Trade flow is driven by Italian canned tomatoes

The Comprehensive Economic Trade Agreement (CETA), the new free-trade agreement between Canada and the European Union, provisionally entered into force a few days ago (21 September).

The provisional application of CETA follows its approval by EU Member States, expressed via the Commission and the European Parliament. It will enter into force "fully and definitively" when all EU Member States have ratified the agreement.

The provisional application of CETA follows its approval by EU Member States, expressed via the Commission and the European Parliament. It will enter into force "fully and definitively" when all EU Member States have ratified the agreement.

Currently, Canada is the 9th largest export market for European food and drink manufacturers, with annual shipments of EUR 3.4 billion – or 3% of the EU's total exports. Meanwhile, Canada was the EU’s 20th largest non-EU supplier of agri-food and seafood products in 2015, with a 2.1% share worth about EUR 900 million.

Here are several key points that define what will change with the new agreement.

Cutting tariffs, opening quotas

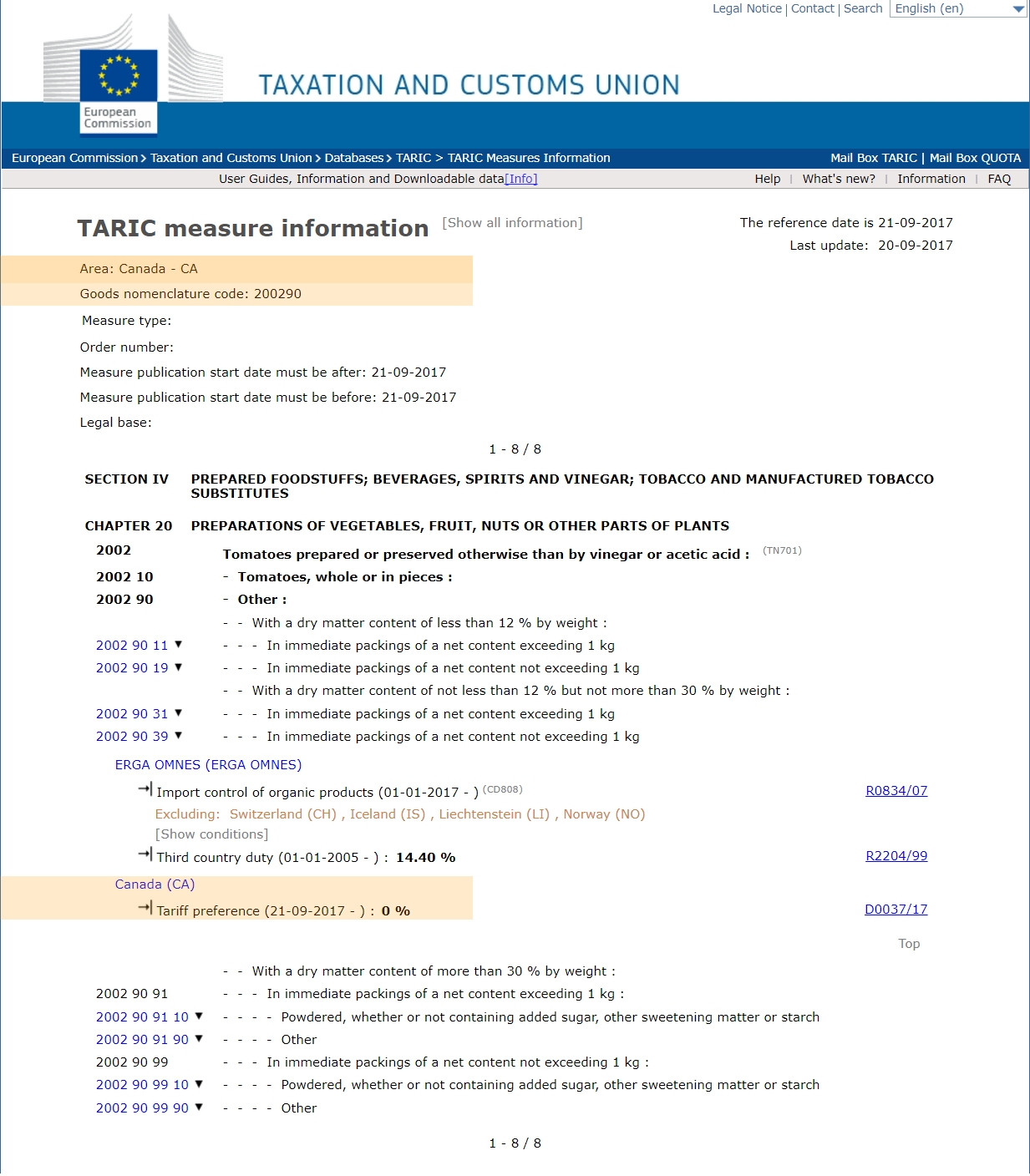

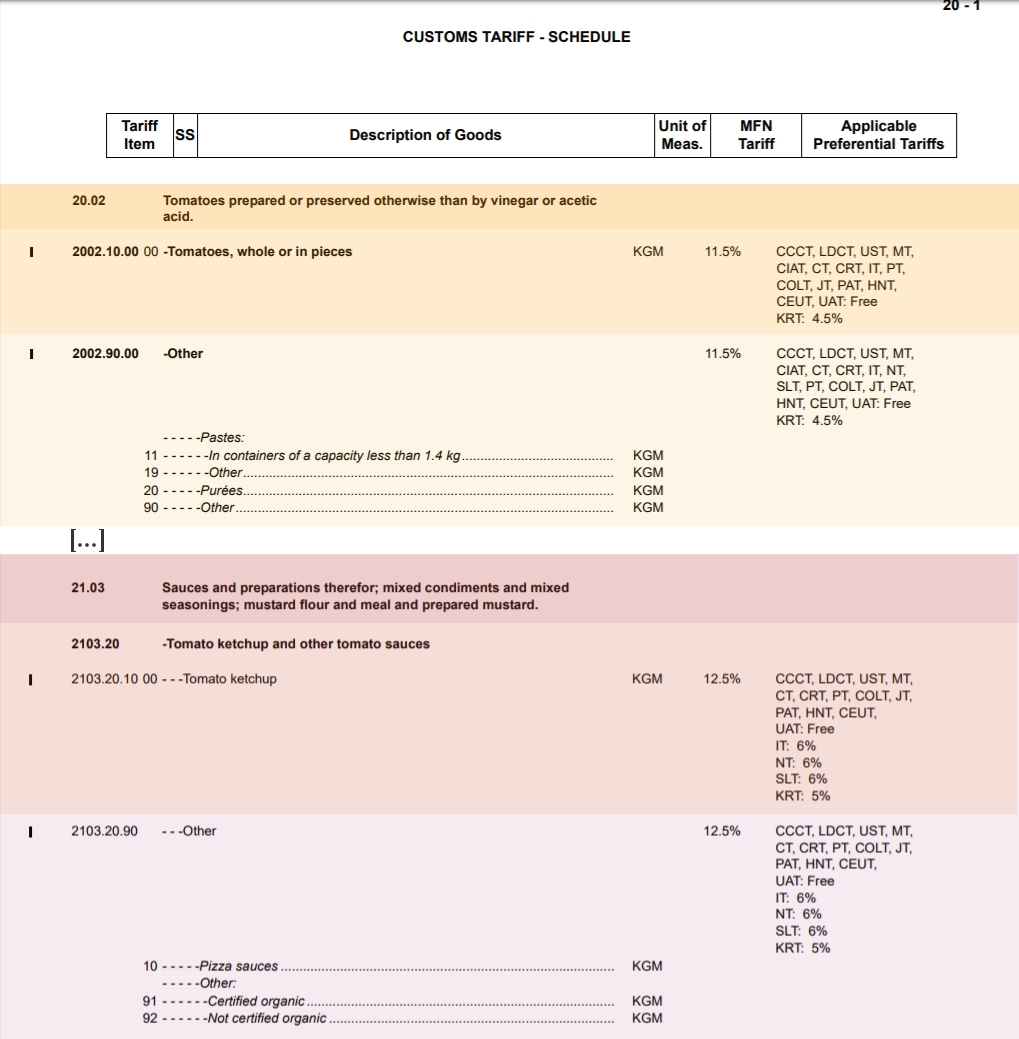

CETA removes Canadian customs duties and opens up the Canadian market to European food and drink products. In particular, the CETA does away with all customs duties on imports of tomato products entering Canada as well as European territory.

When fully implemented, the agreement will remove 99% of all customs duties on goods moving between the two trading blocks. According to the figures published on the EU official website, Europe will be able to export nearly 92% of its agricultural and food products to Canada duty-free, including wines and spirits. The EC said this will make European products cheaper – and therefore more appealing – to Canada's market of high-income consumers. In particular, the EC believes this is an opportunity for European companies to grow exports to Canada of wines and spirits, fruit and vegetables, processed foods, “traditional specialties”, and cheese. There will be "limited quotas” for a few sensitive products such as beef, pork and sweetcorn for the EU and dairy products for Canada.

Given that Canada is virtually dependent on imports of tomato products, particularly those shipped in from its big neighbor next door, the US, any potential benefits to be found in the free trade agreement for European processors will depend on their capacity to export products that must be and must remain – despite fluctuations in exchange rates – sufficiently competitive compared to competing US products, which are also exempt from customs tariffs. In any event, the cancellation of taxes on European products introduces a decisive shift in the trade context with Canada.

