Ag Alert

, François-Xavier Branthôme

-

California farmers are scaling down their processing tomato acreage this year as processors enter the planting season with boosted inventory.

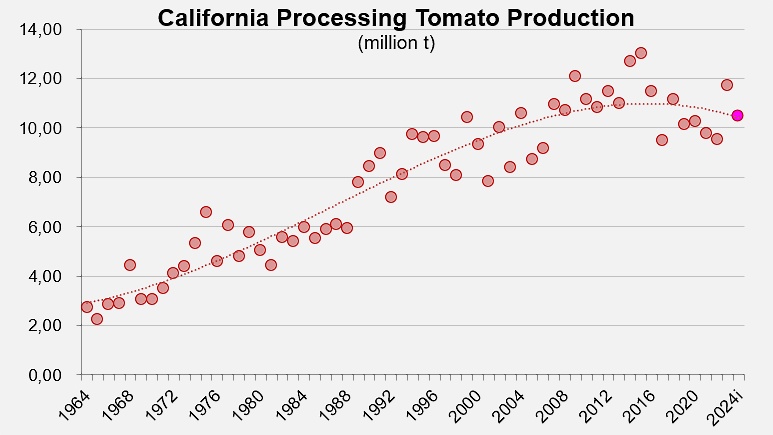

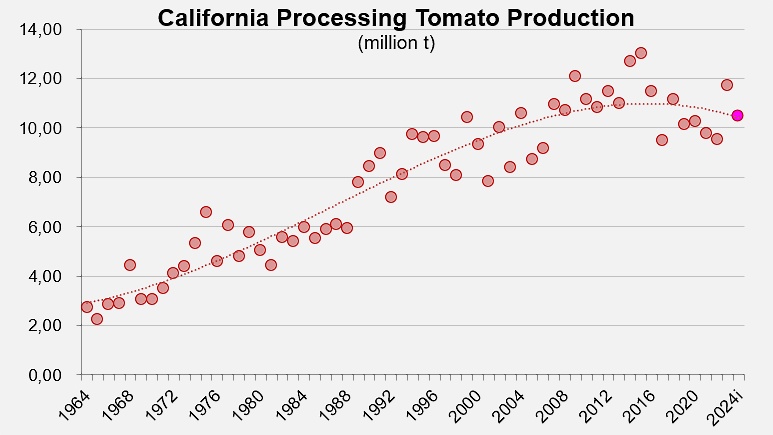

The state’s tomato processors planned to contract for 10.5 million metric tonnes (t) (11.6 million short tons) this year, down about 10% from the 11.7 million t (12.9 million tons) they contracted for in 2023, according to a January report from the U.S. Department of Agriculture.

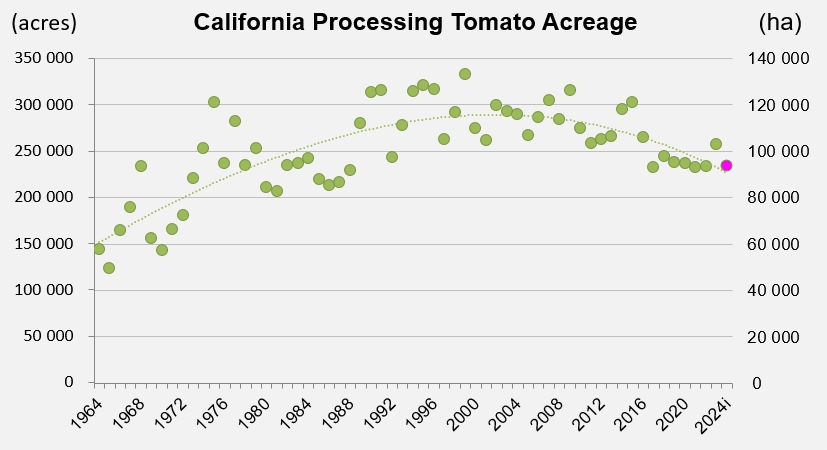

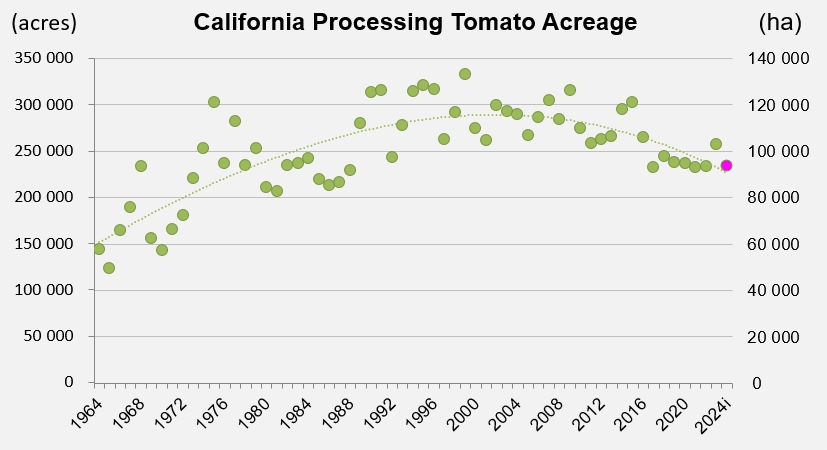

“Every grower for the most part has been reduced,” said Mike Montna, president and CEO of the California Tomato Growers Association. Planted acreage was projected to fall from 103,200 ha (255,000 acres) last year to 94,000 ha (232,000 acres) this year, according to USDA, with growers aiming to produce 112 t/ha (50 tons per acre).

