Is unfair pricing hindering the growth of an industry with immense potential?

In Thailand, “approximately 60-70% of all tomatoes go to the fresh market. It is only in one season (the cool season), mostly in the northeast, where they go to the factories for processing. A rough estimate is that each factory has 5 000 rai (800 hectares) under contract with farmers, who produce an average of 6 tonnes/rai (37.5 mT/ha),” explained Karina Van Leeuwen, tomato crop breeding Manager for the East West Seed Company.

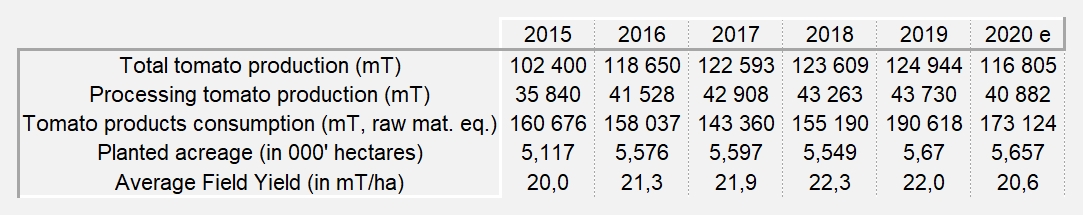

The following diagram presents some figures illustrating the Thai tomato industry, including agricultural production, industrial processing, and consumption of processed tomato products.

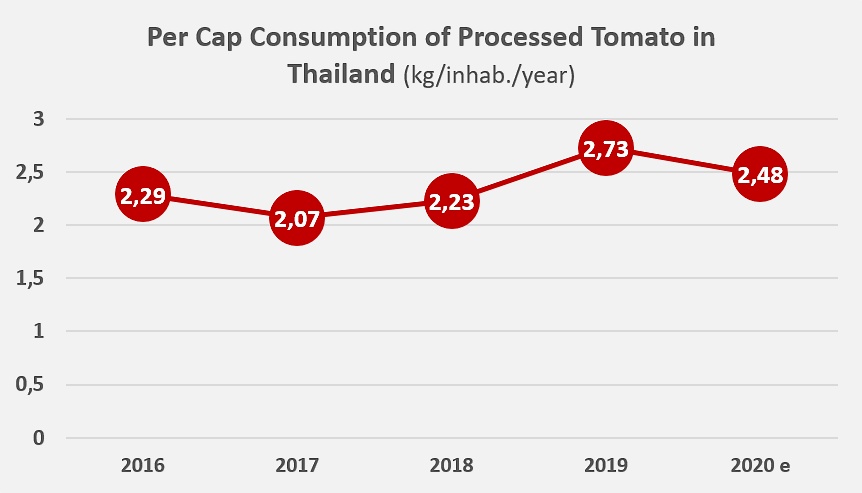

** 2020/2021 estimates indicate slightly subdued demand due to the Covid-19 crisis

The first tomato processing plant in the northeast, which opened in 1987, was founded by the Northeast Agriculture Co. Ltd. (NACO). Tomato processing was previously carried out in small factories using locally made machinery and raw materials supplied by small farmers. However, the tomato processing industry in Thailand has largely grown over the past decade, particularly to serve the fish canning sector (sardines and mackerel). The daily catch of seafood in the Gulf of Thailand is not only appreciated for its exotic flavor but also for its low price, which makes such products an affordable healthy meal. In canned seafood, the proportion of tomato sauce is approximately 40%.

Until the 1980s, tomato juice, sauce, and whole-peeled tomato products were manufactured in limited quantities. Since then, large-scale tomato processing units have been established in the country. Following a period of stagnation in sardine production, the response of these new factories to changes in market demand has had a significant impact on the development of tomato processing in Thailand. Furthermore, several government incentives for the agriculture and food sectors have boosted the development of the tomato paste industry to the point that it can now satisfy local demand, and even has export potential.

