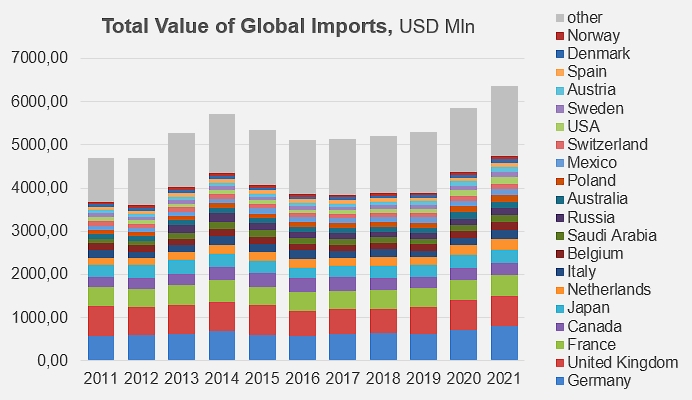

The value of global imports could exceed the USD 6.6 billion threshold in 2022

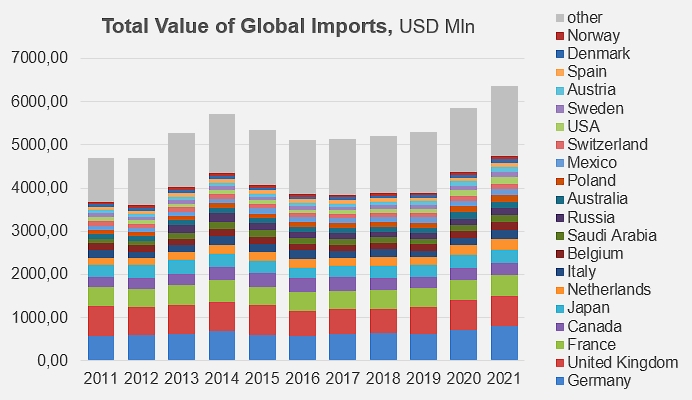

Over the last three years, the Covid pandemic has caused an acceleration in the consumption of tomato products and an almost total exhaustion of stocks. At the same time, the worldwide processing industry has not been able, for various reasons (notably of a climatic nature) to increase the quantities produced and to meet demand. This unprecedented situation has resulted in a spectacular increase in world prices for tomato-based products, which can be observed in all sectors of the industry. Indeed, the relatively slow increase in the total value of products traded each year, which had been averaging close to USD 5.2 billion for the past decade, has given way to a real surge that has brought the total annual value of imported products in 2021 to nearly USD 6.4 billion. If the trend recorded over the first quarter of 2022 continues, the value of overall imports could exceed the historic threshold of USD 6.6 billion in 2022.

