Most of the sector's growth is based on "low concentration" products

Two dynamic forces are currently driving the world trade in tomato pastes: firstly, the countries that have historically been processing countries are losing ground as they compete with the rest of the world; secondly, exports of "low-concentration" products are the only ones to record significant progress.

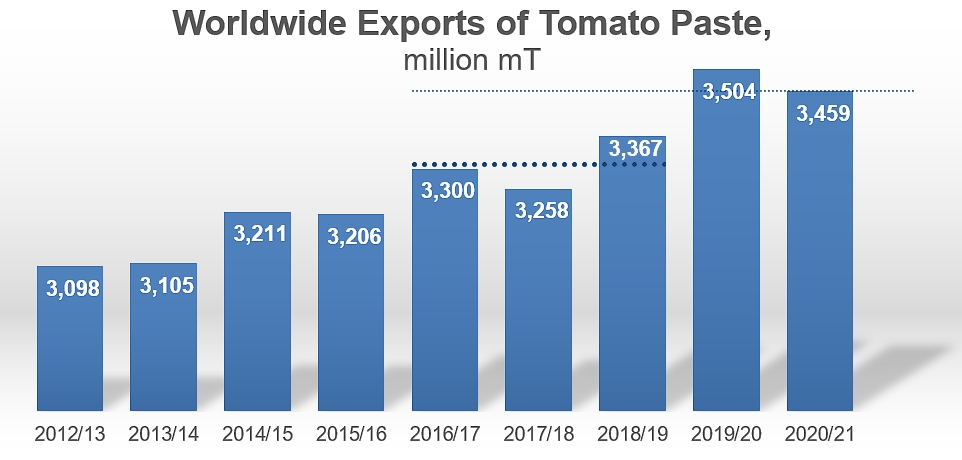

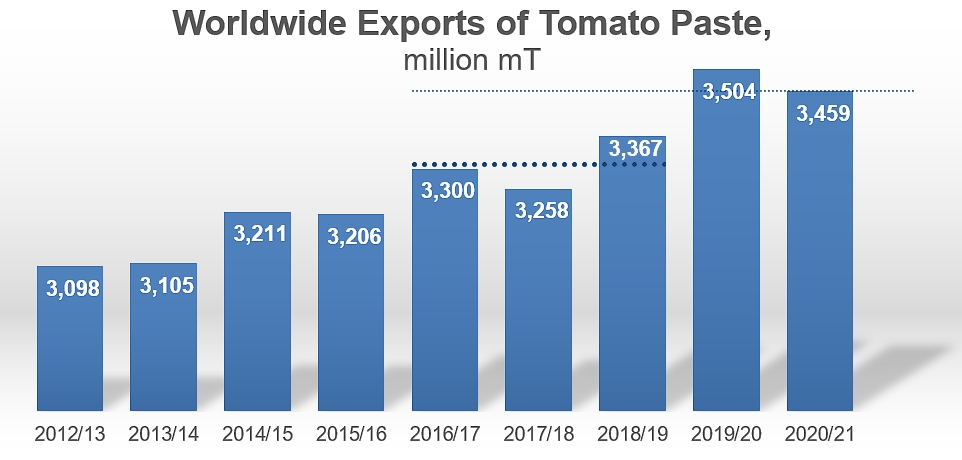

The most recent world trade estimates put the amount of tomato paste exported over the July 2020–June 2021 marketing year at around 3.46 million metric tonnes. While obviously slightly lower (-1%) than the record level of operations reported the previous year (2019/2020, with 3.51 million mT), the volumes shipped last year appear to have capitalized significantly on the gain made during the Covid pandemic crisis. The 2020/2021 result is indeed 2.5% higher than the average of the three immediately preceding marketing years (2017/2018 to 2019/2020). However, although a comparison with the marketing years of the 2016/2019 period (excluding the record result of 2019/2020) shows an increase of nearly 5%, the 3.46 million mT traded last year also places 2020/2021 in the direct continuation of the progress recorded during those "pre-Covid" years. In other words, the 2020/2021 "score" is not yet outside the framework of "mechanical" progression, and it will therefore be necessary to wait for final results of the current 2021/2022 trading year – and probably the following ones – to know if the campaign carried out during the pandemic has really raised the average level of global dynamics or if it was only a one-off episode with no lasting effect on consumption habits on a global scale.