California farmers delivered one of the state’s largest tomato crops in recent years to processors last year. With bolstered inventory, processors contracted less tomato acreage from farms this year.

In 2023, California growers harvested their largest tomato crop in several years after winter storms replenished water supplies. Processors looking to bolster inventory that was depleted during drought years paid a record-high price. After that crop, Morning Star, the state’s largest tomato processor, said in a December statement that “inventory levels have been buffered, and a respectable carryover stock is anticipated for 2024.” (See also related articles below).

Meanwhile, experts in the sector reported softened demand for processed tomato products as consumer habits shifted in response to inflation.

Individual growers and nurseries that supply tomato transplants reported scaling down tomato production by as much as 25% this year, depending on factors such as water availability and proximity to canneries. Some nurseries said acreage appeared to be down more steeply in the central and northern parts of the Central Valley. “A lot of the biggest processors are in the southern part of the state. With the acreage reduction, there’s a lot more flexibility for them to contract acres closer to their facilities to save on freight costs,” said Jonathan Deniz, product development manager for TS&L Seed Co. in Yolo County, which supplies tomato transplants to farmers across the state.

Nicole Nicks, general manager at Westside Transplant in Merced County, said farmers in water districts that rely on the federal Central Valley Project were planting “a little bit less acreage” than growers in other areas because of uncertain water allocations. “When there’s a little bit more water available, we might still see an increase in acres planted,” Nicks said, referring to expectations that the U.S. Bureau of Reclamation could increase water allocations this spring for farmers.

Some ground that was taken out of tomato production last year after flooding refilled the historic Tulare Lake dried out and was ready to be farmed again, Montna said. Otherwise, he said he expected tomato acreage would be reduced “pretty much across the board.”

Industry professionals said processors appear to be shifting delivery schedules earlier in the year to avoid risks that can impact crop quality at the tail end of harvest season and to minimize spending on late-season premiums processors pay farmers to compensate for those risks. “They’ve cut the tonnage from the late deliveries,” Deniz said, adding that he expected many canneries could be done processing tomatoes by mid-October.

Last spring, widespread flooding delayed plantings, and cool weather led to a late harvest that extended into November. Growers and nurseries said planting conditions looked better this year. “The biggest difference from last year to this year is going to be the weather and our ability to get the crop going on time,” said Erik Wilson, northern sales representative for AgSeeds Unlimited in Yolo County, which supplies and plants tomato transplants. “Weather can be unpredictable, but in general, it looks more favorable.”

Planting began at the southern end of the valley in late February and is expected to begin around March 18 at the northern end of the valley, according to growers and nurseries.

Mitchell Yerxa, who grows tomatoes and other crops in Colusa and Sutter counties, said he was contracted to grow 344 ha (850 acres) of processing tomatoes this year, down from 404 ha (1,000 acres) last year.

As of Monday, CTGA was still negotiating with processors on pricing for this year’s crop. The price was expected to come down from the record USD138 per ton processors paid last year. In 2022, the price was USD105 per ton. “We have to find the right balance between (lower demand) and still reflecting the risk of growing tomatoes,” Montna said.

Compared to some field crops, tomatoes are expensive to grow and come with greater risks, including heat stress, rain events, and pest and disease pressures. And as with other crops, input costs have surged. From 2017 to 2023, the cost of planting, growing and harvesting processing tomatoes increased 76%, rising to around Euro 13,500 per hectare (USD 6,000 per acre), according to a study by the University of California Agriculture and Natural Resources.

Nurseries, which have also seen input costs rise, said they were selling tomato transplants this year for 5% to 8% more than last year. The companies were impacted last year by the increased cost of natural gas, which they use to heat their greenhouses. Gas prices have declined, but “everything else has gone up,” Nicks said.

For farmers, making planting decisions before tomato pricing is settled “is not ideal, but it does happen,” said Yerxa, who serves as a CTGA board member. Having ordered his transplants in January, he added he was counting on negotiators to arrive at a price “that’s appropriate for the growing season.”

With tomato plantings down, other crops are expected to make up the acreage. Yerxa said he plans to grow a mix of cucumbers, watermelon, cantaloupe and squash on the ground he took out of tomato production. He said he expected other tomato farmers might plant more safflower, corn and cotton this year.

“Each ranch has their own things they can and can’t do,” he said.

Some complementary data

Source: agalert.com, California Farm Bureau Federation