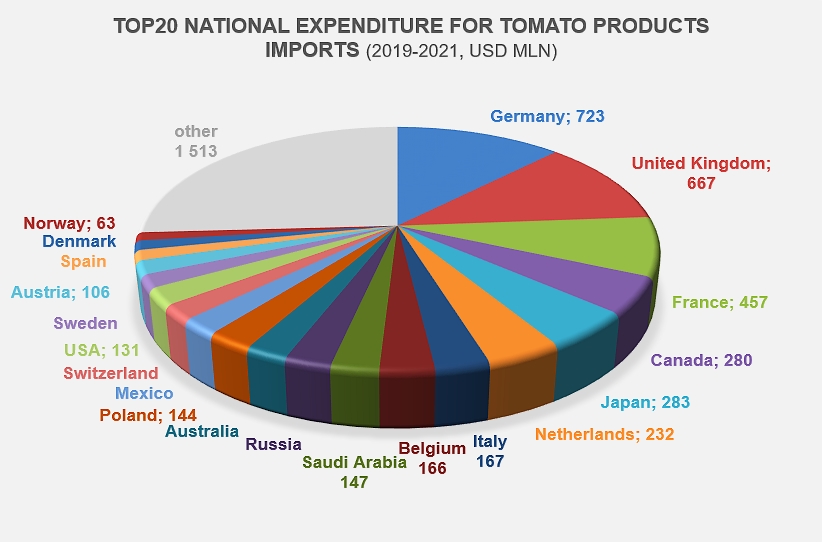

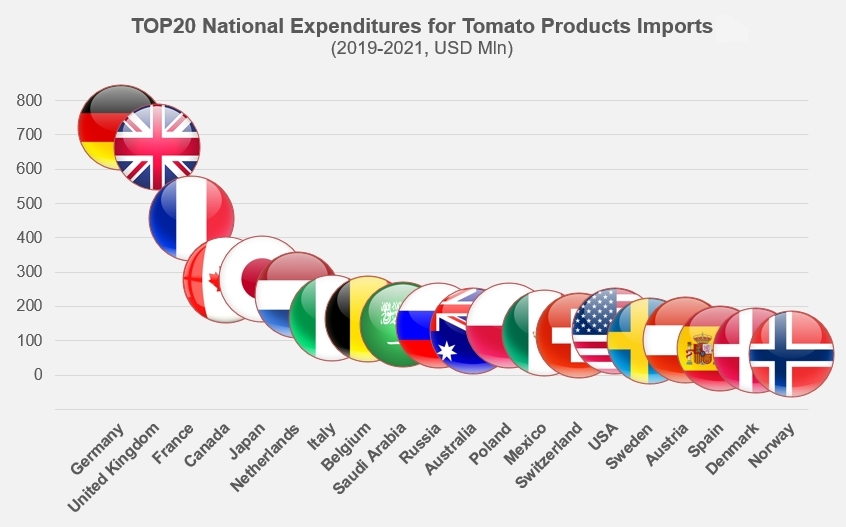

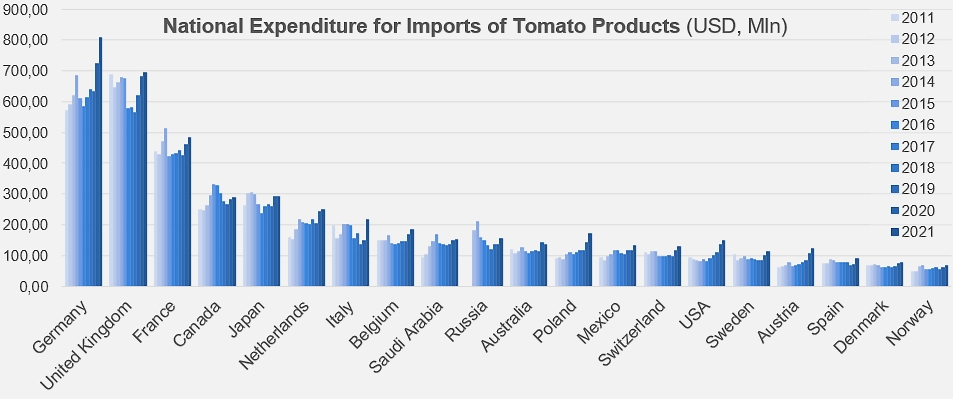

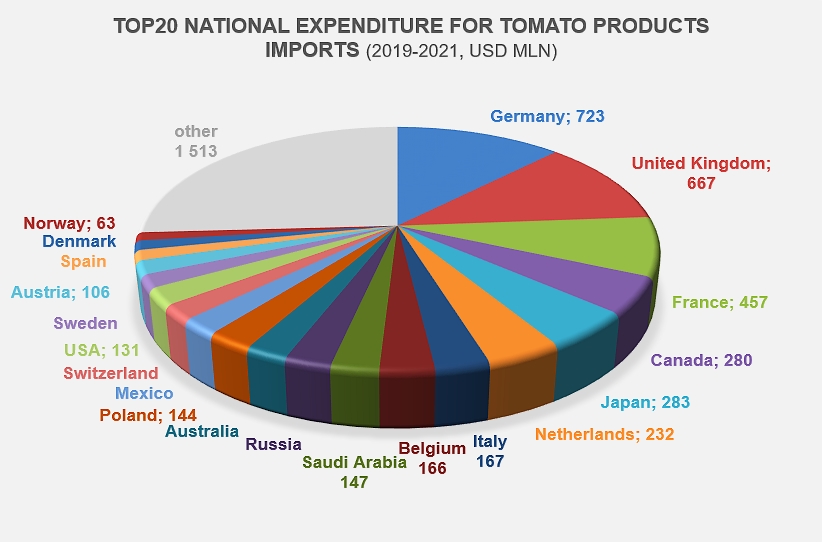

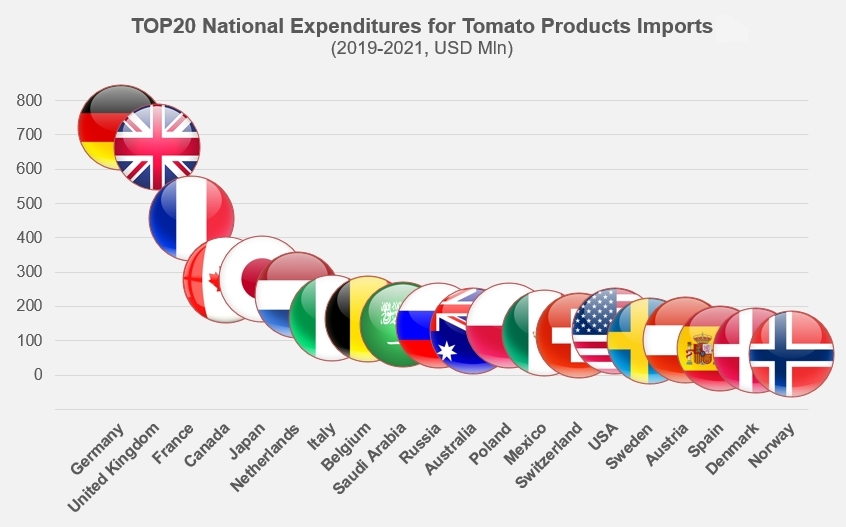

Over the three-year period under review, Germany confirmed its position as the world's largest import market (by value), a rank it has occupied for about six years. The value of German tomato products supplied in 2021 amounted to more than USD 808 million (about EUR 680 million), up 11% from 2020, up 21% from the previous three-year average (2018-2020), and up 28% from the three-year period prior to the Covid pandemic (see additional information at the end of this article). German spending over the past three years has accounted for just over 12% of the total value of recorded global imports.

After ranking in first position for a long time, the UK market is now firmly in second place among the world's importing countries, with an annual expenditure of around USD 700 million (GBP 503 million) last year, 2% higher than in 2020, but more importantly 11% higher than over the 2018-2020 period and 18% higher than during the pre-Covid period (2017-2019). Over the past three years, the average value of UK imports has been around 11% of the overall value recorded.

The position of the French import market for tomato products has not changed for more than a decade, clearly trailing behind the two leading importers (Germany and the United Kingdom) and far ahead of Canada and Japan, which have alternately occupied fourth and fifth position over the past decade. French imports of tomato products resulted in an expenditure of about USD 484 million (EUR 407 million) in 2021, accounting for slightly less than 8% of the overall expenditure recorded. French supplies cost 5% more in 2021 than in 2020, 9% more than in 2018-2020, and 12% more than the average of the three years preceding the Covid pandemic.

