In a recent webinar, Mintec experts commented on the current market environment for metals, including steel and aluminum, and described what they believe to be the short-term evolution of world prices for these essential raw materials for the packaging in tomato processing industry.

Artem Segen is an industrial analyst with fourteen years of experience in the metals market in manufacturing plants and consultancy companies. He provides in-depth analysis of packaging markets and metals.

Artem Segen is an industrial analyst with fourteen years of experience in the metals market in manufacturing plants and consultancy companies. He provides in-depth analysis of packaging markets and metals.

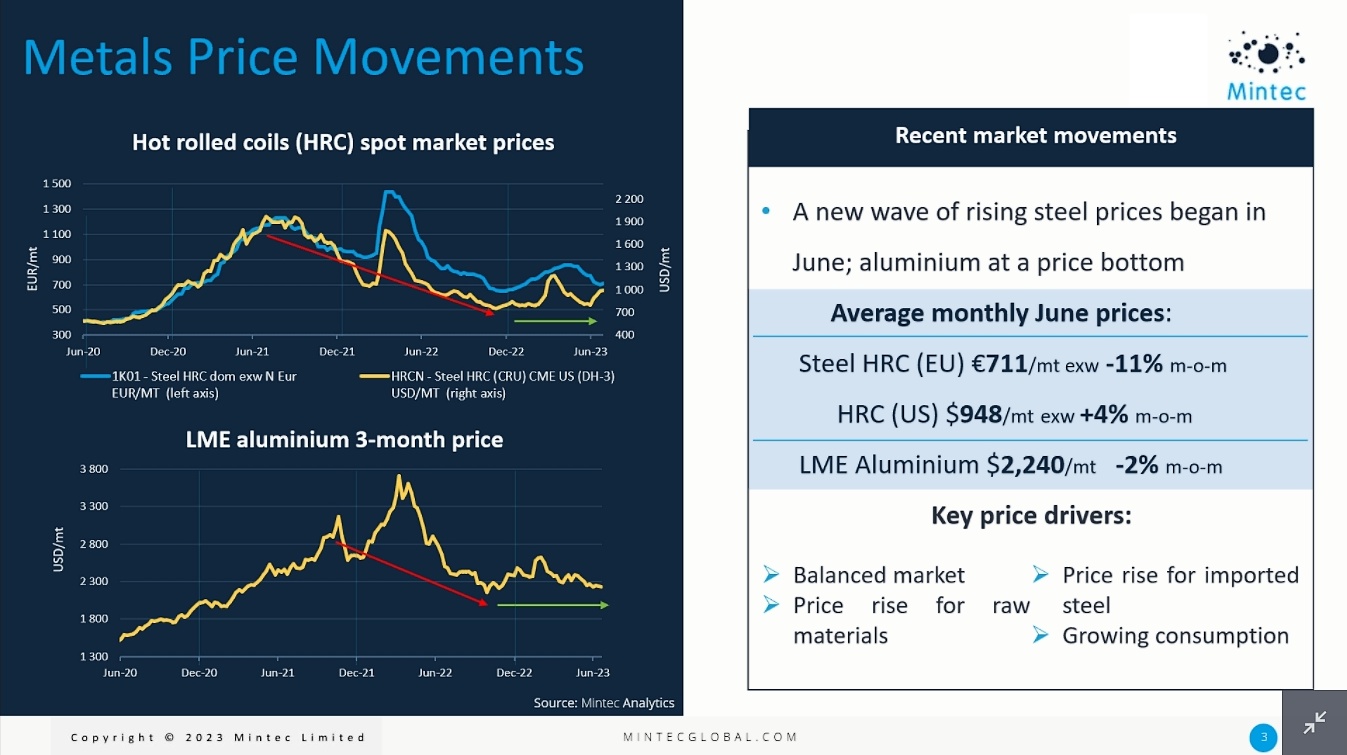

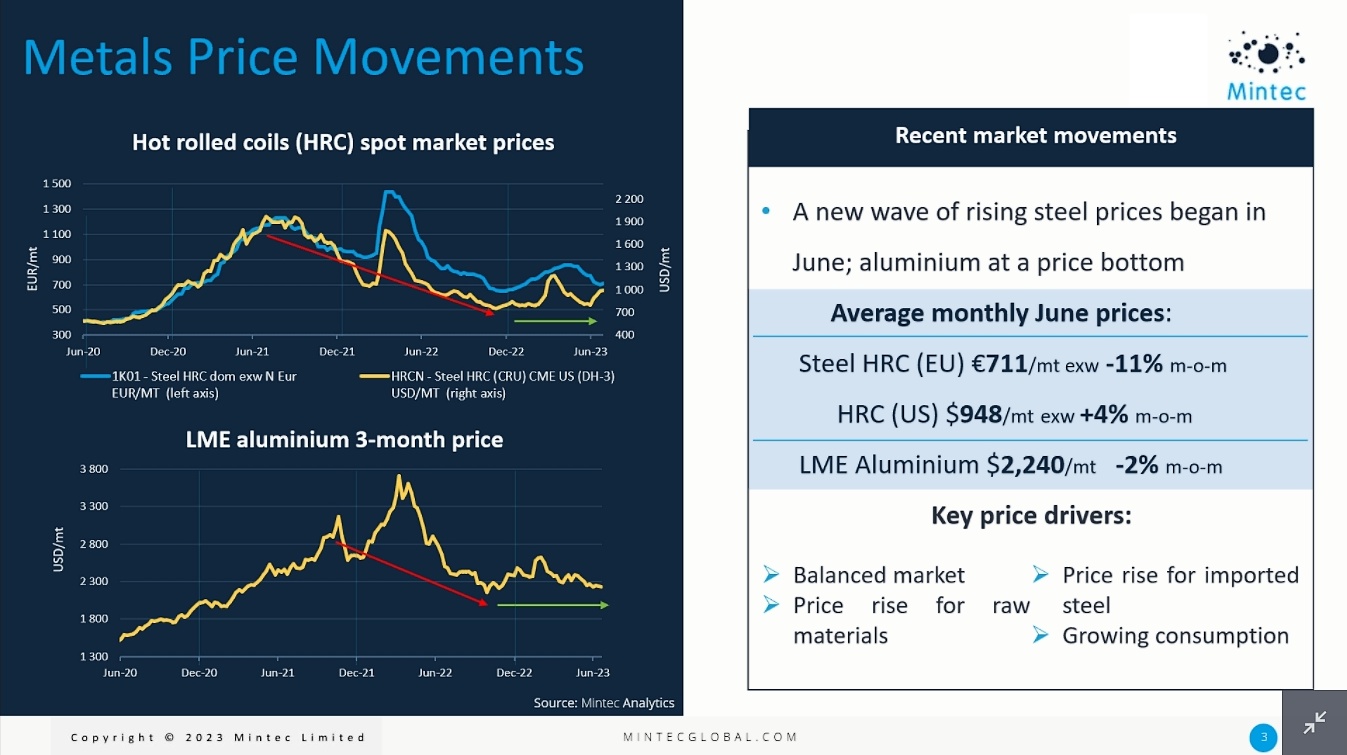

“We start from the metals prices movements we see nowadays; as we can see in the graphs, the new wave for rising steel began in June, and aluminium is still in the bottom. If we talk about steel, the main driver for this came from China, because China started producing more steel, they have some government programs to stimulate steel consumption and also some investors believe in it and try to buy more material and build their stocks.

What is the result? The result of this tendency, with some time lag, is reflected in the US and European markets. Because a lot of steel from the Asian markets come to Europe and US and they try to establish a minimum price; and now, when we see that in the Asian markets that the prices are starting to rise, in that case in the US and in the EU markets, the market participants are trying to get their prices up. Because of pressure and of cheap imports, it is not so strong as it was a couple of months ago.

