Did Brexit cause a slight end-of-year flutter?

Following the United Kingdom's withdrawal from the European Union on 31 January 2020, a transition period entered into force and ended on 31 December 2020.

Since the end of this period, international agreements concluded by the EU no longer apply to the United Kingdom. The provisions of the free trade agreements remain unchanged for the EU (regarding, for example, market access or rates for tariffs and quotas), and EU operators must verify the rules of origin, since British ingredients can no longer be considered as originating in the EU for exported products under these agreements.

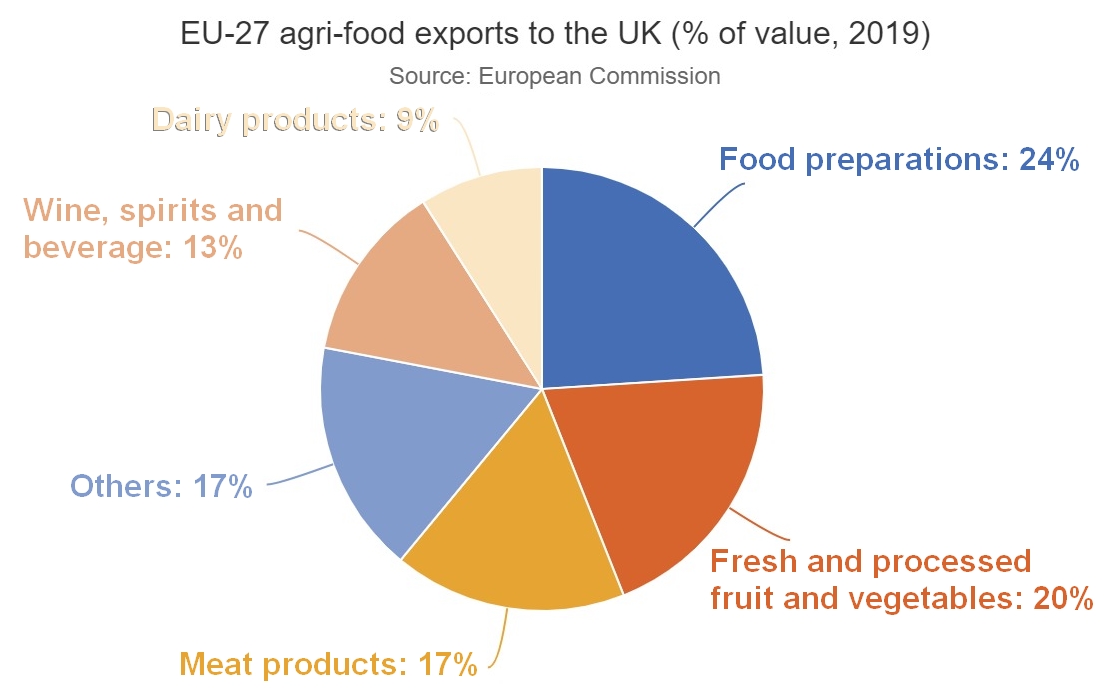

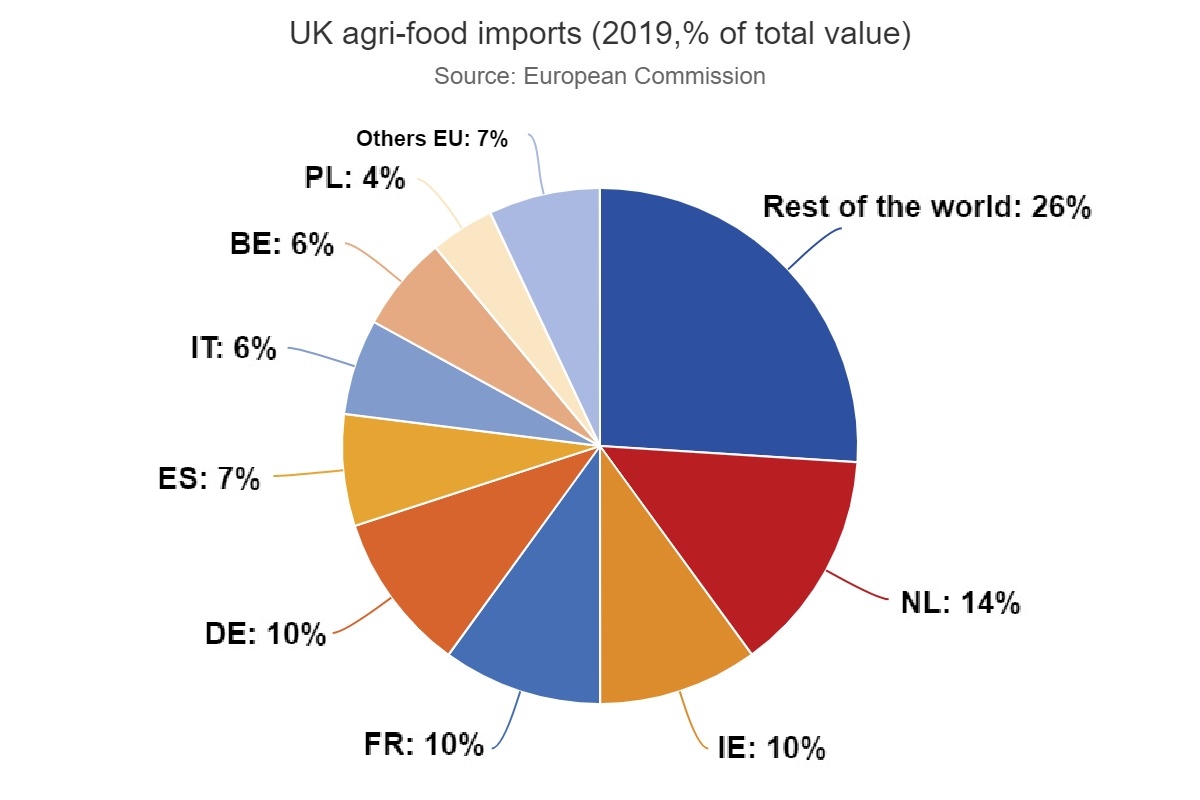

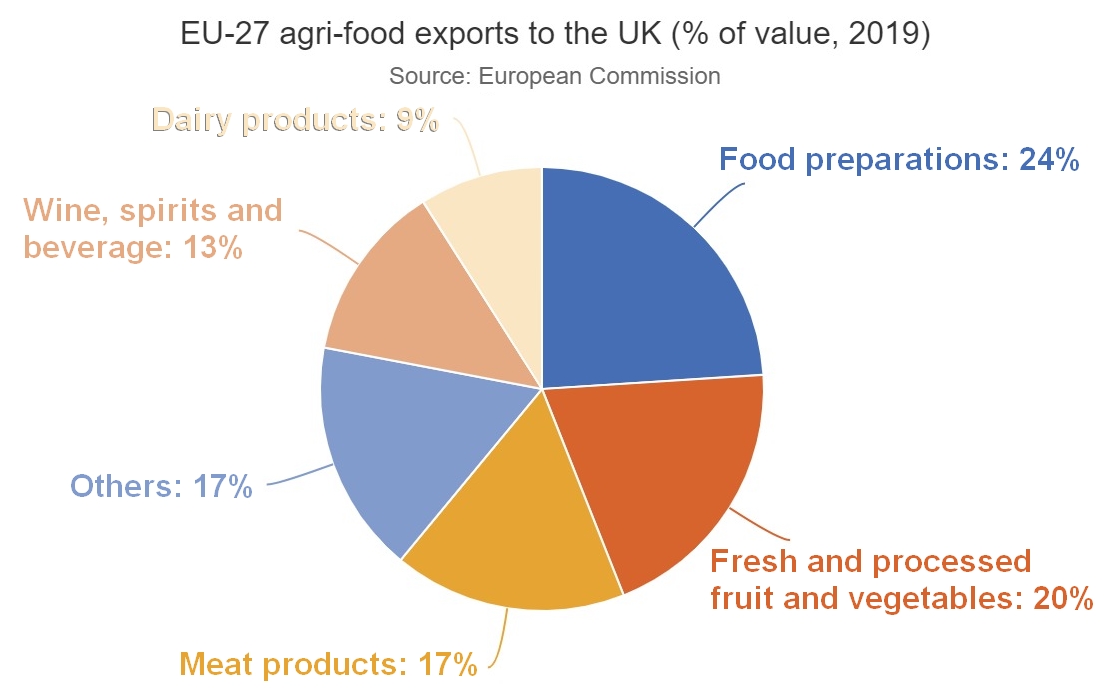

The UK and the EU have close trade links in the agricultural and food sector. According to figures released by the European Commission, EU countries export significant volumes of food products to the UK, including fresh and processed fruit and vegetables, meat products and prepared dishes. In 2019, the value of these exports amounted to EUR 41 billion (see additional information at the end of this article).

