Respect for your privacy is our priority

The cookie is a small information file stored in your browser each time you visit our web page.Cookies are useful because they record the history of your activity on our web page. Thus, when you return to the page, it identifies you and configures its content based on your browsing habits, your identity and your preferences.

You may accept cookies or refuse, block or delete cookies, at your convenience. To do this, you can choose from one of the options available on this window or even and if necessary, by configuring your browser.

If you refuse cookies, we can not guarantee the proper functioning of the various features of our web page.

For more information, please read the COOKIES INFORMATION section on our web page.

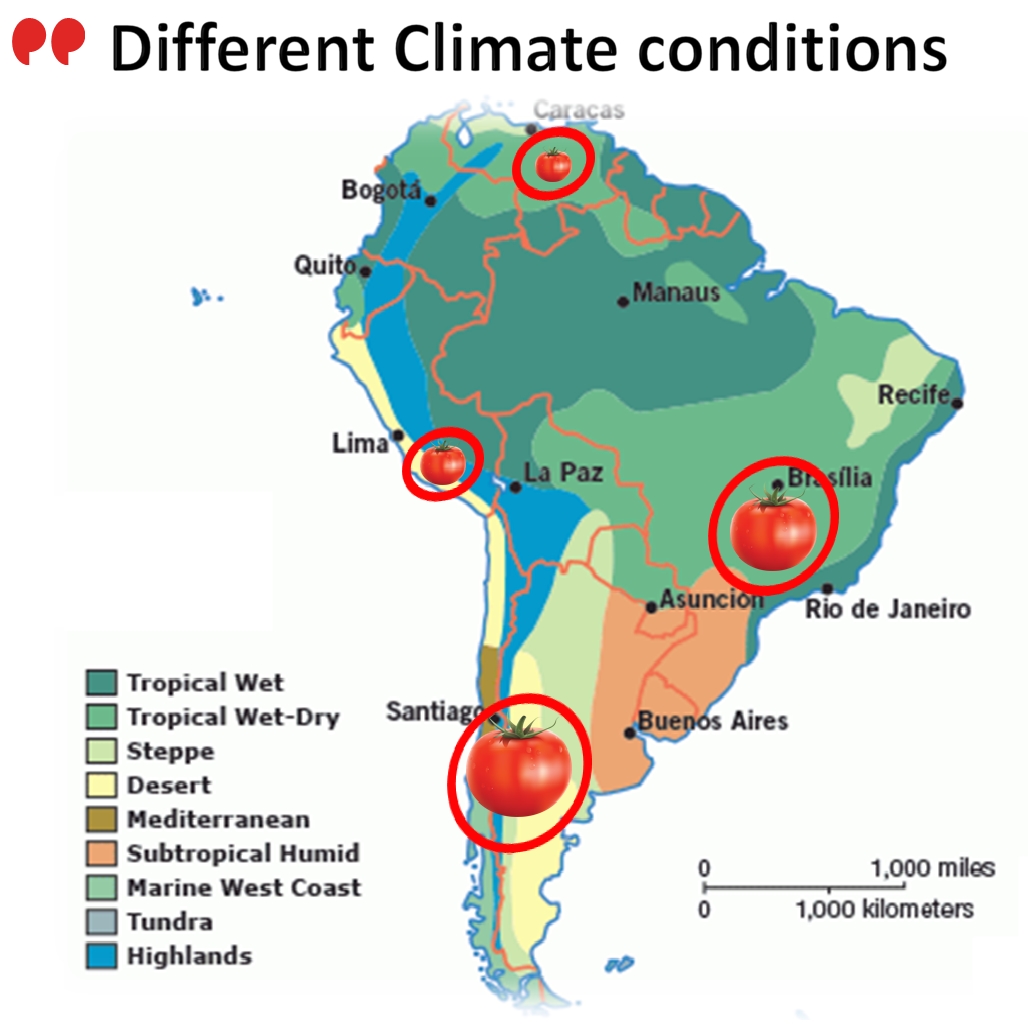

In a brief introduction, Mr. Mira described the general situation of the demographics and economy of the 13 countries that make up South America, and he accentuated some of the most notable contrasts of the region: 422 million people live in this subcontinent (approximately 6% of the total worldwide population), of which almost half (207 million) live in Brazil alone (12% in Columbia and 10% in Argentina), while the seven smaller countries of the region only comprise slightly less than 15% of South America's total population.

