The principle was described in 1795 by Nicolas Appert with his champagne bottles immersed in boiling water, then perfected by Donkin, who was the first to use tin cans. Since then, the materials, techniques, forms and processes used for preserving canned or bottled food have undergone bewildering development and known success that now places the worldwide food industry among the most important business sectors – industrially, economically and socially.

Initially designed and developed for the military, the invention was made available at no cost "for the good of humanity" and rapidly became popular among the general public where it was adapted and transformed in order to cope with extraordinarily rapid growth. It soon became a distinct industrial activity, used around the world and recording impressive development in terms of figures.

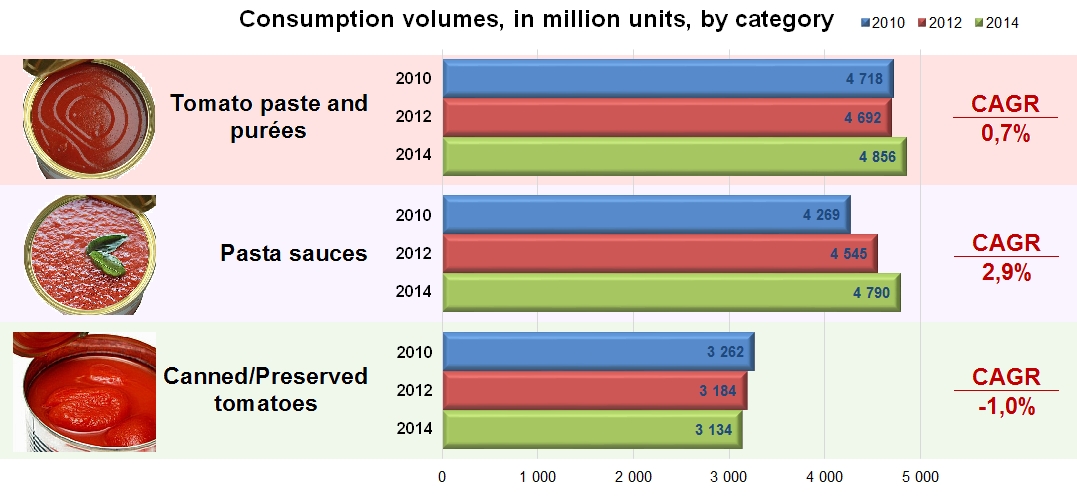

Just in the retail market for tomato products alone, worldwide consumption in recent years (averaged over 2010, 2012 and 2014) is estimated at some 12.5 billion units per year. This estimation by Euromonitor does not take account of global ketchup sales, which probably exceed one billion units (Heinz alone sell more than 660 million bottles each year). The worldwide market in tomato products is currently dominated by concentrated purées or paste, with annual sales amounting to an average of close on 4.76 billion units (b.u.) between 2010 and 2014, and by tomato sauces, which altogether exceeded 4.5 b.u. each year over the same period. Sales of canned tomatoes (peeled or unpeeled, whole or chopped) have remained behind, with "only" 3.2 b.u. sold annually.

In this last category, the figures provided by Euromonitor, which were commented at the last Food News Forum in June 2015, illustrate and confirm the observations published by Italian interbranch organizations regarding the slowdown of global canned tomato sales. These products have recorded a negative growth rate (-1%), which indicates a net drop in consumption volume, from 3.262 b.u. in 2010 to 3.134 b.u. in 2014. At the same time, retail sales of concentrated purées recovered slightly, from 4.72 b.u. in 2010 to 4.86 b.u. in 2014 (0.7% annual growth rate over the past five years). But the category that is currently the main driver turns out to be pasta sauces, whose consumption increased from 4.27 b.u. to 4.8 b.u. (+2.9% annual growth rate!). In total, retail sales of tomato products (excluding ketchup) have grown at an

over the past five years, from 12.25 b.u. in 2010 to 12.78 b.u. in 2014.

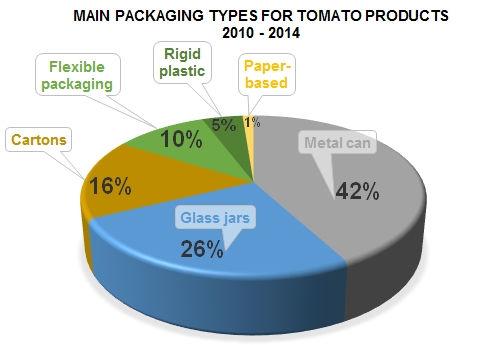

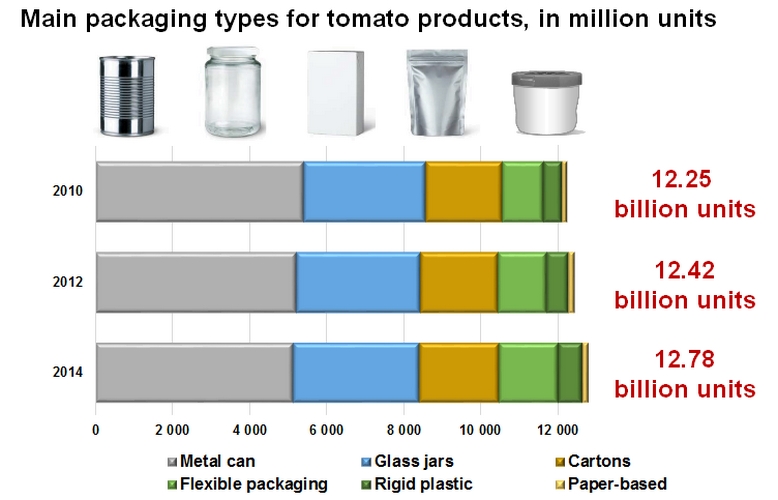

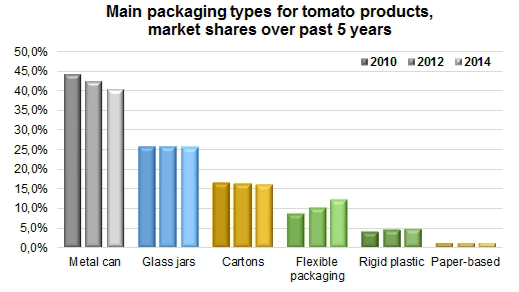

In addition to impressive consumption levels, the tomato products sector also features a wide diversity of presentations, formats, technologies and materials in what it offers consumers: no less than six segments make up the main body of the selection of materials used to manufacture packaging: tin, glass, card, flexible multilayer pouches, rigid plastics, paper-based products, etc...

Tin cans, which are the historic reference in this area, still today represent the main proportion of packagings for the retail trade: over the past five years, "classic" cans have accounted for 42% of the units sold (15.78 billion cans). Glass packaging (bottles, pots, jars, etc.) is also considered one of the "classics", but has "only" been used for 9.6 billion units, accounting for about one retail product in four. Card packaging has only been used in product conditioning in more recent times (Tetra, Combi') and accounts for slightly more than 16% of sales, with 6.1 b.u. sold on average each year between 2010 and 2014.

This same volume corresponds to the total sales of tomato products in flexible pouches, rigid plastic packaging and containers based on paper (board tubs, trays): these materials have respectively represented slightly more than 10%, 4.5% and 1% of the average annual sales for the period, with 3.9 billion units, 1.7 billion units and 451 million units.

