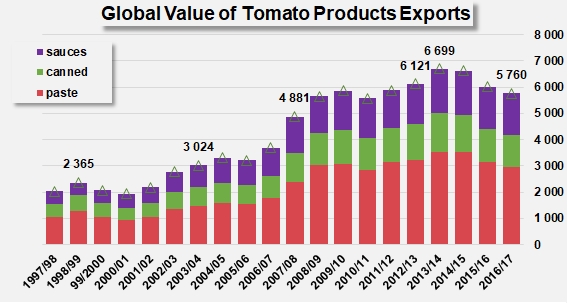

2013/2014, the best marketing year for the past two decades...

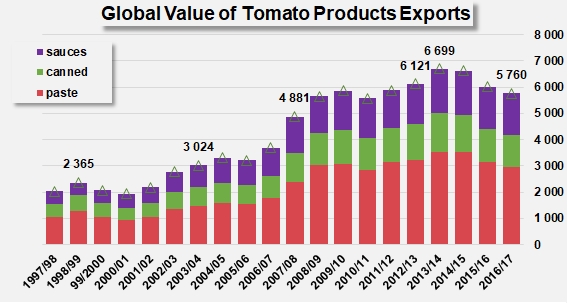

After having largely exceeded the USD 6 billion threshold over the four marketing years running 2012/2013 to 2015/2016, the total value of worldwide exports of tomato products has fallen under the USD 5.8 billion mark during the most recent marketing year, after three consecutive years of decreasing results. The drivers of this contraction have been identified: slower growth of the quantities shipped, increasing trade competition, worldwide decrease in prices for tomato products...