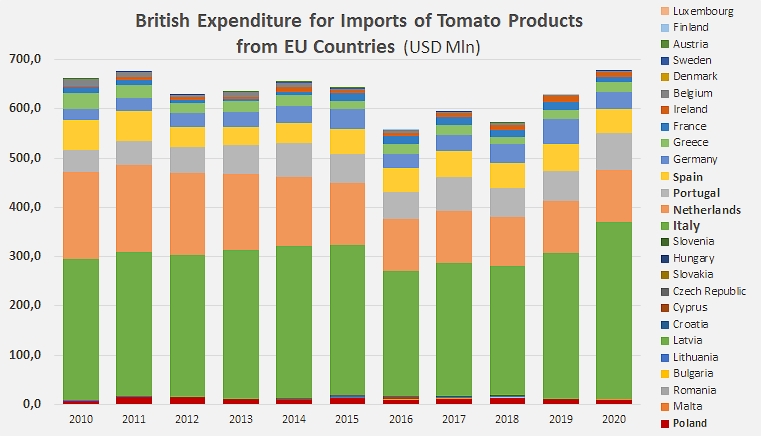

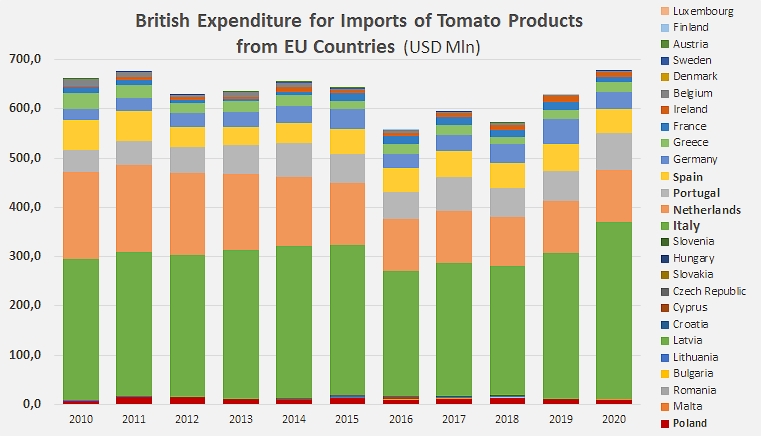

According to trade statistics collected by Trade Data Monitor LLC, the value of UK imports of tomato products in 2020 amounted to almost GBP 545 million (EUR 613 million, USD 700 million), making the UK one of the two leading outlet markets for such products in the world. Over the last ten years, EU countries exporting tomato products have accounted for nearly 94% of British expenditure, which therefore represents a major commercial and industrial stake for processing countries such as Italy, Portugal, Spain, but also the Netherlands or even Germany.

The implementation of the new trade rules could have resulted, among other consequences, in a change in the pace of British imports of tomato products, particularly from the EU, which had been expected to increase over the last months of the year to anticipate any slowdowns, difficulties or additional costs related to customs operations, new documentary provisions, health requirements, etc.

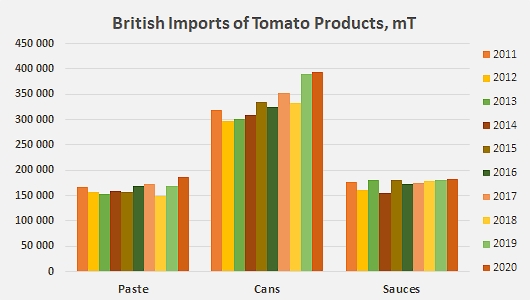

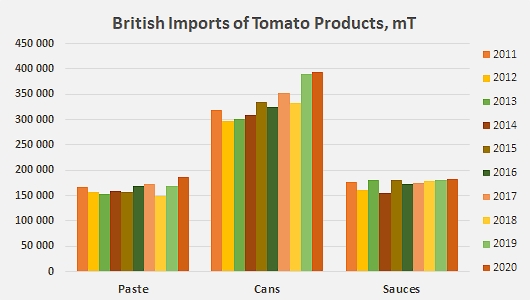

In the end, the “Brexit” effect, if there ever was one, has resulted in nothing more than a slight flutter in recorded volumes, limited to the last few months of the year – possibly even December only – and probably only involving one single category. So on an annual basis, the quantities of tomato products imported by the United Kingdom are not exceptionally high compared to those recorded in 2019 or even over the period 2017-2019.