That said, traditional materials like metal regularly lose market shares because of their weight, their lack of attractiveness, difficulties in terms of usage, a shape that is not optimal for transport, etc... Tin

cans, which are the main packaging found on the market, with 42% of the units sold, have been the only segment to effectively shrink, at an average annual rate of 1.2%, over the 2010-2014 period. Glass and carton packs have only recorded sluggish

growth (respectively 0.8% and 0.6%), whereas paper-based packaging and rigid plastics, due to the very fact of the relatively low volumes involved, have recorded more marked growth, of approximately 4% and 5%. But the category that has seen some serious progress in recent years is clearly flexible pouches, whose market share has grown by more than 10% per year over the past five years.

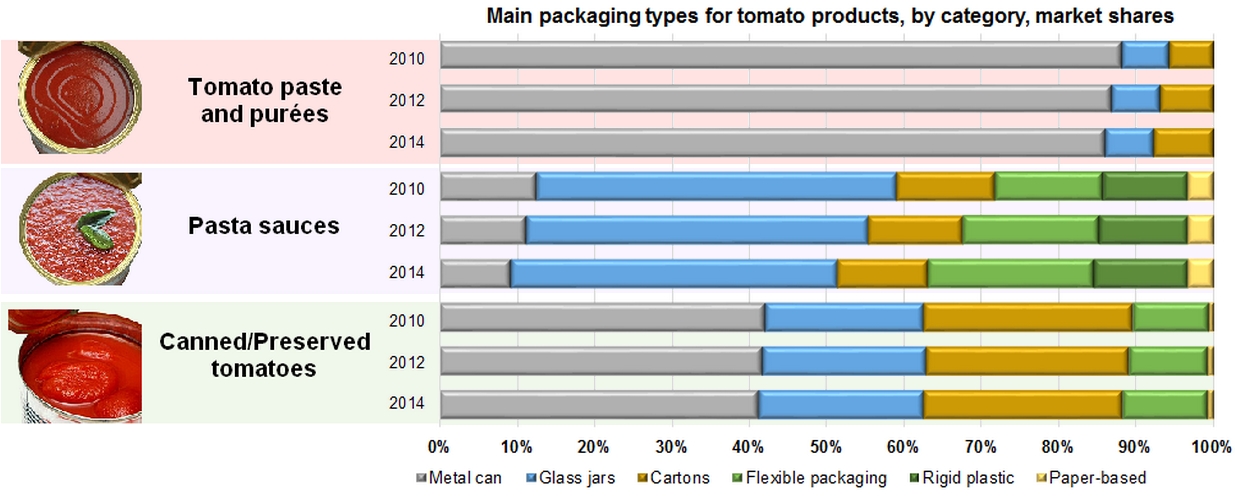

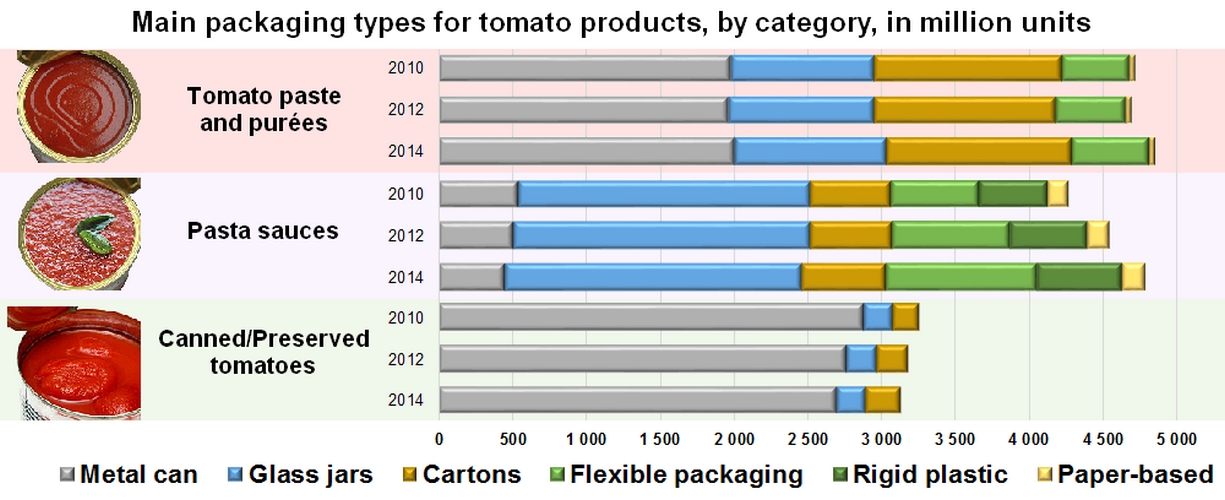

Type of packaging according to product category

All forms of packaging are not indifferently suitable for all product categories or segments. For practical reason, rigid plastic packaging is not adapted to purées or pastes, or to canned tomatoes. Similarly, the required presentation options of sauces seem to practically exclude the use of tin cans, and for the moment, flexible pouches have not been popular for the peeled tomatoes segment...

As the single initial technical purpose (preserving the contents) has progressively seen other concerns appear, like esthetics (the visual quality of the product) or marketability (the differentiation of presentations), some key associations have appeared thanks to continual improvements in technological innovation and the arrival of new materials, etc., driven by considerations of an economic, legal or ethical nature.

Clearly, the market for

tomato purees and paste is dominated by tin cans, which account for close on 42% (average 2010-2014) of sales (just slightly less than 2 billion units per year). Flexible packaging and glass containers are used moderately in this category, respectively accounting for 10% and 21% of total annual sales (4.76 b.u.), totaling slightly less than 1.5 b.u. However, card or carton packaging like Tetra or Combi' occupies a large quarter of the segment, with 1.25 b.u. sold on average each year between 2010 and 2014. The distribution of packaging types within the paste and purées sector has been relatively stable in recent years, maybe with a slight dip in the use of metal cans and card packs, to the advantage of glass and flexible pouches.

Pasta sauces are undoubtedly the main category for glass jars (and pots and bottles): over the past five years, more than 44% of global sales in this category have been sauces offered in glass containers, accounting for an average annual volume of about 2 b.u. out of a total 4.5 b.u. That said, sauces, more than any other tomato product, are the category that uses the widest diversity of presentations: between 2010 and 2014, 11% of the units sold were conditioned in metal packaging; rigid plastics accounted for about the same proportion of the volumes, whereas card and paper-based packaging only accounted for 12% and 3% of the sales in this category.

Flexible pouches are competing increasingly with glass, with close on 18% of the retail sales of sauces (800 million units), and even more spectacularly, with a sharp growth that has seen them increase over the past five years from a 14% market share (600 million units) in 2010 to more than a billion units in 2014 (a share of more than 21% of the market). At the same time, the market share of glass packaging for the sauces sector has dropped from more than 46% to just 41% of sales (therefore dropping under the 2 b.u. mark), along with the sales of metal cans and carton pack conditionings, both close on 13% in 2010, but respectively dropping to 9% and 12% of total sales in 2014. In addition to the previously mentioned progression of flexible packaging, these decreases overall have allowed rigid plastics to slightly improve their market share in the sauces category, from 11% in 2010 to 12% in 2014.

