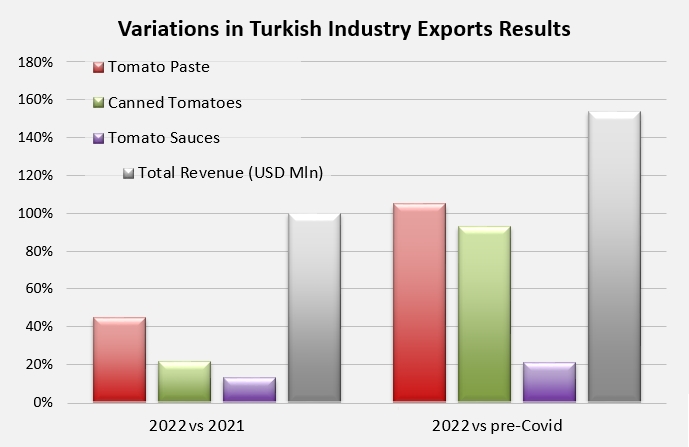

Revenue from tomato product exports doubled compared to last year and increased 2.5 times compared to the pre-Covid period

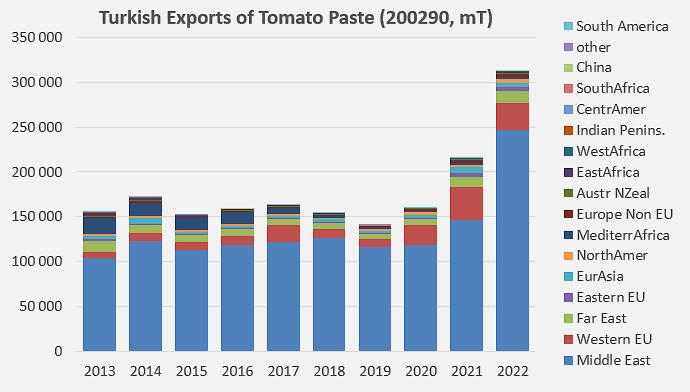

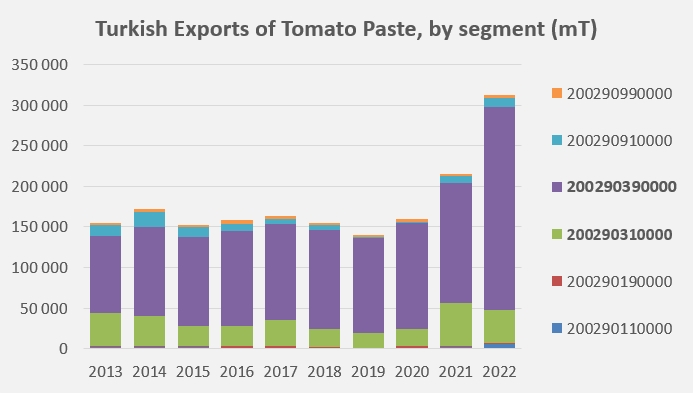

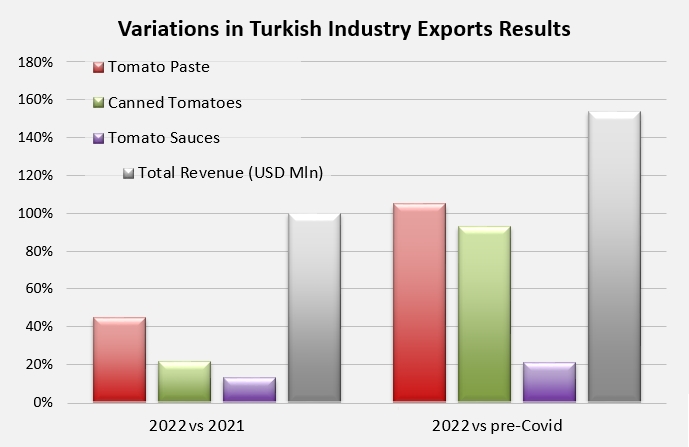

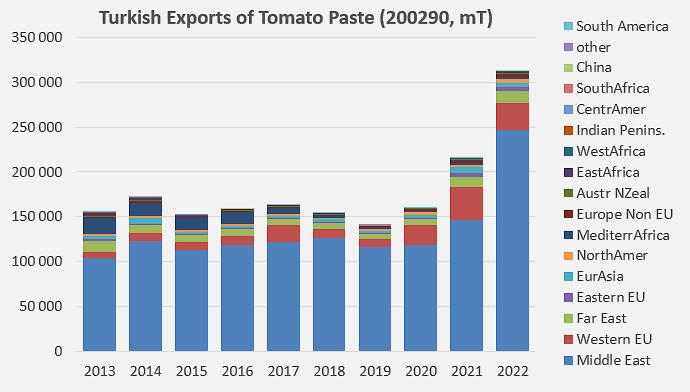

The year 2022 (January-December) was a period of exceptional development for tomato product exports produced by the Turkish processing industry, which confirmed the significant growth already recorded in 2021. The tomato paste category (HS codes 200290) has seen foreign sales jump 45% over the past year, from 216,000 mT in 2021 to 313,000 mT of finished products in 2022 (mostly exported under codes 200290390000). The quantities