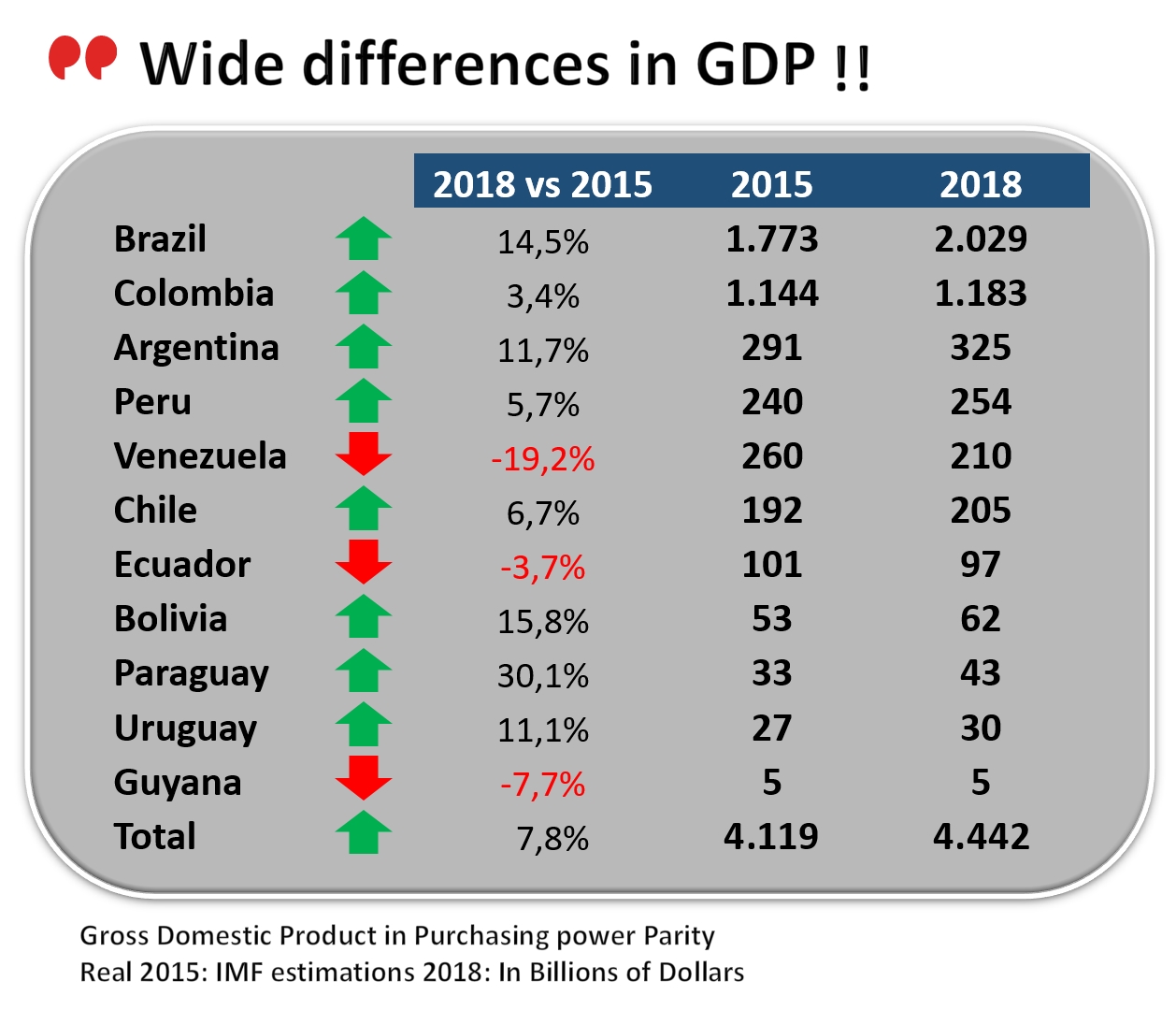

In a brief introduction, Mr. Mira described the general situation of the demographics and economy of the 13 countries that make up South America, and he accentuated some of the most notable contrasts of the region: 422 million people live in this subcontinent (approximately 6% of the total worldwide population), of which almost half (207 million) live in Brazil alone (12% in Columbia and 10% in Argentina), while the seven smaller countries of the region only comprise slightly less than 15% of South America's total population. The region also features a number of big disparities in terms of wealth, linked to the size of the countries as well as to their history and development, as demonstrated by the recent evolution of gross domestic product results in several of these nations: over the past three years, most of the countries in South America have seen their GDP increase, particularly after years of continued depression, for some of them. Total GDP for the region is close on USD 4.5 billion in 2018, which is a 7.8% increase compared to the GDP recorded in 2015 (USD 4.12 billion). It is important to note the impressive progression of the GDP in Brazil (+14.5%), Bolivia (+15.8%), Argentina (+11.7%), etc.

The region also features a number of big disparities in terms of wealth, linked to the size of the countries as well as to their history and development, as demonstrated by the recent evolution of gross domestic product results in several of these nations: over the past three years, most of the countries in South America have seen their GDP increase, particularly after years of continued depression, for some of them. Total GDP for the region is close on USD 4.5 billion in 2018, which is a 7.8% increase compared to the GDP recorded in 2015 (USD 4.12 billion). It is important to note the impressive progression of the GDP in Brazil (+14.5%), Bolivia (+15.8%), Argentina (+11.7%), etc. Brazil's production is distributed very unequally between four different regions: 3% in the Nordeste, 72% in the state of Goiás, 10% in Minas Gerais, and 15% in the state of Sao Paulo. The volumes processed amounted to 1.4 million mT in 2017 and approximately 1.32 mT in 2018 (editor's note), respectively harvested from 17 000 hectares of fields in 2017 and 15 000 hectares in 2018, all of which are equipped with central pivot sprinkler irrigation systems. About 125 to 150 growers are