Against all esthetic logic, the

preserved tomato category (peeled, chopped, whole, etc.) is very largely dominate by the traditional tin can, which holds a market share of about 87%. For obvious practical reasons, paper-based conditionings, rigid plastics and flexible pouches are completely absent from this category, which also only grants a minimal share of total sales (3.2 b.u.) to carton-packed products (less than 7% on average, 217 million units for the 2010-2014 period) and glass conditionings (just over 6%, or approximately 200 million units annually between 2010 and 2014).

Like what has been recorded for other product categories, and in apparent contradiction with their preponderance, metal cans have also undergone a slowdown in this category: the market share of cans dropped sharply between 2010 and 2014, from more than 88% to less than 86% of the market share, in a sector that has seen its sales eroded year after year (2.87 b.u. in 2010, to only 2.69 b.u. in 2014). So the share recorded for other types of packaging has tended to increase, particularly to the advantage of carton packs like Tetra and Combi', which have seen their volumes increase moderately from 187 million units in 2010 to 243 million units in 2014 (an annual average CAGR of +2.5%).

The results for the 2010-2014 period indicate that, against the odds, glass and carton packaging seem to be maintaining their respective global market shares of retail conditionings for tomato products. Rigid plastic packaging and paper-based packs have recorded modest growth, for volumes than remain relatively unimportant; flexible pouches seem to have a good future ahead of them, and the recent period has seen them progress more rapidly than other forms, with volumes that are becoming considerable. In a constantly developing market, the traditional metal can is the only form of packaging to be losing market share.

Some foremost markets

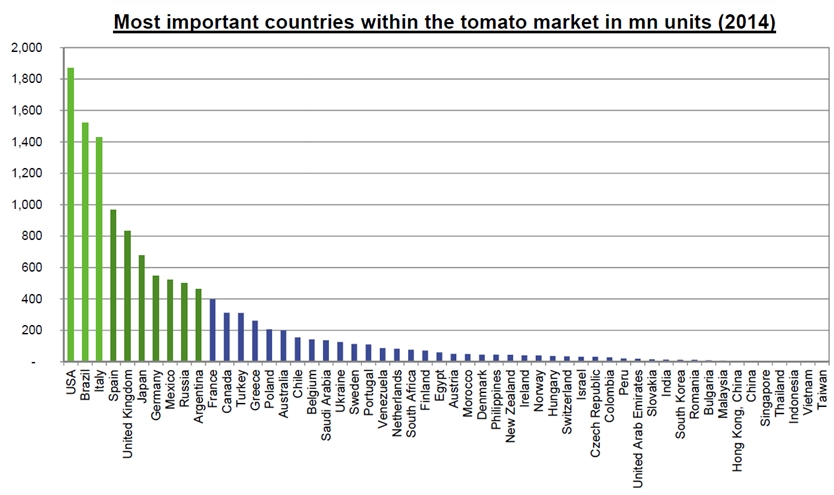

According to the data collected by Euromonitor, the geographical distribution of the worldwide consumption of tomato products is extremely polarized. Expressed in billions of units sold (with no consideration of weight), the results (excluding ketchup) designate the USA, Brazil and Italy as the countries where the greatest number of retail-size units of tomato products are sold.

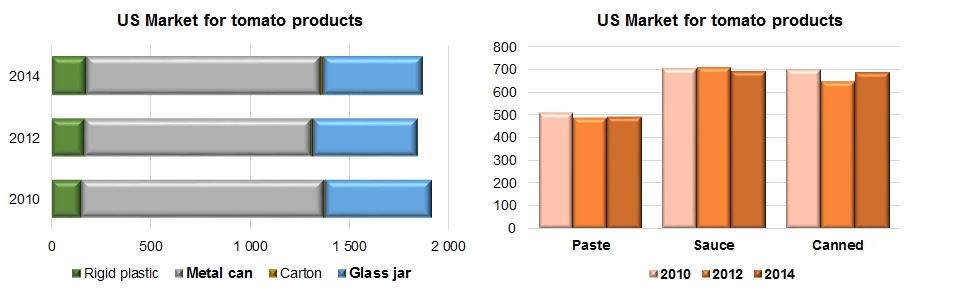

Given a consumption close to 1.87 b.u. in 2014 (slightly under the threshold of 1.9 b.u. reached in 2010), the

US market has recorded relatively high levels in each of the product categories, with a marked preference for sauces and canned tomatoes. Metal cans dominate the market, with 63% of total sales, only challenged by glass packaging (28%), which is primarily used in the sauces category. The products presented in rigid plastic packaging only hold a 9% share of the market, while carton packs are practically absent.

In

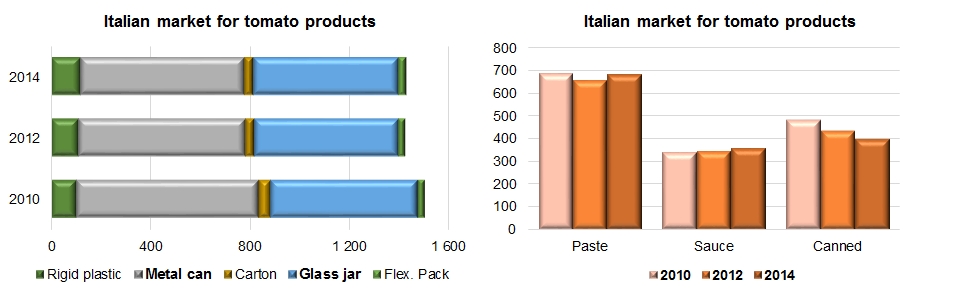

Italy, more than nine products out of ten are sold on the retail market in metal cans (47%) or in glass packaging (40%), while other materials (rigid plastic, card or flexible pouches) are only rarely used on this market, which amounted to 1.43 b.u. in 2014. Purées and paste clearly dominate the market, with 670 million units sold annually over the 2010-2014 period, or 46% of retail sales. Sales of sauces (in number of units) have progressed slowly in recent years (356 million units in 2014), while canned tomatoes have recorded a sharp drop, to 436 million units in 2014.

The conditioning of purées and paste seems to make use of all forms of packaging (metal cans, glass and other materials), whereas sauces are conditioned preferably in glass jars or bottles and peeled tomatoes (in their various forms) are generally sold in metal cans.

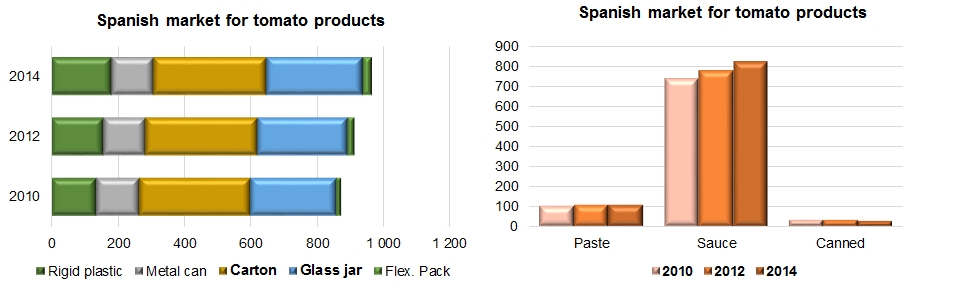

In terms of units sold annually,

Spain is the fourth largest market worldwide and the second largest within Europe, with about 920 million units, and is characterized by its marked preference for the sauces segment (particularly "tomato frito"), which accounts for about 84% of annual sales and has undergone relatively rapid development in recent years (CAGR: 2.9%). Carton packs are the main packaging form found in the sauces sector and on the Spanish market in general, with a market share of almost 37%. Glass packaging is also well represented (almost 30% market share), considerably ahead of rigid plastics and tin cans, on a market that features virtually no purées, pastes or canned tomatoes (peeled, chopped, etc.).

