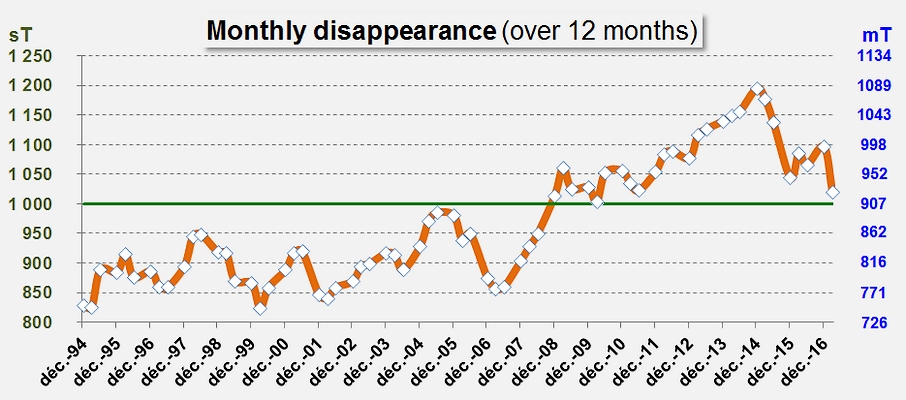

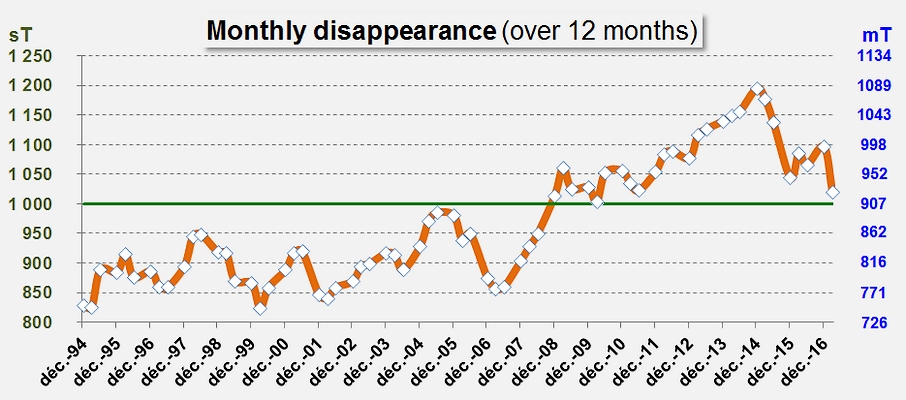

After a slight improvement at the end of the year linked to a temporary recovery of foreign sales, the average monthly apparent consumption rate fell back to a low that had not been seen since March 2010, barely above the threshold of 1 million sT per month.