Performance of the TOP10

However, these figures only express part of the reality of foreign trade. Two dynamics have been underlying the evolution of global trade in tomato pastes for several years, the effects of which can already be observed and are likely to change the face of our industry in the long term, both commercially and agriculturally.

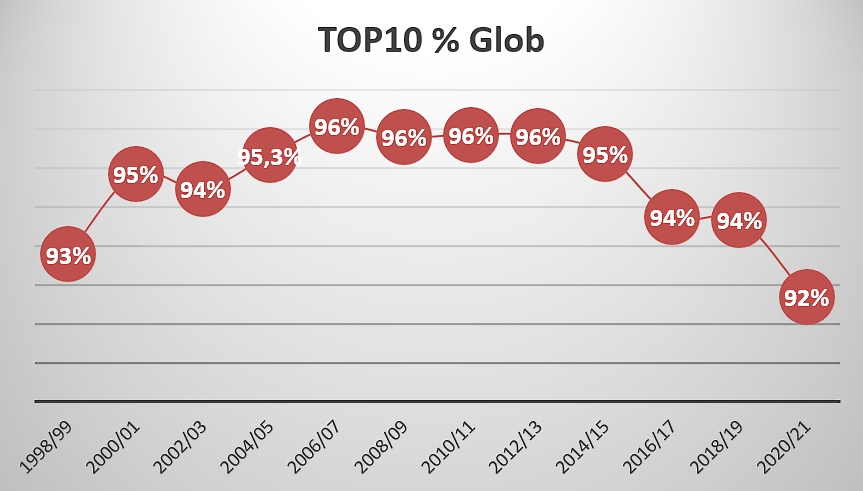

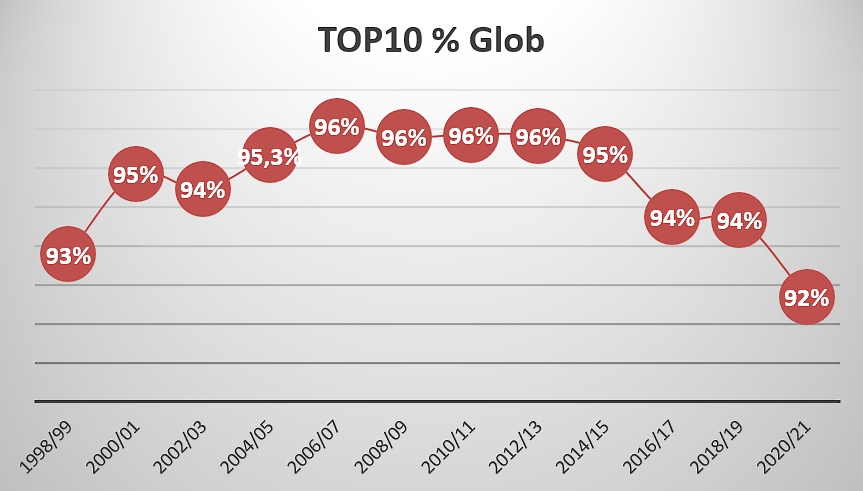

The first change concerns the distribution of market shares among the countries that are leaders in the global supply of tomato pastes. Over the past 15 years, the share of the TOP10 countries (a list that can vary from year to year) has decreased significantly, from more than 96% of total worldwide shipments in 2006/2007 to less than 92% in 2020/2021. Several reasons and mechanisms for this shift have already been commented on in our reports, including investments made by some countries wishing to reduce their dependence on other sources and their expenditure on external supplies, the attainment of self-sufficiency by some of them, and even the emergence of new processing and/or exporting countries on the international scene. The decline is significant and, since the peak reached in 2006/2007, the foreign sales of the TOP10 countries have only grown at an average annual rate of 2.3%, on a global market that has grown at a rate of 2.7% per year. It is likely that the growing pressure of sharp increases in costs, particularly for energy and freight (sea and road), will accentuate these recent developments by encouraging local production and regional sourcing. Although the relative contraction of outlets applies to a global market that is currently developing (as uncertain as this development may be), it has contributed to reinforcing the already tense climate of competition between the major players of the industry.