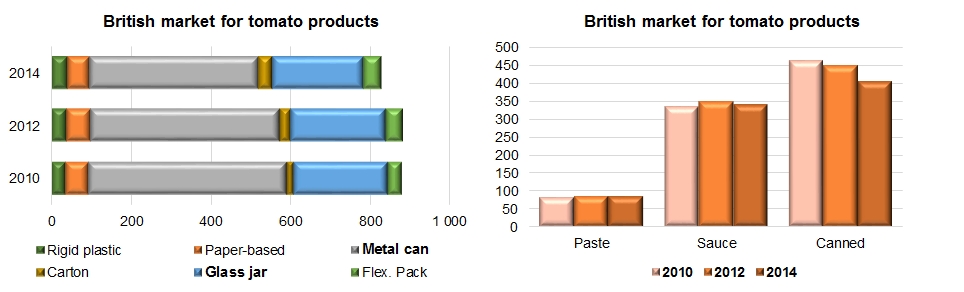

The

British market for tomato products (

see also our article in the December 2015 issue of Tomato News) shows a marked preference for canned tomatoes (peeled, unpeeled, whole, chopped, etc., with 51% of total sales) and sauces (39%), and is largely dominated by the traditional metal can (54% of retail sales) and glass packaging (27% market share). It is also a market that shrunk notably over the 2010-2014 period, with an annual average of 865 million units sold, but only 830 million units in 2014 against more than 880 million in 2010. This downward trend mainly affected "traditional" packaging like metal and glass. This drop primarily concerned the canned tomato category, where carton packs have recorded a notable increase at the expense of tin cans. Sauces sold on the British market are mostly conditioned in glass packaging.

The

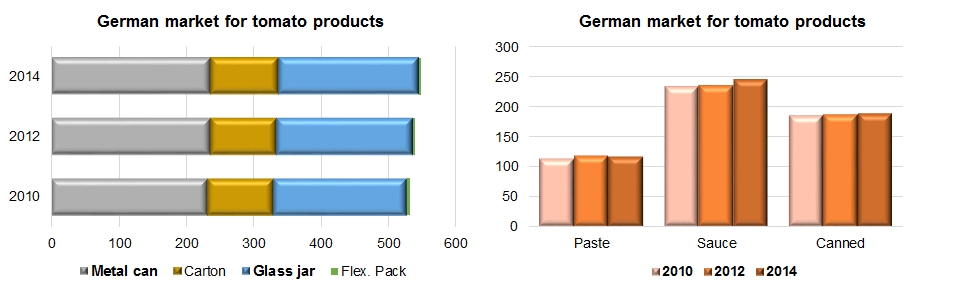

German market ranks fourth in Europe and seventh worldwide with 540 million units sold on average each year over the 2010-2014 period, and shows a marked preference for the sauces category (44% of the units sold, mainly conditioned in glass or carton packs) and canned tomatoes (35%, peeled or not, whole, chopped, etc.), while purées and paste only account for slightly more than one item in five sold on the retail market. Metal cans still hold a majority share of the canned tomato market and the purées and pastes market, in a sector that is growing regularly and where carton packs and glass are driving most of the growth.

With 1.52 billion units sold in 2014,

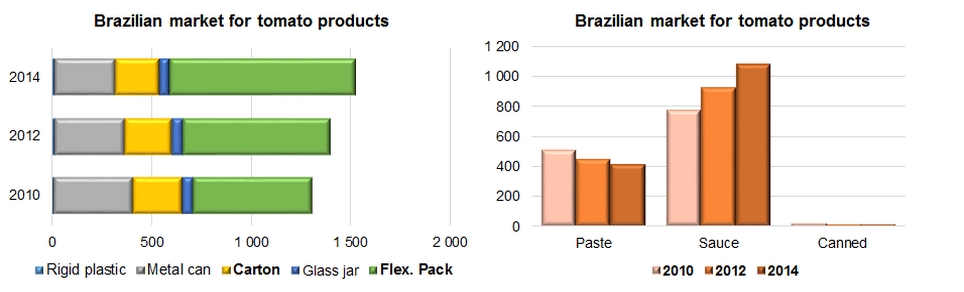

Brazil ranks second worldwide for retail sales, behind the USA and ahead of Italy, which it overtook thanks to a spectacular growth rate of 4% annually over the 2010-2014 period. This growth, which has occurred in a market that is virtually devoid of canned tomatoes, is mostly driven by the rapid development of the pasta sauces category (CAGR: 8.7% over the past five years, from 780 million units in 2010 to 1.09 b.u. in 2014), which is itself driven by the success of flexible packagings (CAGR: about 12%, from less than 600 million units in 2010 to 930 million in 2014). In recent years, this form of flexible pack has become the most frequent form of packaging also for purées and pastes on the Brazilian retail market, noticeably taking over some of the share of metal cans: in the final count, flexible packaging represented almost 61% of the market share of packaging in Brazil in 2014.

The

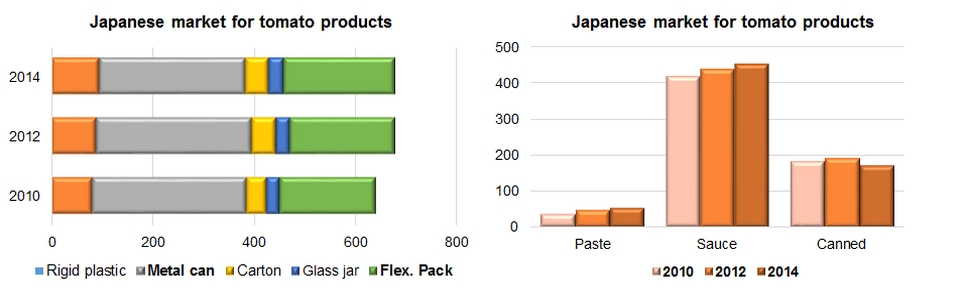

Japanese market also has a clear preference for the sauces category (which accounted for almost two-thirds of retail sales over the period in number of units) with almost 680 million units sold in 2014, a notable increase against 2010 results. It also recording significant movements in the canned tomato sector. Retail sales of sauces most frequently use flexible pouch packaging, a form of conditioning that has developed in recent years at the expense of metal cans. Similarly, traditional metal packaging has lost ground in the canned tomato sector, which increasingly uses carton packs for presenting its products. Glass is practically absent from tomato product sales, while paper-based packaging (board tubs and trays) is exclusively used for conditioning sauces.

Technicality, attractiveness... but above all, sustainability

We need to produce more, better, more intelligently, more economically, make it more attractive... How can we improve quality, sustain profitability, and outshine competition, yet still comply with the requirements for sustainability?