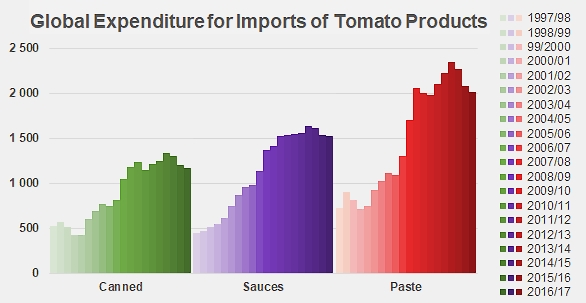

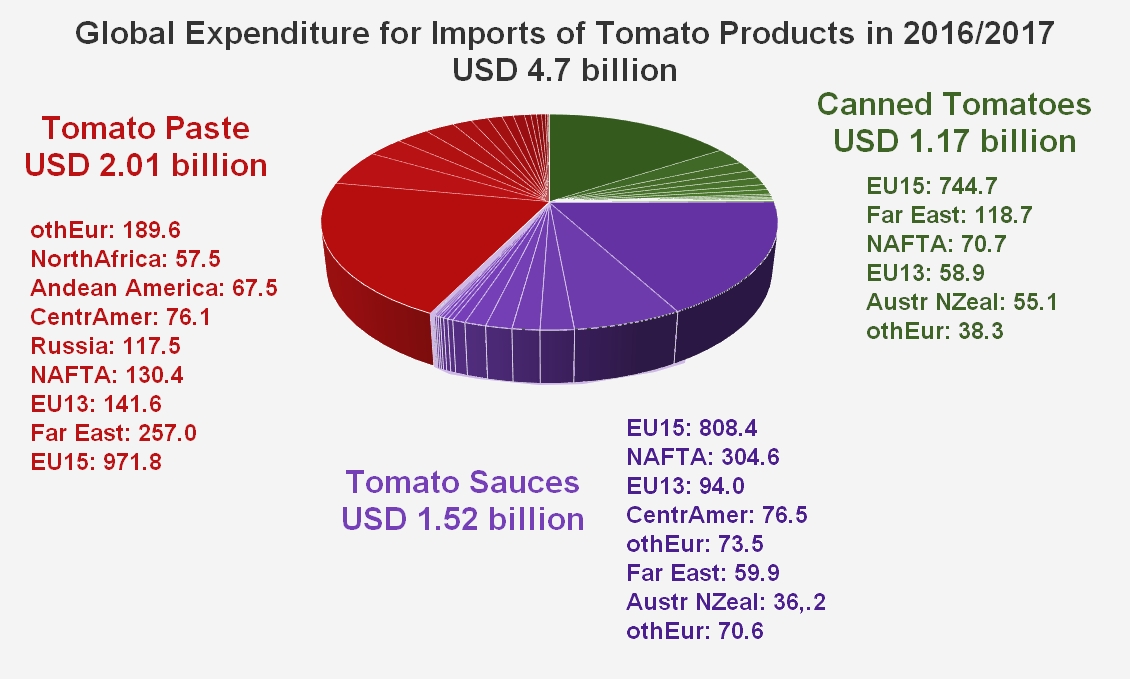

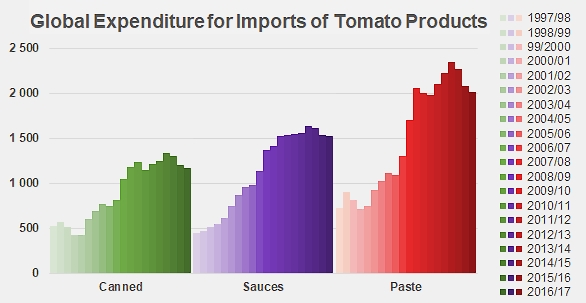

Due to decisions from the statistics institutions, which have been determined by the reliability of the data supplied by each country, only 80 to 90% of the trade and its export values are compensated by corresponding import data. So the total worldwide expenditure from importing countries declaring results for the 2016/2017 marketing year have been evaluated by default at USD 4.7 billion. That said, identical dynamics to those observed in conjunction with the total turnover of exporting countries have contributed in recent years to the evolution of this expenditure, with a maximum (USD 5.32 billion) being reached during the 2013/2014 marketing year, and a progressive but very noticeable downturn over the past three years.

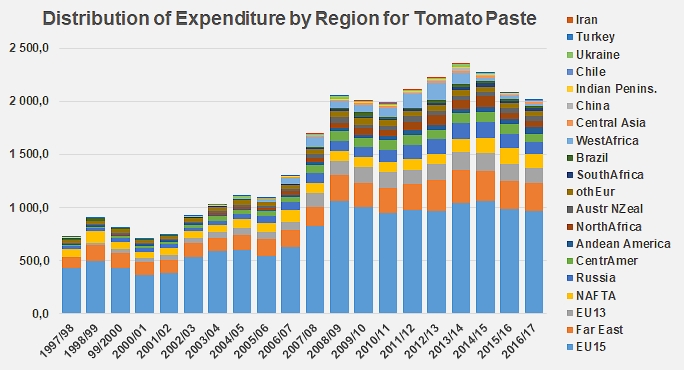

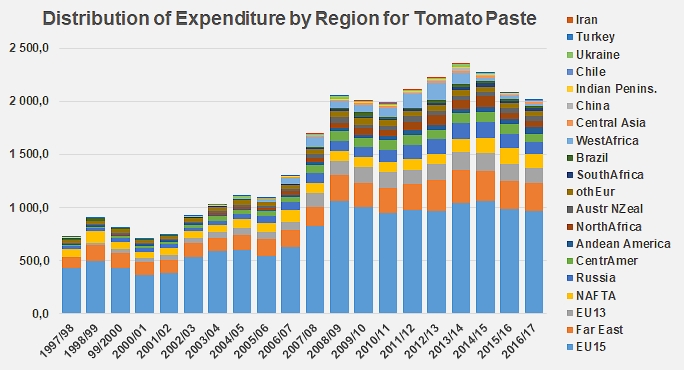

With close on USD 2.1 billion on average over the past ten marketing years, foreign purchases of pastes have absorbed 43% of total expenditure on tomato product imports, practically without variation over the period as a whole. The paste sector, which is the biggest overall expenditure line for imports, is also the one that has most suffered from the contraction in value recorded in recent marketing years. The amount of the "global invoice" in 2016/2017 (USD 2.01 billion) was 10% lower than the average (USD 2.23 billion) of the three previous marketing years (2013/2014, 2014/2015, 2015/2016). The sector's best performance was recorded during the 2013/2014 marketing year, with an amount evaluated at USD 2.35 billion.