exported last year also represent a 105% increase over the average performance (150,600 mT) of the three-year period (2017, 2018, and 2019) that preceded the Covid pandemic.

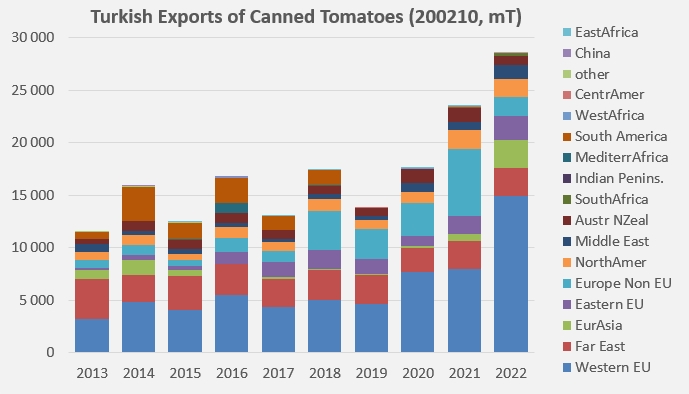

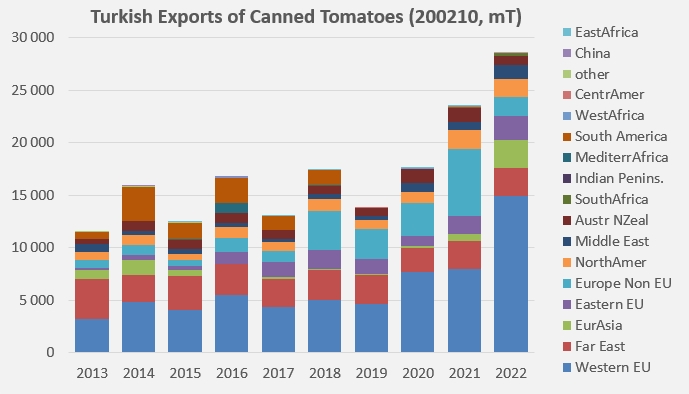

Over the same reference period, Turkish exports of canned tomatoes (customs codes 200210) recorded an increase of 93% in 2022; the annual variation was recorded at 22%, with quantities increasing from 23,500 mT in 2021 to 28,500 mT in 2022.

In comparison, with 22,300 mT exported in 2022, the results of the sauces sector (customs codes 210320) seem less impressive, while they did however increase by 13% compared to the previous year (19,700 mT in 2021) and by 21% compared to the pre-Covid period.