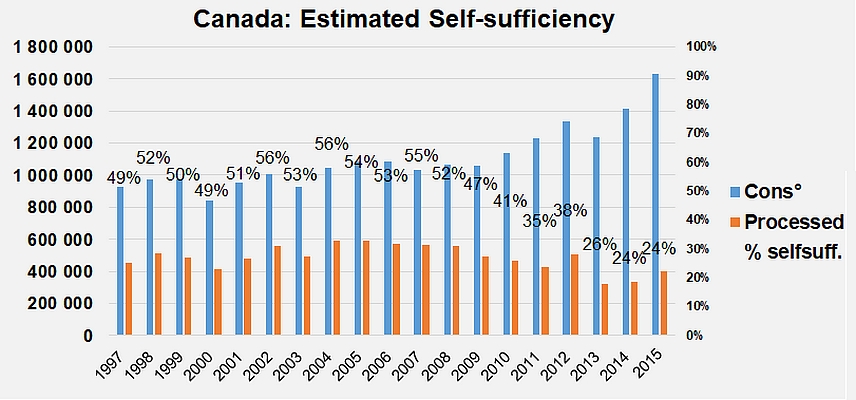

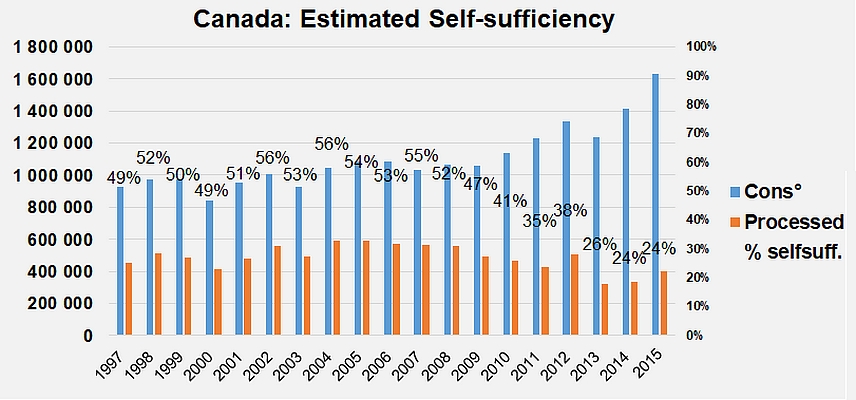

For a long time, the Canadian industry was able to supply approximately one half of the country's tomato product requirements. For the past six or seven years, however, demand has grown much faster than industrial processing , with the result that the capacity of local processors to satisfy domestic demand has progressively diminished: in 2015, Canadian products only covered approximately one quarter of demand.

