…but the underlying momentum remains solid

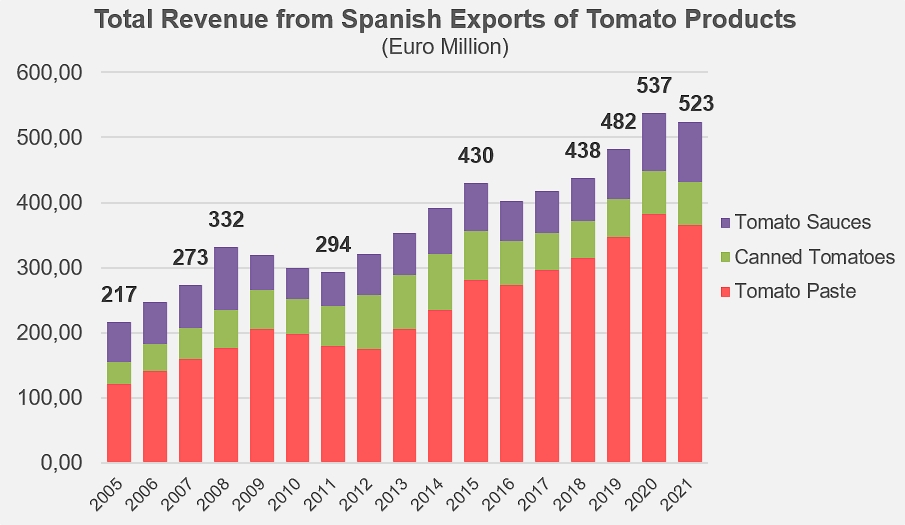

Like the downturn in the foreign trade of a number of European processing countries last year (see related articles below), the 2021 performance of the Spanish industry will not be among the country's best years.