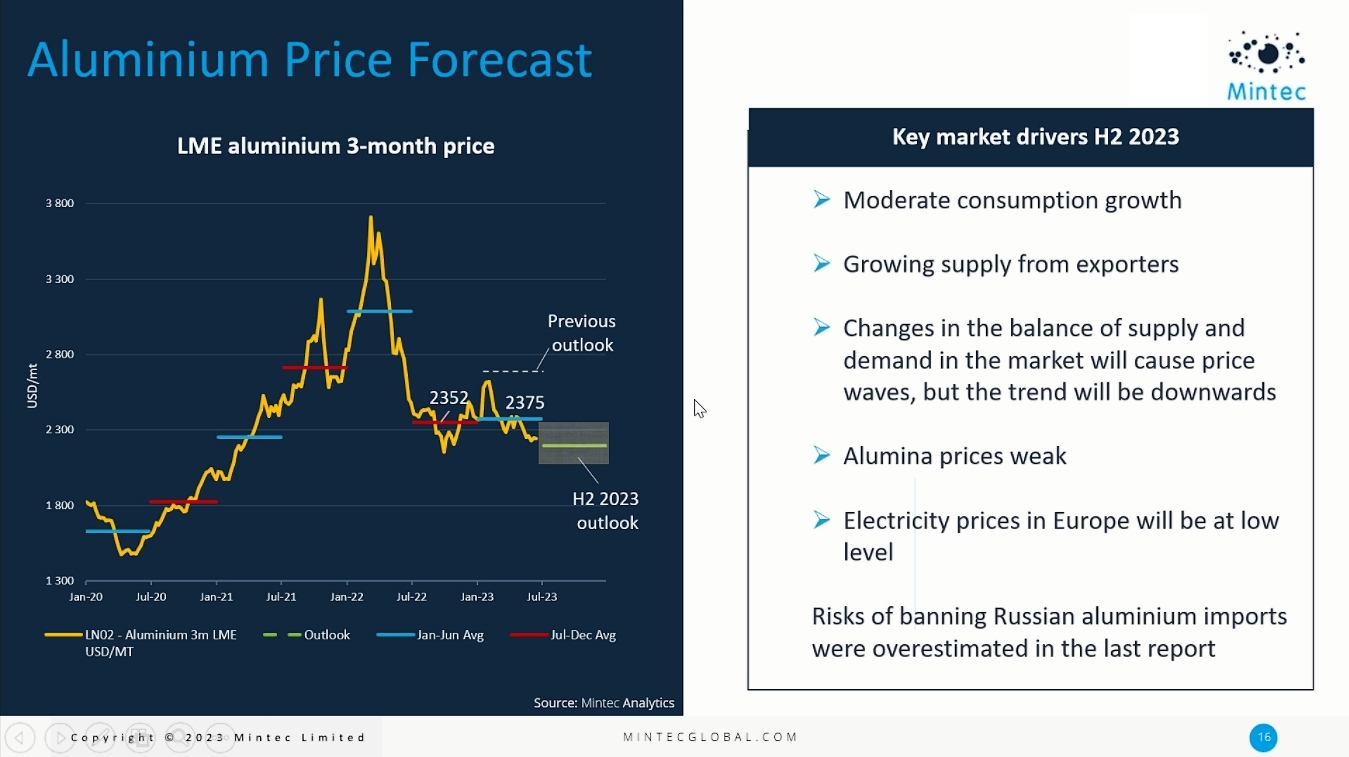

If we talk about aluminium, we see that some fundamental downturn ended at the end of 2022, and now we see that the market trend is quite flat, with some fluctuation and most market participants don’t believe in some strong price growth for aluminium, but also a lot of market players understand that bottom price is near and nobody expects that in coming months, for example, prices will go down further.

If we talk about more fundamental drivers, now we can see that market for steel is well balanced, especially because of low pressure from imports; also we can mention the same thing for aluminium, but in aluminium the market players are still afraid to buy a lot of material because they don’t believe that the market is at the bottom – I mean, they still want to wait until more attractive prices.