“We process raw materials from the farmers under contract with us. We support farmers with knowledge and experience. The total volume of tomatoes processed in our factory each year amounts to 14 metric tonnes (figure confirmed by Doi Kham) . Since our activity is mostly focused on the domestic market, and as our tomato products are the base ingredients for other finished products, the Covid-19 pandemic has not particularly affected our business, nor have we faced competition from the export markets,” stated a representative from the R&D department of the Doi Kham Food Products Company Limited.

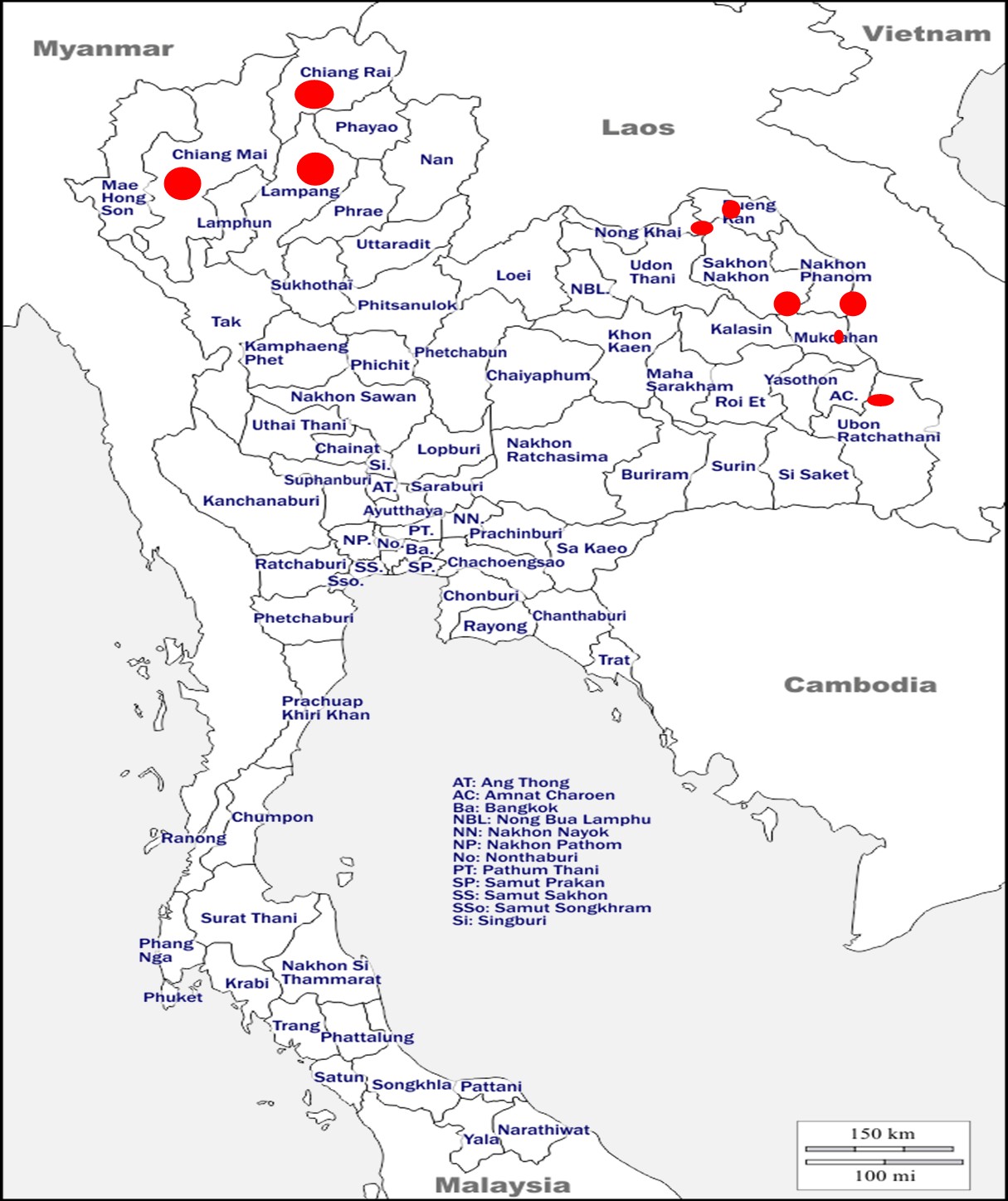

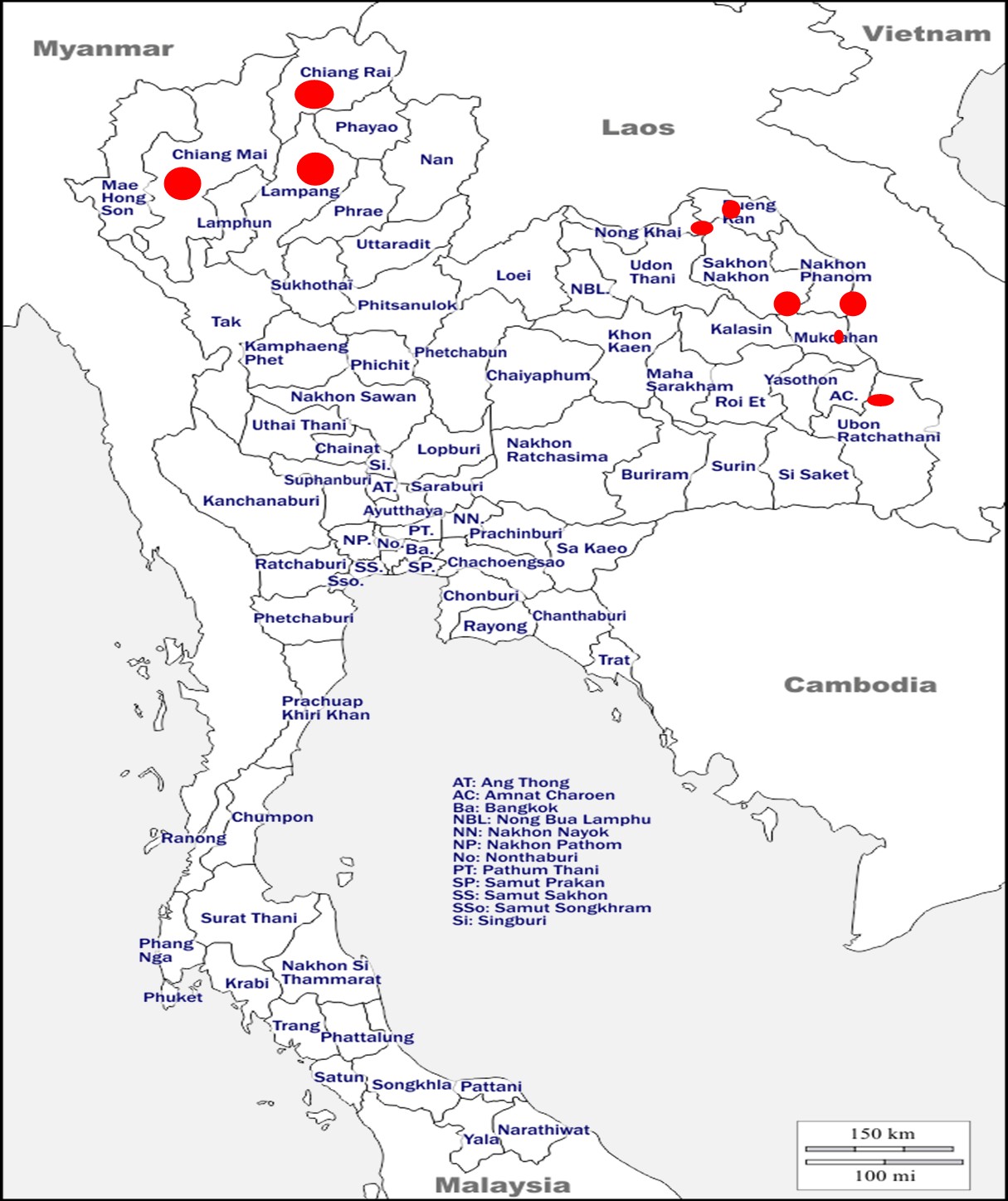

Processed Tomato Cultivation in Thailand

The key tomato-growing regions in Thailand are in the north and northeast of the country, specifically in the two neighboring provinces of Nong Kai and Bueng Kan. The crop-producing fields along the Mekong River are commonly used by the majority of farmers. The northeast produces 55% of the harvest while the north produces 32%, and the central region 13%. The highest yielding provinces are Chiang Mai, Sakon Nakhon, Nakhon Phanom, and Nong Khai.

Crop rotation is used for growing hybrid and local tomato varieties. Tomatoes are first cultivated when the Mekong river’s water levels are low. The riverbank soil is nutrient-rich, which improves the quality of the crops even more. Tomato seedlings are planted in the dry season from October to November, then harvested from January to March. Most farmers cultivate rice from May to September, i.e. during the wet season. Farmers who do not have a greenhouse build an open access system using simple bamboo trellises and rope structures. Thai tomato farmers lack technical efficiency and plant management systems that would help raise their productivity.

