2020 recorded an 11% increase compared to the three previous years

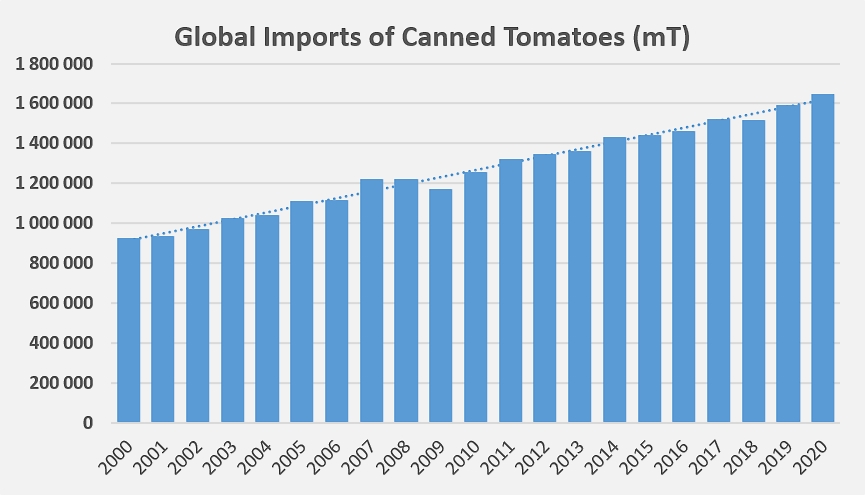

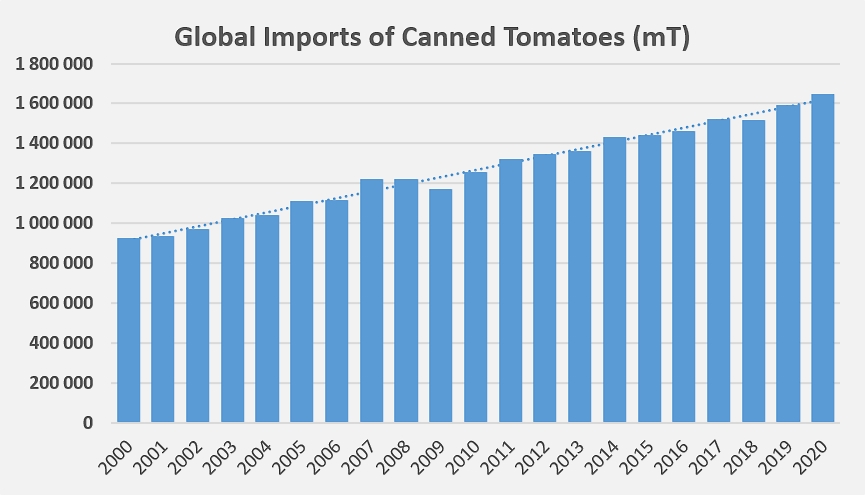

The canned tomato sector once again demonstrated last year how little sensitivity it has to crises which, conversely, deeply impact the global processing tomato industry. Relatively indifferent to the situations of excess production, the variations in exchange rates or the health crises that have affected our industry in recent years, the volumes of canned tomatoes shipped on a global scale have grown virtually without interruptions or irregularities over the last two decades at an almost linear average annual rate (CAGR) close to 3%. Worldwide trade in canned tomatoes involved nearly 1.65 million metric tonnes of finished products last year, compared to around 923,000 mT in 2000.

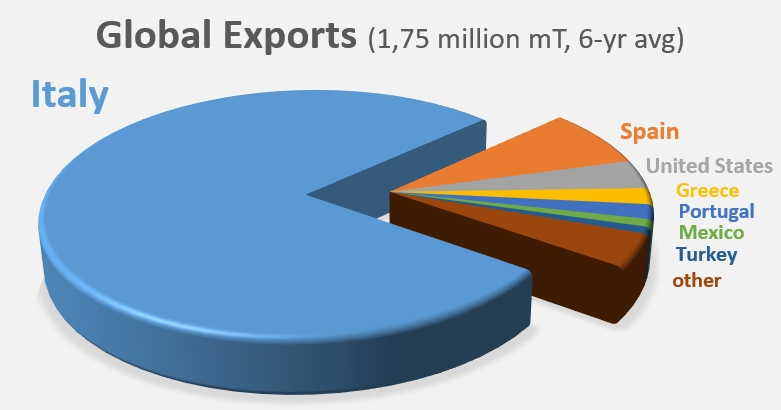

In 2020, like over the past twenty years, most of these products were processed and exported by Italian companies and, to a lesser extent, Spanish ones. These two industries have respectively accounted for 78% and 8% of world trade in the category over the past six years, followed far behind by the US, Greek and Portuguese industries. The processing countries mentioned account for around 94% of the world's export capacities (see additional information at the end of this article).