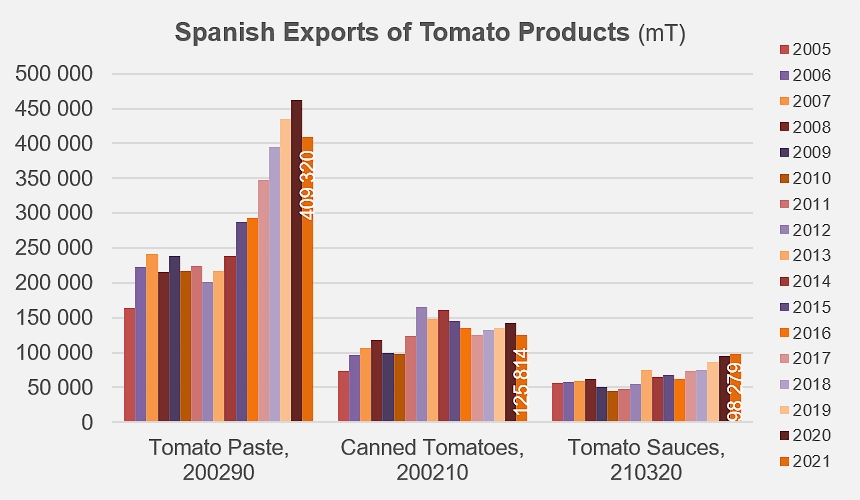

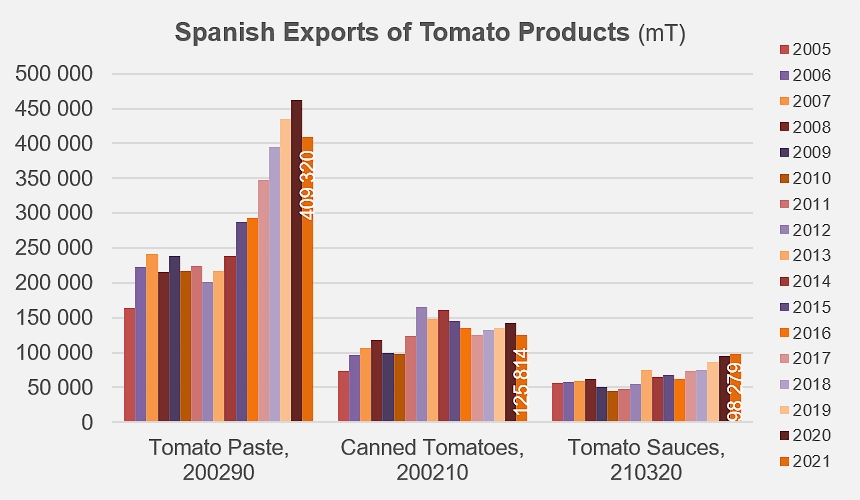

Penalized by a significant decrease in the quantities processed during the 2020 campaign (2.65 million mT, 17% less than in 2019 and 15% less than over the 2017-2019 period), Spanish exports of tomato products recorded decreases in the paste sector (-5%, -21,000 mT of finished products exported under codes 200290), and in the canned tomatoes sector (-8%, -11,000 mT of finished products, codes 200210). On the other hand, the sauces sector has improved the result of the previous year, with a significant increase (+15%, +13,000 mT of finished products, codes 210320).

However, in parallel with the decreases observed in relation to the very exceptional year of 2020, a comparison of 2021 results with those of the pre-Covid period (2017-2019) confirms a positive basic dynamic, highlighting a clear increase in the performance of the paste category (+17,000 mT, +4%) as well as sauces (+20,000 mT, +26%!), with only a slight slowdown for the canned tomato category (-5,000 mT, -4%).