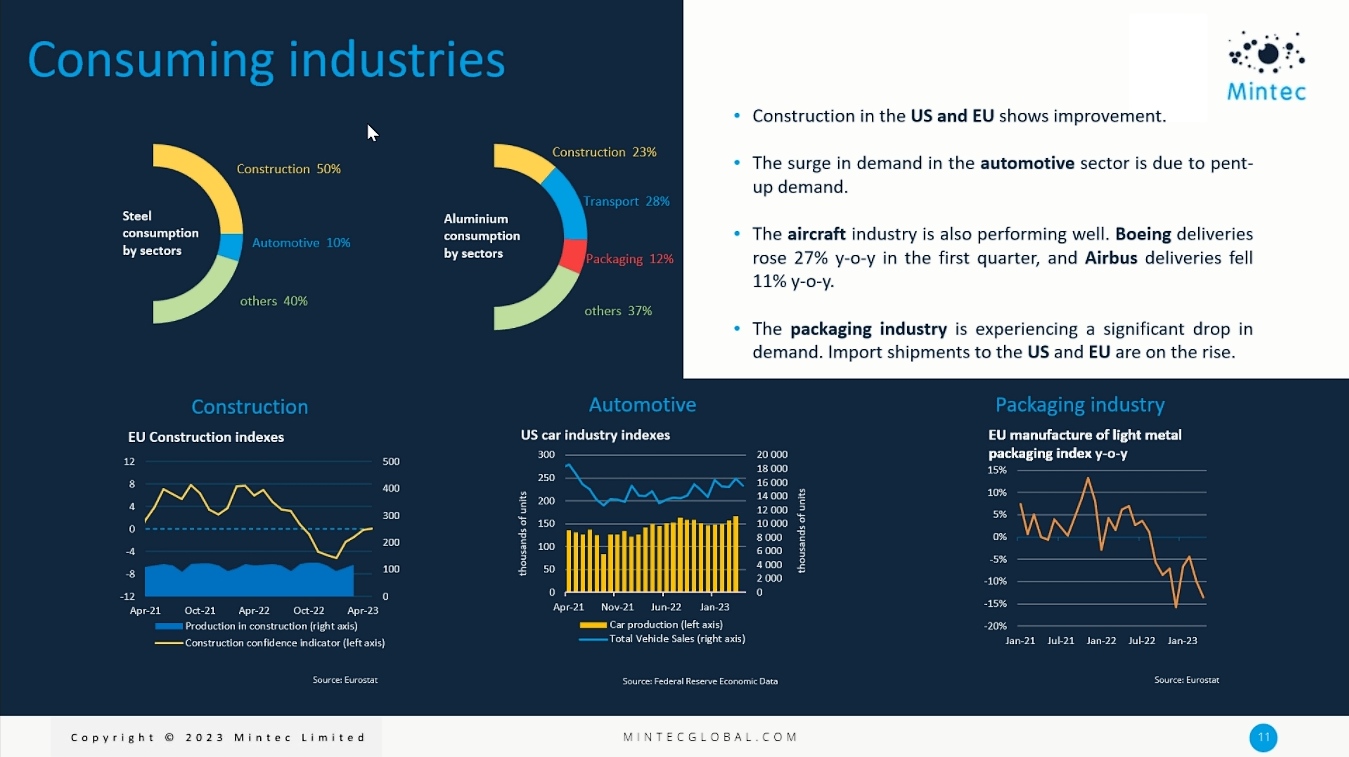

Also I want to add a little bit about growing consumption, because when we talk about current market fluctuation, it is more or less about supply demand; but growing real consumption in construction, in automotive, in airplanes industries – because these sectors are much more in need of aluminium than steel, and we see a very strong growing demand in these industries.

