The emergence of new operators has had a negative impact on business

Processing tomatoes are one of the main horticultural crops of the VFS region (Senegal River Valley). They were the first diversification crop launched in the region, and now involve 12 000 growers spread throughout the regional subdivisions of Dagana and Podor, near the border with Mauritania.

Processing tomatoes are one of the main horticultural crops of the VFS region (Senegal River Valley). They were the first diversification crop launched in the region, and now involve 12 000 growers spread throughout the regional subdivisions of Dagana and Podor, near the border with Mauritania.

In its heyday, the Senegalese tomato industry brought in about XOF 3.5 billion (CFA franc) (EUR 5.32 million or USD 6.33 million, val. Jan. 2018) of revenue every season, and growers could expect a pretax margin of close on XOF 1 000 000 per hectare (EUR 1 520 or USD 1 810). Tomatoes were one of the fresh vegetable crops that provided a high gross profit margin and allowed growers to modernize farms that are often family-operated. More importantly, for growers benefiting from crop contracts, growing tomatoes helped to negotiate better terms for enhancing the value of other crops like rice, thanks to an integrated financing system set up by the CNCAS (Senegalese agricultural credit bank).

But in recent years, despite the progress achieved in terms of contracts and integrated farming, the Senegalese processing tomato industry has been facing great difficulties. With only XOF 1.5 billion in revenue in 2016, for a gross profit margin per grower of close on XOF 550 000 per hectare (EUR 836 or USD 996), interest in this crop has dwindled, all the more so given the increasing uncertainties that have affected contract negotiations and processors' commitments to comply with planned processing targets.

So the quantities processed over the past two seasons have not exceeded 28 000 tonnes (metric, mT) of raw materials grown on planted surfaces of approximately 1 400 hectares, whereas target volumes were closer to 78 000 mT. National requirements are estimated at close on 20 000 mT of paste (amounting to 120 000 mT of tomatoes in farm weight equivalent) and are in fact mostly covered by imported products.

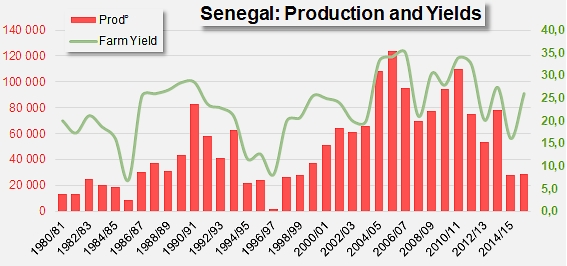

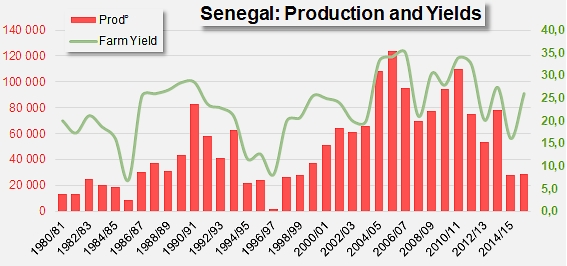

The first explanation put forward by operators within the industry attributes the blame for this situation to the difficulties encountered by growers in complying with technical itineraries and crop calendars. Over the past 35 years, the average yield of processing tomatoes has not exceeded a threshold of 23 tonnes per hectare, for an average production of 50 000 tonnes. These technical difficulties aggravate other problems such as those linked to obtaining loans from the banks, farm debts, lack of agricultural equipment and constraints related to the collection and transport of the crops. All of these obstacles severely limit the development of the industry.

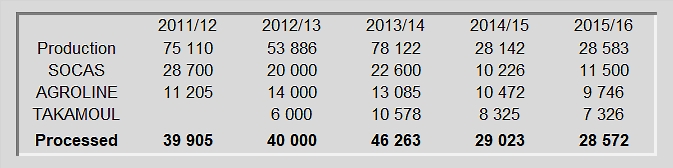

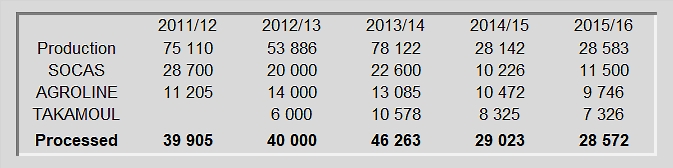

In a report published at the end of 2016, the CGERV (Center for the management and rural economy of the Valley) also explained that competition between the three national companies (SOCAS, AGROLINE and TAKAMOUL) on the Senegalese market for tomato paste has benefited consumers, but not tomato growers. Against all expectations, the quantities of tomatoes processed by Senegalese companies have dropped sharply over the past few seasons due to the quotas policy imposed by the companies. Between 2015/2016 and 2017/2018, an average of less than 37 000 mT of tomatoes were processed by operators, whereas nationally, this sector accounted for slightly more than 53 000 mT between 2012/2013 and 2014/2015 and more than 93 000 mT between 2009/2010 and 2011/2012. For the CGRV, "the arrival of new operators (Agroline in 2004 and Takamoul Food in 2009) put an end to the monopoly of the SOCAS in the industrial processing sector, but has paradoxically not produced the advantages usually expected from an open competition situation. Because of a drop in the number of production contracts, the chronic difficulties of the industry have simply become insurmountable obstacles."