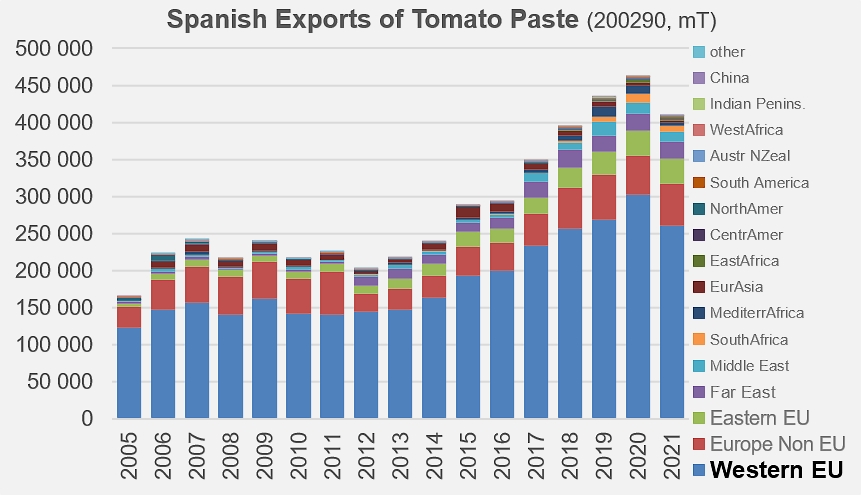

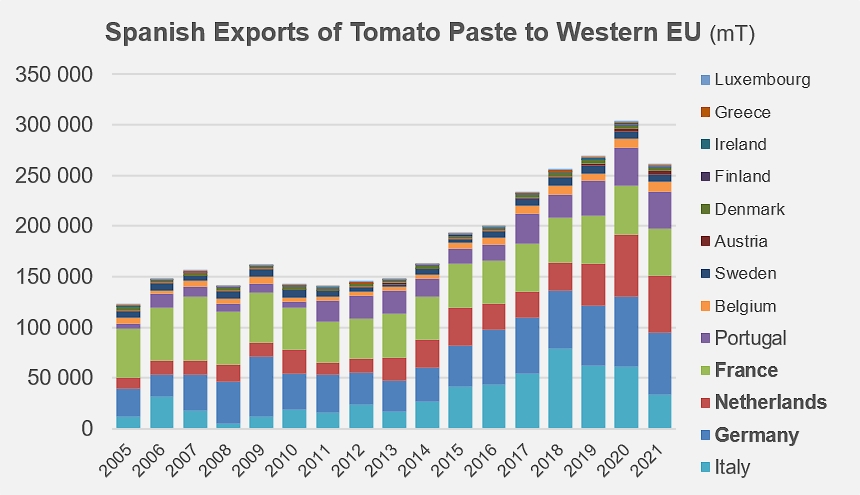

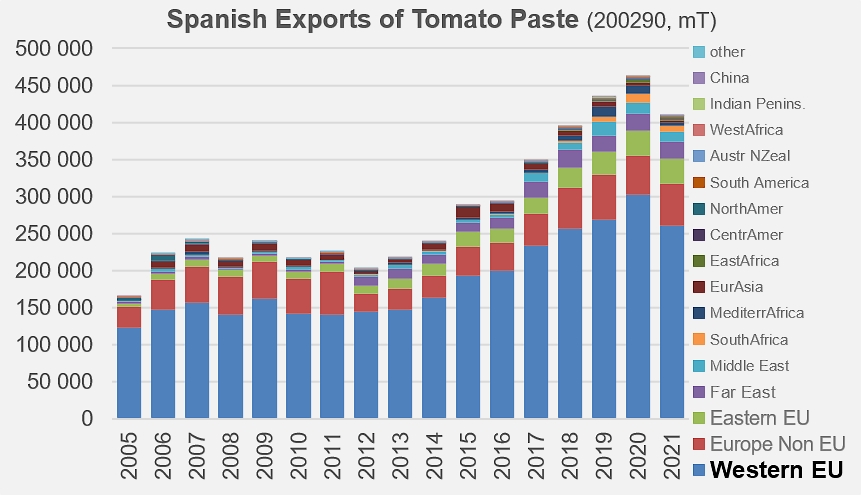

The paste category represents, in terms of volume and value, the main export item of the Spanish industry. In 2021, just over 409,000 mT of finished products were shipped to foreign markets. Within these quantities, European countries (Western and Eastern EU and non-EU) have accounted for a very high proportion of the buyers of Spanish products, with more than 350,000 mT of products in 2021 and 85% of the total activity on average over the last five years. The components of this category's decline in foreign sales are found mainly in these regions, and especially involve trade with Italy, whose purchases of Spanish pastes have literally plummeted in recent years, from over 78,000 mT in 2018 to less than 34,000 mT in 2021. Here again, the results of the 2020 processing season, rather mediocre in Spain while being among the best of the last ten years in Italy, explain a relative drop in Italian demand (also supplied by other competing countries) at the same time as a contraction in Spanish availability.

All the performances achieved with other major European destinations for Spanish products (Germany, Netherlands, France, Portugal, Belgium, but also Poland and the United Kingdom) are largely positive compared to the pre-Covid period, confirming the good performance of Spanish products in terms of competitiveness. Among the other regions that import Spanish pastes (Far East, Middle East, Southern and Mediterranean Africa, Eurasia, etc.), none recorded a significant drop in purchases last year.

