Respect for your privacy is our priority

The cookie is a small information file stored in your browser each time you visit our web page.Cookies are useful because they record the history of your activity on our web page. Thus, when you return to the page, it identifies you and configures its content based on your browsing habits, your identity and your preferences.

You may accept cookies or refuse, block or delete cookies, at your convenience. To do this, you can choose from one of the options available on this window or even and if necessary, by configuring your browser.

If you refuse cookies, we can not guarantee the proper functioning of the various features of our web page.

For more information, please read the COOKIES INFORMATION section on our web page.

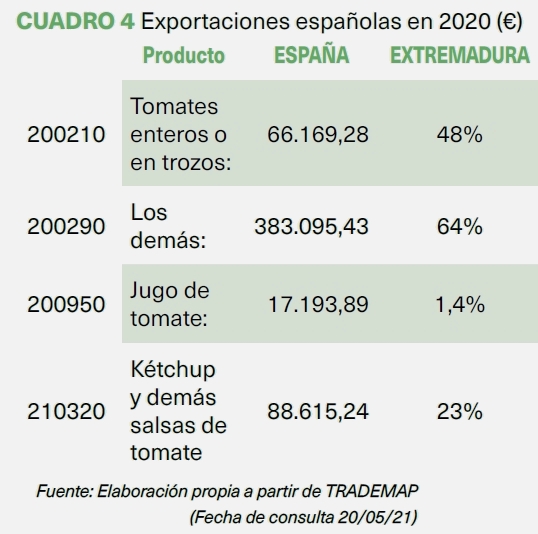

In this last region, production has been structured around about 20 Producers' Organizations working in the fruit and vegetable sector (OPFH): these POs supply 14 processing companies that manufacture tomato paste, dehydrated powders and chopped tomatoes, with an increasingly large production of finished products like ketchup, tomato frito sauce, peeled tomatoes, etc.

In this last region, production has been structured around about 20 Producers' Organizations working in the fruit and vegetable sector (OPFH): these POs supply 14 processing companies that manufacture tomato paste, dehydrated powders and chopped tomatoes, with an increasingly large production of finished products like ketchup, tomato frito sauce, peeled tomatoes, etc.

Finally, one of the important initiatives carried out in recent years in Extremadura has resulted in a major technology dissemination program, in which the CICYTEX (Centro de Investigaciones Científicas y Tecnológicas de Extremadura, or Center for Scientific and Technological Research of Extremadura), helps communicate research results, on the model of the CTAEX, which are made available on the Tomato Observatory's website

Finally, one of the important initiatives carried out in recent years in Extremadura has resulted in a major technology dissemination program, in which the CICYTEX (Centro de Investigaciones Científicas y Tecnológicas de Extremadura, or Center for Scientific and Technological Research of Extremadura), helps communicate research results, on the model of the CTAEX, which are made available on the Tomato Observatory's website

José Luis Llerena Ruiz, Director of the CTAEX (National Center for Food Technology), Ana Serrano Mordillo, in charge of technology transfer for the CTAEX, Sara Machuca Cano, technology transfer te

José Luis Llerena Ruiz, Director of the CTAEX (National Center for Food Technology), Ana Serrano Mordillo, in charge of technology transfer for the CTAEX, Sara Machuca Cano, technology transfer te