The pages of Tomato News have often described and analyzed the technical innovations and sustainable approaches (which are more and more often combined) that provide practical answers to the issues facing the industry, both in the agricultural upstream and the industrial downstream. But these innovations and approaches are also becoming more relevant to the point of contact between the product and the consumer, particularly in terms of the final packaging, which is an increasingly decisive dimension of the continuity and the commercial success of a product range. New concepts, new products, new processes, new materials: what is the real worth of the solutions currently being offered to processors?

In a recent Europe-wide

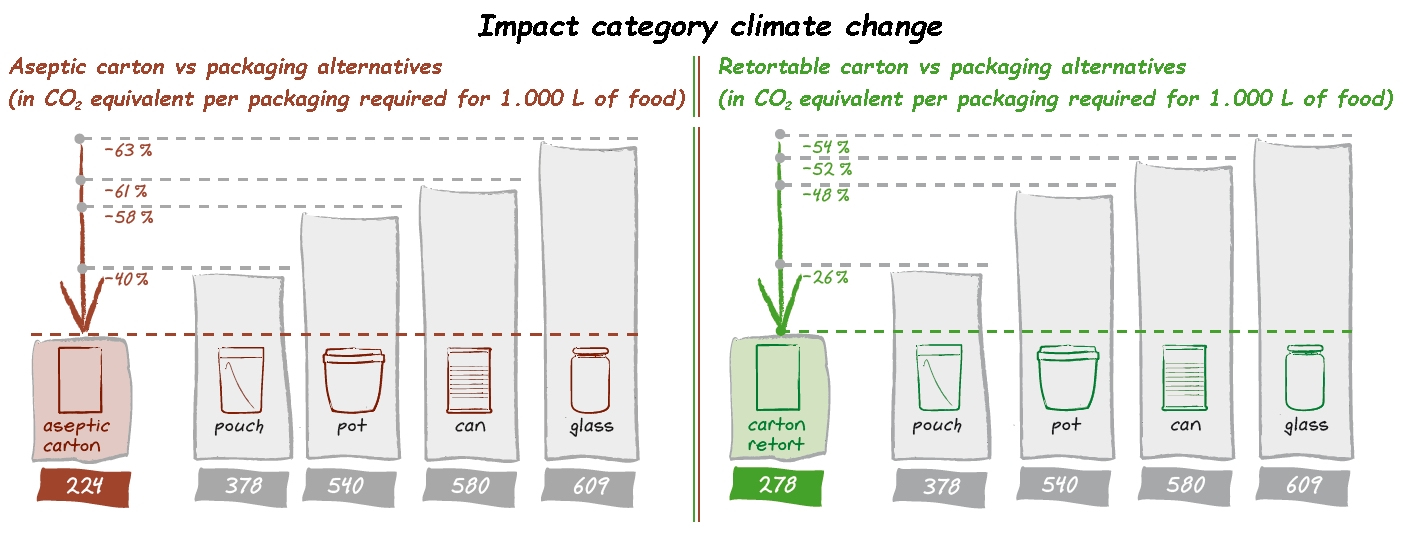

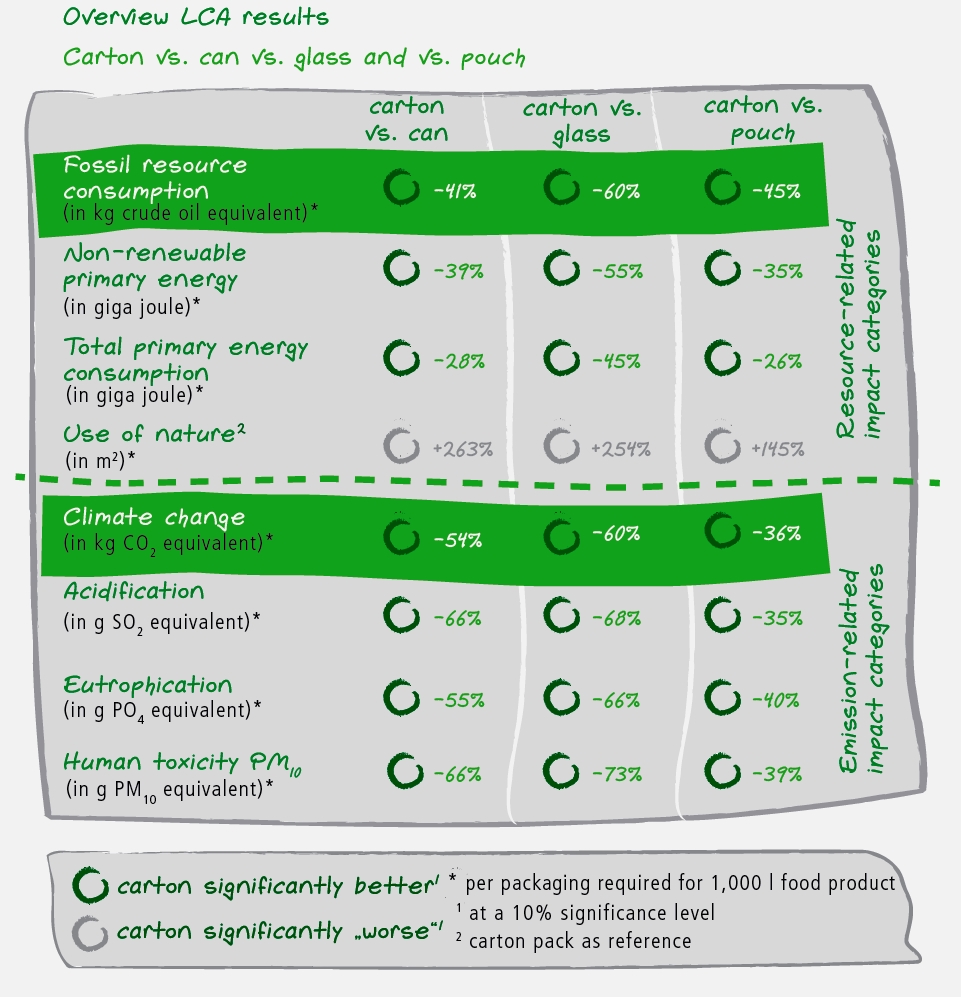

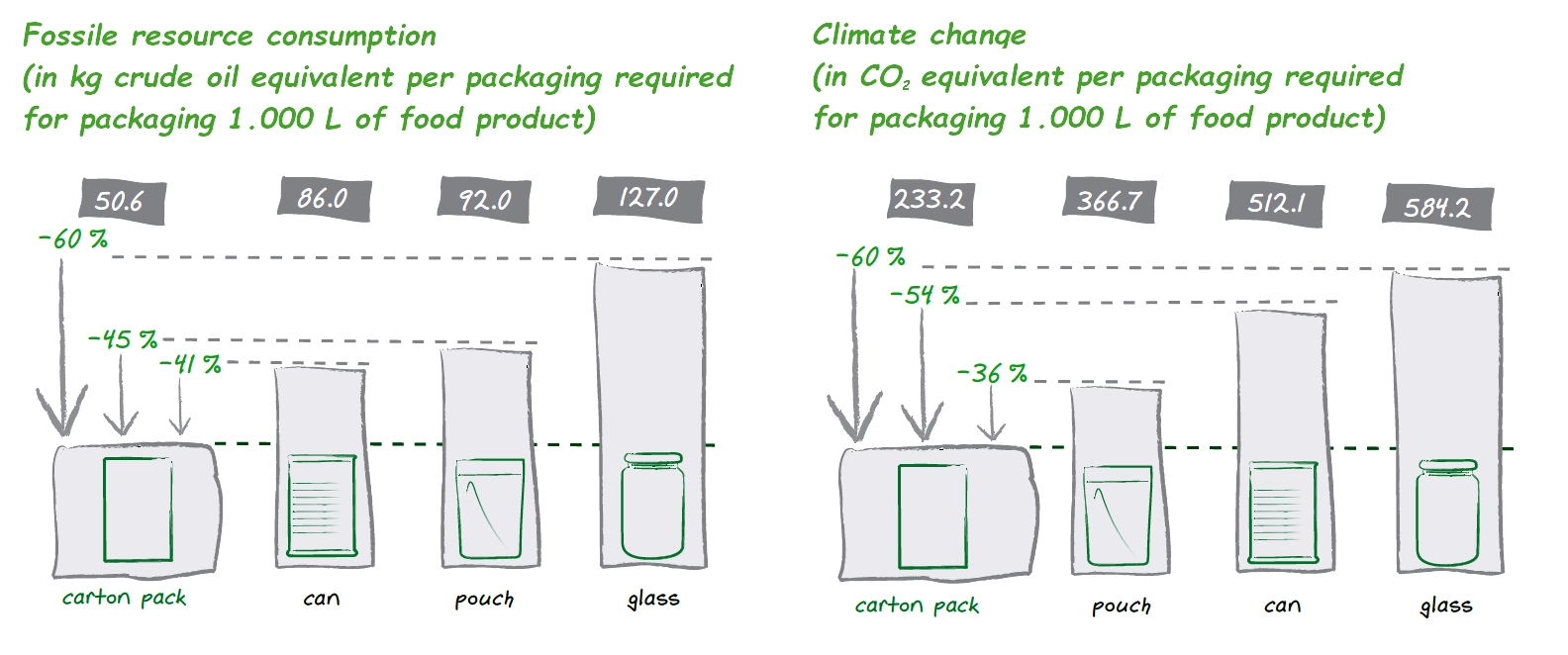

life-cycle assessment(1) (LCA) of packaging solutions for long-life foods (such as soups, sauces and tomato products), the environmental impacts of food metal cans, glass jars, pouches and carton packs were investigated. At each stage of the product’s life-cycle, the key environmental impact categories relevant to the resource, and the emissions-related categories, were investigated and evaluated – 13 categories in all.

In this LCA, all the factors and processes were critically examined and assessed: from the extraction and processing of the raw materials to the package manufacturing process, transport, filling process and distribution to the point of sale and recovery or disposal of the packaging after use.