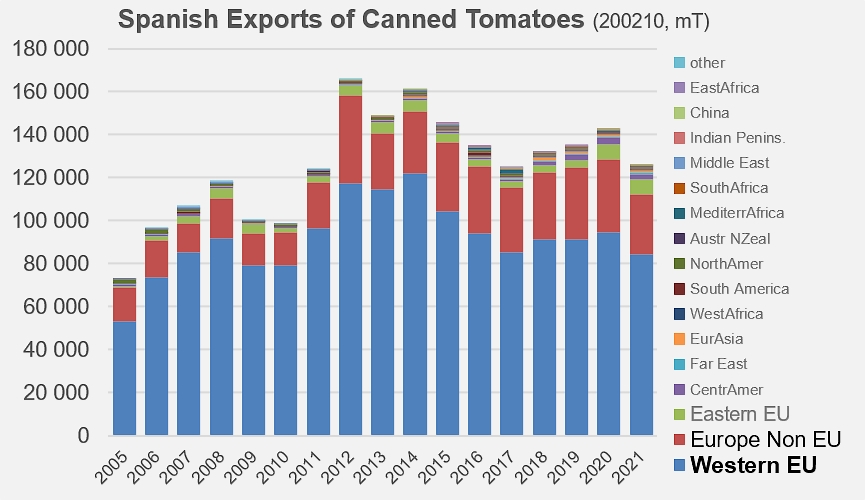

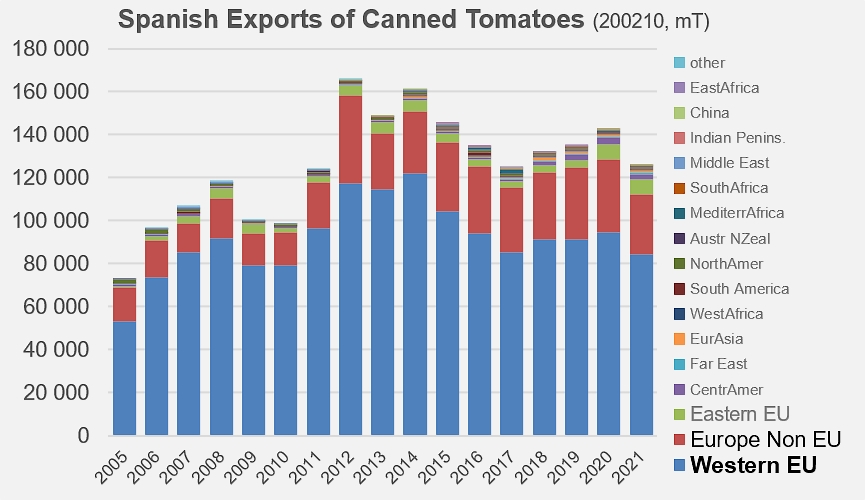

Permanently in competition with Italy, world leader in the category of canned tomatoes, Spain, which is the regular number 2 in this market, is struggling to maintain its level of foreign trade. The rapid development that led to export volumes peaking at 166,000 mT of finished products in 2012 has been followed by an almost steady erosion, with a result of less than 126,000 mT last year. The main markets for Spanish canned tomatoes are countries of Europe (EU27 and non-EU Europe), which account for most of the decline : compared to the pre-Covid period, exports in 2021 to the United Kingdom, Portugal, Germany and the Netherlands have fallen by between 14% and 18%, only partially offset by increases in the French, Belgian and Estonian markets.

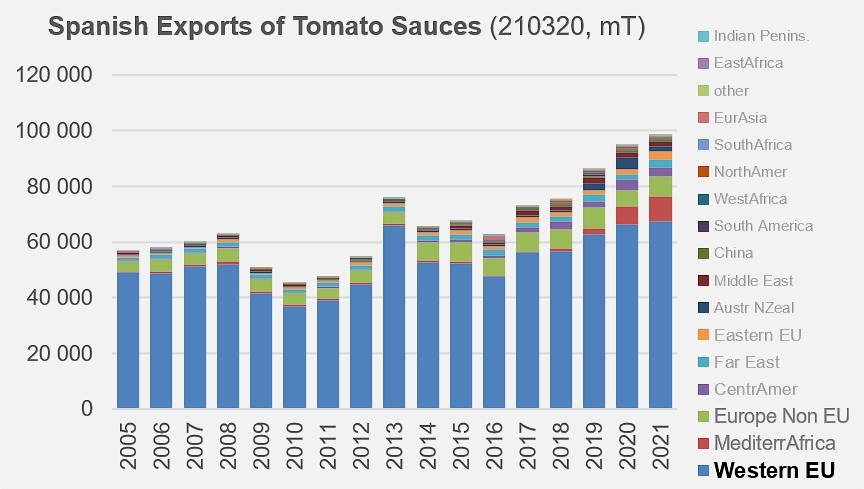

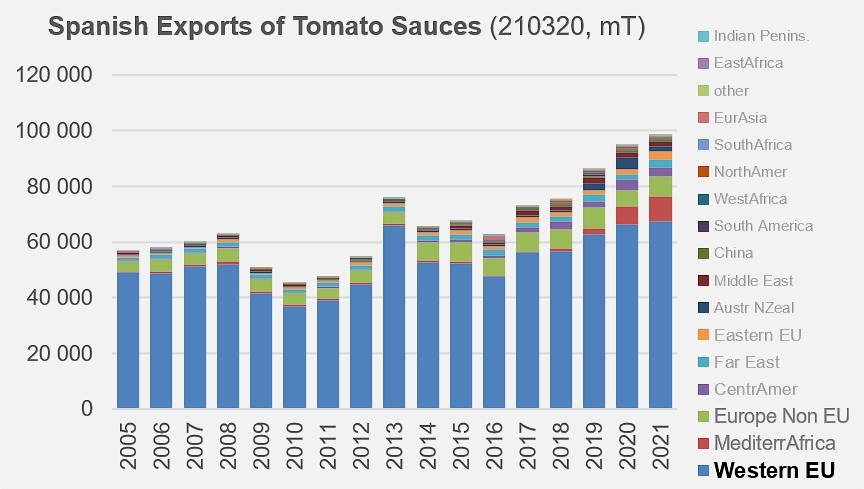

Contrary to the dynamics observed in the paste and canned tomatoes categories, the development of foreign sales of sauces and ketchup has remained virtually unchanged for a decade. Growth in this category brought the quantities exported to about 98,000 mT in 2021 with, once again, a strong representation of the European markets, in particular the French market and to a lesser extent the Dutch, German, British, and Moroccan ones.