Over the most recent marketing year, the 28 countries that make up the EU – the biggest market for the paste sector – spent a total of USD 85 million less than they had over the three previous marketing years. The most noticeable decreases have been observed in the biggest markets, like Germany (USD -16.5 million), the Netherlands (USD -16.6 million), Poland (USD -13.5 million), the United Kingdom (USD -13.2 million), France (USD -11.2 million), Belgium (USD -8.7 million USD), Slovenia, Lithuania, Austria, etc.

Expenditure for supplies of paste in 2016/2017 in countries of the Far East has also dropped (-10%), due to the noticeable contractions of purchases recorded in Japan (USD -12.8 million), the Philippines (USD -4.9 million), South Korea (USD -4.4 million), Thailand, etc.

In the final count, almost all of the amounts paid by the different regions for their paste supplies have dropped in 2016/2017: as well as the outlet countries or regions already mentioned, Russia (USD -23 million), Central America (USD -22 million), Mediterranean Africa (USD -19 million) and Ukraine (USD -11 million) also largely saved money last year on their "tomato paste budget”. The only noticeable exception was expenditure in Andean America, carried by the increase in Argentinian imports of paste (see our article dated 21/03) which leapt by 82% (USD +22 million compared to the average of the three previous years).

In 2016/2017, global expenditure for paste supplies was USD 225 million lower than during the three previous marketing years.

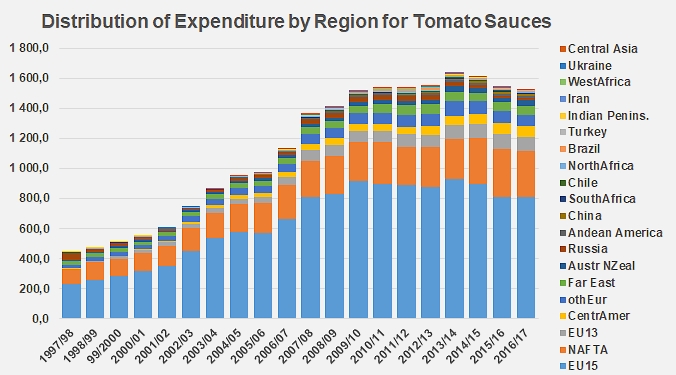

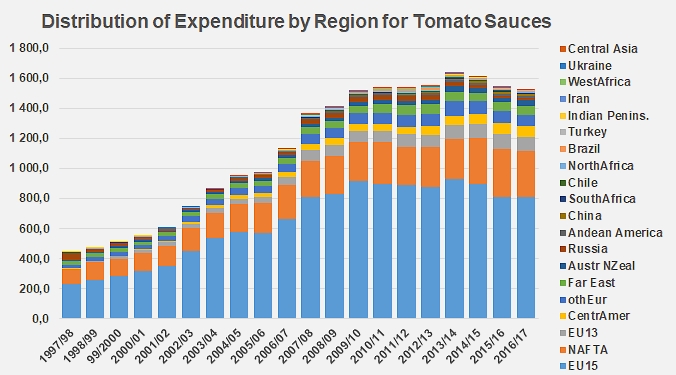

Over the past ten years, worldwide imports of sauces accounted for 32% of total expenditure, with an average of USD 1.52 billion. Unlike paste, sauces are the category that has best resisted the erosion of prices and stood up to the various crises that have hit our industry, in line with the many observations that have been commented in recent years. However, with USD 1.52 billion, global expenditure on sauce imports recorded a noticeable drop in 2016/2017 (-4.5%) compared to the average of the three previous marketing years (USD 1.6 billion). In 2013/2014, the global invoice for sauces imports had amounted to USD 1.63 billion.