For the study, conducted by the Institute for Energy and Environmental Research (IFEU, Heidelberg) for Sig Combibloc, packaging types for ambient food products were selected according to their relevance for the European market and for use by major international food brand owners. These packaging types included

Combibloc aseptic carton packaging (13.9 g) as well as the retortable

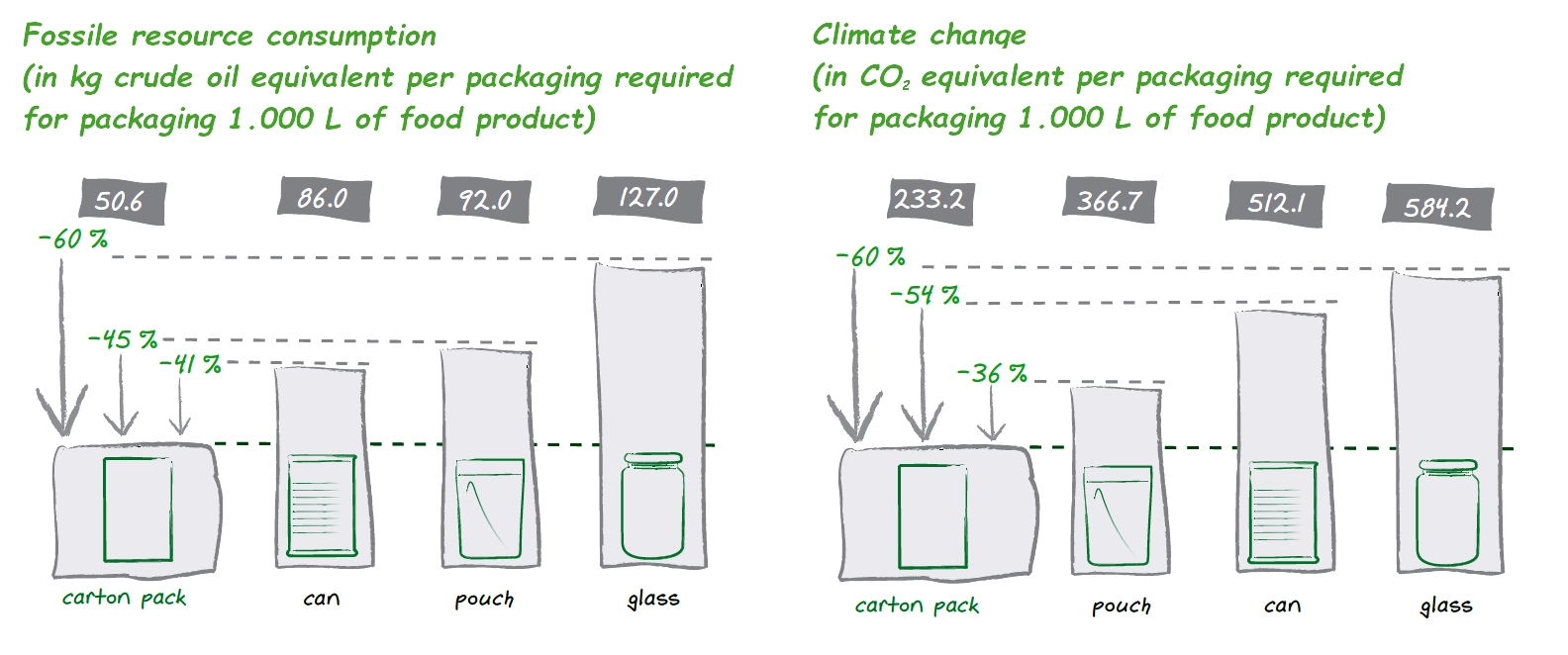

Combisafe carton packaging (16.7 g), along with retortable 3-layer pouches (10.1 g), glass jars with twist-off tops (211.3 g) and food metal cans with a ring-pull (52.5 g). All packaging specifications (weight, structure, tray formations, tray types, etc.) represented actual market samples. The findings of the independently reviewed study show that the overall weight and the material of the packaging are the main factors of the environmental impacts of a packaging system for ambient food products such as soups, sauces, tomato products, ready meals and vegetables. But above all, the study demonstrates that carton is the top performer from an environmental point of view: aseptic and retortable carton packaging systems had the best results in virtually all environmental impact categories – in respect of resource management and emissions. In the impact categories “Consumption of fossil resources”, “Use of primary energy” and “CO2 output/climate change”, the carton presents significant advantages over the other packaging forms included in the study. The study confirms that using carton packaging saves CO2 emissions and decreases fossil resource consumption by up to 60% compared to the other packaging solutions.