Whether in terms of canned tomatoes or of sauces, the increases recorded over the past two years are practically nil (between 0% and 1% for volumes close to 390,000 mT and 181,000 mT of finished products, respectively). Furthermore, in the sauces category, a comparison of operations in 2020 with operations over the three previous years does not show any significant variation (less than 2%).

For the canned tomato category, the apparent acceleration in purchases recorded in 2019 and 2020 seems to be part of the solid growth dynamic (CAGR close to 4%) observed for nearly ten years, and it is mainly based on the sharp contrast created by the drop – as significant as it was temporary – in British canned tomato imports in 2018. If a proportion of the increase in canned tomato imports is to be attributed to Brexit, it remains fairly anecdotal for the moment, if it even exists.

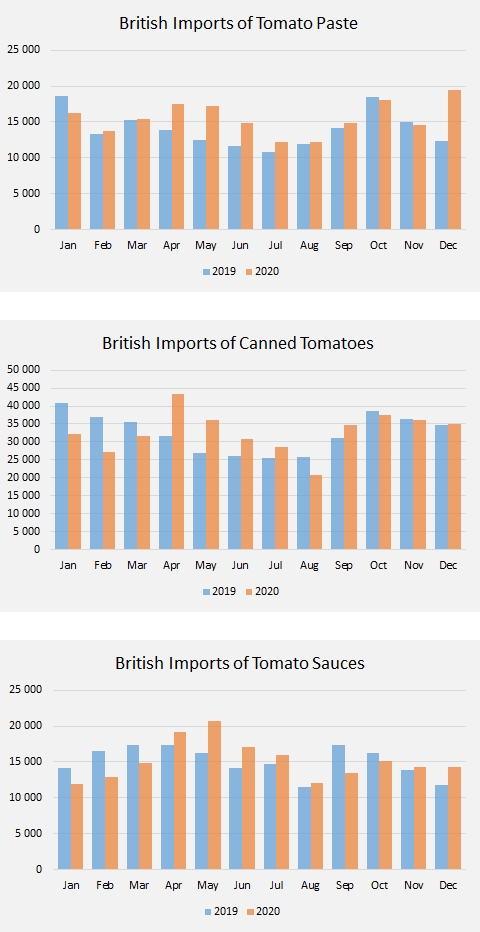

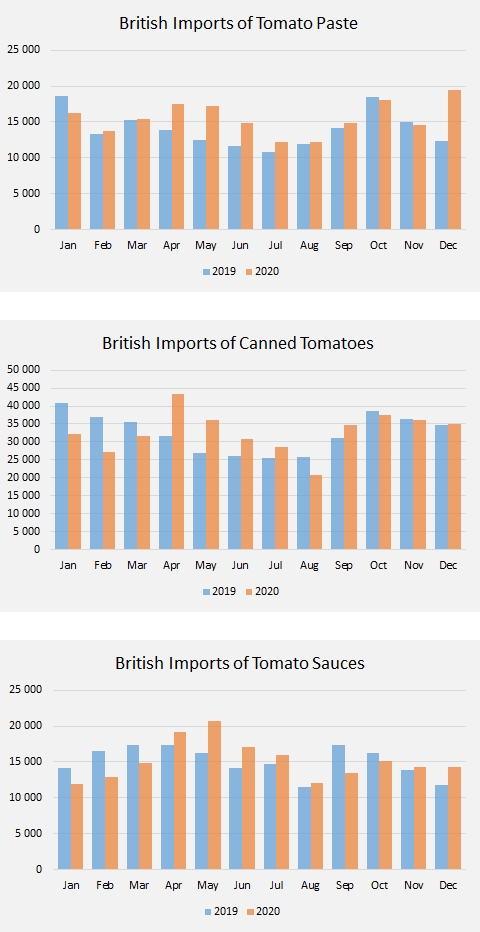

A closer examination of monthly data, comparing 2020 against 2019 and comparing 2020 with the three previous years, does not show any particular increase in the flow of imports of canned tomatoes or sauces.

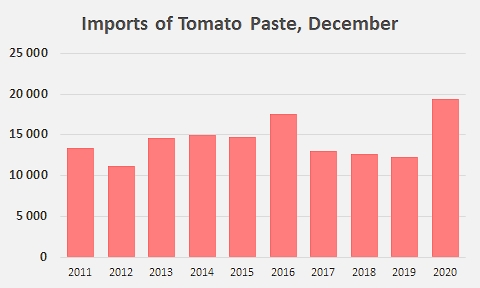

In the case of tomato paste, annual imports followed a similar pattern to that of canned tomatoes, with a marked contrast between the significant drop recorded in 2018 and the equally marked increases that followed in 2019 and 2020, without it being objectively possible to attribute the most recent variations to a Brexit effect. The quantities imported last year were very slightly above the average increases recorded since 2012. At most, there is a slight divergence from previous monthly dynamics: the quantities of paste delivered to the United Kingdom in December broke with the regular downward trend observed for this particular month over the past ten years, with an increase recorded at more than 50% compared to the quantities “usually” delivered over the months of December 2017, 2018 and 2019 (see additional information).