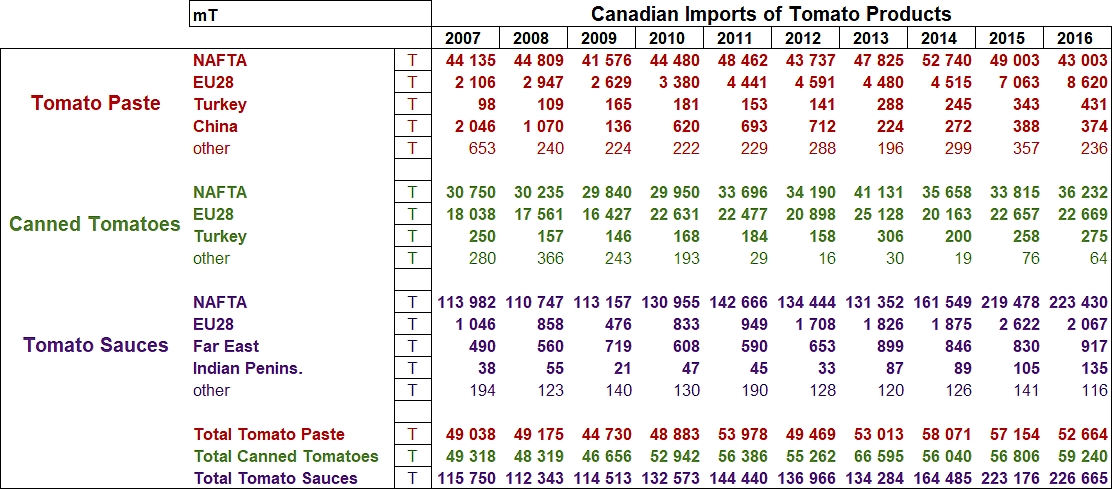

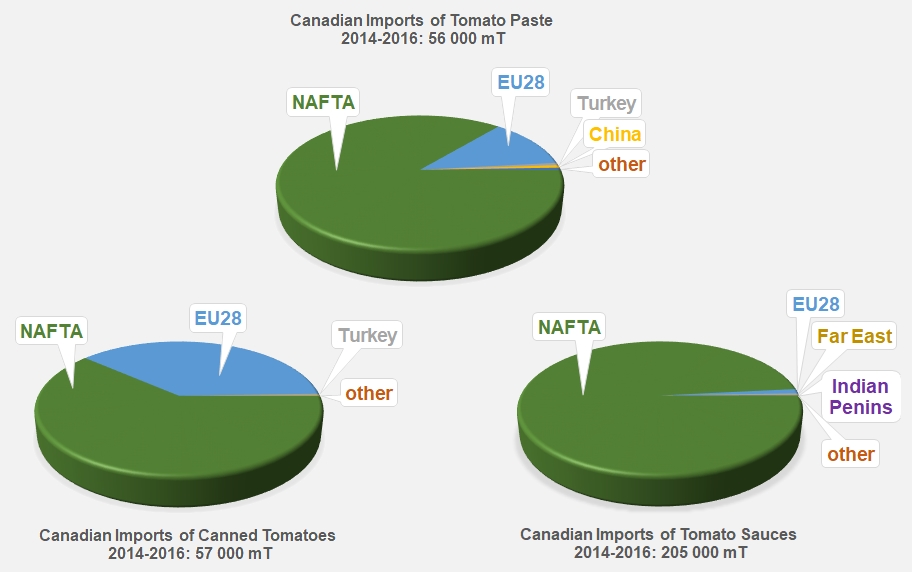

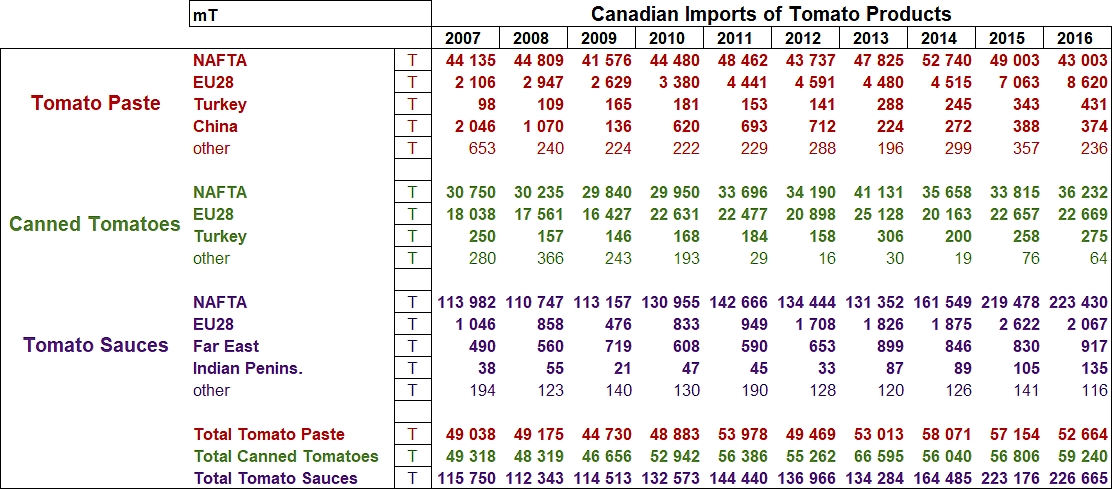

So Canada is a major importer of tomato products: over the past three years (2014, 2015 and 2016), average annual imports of paste have amounted to close on 50 000 mT of finished products. Over the same period, Canada also imported 57 000 mT of canned tomatoes and close on 205 000 mT of sauces and ketchup, ranking the country in 10th position on the worldwide list of paste importing countries, in 5th position for canned tomatoes and in 1st position worldwide for sauces.

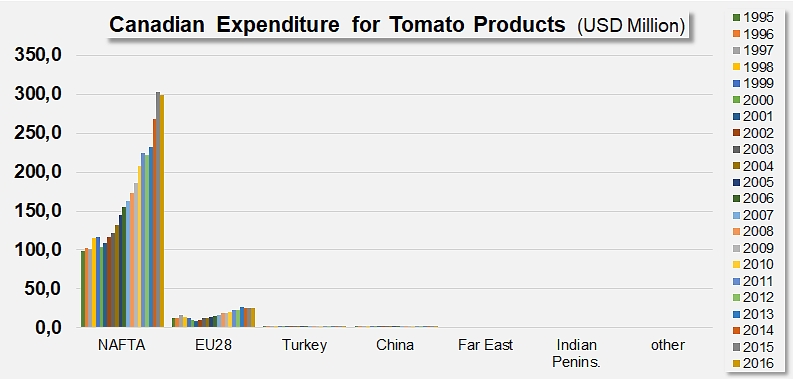

As a privileged trade partner for Canada, the United States continued to claim the lion's share of Canadian purchases. In the tomato paste sector, the US industry alone accounts for an average of 86% (approximately 48 200 mT) of required supplies over the past three years. Competition from Italian products is harsher in the canned tomato category, where US operators have been able to claim "only" 37 200 mT (61%) of the 57 000 mT imported every year by Canada. However, US products are practically the only ketchup and sauces to be shipped into Canada from abroad, accounting for 98% of total supplies in this category over the past three years.