2021 results for Spanish exports of sauces were in excess of 20,000 mT of finished products (+26%) higher than the average level of trade during the pre-Covid period.

So although the Spanish performance is slightly down (EUR -14 million, -3%) compared to the 2020 result due to a decrease in paste exports, its performance in 2021 (EUR 523 million) shows an increase that is notable not only compared to the previous three years (+8%) but is also and above all exceptional compared to the average annual result of the pre-Covid period (+77 million EUR, +17%). The value of paste exports last year amounted to around EUR 366 million, up 15% compared to the 2017-2019 period, against EUR 91 million generated by the sauces category (+32%) and 66 million by the canned tomatoes category (+14%).

Some complementary data

To simplify comparisons, trade with the United Kingdom has been considered under non-EU Europe for all the years presented (2005-2021). Detailed statistics are available on request from Tomato News.

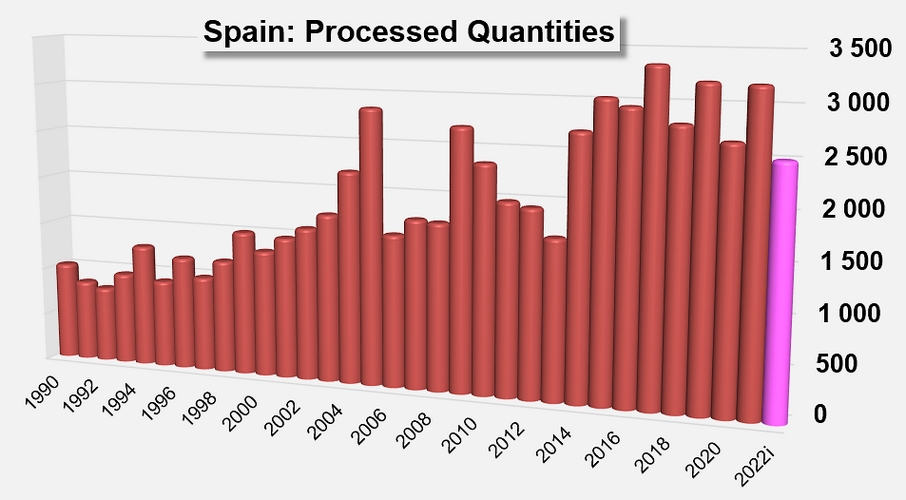

Quantities processed in Spain over the last thirty harvest seasons.

Spanish exports of tomato pastes (200290) to EU27 member countries.

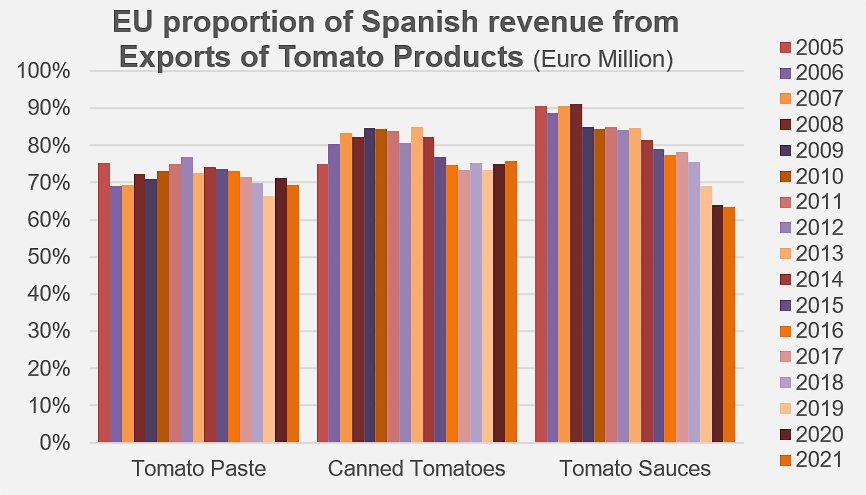

Having remained for a long time between 75% and 80%, the influence of EC buyers (EU27) on the revenue generated by Spanish exports of tomato products has tended to decrease, especially since 2012. It has been relatively stable for the pastes and canned tomatoes categories, but the fraction attributable to imports of sauces from EU27 countries has decreased sharply since 2005, as British imports have increased.

In 2021, exports of tomato products to EU countries generated around 69% of the Spanish income from this sector.

Sources: TDM