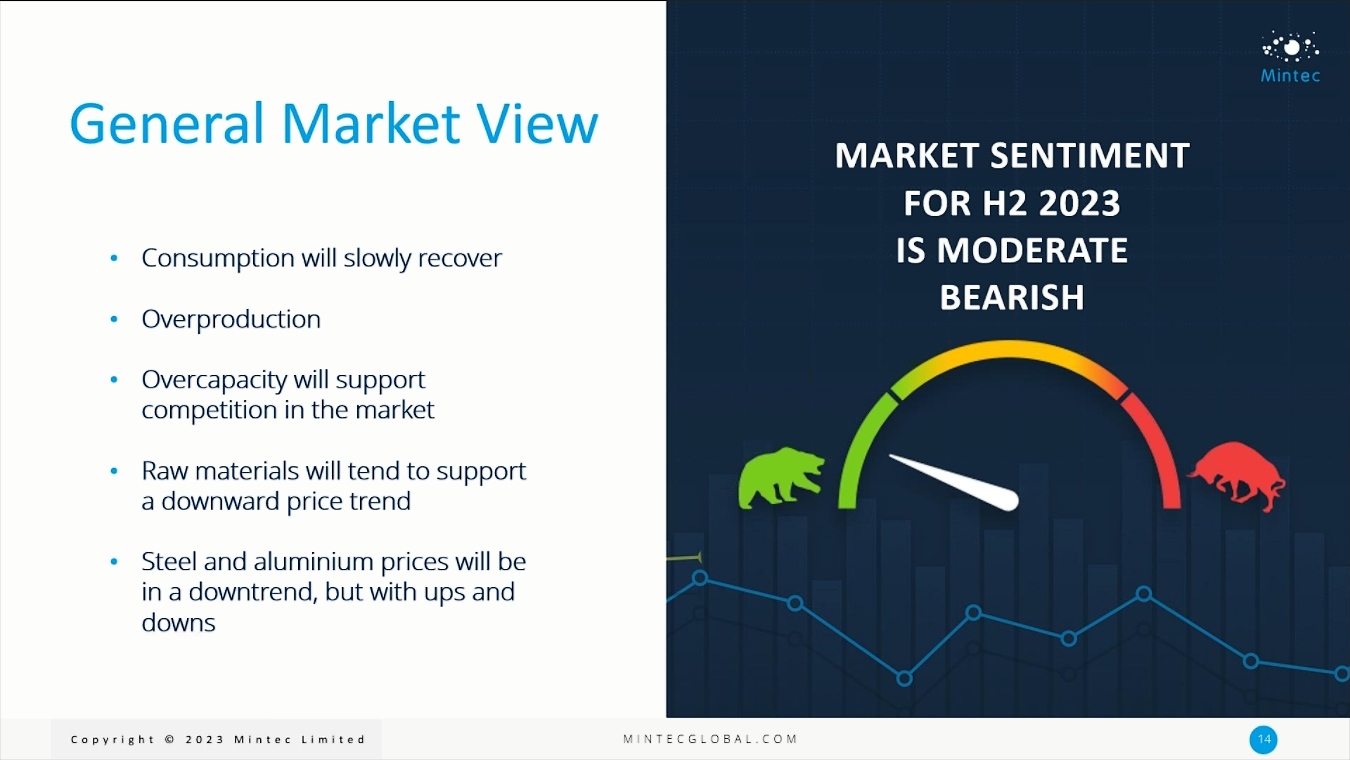

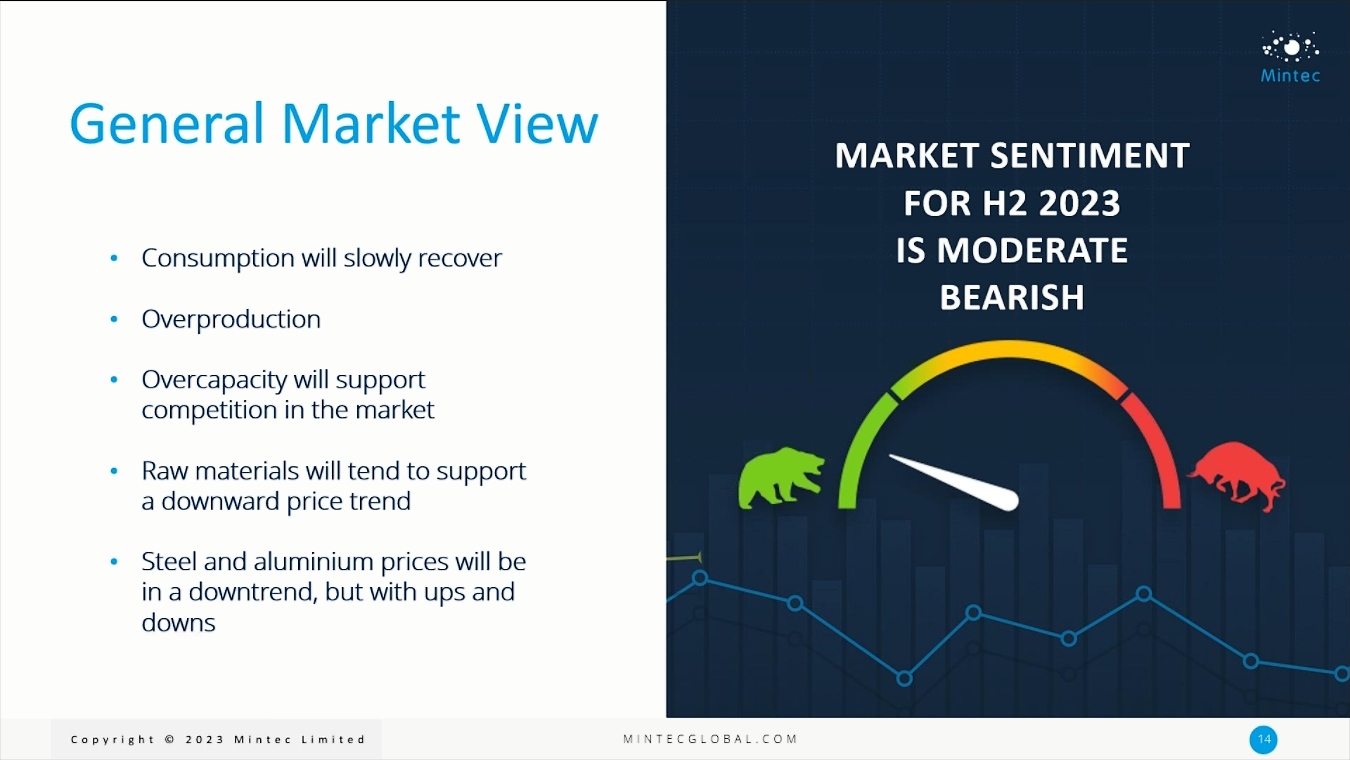

Let’s talk about market sentiment. Firstly, most market players’ sentiment is moderate bearish, because consumption will recover very slowly; they also saw overproduction because of overcapacity, firstly in China and also in Europe. More or less, the market believes that in the second half, typically China reduced their steel production, and in that case, market expects that raw materials will tend to support downwards price trends in steel.

Steel and aluminium prices will also be in some downtrends but, as I mentioned, with some ups and downs. For example in the coming months, markets participants believe that we will see some price recovery, in Europe and in the US, and they doubt that price recovery will continue in autumn, because they don’t believe that firstly macroeconomic circumstances help to support end users’ consumption growth and then also because of sales and production.