The rise of "low concentration" products

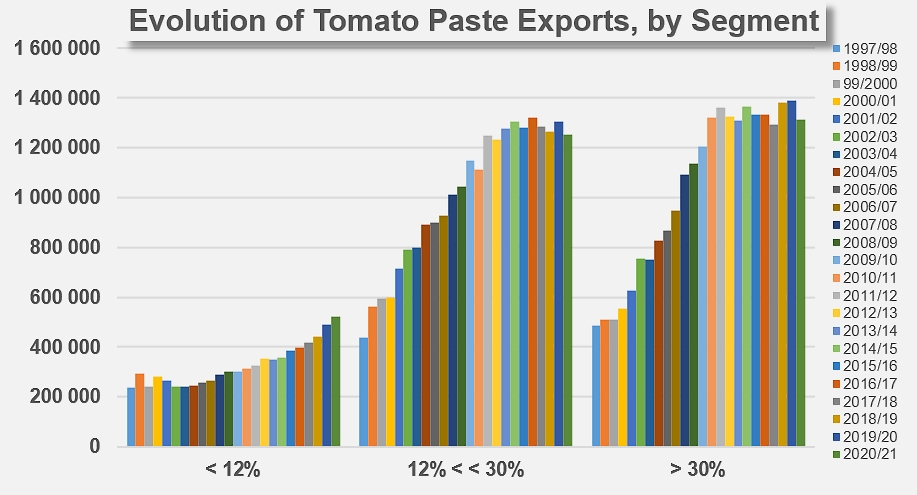

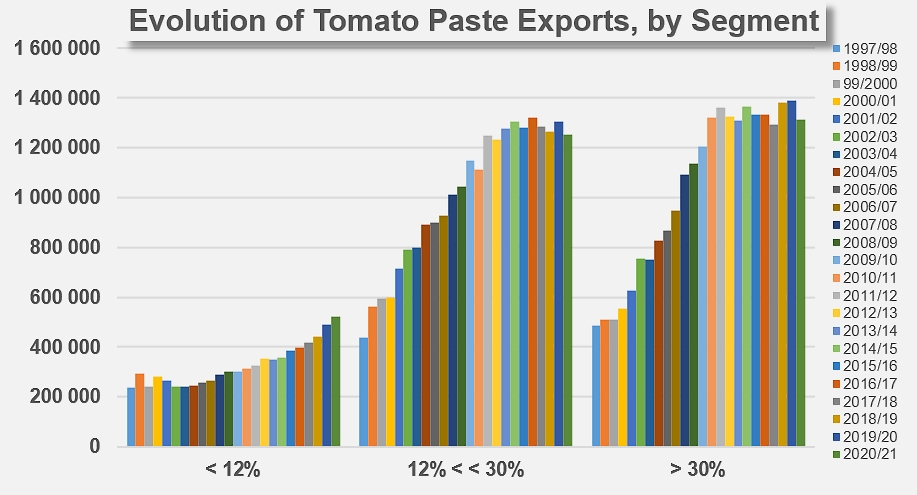

The growing share of the world market that is "escaping" the hold of historical leaders of the sector weighs all the more heavily on the operations of these big players for the fact that the decline is coupled with a gradual but profound change in the nature of the tomato products that are being requested on the market. For the last ten years, world trade in paste with a soluble solids content between 12% and 30% (customs codes 20029031, 20029039) and above 30% (customs codes 20029091 and 20029099) has tended to stagnate, the former at around an annual average of nearly 1.28 million mT of finished products, the latter at around 1.34 million mT. In both cases, the average annual growth (CAGR) is close to zero. At the same time, the quantities of tomato pastes with a soluble solids content of less than 12% (customs codes 20029011 and 20029019) have increased significantly, from 320,000 mT of finished products in 2011/2012 to 520,000 mT in 2020/2021, which is an average annual rate of approximately 5%. "Low concentration" products are now experiencing strong development, which is also due to the technical qualities of viscosity, color, etc. that technological advances in processing have made possible. The result of this new orientation of the world market is a sluggish growth in the quantities of raw material mobilized annually for worldwide trade, specifically affecting the countries and companies whose activity is most based on international exchanges.

According to official customs statistics, the average annual growth rate of TOP10 exports of pastes (expressed in raw material equivalent) over the last ten years can be estimated at less than 0.8%. The estimated quantities of fresh tomatoes involved have reportedly decreased from 17.2 million mT to 17.5 million mT over the period under