TOP15 ranking of importing countries: 80% of worldwide trade

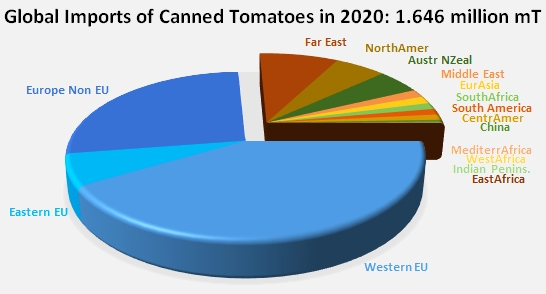

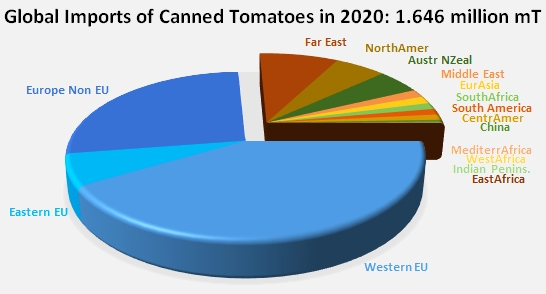

The countries that consume the most canned tomatoes, or at least are the main importers of this product, are largely found within the European Union (48% of the trade recorded over the past three years) or among non-EU countries of Europe (26% of quantities imported on a global scale over the same period).

The United Kingdom (considered a non-EU country in this article is by far the most important market in the world for this type of product. British imports almost reached 400,000 mT last year, up 11% from the three previous years (2017-2019), representing a small quarter of the global trade recorded over the last three years, for a value estimated at EUR 287 million (USD 327 million) in 2020.

The German market absorbed around 16% of the global quantities traded over the period running 2018-2020, and it has been particularly regular for the past three years, around an average of approximately 246,000 mT of finished products. It is the second largest market in the world, and was valued at around EUR 78 million (USD 203 million) in 2020.

The world's third biggest market for canned tomatoes is also European and within the EU: French imports in this sector amounted last year to more than 130,000 mT, up 8% compared to the three previous years, for an amount of EUR 107 million (USD 122 million).

Japan is the main non-European market for the canned tomato category. Annual Japanese purchases approached an average of 100,000 mT over the period running 2018-2020, or about 6% of world trade, increasing 8% in 2020 against the previous three years. Japanese expenditure last year amounted to USD 103 million (EUR 91 million).

The fifth rank worldwide is also occupied by a non-European country, Canada, which imported in 2020 just under 73,000 mT of canned tomatoes, or 9% more than over the period running 2017-2019.

Among the important features of the canned tomato trade sector, it is important to mention the recent increase in Belgian imports, which, with more than 73,000 mT in 2020, were 20% above their average level of the three previous years. Conversely, with less than 64,000 mT imported, Dutch purchases stalled last year.

Australian imports, which had risen sharply until 2010, seem to have plateaued since then, with annual imports hovering around an average of approximately 62,000 mT of finished products. Australia imported just under 66,000 mT last year, valued at USD 57 million (EUR 50 million).

The next six markets are all European. Regarding these outlets, whose imports last year ranged from 42,000 mT for the largest (Sweden) to just 22,000 for the most modest (Ireland), it must be pointed out that a marked overall pattern of increasing growth has been recorded: the other most significant increases were observed in Poland (40,000 mT imported in 2020, +29% compared to the period 2017-2019), Austria (26,000 mT imported in 2020, +24% compared to the same period the previous year) and Denmark (27,000 mT imported in 2020, +15%). Swiss purchases, close to 24,000 mT last year, also made good progress.

Finally, with just under 21,000 mT of canned tomatoes imported annually over the past three years, Saudi Arabia ranks last in the Top15 list. Given the pace of its purchases (+19% last year compared to the 2017-2019 period), this country could, however, progress rapidly in the world's ranking.

Total purchases of canned tomato imports by these Top15 countries have accounted on average for more than 80% of the quantities mobilized on a global scale over the past three years. The remaining quantities, just under 295,000 mT of finished products per year, were sent to more than 80 different countries. Besides China, these low-consumption countries are mostly located in the Middle East, Eurasia, Africa, Central and South America, and the Indian Peninsula.

The total value of canned tomato imports for the year 2020 is estimated at around EUR 1.28 billion, or about USD 1.46 billion.

Additional information:

Main supply sources for the global canned tomato market over the past six years

The top fifteen importing countries of canned tomatoes (in metric tonnes)

Source: Trade Data Monitor