On its own, Europe (EU28 and non-EC European countries) benefited from almost all of the drop in value of worldwide sauce supplies. Its total expenditure (USD 976 million) dropped by more than USD 83 million (-8%), well ahead of the savings achieved by Russia (USD -5 million), Ukraine (USD -1.8 million), Brazil (USD -1.4 million), the Indian peninsula (USD -1.3 million), the Far East (USD -1.2 million). However, several regions saw their expenditure increase in 2016/2017, among which the most noticeable were Central America (Nicaragua, Guatemala, Venezuela, Panama, Colombia) (USD +9.7 million, which is a 15% increase compared to the 67 million spent on average on this category over the three previous marketing years).

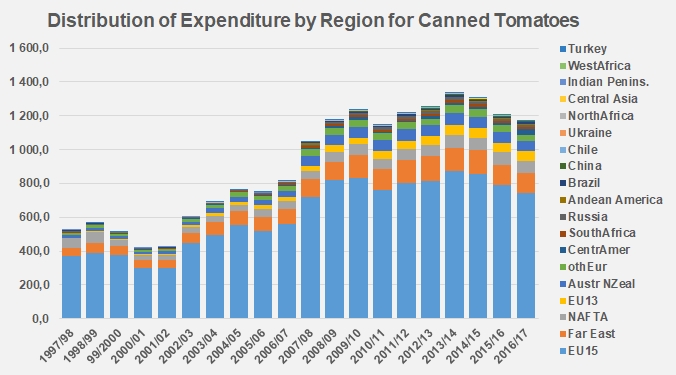

Canned tomato imports accounted for USD 1.21 billion in expenditure over the past ten years, which is 25% of total expenditure on imported tomato products overall. In a trade climates that is said to be very difficult, the performance of this category has been better than that of pastes, but not as good as the performance of sauces. With a total of USD 1.17 billion in 2016/2017, worldwide expenditure has been more than 8.5% lower than the average expenditure for the three previous marketing years (USD 1.28 billion), and well below the peak level reached in 2013/2014 (USD 1.34 million).

As an importer of products in this category, the zone made up of EU countries and non-EC European countries, which is the main supply region for this category of products but also the biggest outlet for the Spanish and Italian productions, has been the main beneficiary of the erosion of the category's worldwide prices. British, German, French, Belgian and Danish expenditures recorded the biggest decreases, in a context where the total European invoice (USD 842 million) dropped by more than USD 100 million in 2016/2017 compared to the average of the three previous years (USD 942 million). That said, a few exceptions should be noted for the 2016/2017 marketing year, with clear increases in the expenditures of Poland (USD +2.1 million, +11%), the Netherlands (USD +2.6 million, +6%), Spain, Bulgaria, Finland, etc.

But the decreasing trend of expenditure remains generalized, and has also hit regions like Australia-New Zealand (USD -13.8 million, -20%), the Far East (USD -12 million, -9%), southern Africa, Russia, etc.

In 2016/2017, twelve countries accounted for two thirds of total global expenditure on imports of tomato products. The accumulated expenditure of this Top12 list amounted to USD 3.09 billion, which is almost 9% less than the average of the three previous marketing years.

Three countries that are members of the EU feature at the top of this list of countries in terms of global expenditure: Germany, the United Kingdom and France. Last year, they were followed by Canada and Japan, with two further countries of the EU ranking just below: the Netherlands and Italy. In eighth position, Russia was just ahead of another EU country, Belgium. Australia, the only representative from the Asia-Pacific region, and Mexico, the only southern-American country of the Top12 closed the list just ahead of one last EU member: Poland.