using approximately 120 to 135 hectares each, obtaining yields of approximately 82 mT/ha. The field gate price of raw tomato amounted in 2017 to USD 73 /mT, but the big distances covered result in high transport costs (approximately USD 25 /mT), which negatively affects the price of raw materials (USD 98 /mT) in the final count. The soluble solids content has improved in recent years but, at 4.2 to 4.5, the Brix remains lower than the worldwide average.

Brazil's production is distributed very unequally between four different regions: 3% in the Nordeste, 72% in the state of Goiás, 10% in Minas Gerais, and 15% in the state of Sao Paulo. The volumes processed amounted to 1.4 million mT in 2017 and approximately 1.32 mT in 2018 (editor's note), respectively harvested from 17 000 hectares of fields in 2017 and 15 000 hectares in 2018, all of which are equipped with central pivot sprinkler irrigation systems. About 125 to 150 growers are using approximately 120 to 135 hectares each, obtaining yields of approximately 82 mT/ha. The field gate price of raw tomato amounted in 2017 to USD 73 /mT, but the big distances covered result in high transport costs (approximately USD 25 /mT), which negatively affects the price of raw materials (USD 98 /mT) in the final count. The soluble solids content has improved in recent years but, at 4.2 to 4.5, the Brix remains lower than the worldwide average. The production of processing tomatoes in Chile is concentrated in the central region of the country, within a 300 km zone that stretches south of Santiago. The volumes processed in 2018 have amounted to approximately 1.2 million mT, harvested on surfaces of 12 550 hectares, including 20% that are equipped with drip irrigation systems, while the remaining 80% are still watered by furrow irrigation. Agricultural yields in this area reach 96 mT/ha on average, with an average soluble solids content between 5.0 and 5.1 Brix. Last year, about 500 growers supplied the processing plants of three companies (Sugal Chile, Patagonia Fresh and Carozzi), from crops grown within an average distance of 50 km from the processing factories. The price of raw materials (in Chilean pesos) amounted to the equivalent of approximately USD 80 /mT, but the cost of land is currently very high in Chile, up to USD 60 000 or 65 000 per hectare on a number of farms, due to the competition from other fruit and vegetable crops that are very profitable.