Over the past three years, "the price of raw materials paid to growers has remained unchanged, which seems to indicate that it is more profitable for manufacturers to produce double-concentrated paste from imported triple-concentrated paste than it is to process local crops."

Evolution of planted surfaces and productivity in the VFS

Between 1980 and 2017, the average surfaces planted with processing

tomatoes totaled 2 033 hectares each year, for an average production

of 49 800 mT and a yield of 24.5 mT/ha. But, contrary to the industry's

main processing countries, the evolution of planted surfaces and the

yield are very haphazard in Senegal.

For a long time now, supply patterns for processing plants have been controlled by a well-established contractual procedure between tomato growers and processing operators (Socas, Agroline and Takamoul Food), under the supervision of the CNCFTI (National advisory committee for the tomato industry, set up in 1995). But this mechanism, which was already not particularly efficient when 83% of the planted surfaces along the Senegal River Valley were under contract with the Socas, thereby benefiting from CNCAS financing, has shown its limitations since the 2011/2012 season, when the volumes delivered to Agroline reached 11 200 mT and competition for raw materials on the Senegalese market started to take shape. During that season, only 35 905 mT of tomatoes were processed, out of a total crop of 75 110 mT. For the following crops, the arrival on the market of Takamoul Food further complicated the situation, as the 2012/2013 and 2013/2014 seasons only saw an average of 66% of the Valley's production actually delivered to factories.

The CGERV report mentions "noncompliance with transport agreements" from the farms and concludes that "the competition among food processors vying for bigger shares of the national market for double-concentrated paste has had a negative impact on the procedures that determine contracts, raw material shipping and tomato processing."

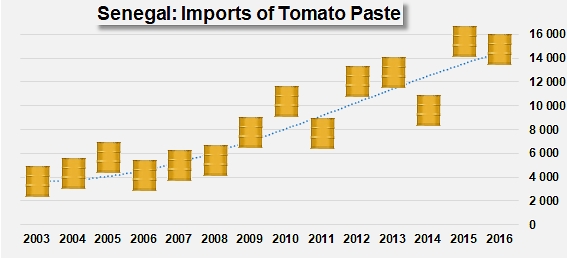

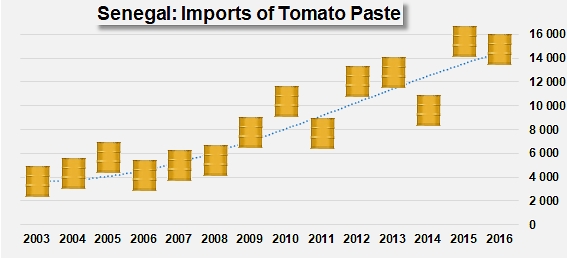

It is clear that more effective management of paste imports has become a major issue for processors and for the industry as a whole. At the start, imports of triple-concentrated paste were supposed to complement the national production, which had become increasingly irregular. But imports increased after 1995 thanks to the liberalization of the market. They grew from 3 000 mT in 2003 to 5 500 mT in 2004; then they exceeded the 10 000 mT threshold in 2010, and have continued to do so each year since 2012. Given this situation, Senegalese authorities decided in 2013 to impose import quotas determined according to the quantities of fresh tomatoes bought locally. But although the total annual processing capacity of Senegalese companies amounts to approximately 130 000 mT, these governmental measures have had no incidence on local production or on the volumes processed by industrial operators. In recent years, the volumes processed have stagnated at an historically low level, and imports have continued to increase.

Considering that the processing tomato industry should be encouraged with regard to its status as a staple food market for the Senegalese population, public authorities are currently considering further ways of getting processors to commit to buying and processing all of the local crop, as well as implementing taxation measures that could effectively "protect the national industry" from imported products.

Sources: CNCFTI (Comité national de concertation pour la filière tomate), CGERV (Centre de gestion et d’économie rurale de la Vallée), WPTC

Some complementary data

1 000 CFA Franc = 1.52 Euro = 1.81 USD (val. 10 January)

Processing tomatoes are one of the main horticultural crops of the VFS region (Senegal River Valley). They were the first diversification crop launched in the region, and now involve 12 000 growers spread throughout the regional subdivisions of Dagana and Podor, near the border with Mauritania.

Processing tomatoes are one of the main horticultural crops of the VFS region (Senegal River Valley). They were the first diversification crop launched in the region, and now involve 12 000 growers spread throughout the regional subdivisions of Dagana and Podor, near the border with Mauritania.