Seed companies have been playing an important role in introducing improved varieties of processing tomatoes. Competition among seed companies has led to the development of high-quality seeds.

These factors have resulted in the highest tomato yields in the country in the provinces of Nong Khai, Bueng Kan, Nakhon Panom, Mukdahan and Amnat Charoen. Growing tomatoes in these regions generates profits of THB (Thai baht) 40,000 per rai which is approximately equivalent to EUR 6,660 (or USD 7,980) per hectare.

“Tomatoes are grown in two seasons – during the summer months, i.e. from October to December, and in the winter, which is at the beginning of January until mid-April” said Chu An-Ou, head of marketing for the Thai Soon Foods Company Limited.

Raw material prices

Thai tomato processing factories buy tomatoes through contractors who purchase the fruit from farmers and transport it to the processing plants. The factory gate price fluctuates from a high early season price of THB 4 /kg (USD 0.13 /kg) to a low at season’s end of THB 2 /kg (USD 0.06 /kg). Occasionally, a surplus of fruit upsets the market. This is due in part to the unpredictable climate of northern Thailand, and in part due to lack of overall planning and cooperation from the farmers. The productivity of Thai tomato growers is low compared to that of their counterparts in China, the USA and Europe, where yields of 90 mT/ha are common. As the raw material accounts for the highest proportion of the cost of tomato processing, there is a great potential for improvement in the price of products through horticultural advances. However, the average field yield on most farms that grow processing tomatoes is similar to the national average field yield for both hybrid and local Thai varieties of tomatoes. Average productivity per hectare was recorded at 20-22 mT from 2015 to 2020.

“Depending on the market price, about 30-40% of tomatoes go to the fresh market. At this moment, the price of fresh tomatoes is very low and approximately 80% of the crop is processed. Tomatoes for processing are low-priced at THB 2.50-3.00 /kg (approximately USD 0.08-0.09 /kg), while fresh tomatoes fetch farmers about THB 10-15 /kg (approximately USD 0.32-0.48 /kg),” said Karina Van Leeuwen, from the East West Seed Company.

Thai Soon Foods’ Chu-An Ou stated: “Our company undertakes contract farming in the northeastern provinces, where we process 20,000 to 24,000 metric tonnes of fresh tomatoes on average per year. The average price of processing tomatoes is THB 3-5 /kg, depending on the harvest volume.”

According to the Nong Kai Provincial Agricultural Extension Office, growers have joined the contract farming program with some of the leading tomato processors in the region such as Roza Agri-Industrial Co. Ltd, Srichiengmai Industry Co. Ltd and Thai Soon Foods Co. Ltd. After having realized the importance of the processed tomato industry, during the period from 2012 to 2016, the Thai government reinforced tomato cultivation strategies in the Nong Kai province.