Parallel to the increase in import volumes, the expenditure in pounds sterling has, for its part, gradually and considerably increased since 2014, going from some GBP 413 million (EUR 513 million or USD 679 million) to nearly GBP 545 million (EUR 613 million or USD 699 million) in 2020. Like supplies to the German or French markets, tomato products of Community origin account for almost all of the processed tomato entering British territory, resulting in a total of 97% of British expenditure over the last three years going to companies in Italy (47%), the Netherlands (16%), Portugal (10%), Spain (8%), Germany (6%), Greece (3%), France (2%), etc.

British imports of tomato paste in the month of December since 2011

Distribution of UK food import expenditure according to country in 2019

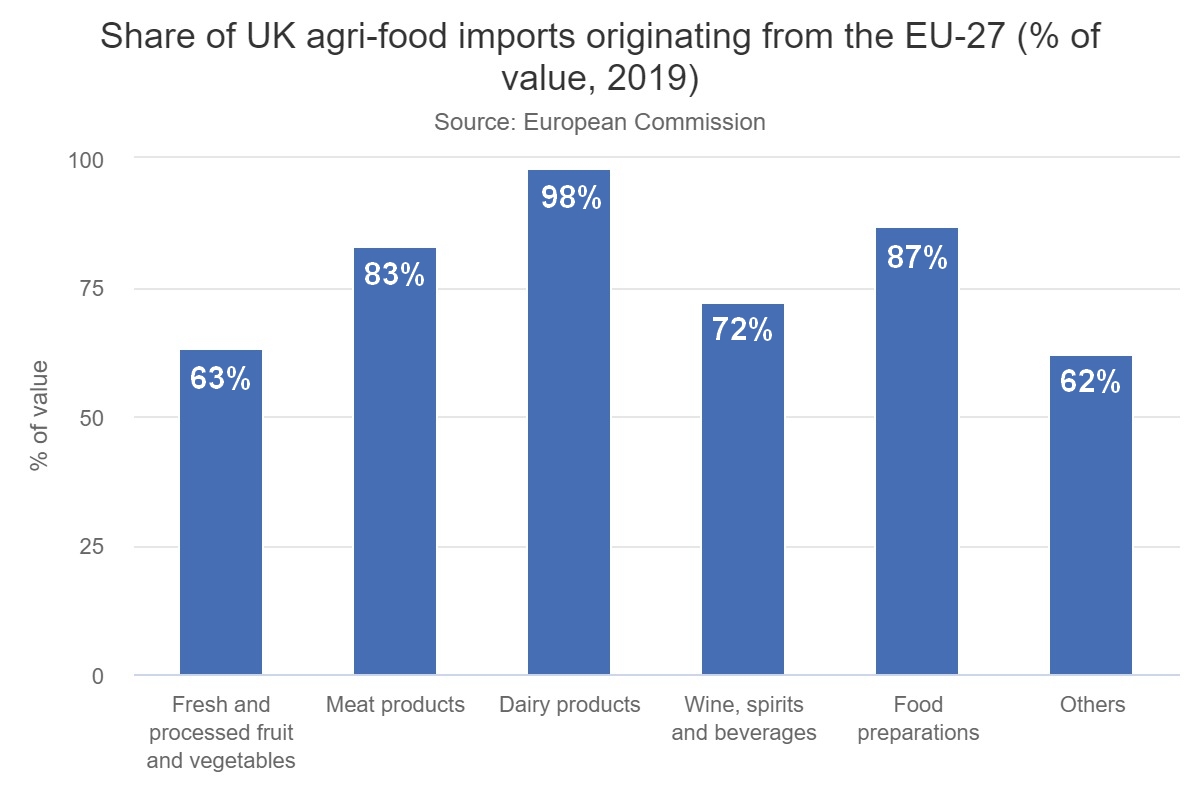

Proportion (in value) of UK food imports from EU-27 countries, by sector (processed F&V, meat products, dairy products, wines and spirits, etc.)