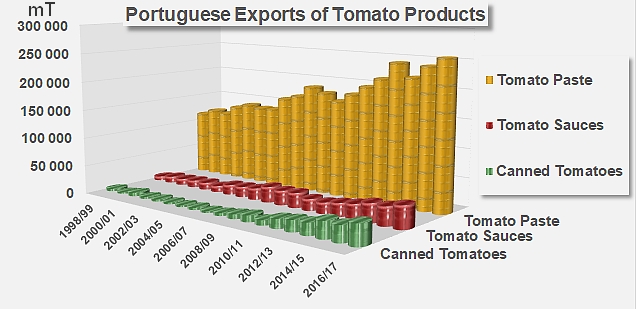

Ranking 5th worldwide in 2016/2017 among paste exporting countries, 4th for canned tomatoes and 9th for sauce exports, the foreign focus of the Portuguese tomato processing industry is now a recognized fact. But while other major industries, in Europe, China or the USA, are facing the difficulties of a global market whose growth is uncertain, Portuguese products (concentrated purées, but also canned tomatoes and sauces) have demonstrated a surprising capacity for resisting the crisis.

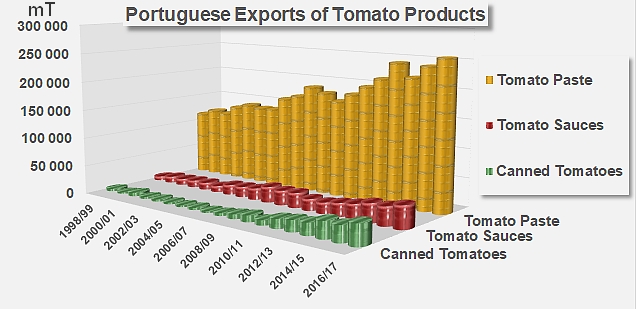

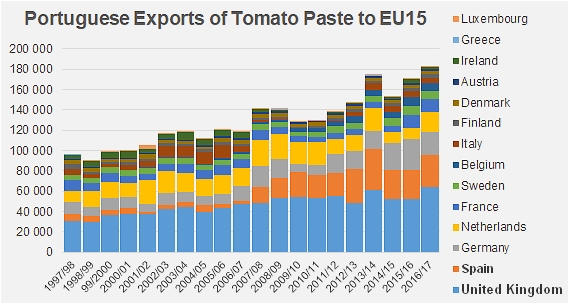

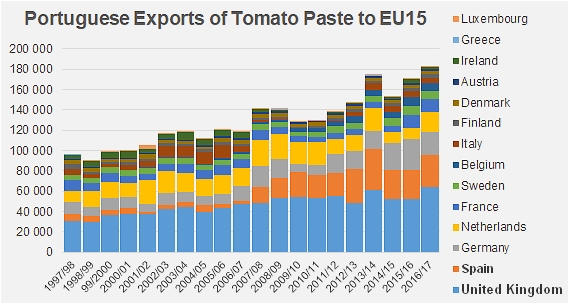

In the paste category, 2016/2017 results for Portuguese foreign sales (255 700 metric tonnes (mT)) recorded growth of more than 9% against the average of the three previous marketing years (234 400 mT). This spectacular development has been driven by an increasingly large demand from South Africa and Japan, but mostly from within the EU15 itself (+16 700 mT, or 10% more than for the period running 2013-2016), particularly from the United Kingdom (+8 600 mT), the Netherlands (+4 700 mT) and France (+3 600 mT). Sales to the Czech Republic have also recorded a considerable increase.

Portuguese paste exports to third-party countries only accounted in 2016/2017 for approximately 25% (64 400 mT) of total volumes, which is a slight drop compared to the peak level of 27.2% reached between 2012 and 2015.

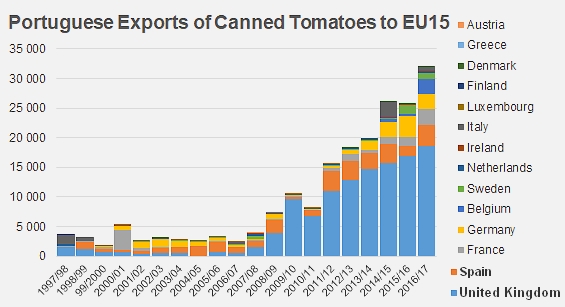

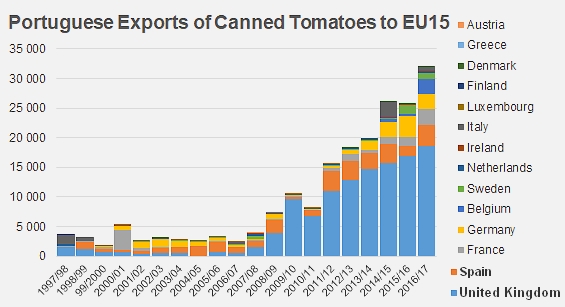

The volumes absorbed by canned tomato exports are far smaller, but their progression is even more impressive. Whilst not reaching the levels of its European competitors (Italy, which is the clear category leader, and Spain, which is Portugal's avowed challenger), this category has grown from less than 3 000 mT in 2006/2007 to the status of a major player with close on 36 000 mT in 2016/2017 – an annual growth rate of more than 28% over the past ten years).