“The northeastern provinces are well-known for their processing tomatoes. These provinces include Nong Khai, Bueng Kan, Nakhon Phanom, and Sakhon Nakhon. A small quantity is grown in the northern provinces of Chaing Mai, Chaing Rai, and Lampang. Thai farmers grow dual purpose varieties, which means that the first harvests go to the fresh market, and when the price of fresh tomatoes drops, the fruit is then sent for processing. Hybrid varieties include Gamma, Extra 390 and Premium Gold (East West Seed Company), as well as Perfect Gold (Syngenta). Some local varieties are also grown,” added Karina Van Leeuwen.

“The northeastern provinces are well-known for their processing tomatoes. These provinces include Nong Khai, Bueng Kan, Nakhon Phanom, and Sakhon Nakhon. A small quantity is grown in the northern provinces of Chaing Mai, Chaing Rai, and Lampang. Thai farmers grow dual purpose varieties, which means that the first harvests go to the fresh market, and when the price of fresh tomatoes drops, the fruit is then sent for processing. Hybrid varieties include Gamma, Extra 390 and Premium Gold (East West Seed Company), as well as Perfect Gold (Syngenta). Some local varieties are also grown,” added Karina Van Leeuwen.

“The main tomato varieties grown by our contract farmers include TP 115-8, Saorn, Jutter, Lukla Kamphaeng, etc.” said the representative of the Doi Kham Food Products Company.

Major constraints in the tomato processing industry

Price fluctuations for tomatoes (fresh and processed) reflect seasonal changes in the yields of these crops. Prices are always low in winter (January, February, and March) when the crops grow well. They are mainly grown in lowland areas, and high prices are observed during the hot and rainy season. High temperatures are also a limiting factor for tomatoes. Rising labor costs in Thailand and competition from China in the lower-end grade of the paste market cause further constraints.

“The main challenge for the factory is when the fresh market price is high. In this case, all or most of the tomatoes are sent to the fresh market, thereby causing a shortage in the processing factories. The farmers and brokers usually prioritize fresh market tomatoes, as this is where they tend to earn larger profit margins. Another concern is the large aging population of Thai farmers without a successor to replace them in the future,” underlined Karina Van Leeuwen.

Thai Soon Foods’ Chu An-O pointed out that “the challenges mainly come from the selling price, as most Thai processors face price competition from processed tomato products that are imported from China.”