Some complementary data

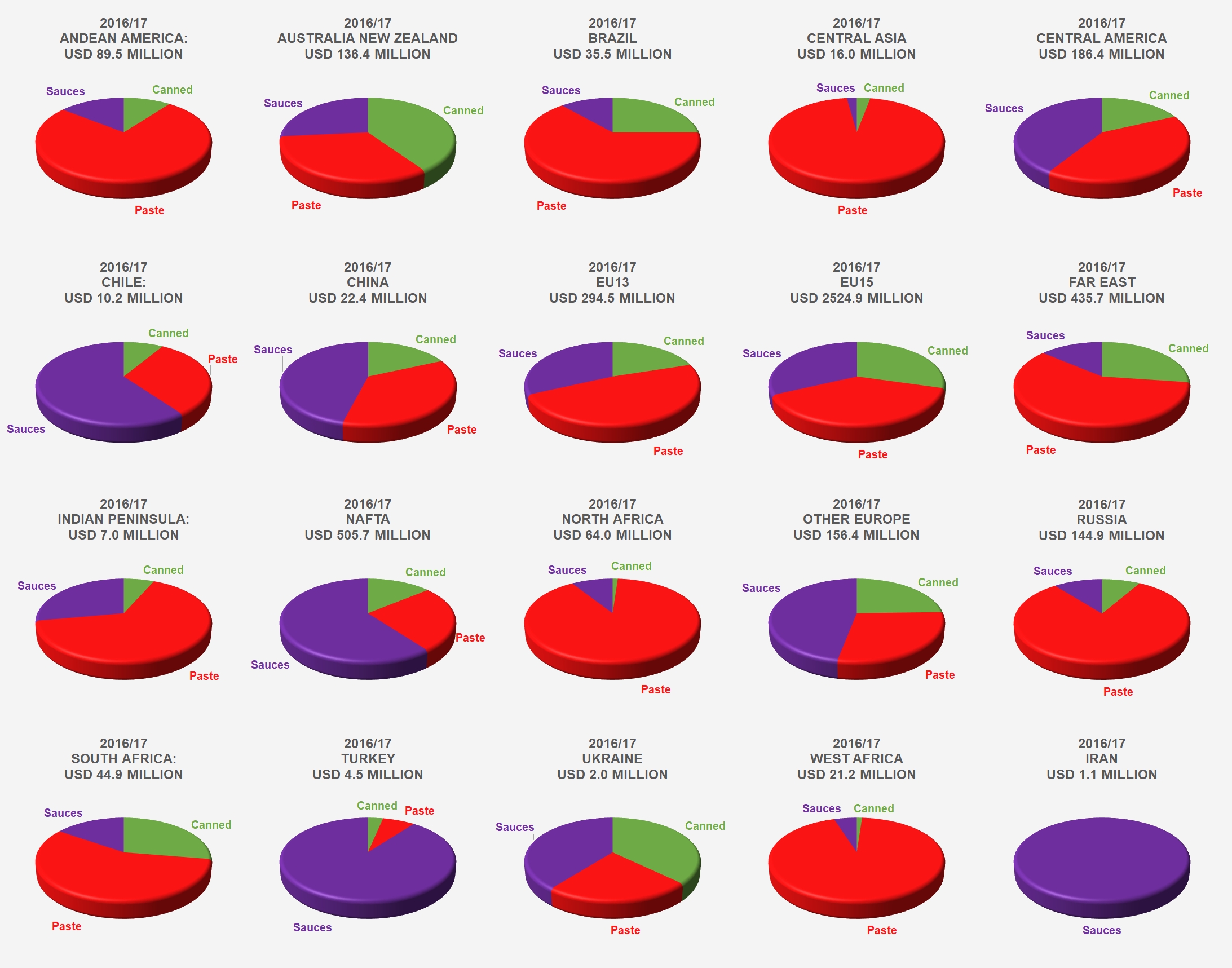

Distribution of expenditure on imports of tomato products in the main trade regions.

Source: IHS, Tomato News