The production of processing tomatoes in Chile is concentrated in the central region of the country, within a 300 km zone that stretches south of Santiago. The volumes processed in 2018 have amounted to approximately 1.2 million mT, harvested on surfaces of 12 550 hectares, including 20% that are equipped with drip irrigation systems, while the remaining 80% are still watered by furrow irrigation. Agricultural yields in this area reach 96 mT/ha on average, with an average soluble solids content between 5.0 and 5.1 Brix. Last year, about 500 growers supplied the processing plants of three companies (Sugal Chile, Patagonia Fresh and Carozzi), from crops grown within an average distance of 50 km from the processing factories. The price of raw materials (in Chilean pesos) amounted to the equivalent of approximately USD 80 /mT, but the cost of land is currently very high in Chile, up to USD 60 000 or 65 000 per hectare on a number of farms, due to the competition from other fruit and vegetable crops that are very profitable. In Argentina, 78% of the processing tomato crop is grown in the region of Cuyo, between Mendoza and the San Juan area. The Rio Negro region, in the South, accounts for 8% of the national total, La Rioja for 6%, and the NOA region ("North of Argentina") for the remaining 8%.

In Argentina, 78% of the processing tomato crop is grown in the region of Cuyo, between Mendoza and the San Juan area. The Rio Negro region, in the South, accounts for 8% of the national total, La Rioja for 6%, and the NOA region ("North of Argentina") for the remaining 8%. The total production of Peru, which amounts to approximately 100 000 mT, is grown in the desert valley of Ica, 250 km south of Lima. The harvest season generally lasts from October to April, and planted surfaces cover slightly less than 800 hectares, all of which are equipped with drip irrigation systems. Yields reach 120 mT/ha, destined solely for one company (Icatom), which is both the only grower and the only processor in the country. The price of raw materials – or its cost, according to viewpoint – amounts to the equivalent of USD 80 /mT. Agricultural conditions are among the most demanding of the region, with major health issues (insect infestations, diseases) caused by difficult weather circumstances. So crops are costly in terms of irrigation and limited because of available land surfaces, leading to very high production costs and the necessity of obtaining high yields, without which the price level of raw tomatoes would be completely noncompetitive. Peruvian cooking does not use a lot of processed tomato products, so 80% of the crop – which is entirely used for making tomato pastes – is shipped to foreign markets (Argentina, Brazil, Colombia, Ecuador, etc.).

The total production of Peru, which amounts to approximately 100 000 mT, is grown in the desert valley of Ica, 250 km south of Lima. The harvest season generally lasts from October to April, and planted surfaces cover slightly less than 800 hectares, all of which are equipped with drip irrigation systems. Yields reach 120 mT/ha, destined solely for one company (Icatom), which is both the only grower and the only processor in the country. The price of raw materials – or its cost, according to viewpoint – amounts to the equivalent of USD 80 /mT. Agricultural conditions are among the most demanding of the region, with major health issues (insect infestations, diseases) caused by difficult weather circumstances. So crops are costly in terms of irrigation and limited because of available land surfaces, leading to very high production costs and the necessity of obtaining high yields, without which the price level of raw tomatoes would be completely noncompetitive. Peruvian cooking does not use a lot of processed tomato products, so 80% of the crop – which is entirely used for making tomato pastes – is shipped to foreign markets (Argentina, Brazil, Colombia, Ecuador, etc.).