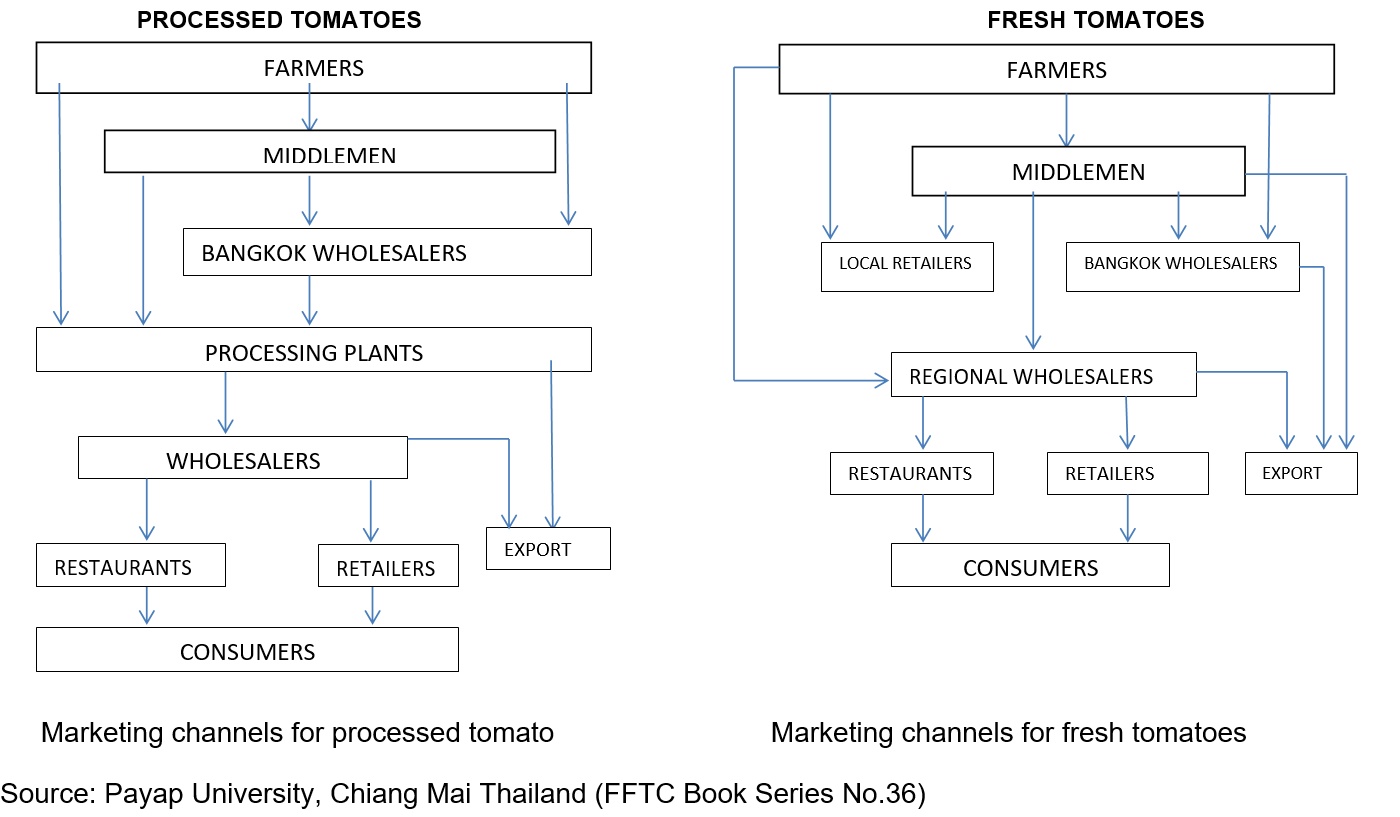

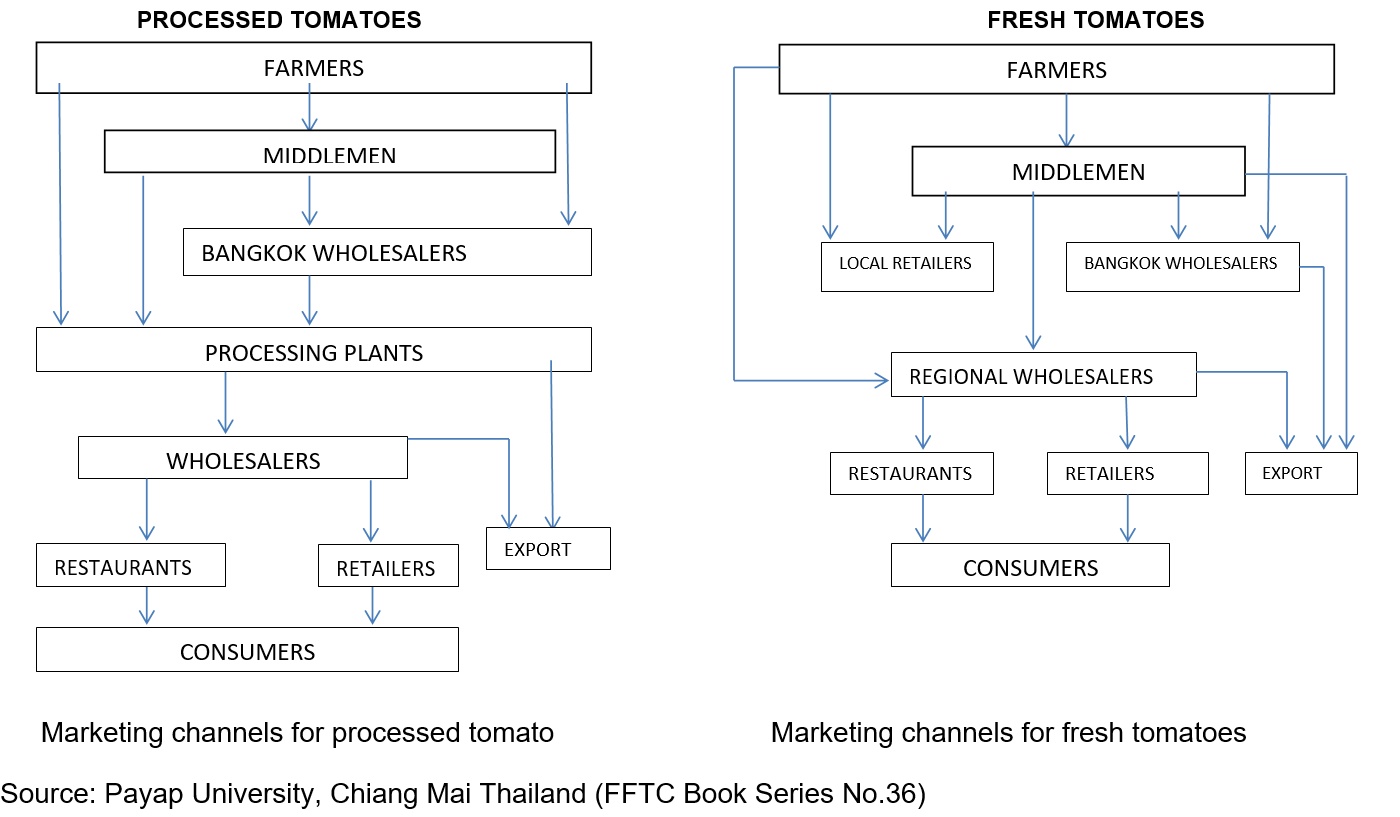

Marketing strategies for processed tomatoes vs fresh tomatoes

The different kinds of tomatoes are marketed according to different marketing systems (see figures below). They are rarely sold directly through Pak Klong Talad or Hoa It markets (local vegetable marketplaces located in Bangkok and Nakorn Srithamaraj). There is usually a middleman who finances the inputs for the crops and purchases the harvest for sale to the factories. Most processing tomatoes are sold to plants near the site where they are grown, while a few are sold fresh to local markets, and quite a large number are exported fresh to Hong Kong and Malaysia.

“While contract farming is prevalent in Thailand, the process is a bit different. Here, processing plants work with brokers and each broker has a group of farmers they work with. The brokers (mostly in the northeastern provinces) are generally also the lenders,” said Karina Van Leeuwen.

The second part of the article is published here

“The northeastern provinces are well-known for their processing tomatoes. These provinces include Nong Khai, Bueng Kan, Nakhon Phanom, and Sakhon Nakhon. A small quantity is grown in the northern provinces of Chaing Mai, Chaing Rai, and Lampang. Thai farmers grow dual purpose varieties, which means that the first harvests go to the fresh market, and when the price of fresh tomatoes drops, the fruit is then sent for processing. Hybrid varieties include Gamma, Extra 390 and Premium Gold (East West Seed Company), as well as Perfect Gold (Syngenta). Some local varieties are also grown,” added Karina Van Leeuwen.

“The northeastern provinces are well-known for their processing tomatoes. These provinces include Nong Khai, Bueng Kan, Nakhon Phanom, and Sakhon Nakhon. A small quantity is grown in the northern provinces of Chaing Mai, Chaing Rai, and Lampang. Thai farmers grow dual purpose varieties, which means that the first harvests go to the fresh market, and when the price of fresh tomatoes drops, the fruit is then sent for processing. Hybrid varieties include Gamma, Extra 390 and Premium Gold (East West Seed Company), as well as Perfect Gold (Syngenta). Some local varieties are also grown,” added Karina Van Leeuwen.