Carton packs generate 54% less CO2, use 41% less fossil resources, and consume 28% less primary energy than food metal cans. When compared to glass, these figures are 60% for CO2, 60% for fossil resources, and 45% for primary energy, while for pouches, the savings are 36% for CO2, 45% for fossil resources and 26% for primary energy.

The criteria for analyzing environmental impacts are numerous (acidification, aquatic or terrestrial eutrophication, toxicity for humans, intensity of transport, alteration of the ozone layer, depletion of abiotic resources, impact on renewable energy, etc.). In terms of the most immediately apprehensible criteria, it is also important to note that metal cans actually consume slightly less fossil fuels than flexible pouches or glass packaging. Similarly, research carried out by the Institute for Energy and Environmental Research (IFEU) clearly establishes that metal cans are more “noxious” in terms of climate change than flexible pouches, but less damaging than glass, which ranks last according to almost all the criteria applied.

2016: will we see an end to the highly complex issue of BPA?

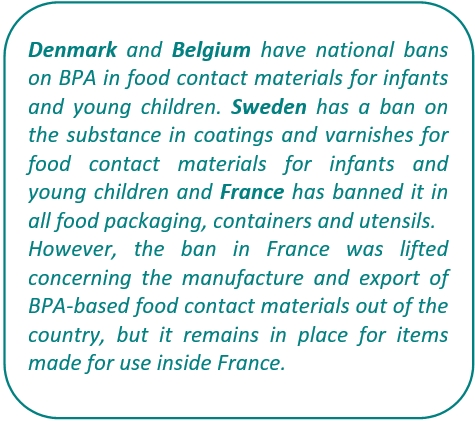

The information collected by Euromonitor confirms that tin cans remain, at a global level, the core packaging of the tomato processing industry, be it only at the final marketing stage. Also a core focus of the industry: the controversy surrounding the use of bisphenol A (BPA) as an inner coating for these cans. After years of intense debate, a number of research options are now about to reach fruition. The technical, legal and economic stakes are colossal, just like the volumes of products concerned at the global level of the food industry.

In Europe, most of the packaging used for preserving these products (about 80%) uses epoxy resin technology based on BPA for inner coatings. It is estimated that 90 lines are currently operating in the UK, Germany, Spain and France, in addition to the many companies running plants in this sector in countries like Italy and Greece… 50 billion drink cans and 20 billion food cans are produced in the EU each year. The value of the tin can market alone was estimated at close on EUR 30 billion in 2010.

The European Commission recently admitted that the implementation of national legislation on the issue had not given manufacturers of food contact materials enough time to evaluate and test alternative products. For 90% of the food products whose packaging contains BPA, substitution coatings are still at the experimental stage, with a number of test runs still to be carried out. For the remaining 10%, there will probably be no alternative solution.

Among the criticisms expressed regarding the forced move towards “non-BPA” packaging, the Commission has accepted that “

The alternative options could for example hinder the performance of the packaging, the durability of the food and in turn potentially affect the organoleptic properties of the foodstuffs that the packaging is intended to protect. […] One significant impact reported by industry […] is a decrease in the shelf life of many products, which if not addressed may in turn lead to increase in food waste. Industry has claimed that the switch to alternative substances may reduce the shelf-life of food in cans by 1-2 years."

In order to mitigate the major difficulties caused by the multitude of different national legislations (often lacking coherence with regard to European legislation) and to remedy the negative effects on consumer confidence of widely divergent scientific opinions, the European Commission will propose new regulations on BPA next year.

It said that a

new specific migration limit (SML) is needed after an EFSA opinion in January lowered the Tolerable Daily Intake (TDI) from 50 to 4 µg/kg body weight – a temporary TDI (t-TDI), pending further studies. BPA is subject to an SML of 0.6 mg/kg. EFSA's scientific opinion shows the level of BPA that consumers of all ages are exposed to is well below the t-TDI and concludes there is no health concern for any age group from dietary exposure, and low health concern from aggregated exposure, which includes sources other than food.

The Commission is looking into

five options:

- no policy change,

- restricting BPA in plastic food contact materials,

- the previous restriction and introducing measures in coatings and varnishes,

- the previous two options adding other food contact materials,

- an EU-wide ban on BPA in food contact materials.

A consultation is expected with an outcome provisionally set for mid-2016.

The Commission said differences between national laws, regulations and administrative provisions can “

create conditions of unequal and unfair competition and reduce flexibility compared with those that only supply to EU Member States that do not have such national laws on BPA."

Real innovative alternatives

The last of those five options – and the most constraining – would in fact be a total and final ban on the use of BPA. However, this solution does not have the Commission’s preference, as it does not reflect the EFSA’s current scientific knowledge and would require the immediate replacement of BPA by substances that could not guarantee the same levels of functionality and efficiency, and which have not all been tested yet. However, in absolute terms (i.e. without consideration of the specificities of individual companies or products, or of costs and of required investments, etc.), alternatives do exist that allow existing varnishes to be replaced by others that are suited to the expectations of consumers and law-makers. All over the world, scientific initiatives are suggesting that by-products of the food industry could be used to perfect internal coatings. Also, a switch to other forms of packaging (flexible pouches, carton packs, glass, etc.) remains an acceptable option, as shown by the recent decrease in the global market shares held by metal cans…

Other solutions exist: over the past two or three years, several companies in Europe and in the USA have proposed alternative solutions that are effectively innovative, half-way between the traditional tin can and rigid plastic packaging.

- In July 2013, UK-based RPC Containers Corby launched a plastic container designed to offer the benefits traditionally associated with metal can packaging.

The 380 ml container combines extended ambient shelf life (typically associated with metal cans) with all the established lightweight, easy handling and safety benefits of plastics, and also offers re-closing capability.

The high barrier container features a PP/EVOH/PP multilayer structure, intended to protect against oxygen ingress in order to ensure long shelf life. It reportedly is suitable for a variety of food processes, including hot fill, retort and pasteurizing.

According to the maker, the container offers an attractive, fluted design in the same diameter as a can, with full sleeving and labeling options to create effective branding and on-shelf appeal.

- During summer 2014, the Milacron Company (Ohio, USA, previously known as Kortec, until its acquisition in February 2014) launched multi-layer co-injection technology to make clear plastic cans for food packaging. Clear plastic cans provide an “attractive alternative” to traditional metal cans because consumers want to see the quality of food at the point of sale, according to Kortec.

The

Klear Can suits products including fruits, vegetables, soups and meats. It has a three-layer plastic construction (PP outer and inner layers, with an EVOH barrier) and is BPA free. The packaging is stackable and offers a shelf life of up to five years, the company claims. The new can has been designed to be used with existing metal can facilities, so manufacturers can use the same filling, seaming, retorting and cooling equipment. Although the body of the can is plastic, it retains a traditional metal ring pull lid and uses the same steel or aluminium ends.

- More recently, Sonoco (South Carolina, USA) introduced a clear can as an alternative to the traditional metal version that has been a mainstay packaging option for more than 200 years. Presented last November, the TruVue can (Sonoco's patented Fusion Freshlock Technology) is made of a multilayer plastic substrate that allows consumers to see the product inside. The clear, retortable plastic can incorporates the metal lid and metal bottom found on a traditional can and runs on existing equipment.