Over the past three years, Japanese and Canadian expenditures have been almost identical, at around USD 281 million, or about 4.8% of total listed spending. At nearly USD 294 million in 2021 (the same as in 2020), Japanese spending on tomato product supplies was 7% higher than over the 2018-2020 period and 12% higher than in the pre-Covid period. At USD 291 million last year, the increase in spending on Canadian imports was 3% higher than the amount paid in 2020, 5% higher than the 2018-2020 period average, and 3% higher than the pre-Covid period.

Dutch imports rank sixth in the world: with an annual expenditure of USD 250 million last year, the increase in import expenditure is still minimal compared to 2020, but marks a real break, as is the case for the UK and Germany, compared to the average annual expenditure of the previous three years (+13%) or the three years of the pre-Covid period (+20%).

Some additional data

A small number of countries (5) import more than USD 300 million worth of tomato products annually. 2021 saw a marked increase in the number of countries whose expenditure reached or exceeded the thresholds of USD 120 and 150 million.

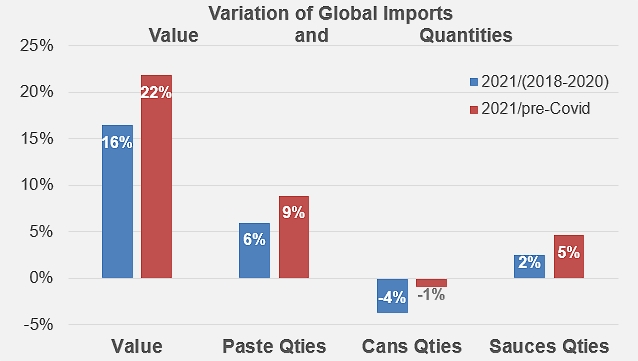

The increase in the value of imports was disconnected from that of quantities. While total quantities imported in 2021 mobilized increased volumes, at best 6% compared to 2018-2020 and 9% compared to the pre-Covid period in the case of pastes, the increase in the value of supplies amounted to 16% and 22% over the same periods.

Source: Trade Data Monitor