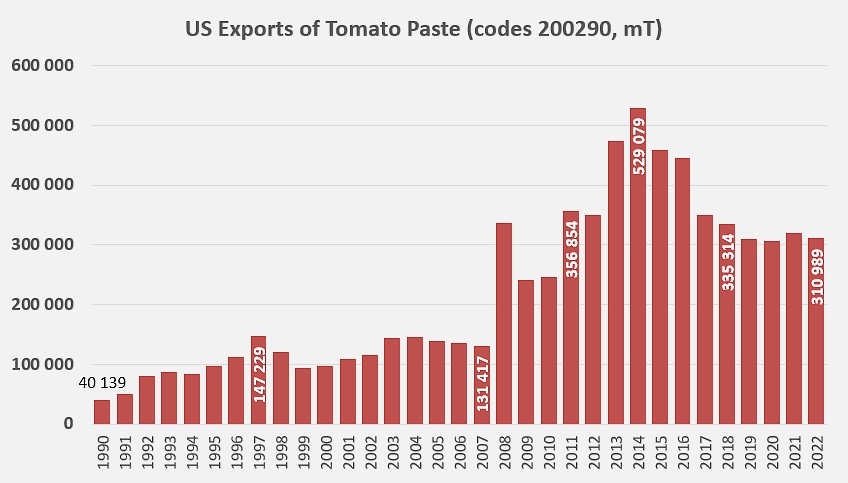

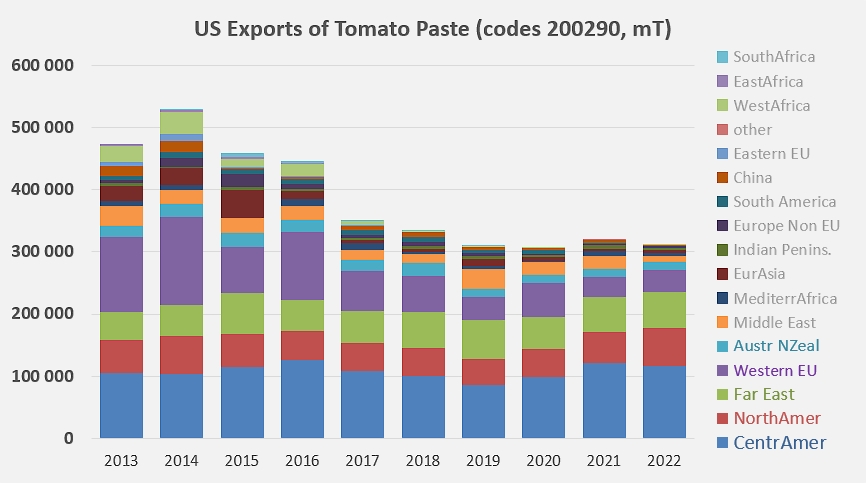

U.S. exports of tomato paste have been affected in recent years by the slowdown in processing activity that has resulted from a combination of adverse weather and economic conditions. After the dramatic surge that brought U.S. foreign sales from just over 130,000 metric tonnes (mT) of pastes in 2007 to nearly 530,000 mT in 2014, trade flows have seen a sharp downturn that has brought U.S. foreign activity to the levels recorded for the past four to five years, in the range of 300,000 to 310,000 mT annually.

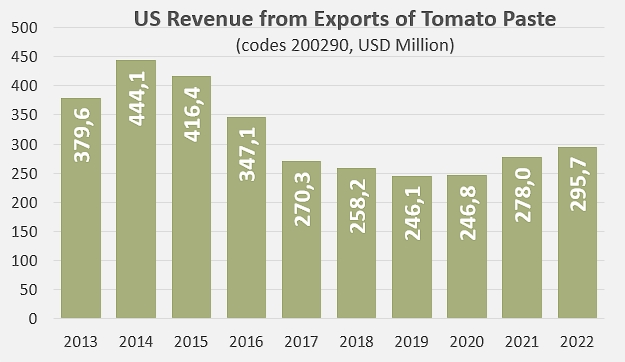

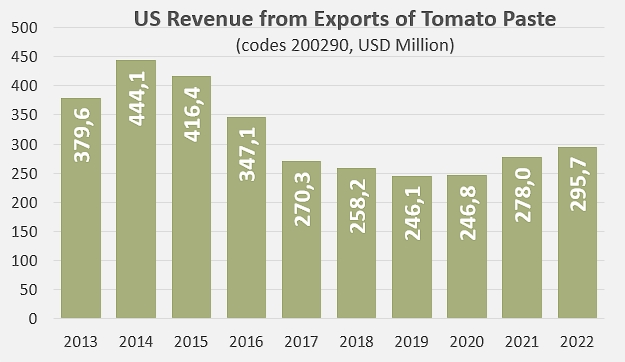

The total value of US paste exports followed a similar pattern, except that the inflationary surge of the last two years increased the 2022 result (USD million) by 6% compared to the previous year and by about 15% compared to the average of the previous three years as well as to the pre-Covid period (about USD 258 million).