Jack Sanders, Sonoco’s CEO, said that with more than 47 000 products competing for attention in the average supermarket, standing out from the crowd is increasingly important: "

This is especially true for processed and shelf-stable foods like soups, sauces, fruits and vegetables – products traditionally sold in a metal can in the center of the store, an area which is losing share to fresh products found on the perimeter," he said.

Sonoco said it is the first clear plastic can to withstand the rigors of continuous retort systems without overpressure, performing in high-temperature and high-pressure environments. It provides a more uniform heating experience, a quicker retort cycle and greater strength performance throughout the supply chain, compared to competitive formats.

The US company is also looking closely into the other main packaging markets: Sonoco has updated on projects through 2017 to expand production capability in composite cans, flexible packaging and rigid plastic containers. These projects include an investment of USD 13 million to USD 15 million to grow composite can production capacity in Poland, an investment of USD 20 million in a composite can facility in Kuala Lumpur, Malaysia, which opened in September 2015 and a ramping-up of production throughout the first half of 2016. It is also investing in a composite can line at its new plant in Shanghai, China, with the possible development of a second plant in south China in 2016 or 2017.

Some complementary data

(1)The results are relevant for the European market, and are not limited to a single country. The life-cycle assessment was carried out by the IFEU Institute. A critical review confirms the study’s compliance with the corresponding ISO standard 14040ff.

In recent years, metal cans and glass packaging have accounted for most of the presentation packaging of tomato products, well ahead of carton pack conditioning like Tetra or Combi’, flexible pouches and other materials.

The carbon footprint of aseptic or retortable carton packs compared to the footprints of other types of packaging (pouches, plastic jars, metal cans and glass jars)

General results of the compared LCA of carton packs, glass jars and flexible pouches

(See also our articles on the Biocopac project.)

Appendices/Annexes

Distribution of packaging forms according to product category

Consumption of tomato products, by country, in millions of units

cans, which are the main packaging found on the market, with 42% of the units sold, have been the only segment to effectively shrink, at an average annual rate of 1.2%, over the 2010-2014 period. Glass and carton packs have only recorded sluggish

cans, which are the main packaging found on the market, with 42% of the units sold, have been the only segment to effectively shrink, at an average annual rate of 1.2%, over the 2010-2014 period. Glass and carton packs have only recorded sluggish

Flexible pouches are competing increasingly with glass, with close on 18% of the retail sales of sauces (800 million units), and even more spectacularly, with a sharp growth that has seen them increase over the past five years from a 14% market share (600 million units) in 2010 to more than a billion units in 2014 (a share of more than 21% of the market). At the same time, the market share of glass packaging for the sauces sector has dropped from more than 46% to just 41% of sales (therefore dropping under the 2 b.u. mark), along with the sales of metal cans and carton pack conditionings, both close on 13% in 2010, but respectively dropping to 9% and 12% of total sales in 2014. In addition to the previously mentioned progression of flexible packaging, these decreases overall have allowed rigid plastics to slightly improve their market share in the sauces category, from 11% in 2010 to 12% in 2014.

Flexible pouches are competing increasingly with glass, with close on 18% of the retail sales of sauces (800 million units), and even more spectacularly, with a sharp growth that has seen them increase over the past five years from a 14% market share (600 million units) in 2010 to more than a billion units in 2014 (a share of more than 21% of the market). At the same time, the market share of glass packaging for the sauces sector has dropped from more than 46% to just 41% of sales (therefore dropping under the 2 b.u. mark), along with the sales of metal cans and carton pack conditionings, both close on 13% in 2010, but respectively dropping to 9% and 12% of total sales in 2014. In addition to the previously mentioned progression of flexible packaging, these decreases overall have allowed rigid plastics to slightly improve their market share in the sauces category, from 11% in 2010 to 12% in 2014.

In a recent Europe-wide life-cycle assessment(1) (LCA) of packaging solutions for long-life foods (such as soups, sauces and tomato products), the environmental impacts of food metal cans, glass jars, pouches and carton packs were investigated. At each stage of the product’s life-cycle, the key environmental impact categories relevant to the resource, and the emissions-related categories, were investigated and evaluated – 13 categories in all.

In a recent Europe-wide life-cycle assessment(1) (LCA) of packaging solutions for long-life foods (such as soups, sauces and tomato products), the environmental impacts of food metal cans, glass jars, pouches and carton packs were investigated. At each stage of the product’s life-cycle, the key environmental impact categories relevant to the resource, and the emissions-related categories, were investigated and evaluated – 13 categories in all.

In Europe, most of the packaging used for preserving these products (about 80%) uses epoxy resin technology based on BPA for inner coatings. It is estimated that 90 lines are currently operating in the UK, Germany, Spain and France, in addition to the many companies running plants in this sector in countries like Italy and Greece… 50 billion drink cans and 20 billion food cans are produced in the EU each year. The value of the tin can market alone was estimated at close on EUR 30 billion in 2010.

In Europe, most of the packaging used for preserving these products (about 80%) uses epoxy resin technology based on BPA for inner coatings. It is estimated that 90 lines are currently operating in the UK, Germany, Spain and France, in addition to the many companies running plants in this sector in countries like Italy and Greece… 50 billion drink cans and 20 billion food cans are produced in the EU each year. The value of the tin can market alone was estimated at close on EUR 30 billion in 2010. The 380 ml container combines extended ambient shelf life (typically associated with metal cans) with all the established lightweight, easy handling and safety benefits of plastics, and also offers re-closing capability.

The 380 ml container combines extended ambient shelf life (typically associated with metal cans) with all the established lightweight, easy handling and safety benefits of plastics, and also offers re-closing capability. The Klear Can suits products including fruits, vegetables, soups and meats. It has a three-layer plastic construction (PP outer and inner layers, with an EVOH barrier) and is BPA free. The packaging is stackable and offers a shelf life of up to five years, the company claims. The new can has been designed to be used with existing metal can facilities, so manufacturers can use the same filling, seaming, retorting and cooling equipment. Although the body of the can is plastic, it retains a traditional metal ring pull lid and uses the same steel or aluminium ends.

The Klear Can suits products including fruits, vegetables, soups and meats. It has a three-layer plastic construction (PP outer and inner layers, with an EVOH barrier) and is BPA free. The packaging is stackable and offers a shelf life of up to five years, the company claims. The new can has been designed to be used with existing metal can facilities, so manufacturers can use the same filling, seaming, retorting and cooling equipment. Although the body of the can is plastic, it retains a traditional metal ring pull lid and uses the same steel or aluminium ends.

Jack Sanders, Sonoco’s CEO, said that with more than 47 000 products competing for attention in the average supermarket, standing out from the crowd is increasingly important: "This is especially true for processed and shelf-stable foods like soups, sauces, fruits and vegetables – products traditionally sold in a metal can in the center of the store, an area which is losing share to fresh products found on the perimeter," he said.

Jack Sanders, Sonoco’s CEO, said that with more than 47 000 products competing for attention in the average supermarket, standing out from the crowd is increasingly important: "This is especially true for processed and shelf-stable foods like soups, sauces, fruits and vegetables – products traditionally sold in a metal can in the center of the store, an area which is losing share to fresh products found on the perimeter," he said.