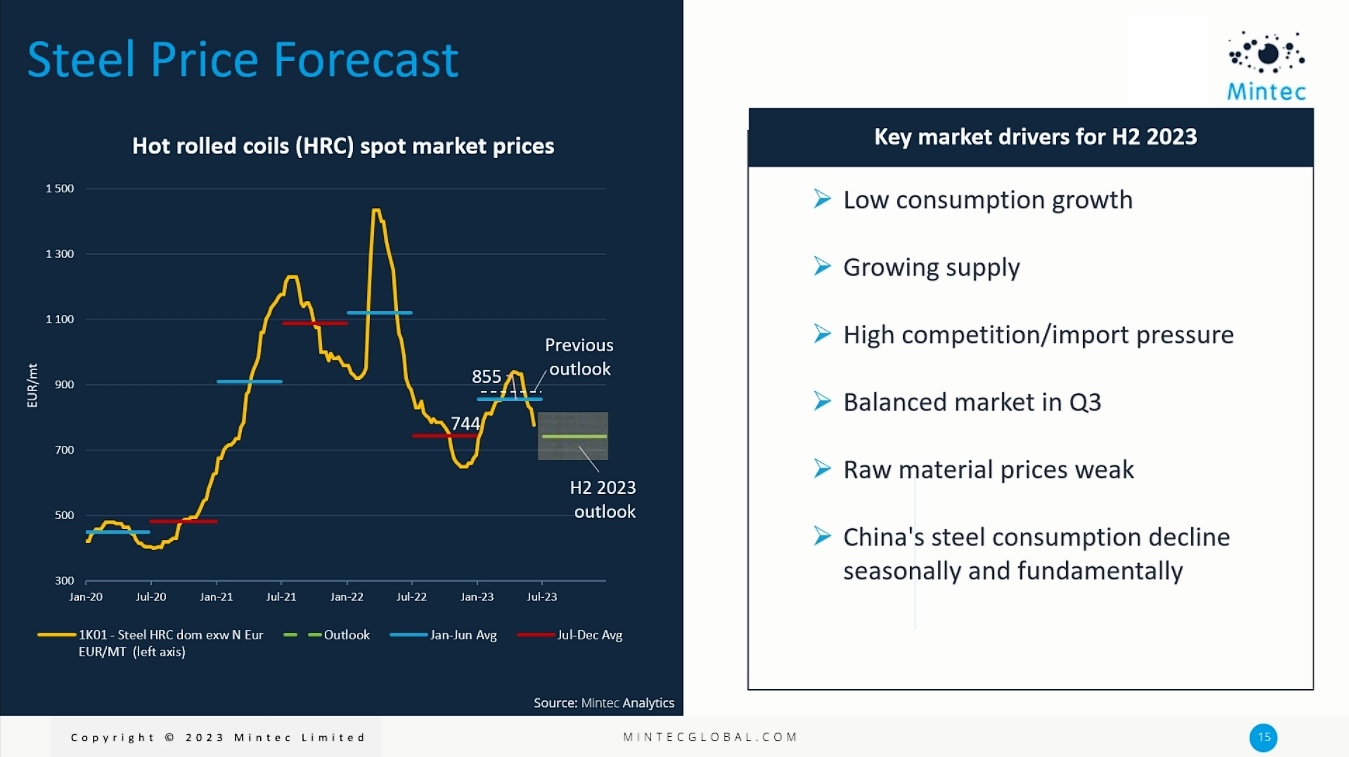

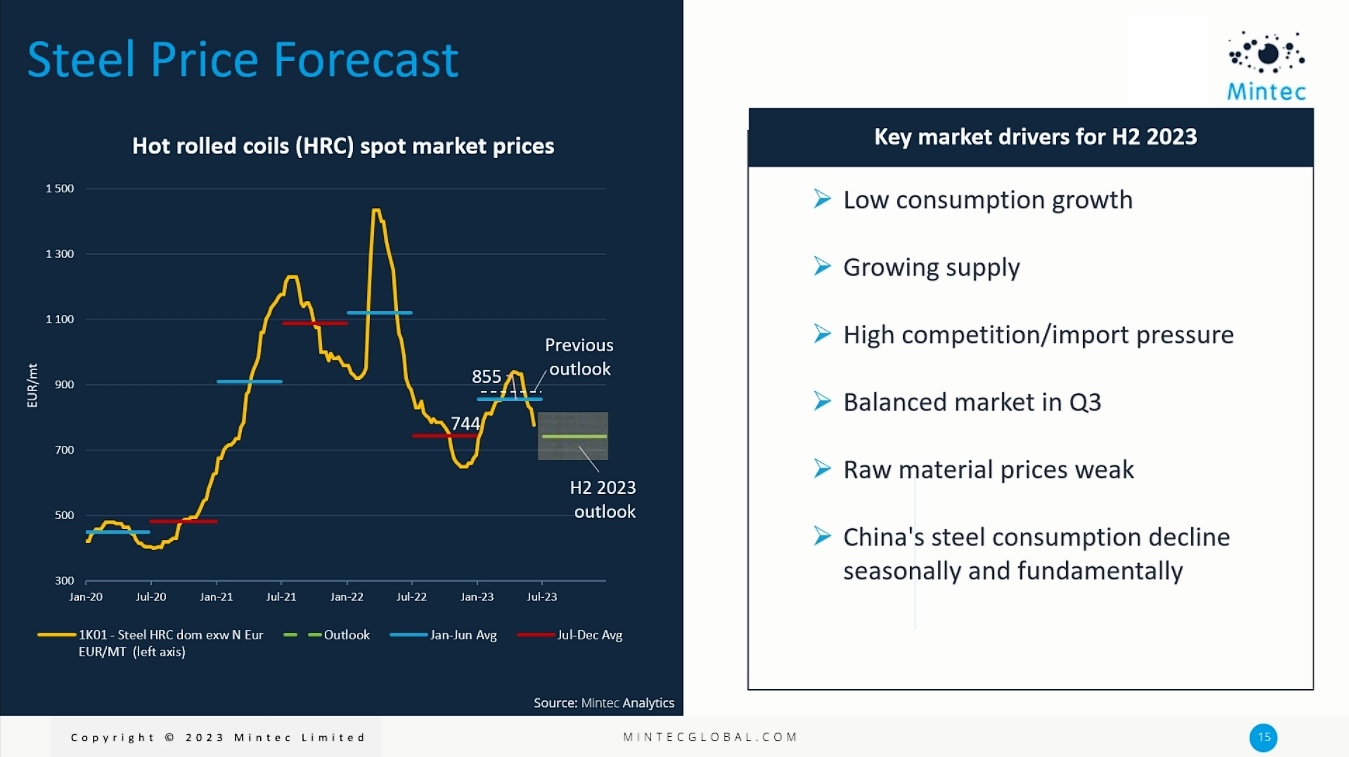

So, we are on the steel prices outlook, and I want to show you that our previous outlook was pretty close to reality as we talked about steel, and hope that another outlook will also be close to reality in the second half of 2023.

So, key market drivers for the second half: it is still low consumption growth; it is also growing supply, especially from Asia; it is high competition from imports; it is the sentiment that in second quarter, may be till September, market will be in balance; the raw material prices also will be going up in the nearest months, but the general trend is downturn; and China’s steel consumption will decline and it is a reflection of the steel prices and raw materials’ prices, as we can see the situation in the first half of this year.