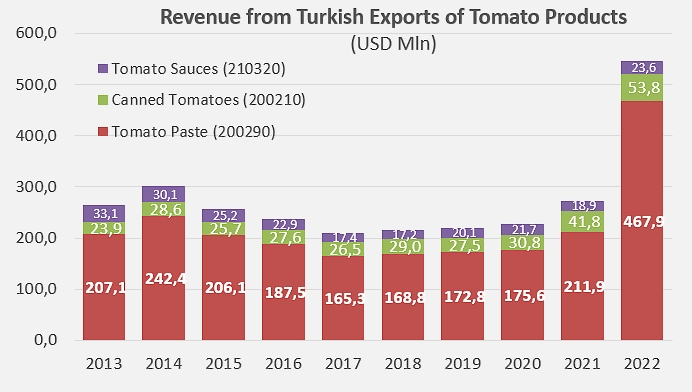

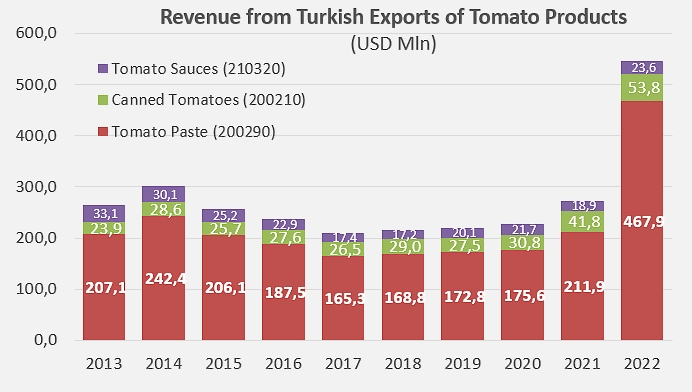

These developments over the past two years have resulted in an unprecedented increase in revenue from export operations. Last year, Turkey's foreign sales of tomato products reached a total value of USD 545 million, up 100% from the result achieved in 2021 (273 million) and more than 150% compared to the pre-Covid three-year period (215 million). This gain has been driven primarily by increases in both quantity and value in the paste sector, resulting in a jump of USD 256 million compared to the 2021 figure and nearly USD 300 million compared to pre-Covid results.

The other sectors also contributed to the increase in total export sales, but to a lesser extent. The value of foreign sales of canned tomatoes increased in 2022 by USD 26 million compared to the pre-Covid figure, and foreign sales of sauces by 5 million USD.

The share of pastes in total export sales has risen from an average of 79% over the previous ten years to 86% in 2022, at the expense of canned tomatoes, whose share has fallen from 12% to 10%, but especially sauces, whose share has fallen from an average of 9% to 4% in 2022.

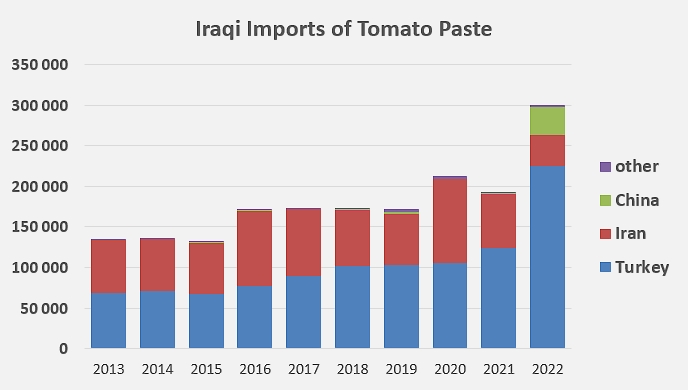

In terms of markets, the spectacular increase in Turkish sales of pastes abroad last year can largely be attributed to Iraq, whose wide variability has already pointed out, and, to a much lesser extent, Germany, Italy, Japan and the Sultanate of Oman, which are the main historical outlets for Turkish production.

As for Iraq, it is important to emphasize that the strong increase in supplies recorded last year (+127,000 mT, see additional data at the end of this article) mainly benefited the Turkish sector (+126,000 mT) and Chinese products, whose first significant incursion (+34,000 mT) on the Iraqi market was accompanied by a significant drop of Iranian sales (-33,000 mT) to this country.

On a more modest note, Turkish exports of canned tomatoes also recorded significant increases last year in Germany, Italy, France and Poland. In total, the quantities recorded in 2022 were 93% higher (nearly 14,000 mT) than the average level of operations during the pre-Covid period. However, this increase has not been uniform. Exports to the British market have fallen by 75% (-4,500 mT) compared to the exceptionally high result of 2021, but also by 35% (-800 mT) compared to the period before Covid.

Finally, the sauces sector does not show any really significant annual variation, and the balance sheet for the year 2022 can be interpreted as a consolidation of the measured progress of previous years on western EU markets (Germany, Belgium, Netherlands). Exports to Iraq confirm the volatile nature of this outlet, with a dramatic decline last year following equally notable increases in 2019 and 2020. The Georgian market also recorded a major surge in 2022.

Some complementary information

Distribution of Turkish exports of pastes by categories (soluble solids content, packaging format) over the last ten years.

Recent evolution of paste imports to the Iraqi market, by origin.

Source: Trade Data Monitor