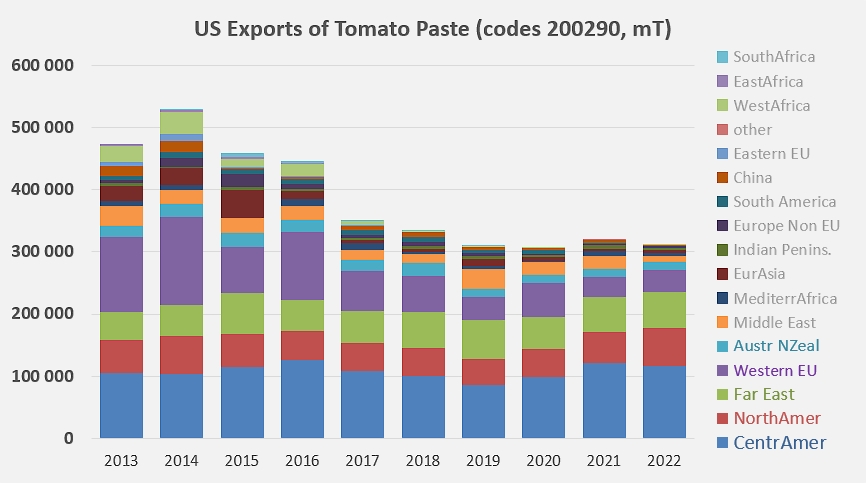

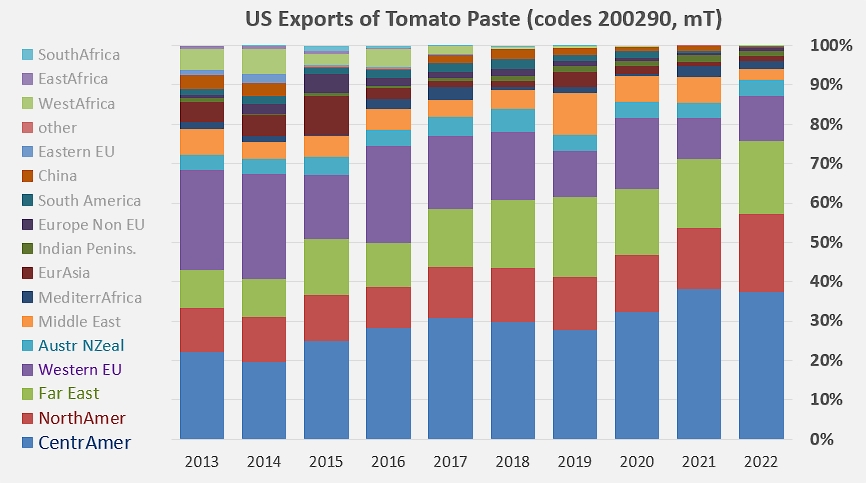

The stability of the quantities exported is only apparent. It can mainly be observed on the markets of the Far East and the Asia-Pacific region, but it is also due to a marked refocusing of sales on the North American continent (mainly Canada) and Central America (Mexico, Costa Rica, Honduras), accompanied by a net decline in trade flows to the Italian market, which were not offset by developments on the South Korean and Dutch markets.

In total, the US industry exported nearly 311,000 mT of pastes (under codes 2002900060 and 2002900080) in 2022, 8,000 mT (2.5%) less than in 2021 and 21,000 mT (6.3%) less than during the three-year period (2017, 2018, and 2019) prior to the Covid pandemic. This performance ranks the US industry as the fifth largest exporter of pastes in the world in 2022, between Turkey (313,000 mT) and Portugal (277,000 mT).

Some complementary data

The evolution of the regional distribution of US exports clearly shows accelerating dynamics to the "closer" destinations of North and Central America and the Far East, in parallel with a slowdown on the markets of the Western EU.

Evolution of U.S. exports of tomato pastes over the last thirty years.

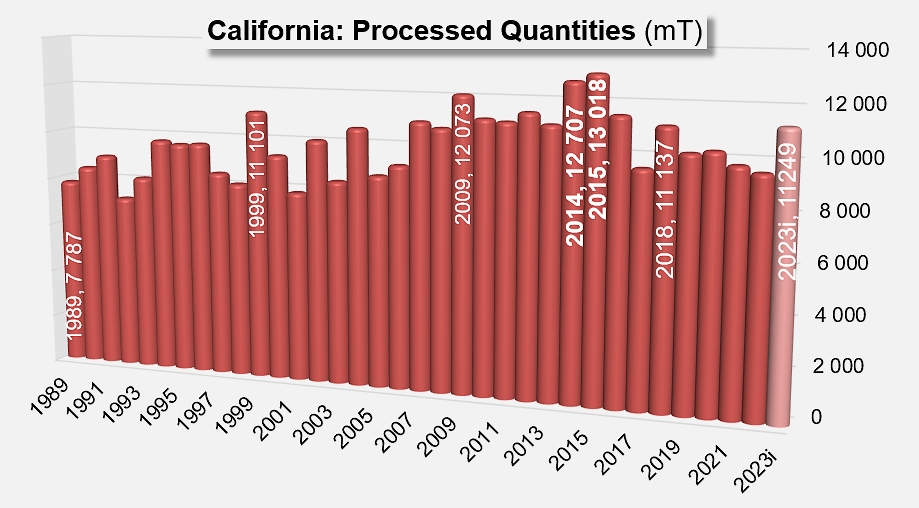

Evolution of the quantities processed by the US industry since 1989.

Sources: TDM