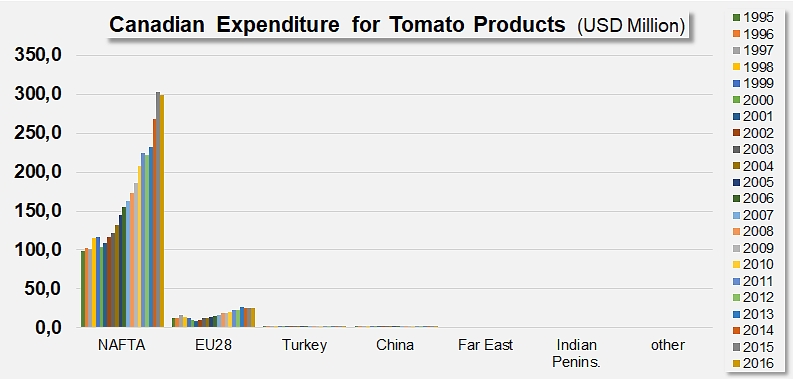

In summary, of the USD 320 million spent on average for the period running 2014-2016, approximately USD 290 million (91%) went to US companies, USD 25 million (less than 8%) to European companies, and the remainder – slightly more than USD 4 million, which is less than 1% – went to companies in Turkey, the Philippines, China and elsewhere.

So in effect, even if the potential of this opening of the Canadian market is fairly narrow, European processors and products have a real possibility of developing these small but established trade flows.

In competition with US products, Italian products are currently the only ones to be sufficiently well positioned to hope to claim a few market shares. Italian companies like Conserve Italia, Mutti or the Consorzio Casalasco have understood that the reputation of Italian products and the solid link between tomatoes and the "bel paese" in the collective subconscious of consumers are major advantages that processors should not underestimate if they want to open up North American markets.

Between 2014 and 2016, Italy alone accounted for approximately 94% of the turnover generated by Canadian purchases of EU products, though the same could be said for virtually all of the past 20 years. Of the USD 25.3 million spent by Canada on European tomato products, Italian companies claimed USD 23.7 million approximately (USD 5.1 million for paste, 15.8 million for canned tomatoes and 2.8 million for sauces), only leaving 3% (USD 0.8 million) of the turnover generated by imported European products for Spanish operators, 1% (USD 0.28 million) for Greek operators, and 0.5% (USD 0.13 million) for Polish operators.

Over this recent period, Greece achieved most of its turnover thanks to its modest sales of paste. Spain, whose well-established presence in the canned tomato sector disappeared completely between 1995 and 2005, achieved almost all of its results in the sauces category. Poland also only exported sauces to Canada.

European foreign sales are the only credible competitors on the Canadian market, although they remain minimal in certain sectors and do not come close to rivaling the impressive US trade flow, although they have progressed regularly for more than the past 10 years, before a free-trade treaty was even being considered.