For this kind of product, the Portuguese industry is even more resolutely focused on Community outlets. Only 5% (slightly less than 1 700 mT) of the quantities exported over the past marketing year were shipped outside of the EU28, mainly to Angola, a previous Portuguese colony that has been independent since 1975.

European outlets, which were practically nonexistent ten years ago, have been consolidating since the years 2008-2010, mainly thanks to demand from Britain, which is the world's biggest importer of canned tomatoes. Over the past marketing year, close on 18 600 mT of canned tomatoes were shipped to the United Kingdom, which is 18% more than over the three previous years. Over the past three marketing years, the British market has absorbed 55% (slightly more than 17 000 mT) of total Portuguese canned tomato exports. Germany and Spain each absorbed close on 2 900 mT (9% of the total) of Portuguese canned tomatoes, while France absorbed 1 800 mT (6%).

Third-party countries only account for a minimal share of Portuguese outlets for the sauces sector. The Portuguese industry only dedicated slightly less than 4% of its foreign sales to non-Community markets over the past three years, which is approximately 1 300 mT per year. Angola and Morocco absorbed most of these quantities.

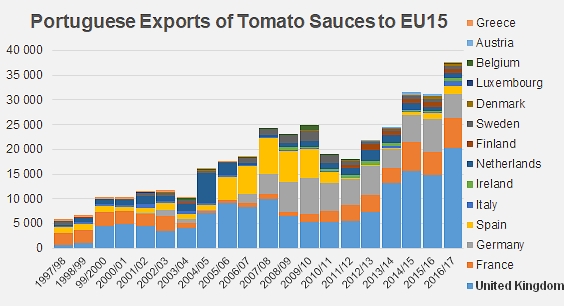

EU countries, with the UK once again in top position, make up the main outlet for Portuguese exports of sauces and ketchup. Exports of this category amounted to more than 39 000 mT over the past marketing year, a 20% increase (approximately 8 500 mT) against the average of the three previous marketing years (30 600 mT). Well ahead of the German and French markets, which respectively imported 5 700 mT and 5 400 mT on average over the past three marketing years, the United Kingdom accounts for close on half (48.5%) of the outlets of Portuguese sauces for the same period, with a notable increase of 40% (5 700 mT) in 2016/2017 compared to the three previous marketing years.

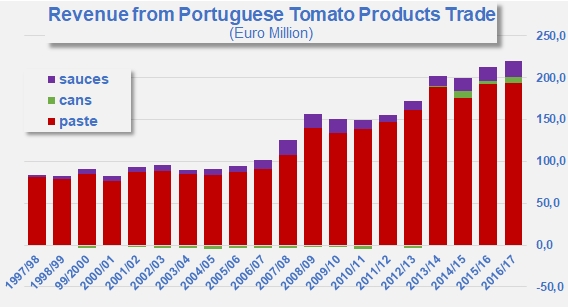

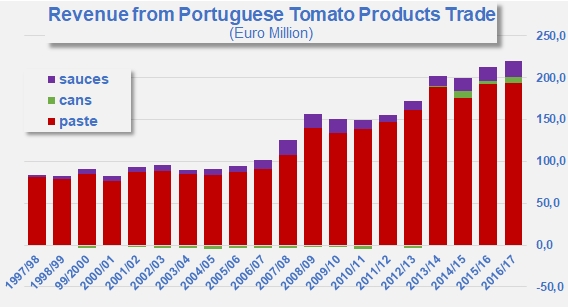

The turnover generated by these exports of tomato products exceeded EUR 219 million (approximately USD 239 million) for fiscal 2016/2017, a progression of more than 7% on the average result of the three previous fiscal years (less than EUR 205 million). Despite the adverse context of recent years, Portugal's total revenue has continued to grow at an annual rate that has exceeded 9% over the past ten marketing years. In coming years, like for the other leading European industries, negotiations surrounding Brexit and the future framework for commercial trade with the United Kingdom will be major deciding factors.

Sources: IHS, Tomato News

Some complementary data