Respect for your privacy is our priority

The cookie is a small information file stored in your browser each time you visit our web page.Cookies are useful because they record the history of your activity on our web page. Thus, when you return to the page, it identifies you and configures its content based on your browsing habits, your identity and your preferences.

You may accept cookies or refuse, block or delete cookies, at your convenience. To do this, you can choose from one of the options available on this window or even and if necessary, by configuring your browser.

If you refuse cookies, we can not guarantee the proper functioning of the various features of our web page.

For more information, please read the COOKIES INFORMATION section on our web page.

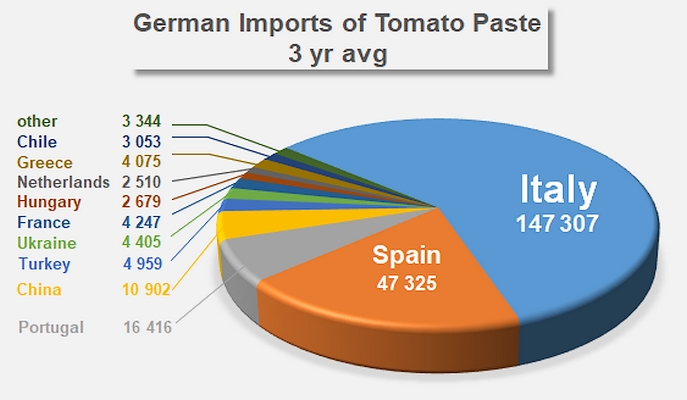

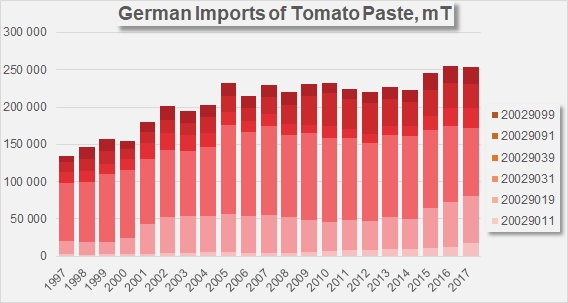

The leading countries of the European tomato processing industry are naturally the main supply sources of paste for the German market. Italy (147 300 mT of finished products, or 59% of total volumes over the past three years), Spain (47 300 mT, 19%) and, to a lesser extent, Portugal (16 400 mT, 7%), supply most of Germany's imports for this sector. Chinese products (10 900 mT on average over the period running 2015-2017), along with Turkish products, Ukrainian products and French products, only amounted to 24 500 mT per year over the past three years, which is barely 10% of Germany's total foreign purchases.

The leading countries of the European tomato processing industry are naturally the main supply sources of paste for the German market. Italy (147 300 mT of finished products, or 59% of total volumes over the past three years), Spain (47 300 mT, 19%) and, to a lesser extent, Portugal (16 400 mT, 7%), supply most of Germany's imports for this sector. Chinese products (10 900 mT on average over the period running 2015-2017), along with Turkish products, Ukrainian products and French products, only amounted to 24 500 mT per year over the past three years, which is barely 10% of Germany's total foreign purchases.