consideration. In other words, the average soluble solids content of the paste marketed worldwide seems to have progressively decreased over the last twelve years, from more than 28% in 2009/2010 to less than 27% in 2020/2021. This change in the quality demanded by the market corresponds to a decrease of about 6% of the quantities mobilized, and if it only affects the part of the world trade in tomato paste provided by the TOP10 countries of the sector, its impact is nonetheless measurable on the global scale and on that of the past decade.

This strong trend is currently focusing the growth of trade overall almost exclusively on low-concentration products. But, given the relative weakness of its contribution to the whole, both in terms of finished products and in terms of fresh equivalents, the segment is clearly not in a position to guarantee strong growth for the sector. On the one hand, the rise of low-concentration products, together with the relative stagnation of the other categories (28/30% and >30%), contributes to maintaining the rate of development of trade at a very low level. On the other hand, the importance of the sector in terms of fresh tomato equivalent remains marginal and has had little effect for the moment on the evolution of the quantities of fresh tomatoes absorbed by the whole of world trade and, by way of consequence, by the processing sector overall.

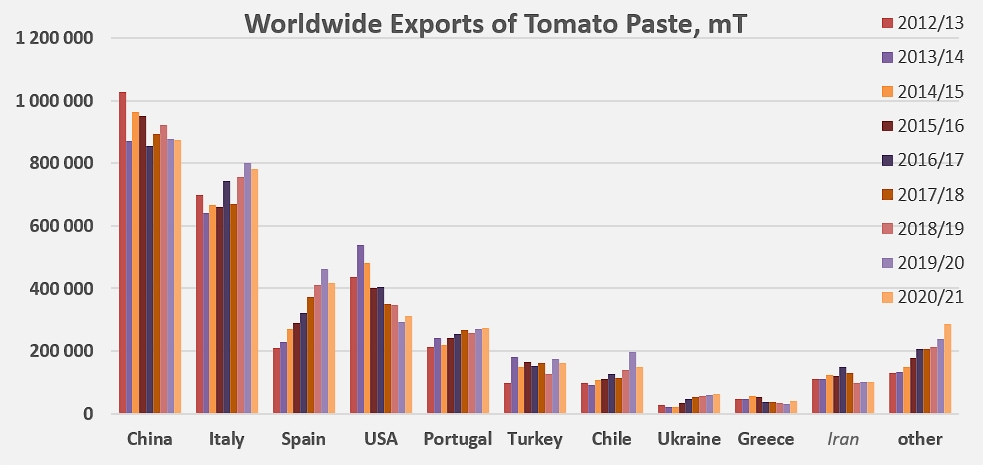

Evolution of tomato paste exports from the world's TOP10 countries

Some additional information

Evolution of exports of the main processing and exporting countries.

(Iranian data extrapolated)

Comparison of the average annual growth rates of exports of the different grades of paste, before and after 2011/2012: over the last nine years, the only segment to have shown significant growth is that of concentrated purées with a solids content of less than 12°Brix.

Sources: Trade Data Monitor