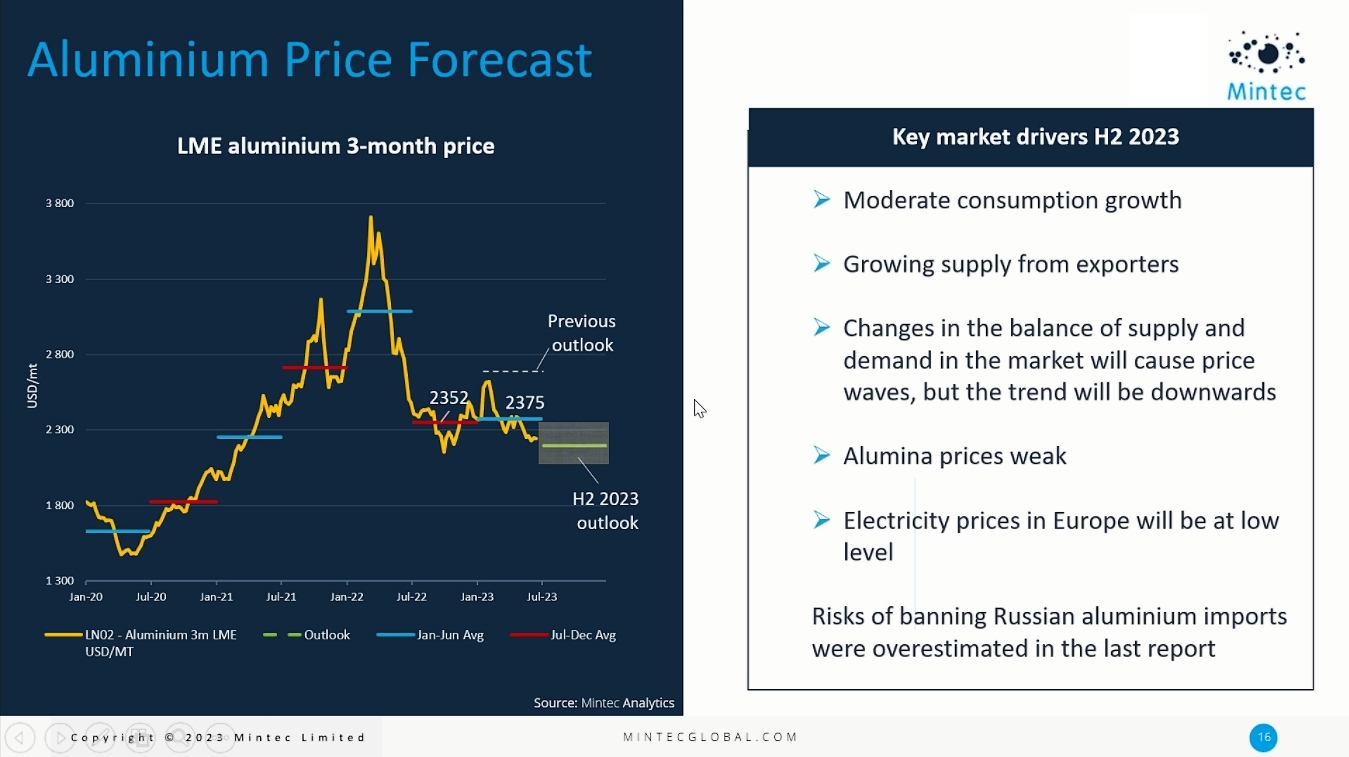

If we talk about aluminium, I want to say that during the last webinar the expectations of banning Russian aluminium imports to the US and to the EU were overestimated; it is not reflected in the market because nowadays a lot of the Russian aluminium still arrives in the EU; a lot of aluminium is redirected to Turkey, India and Asia. So, it helps the markets to be oversupplied and even if we can see consumption growth for the transport industry, aluminium is enough for this on the world market. And in that case, for the second half, market expects that there are no strong drivers to pick up the prices from the bottom; also market players believe in some ups and downs, but the trend will be downturn.

So other main beliefs are: a moderate consumption growth, growing supply from exporters, firstly Asia; aluminium prices will be weak, but I want to add that it helps to do some flat bottom for the aluminium prices.

Some complementary data

Consuming industries: about half of steel is consumed in construction, 10% in automotive sector and 40% by other industries; for aluminium, construction share is 23%, 28% for transport (including automotive and aircrafts, rockets), 12% for packaging and 37% for other sectors.

Source: Mintec (Steel and Aluminium Market Expectations June 2023 Webinar)

Artem Segen is an industrial analyst with fourteen years of experience in the metals market in manufacturing plants and consultancy companies. He provides in-depth analysis of packaging markets and metals.

Artem Segen is an industrial analyst with fourteen years of experience in the metals market in manufacturing plants and consultancy companies. He provides in-depth analysis of packaging markets and metals.