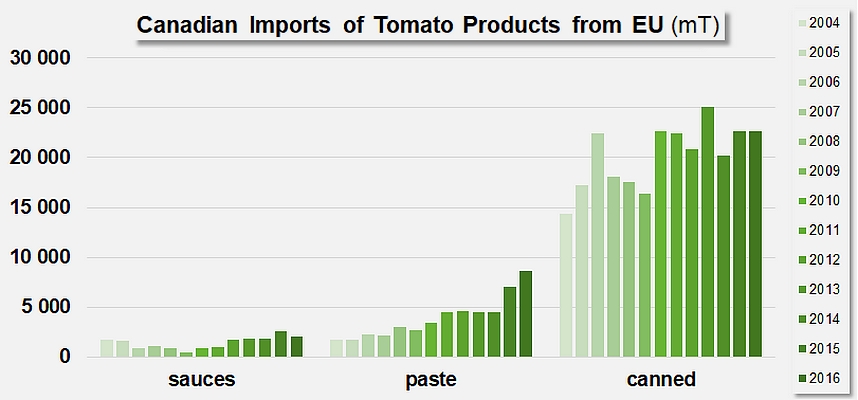

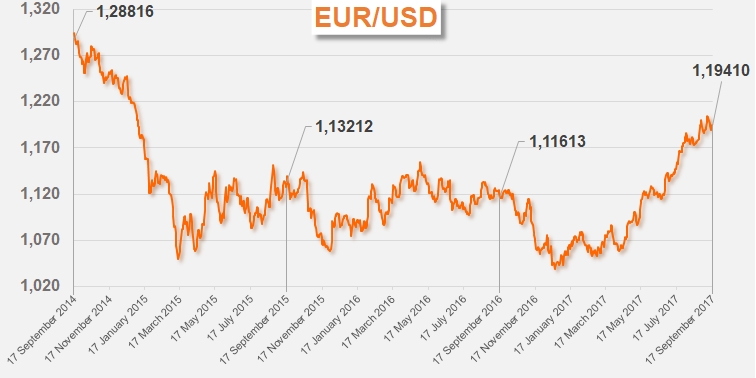

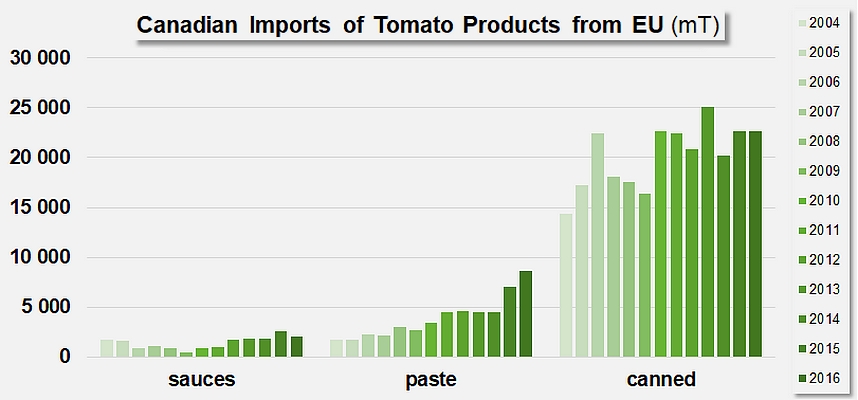

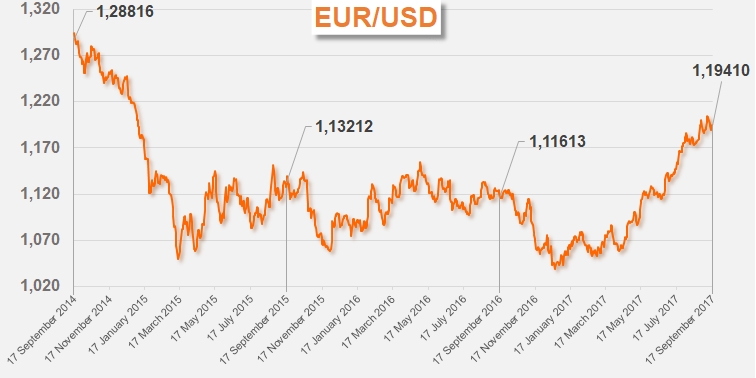

Over the past 12 years, European sales of pastes to Canada have grown at a reasonable speed, from 1 700 tonnes in 2004 to 2 100 tonnes in 2016 (approximately 1.5% per year). Canadian purchases of European canned tomatoes have grown considerably faster, from 1 700 tonnes in 2004 to 8 600 tonnes last year (+14% per year). European sales of sauces have also grown, from 14 400 tonnes in 2004 to 22 700 tonnes in 2016. It is a fact that the Canadian market has acquired a taste for European products, and the attraction for local consumers has been complemented over the past two or three years by the lower prices that have been made possible by the dip in value of the European currency.

In a context where many indicators seem to provide reasonable grounds for believing in the future consolidation of products from Italy, Greece and Spain on the Canadian market, this last parameter is likely to be considered of major importance over the coming months. The European currency has indeed recorded a spectacular recovery against the US dollar since spring 2017, bringing it back to levels it had not seen since early January 2015 (USD 1.2 for EUR 1, val. 20 September 2017). Contrary to the dynamics that in 2015 and 2016 saw European exports being promoted on the worldwide markets at the expense of competing products from the US, China and elsewhere, the consolidation of the euro considerably increased the price of European products and could therefore also be an obstacle to trade flows.

If this trend is confirmed, it is not unlikely that worldwide trade could enter a new phase and that the attraction of European products could decrease over the coming months. In the specific context of the Canadian market, these monetary factors could jeopardize the potential improvement expected after customs tariffs are removed – European processors would then need to wait before they could benefit from the possible positive results of the CETA.

Other key points of the agreement either do not concern tomato products or are not directly related to them. It is nonetheless important to note that the CETA should allow the EU to extend the international acknowledgement of its geographical indications system, which has been developed to protect products whose description or denomination is particularly significant for a region or a country. The Commission reaffirmed that "Promoting and protecting Europe's flagship food and drink products in countries outside the EU is a top priority for CETA, as for any EU trade deal.'' The status of geographical indication is already acknowledged for 143 products in Canada, where these items are protected from imitations and counterfeit production in the same way as they are in European law.

