China to slash import tariffs on many consumer products by 60% from July

About the same time that the United States announced a hardening of their trade policy and an increase in the import duties to be paid on a number of targeted products, China decided to loosen its conditions for entry into the country for several hundred food products and manufactured items.

According to Reuters, China will cut import tariffs on nearly 1 500 consumer products from 1 July, in a bid to boost imports as part of efforts to open up the economy. The Finance Ministry published a detailed list of products affected and their new reduced tax rates on 31 May, following early announcements of the broader plan. Starting next month, the average tariff rate on 1 449 products imported from Most Favored Nations will be reduced from 15.7% to 6.9%, which is equivalent to a cut of about 60%, the Finance Ministry said in a statement on its website.

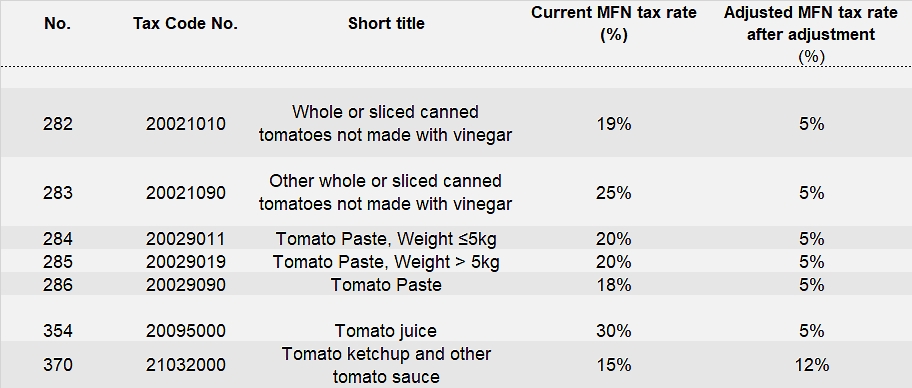

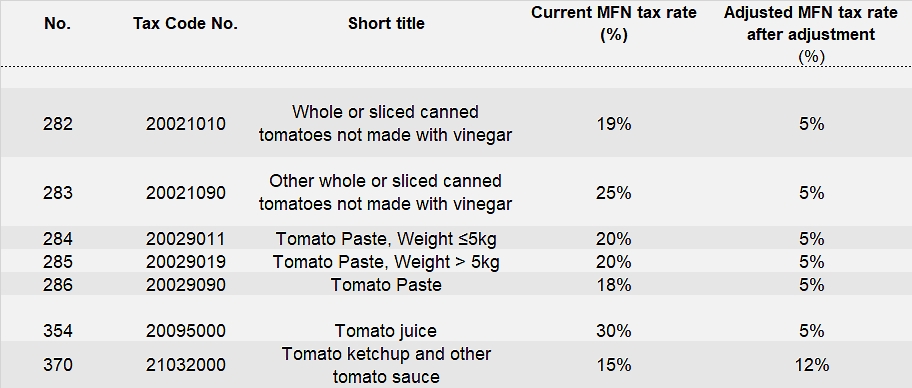

Tomato sauces, purees or juices are among numerous food products whose imports will benefit from significant reductions in customs tariffs from the beginning of next month. The least significant reduction applies to tomato ketchup and other tomato sauces (from 15% down to 12%), with all other categories benefiting from tax cuts of between 72% and 83%, to a final rate of 5% only.

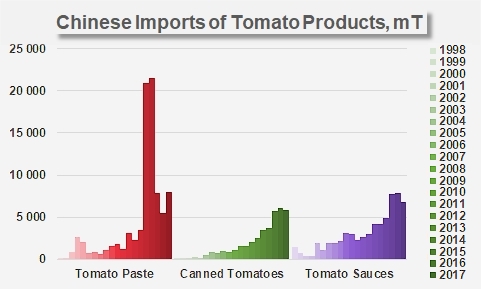

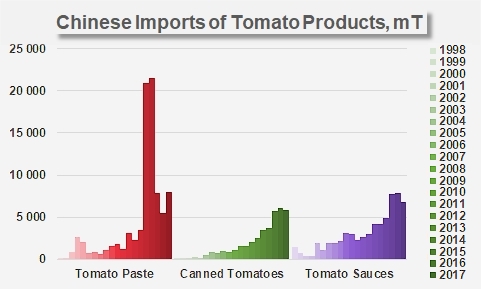

It seems likely that this adjustment of customs tariffs will have little impact on the flow of paste shipments entering the country, as this category remains the spearhead of China's own foreign business (852 000 metric tonnes exported in 2017).

On the other hand, and despite processed tomato products only playing a small role in traditional Chinese cooking, the drop in import taxes could have a positive effect on arriving volumes of canned tomatoes (peeled, unpeeled, whole, chopped, diced, sliced, etc.), which is potentially interesting for market leaders like Italy. This sector has recorded a notable increase in recent years, with quantities shipped into China growing from less than 3 300 mT annually over the period running 2012-2014 to close on 6 000 mT over the past three years (2015-2017). The progressive development of Western food habits in this country could benefit from these lighter taxes in order to encourage new growth in this sector. The same can be said for the ketchup and tomato sauces category, whose imported quantities have sharply increased in recent years (approximately 4 400 mT per year between 2012 and 2014, and more than 7 500 mT per year between 2015 and 2017).

In these last two categories alone, China's annual average expenditure on foreign tomato products has more than doubled over the past six years, growing from USD 9.6 million for the period running 2012-2014 to USD 14.7 million for the period running 2015-2017.

Source: Reuters, just-food, HIS, TomatoNews