The Commission also insists on the fact that the new agreement will in no way lower food safety standards, whether in terms of the regulations pertaining to animal well-being or to maximum pesticide residue limits: "All imports from Canada have to meet EU rules and regulations," stressed a Commission statement.

Sources: GTIS, FoodNavigator

Some complementary data

Canadian imports of tomato products in metric tonnes since 2007.

Contribution of the different supplier regions to Canadian purchases, on average, for the period running 2014-2016.

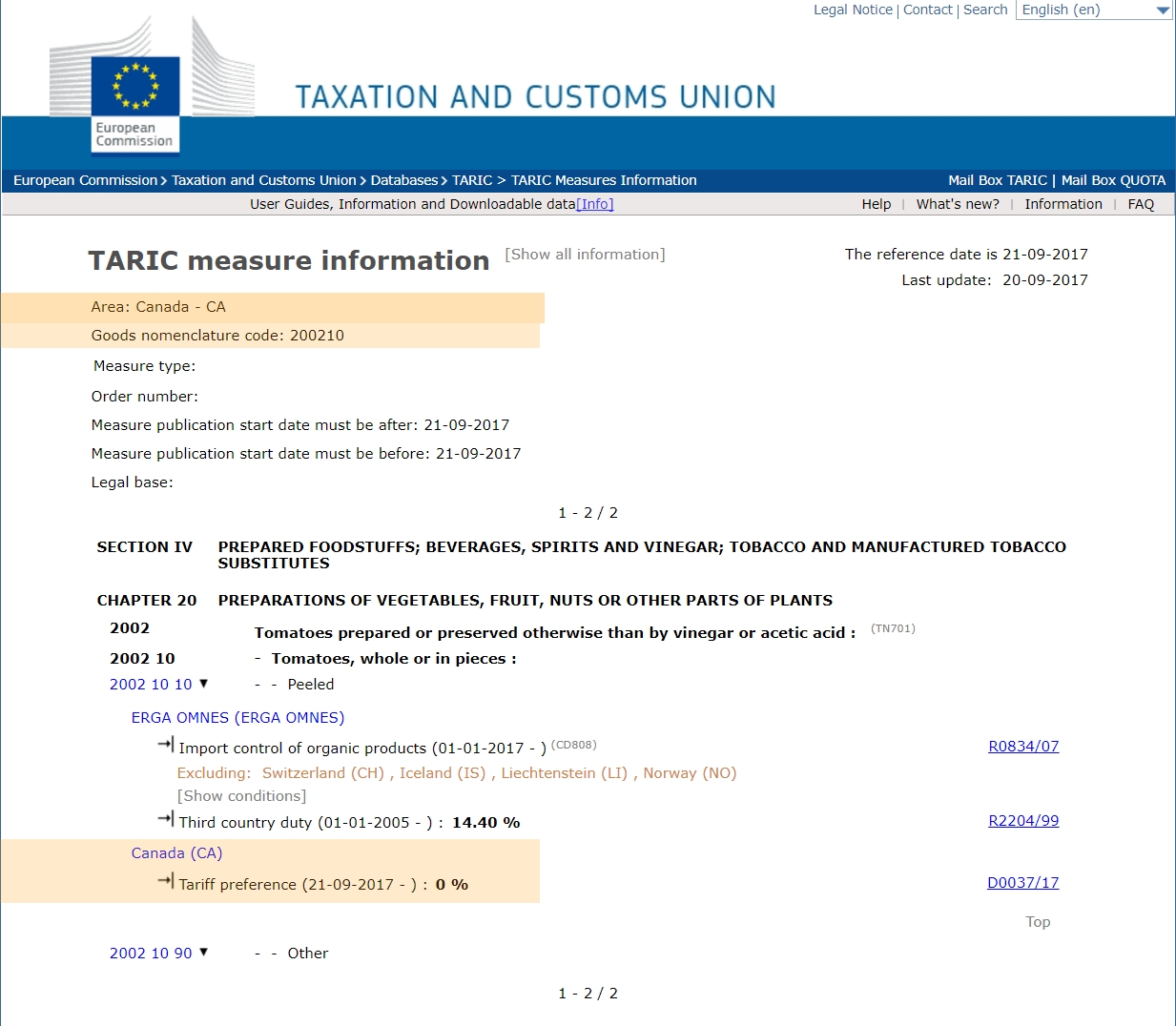

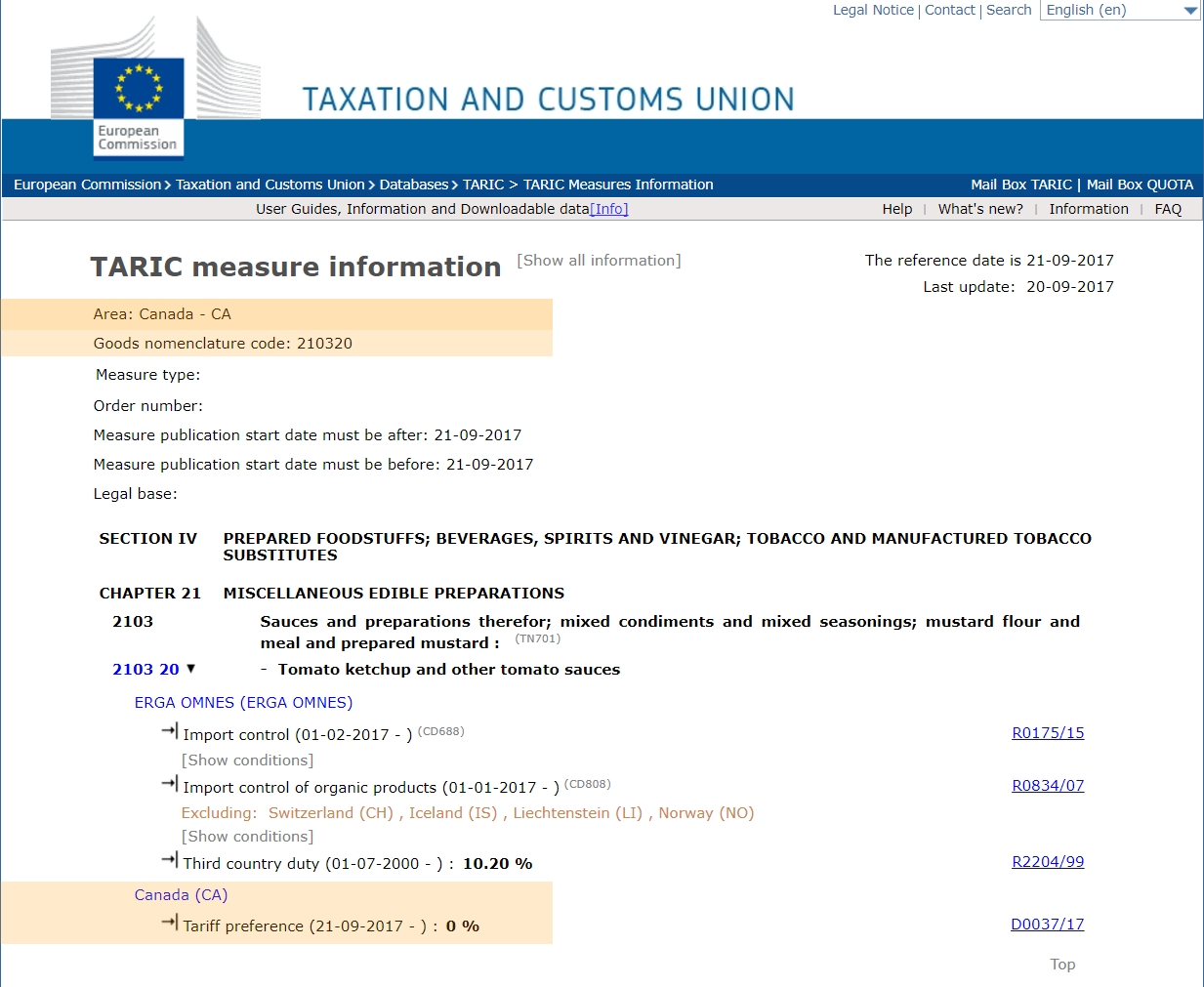

EU: From the European TARIC database regarding imports of tomato paste (codes 200290...). Below is the example of pastes between 12° and 30°Brix, in conditionings below 1 kg (20029039), with a customs tariff reduced to 0% after 21 September 2017. The same preferential treatment from customs has been applied to all other products of the code 200290 as well as canned tomatoes (codes 200210...) and sauces and ketchup (codes 210320...).

Canada: From the database of customs tariffs applied to imports of tomato products entering Canada (updated 21 September 2017)

EU: From the TARIC European database for imports of canned tomatoes (codes 200210...)

EU: From the TARIC European database for imports of ketchup and sauces (codes 210320...)

The provisional application of CETA follows its approval by EU Member States, expressed via the Commission and the European Parliament. It will enter into force "fully and definitively" when all EU Member States have ratified the agreement.

The provisional application of CETA follows its approval by EU Member States, expressed via the Commission and the European Parliament. It will enter into force "fully and definitively" when all EU Member States have ratified the agreement.