According to a recent report relayed by The Guardian, two firms control 40% of global commercial seed market, compared with ten companies twenty five years ago.

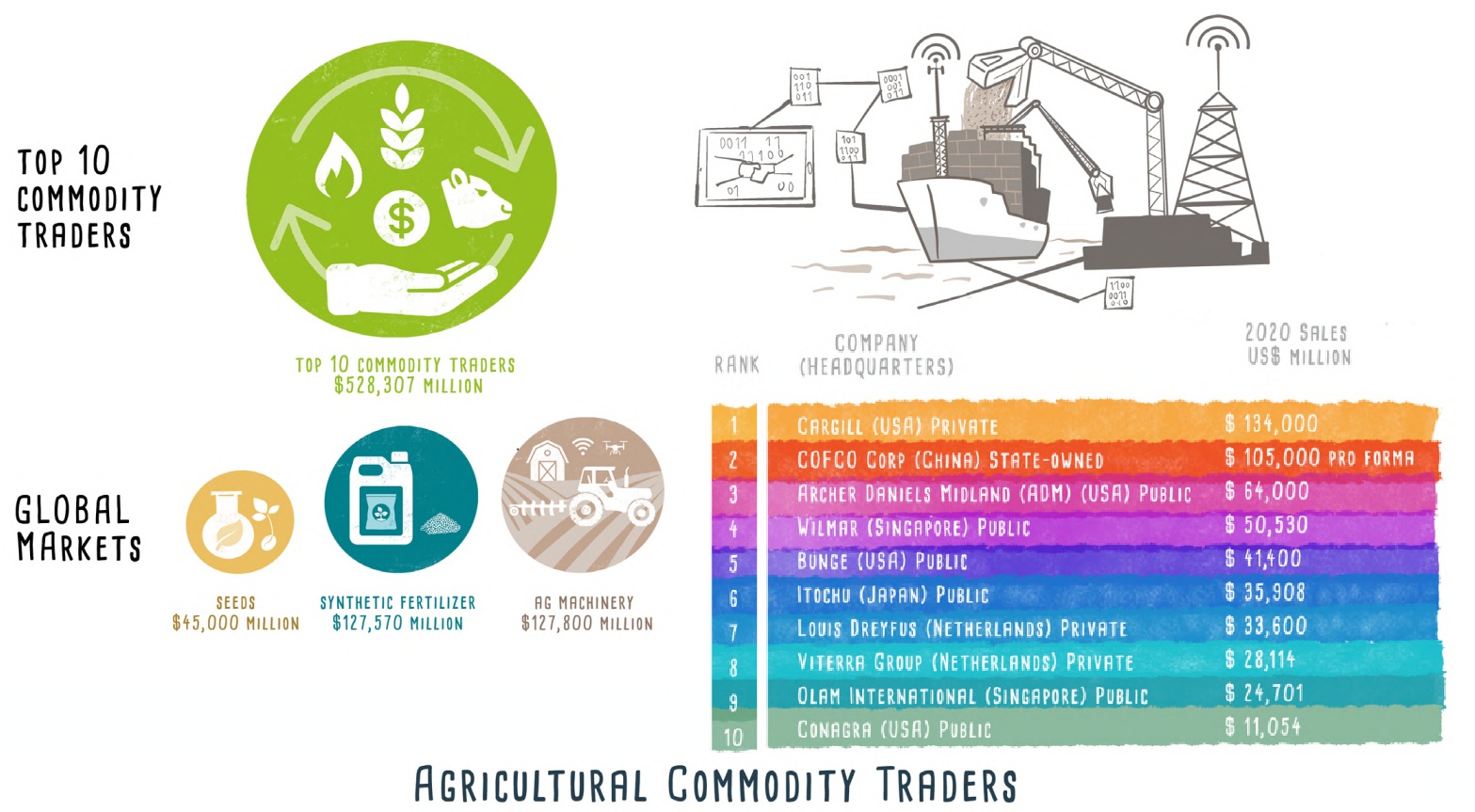

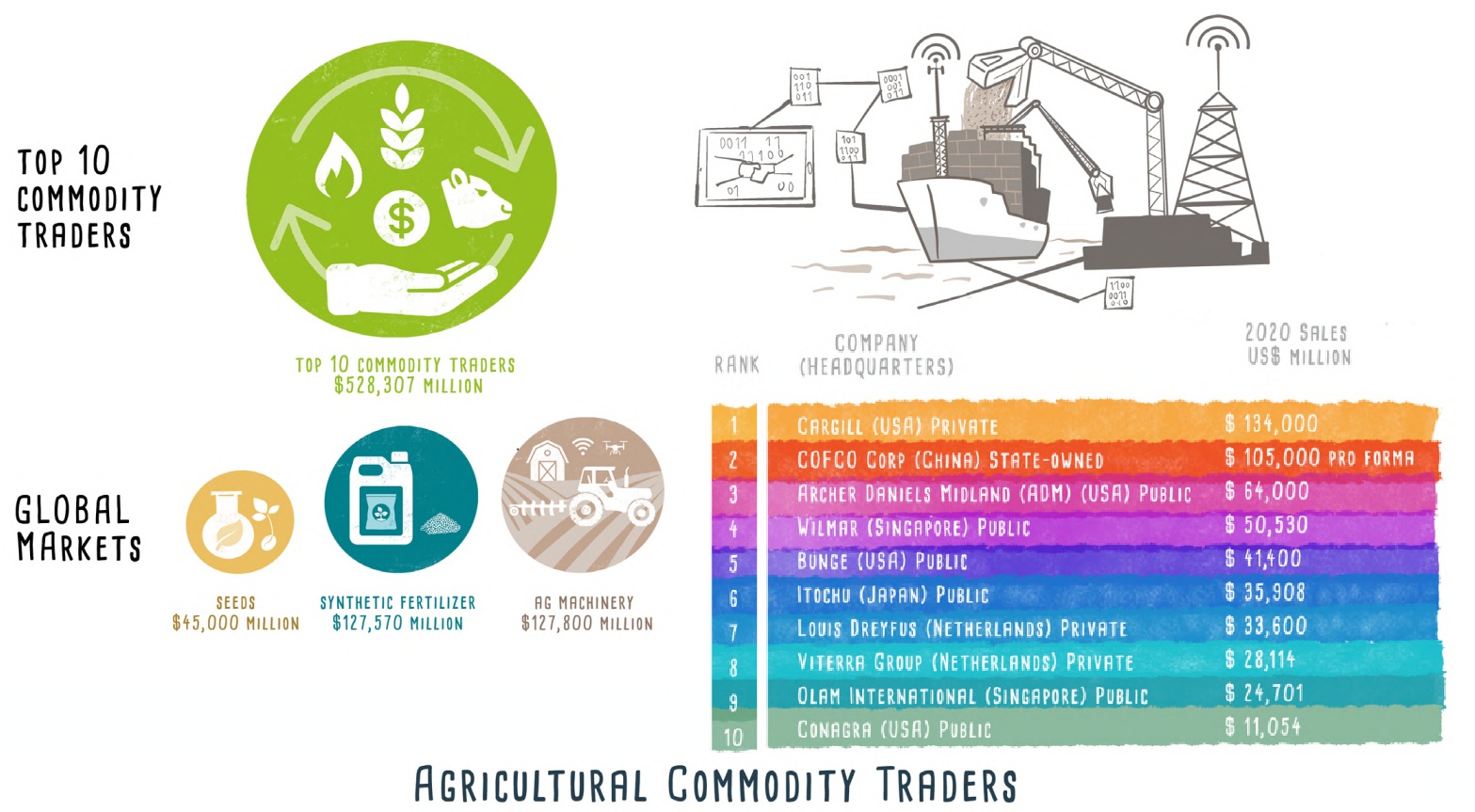

The dominance of a small number of big companies over the global food chain is increasing, aided by the rising use of “big data” and artificial intelligence, new research has found. Only two companies control 40% of the global commercial seed market, compared with ten companies controlling the same proportion of the market twenty five years ago, according to the ETC Group, an eco-justice organization. Agricultural commodity trading is similarly concentrated, with ten commodity traders in 2020 dominating a market worth half a trillion dollars.

Food prices have risen sharply in recent months, after the disruptions caused by the Ukraine war, and the continuing impacts of the Covid pandemic, sending the profits of key commodity traders and grain producers soaring.

Chinese companies are also coming to the fore, according to the ETC Group’s latest 141-page report published in late September. The Chinese state-owned company Cofco is now the world’s second-biggest agricultural commodity trader, behind only Cargill of the US, with sales in 2020 of just over USD 100 billion (about Euro 100 billion), compared with USD 134 billion for Cargill.

The next biggest trader, Archer-Daniels-Midland, had sales of USD 64 billion in 2020, according to the latest data on which the report is based.

Syngenta, the seed, pesticides and biotech company, is now majority owned by the Chinese government through Sinochem and ChemChina. The group controlled about a quarter of the global market in agricultural chemicals in 2020, with USD 15 billion in sales, far greater than its nearest rivals Bayer and BASF.

Two of the other Top 10 agrochemicals companies are also Chinese, as is the seventh big synthetic fertiliser company, Sinofert.

ETC also pointed to increasing interest from the Middle East. The report found: “In 2020, the sale of 45% of one of the world’s largest commodity firms, Louis Dreyfus, to a state-owned holding company in the oil-rich United Arab Emirates signals that cash-rich countries are positioning to climate-proof food security via offshore food production with little consideration for sustainability or the notion of regional food self-reliance.”

Jim Thomas, of ETC Group, said the increasing market dominance of a small number of companies was concerning, particularly at a time of high and rising food prices, a gathering climate crisis and biodiversity crisis. “Power over the global food system is being concentrated in a very small number of hands, and we should be concerned about that,” he said.

He added that increasing digitization was also working to consolidate that power further, by making it possible for companies to avoid transparency, automate transactions and influence consumer demand. He also warned that agricultural workers were in danger of being thrown off the land as robotic technology began to be used in an increasing number of countries. “We uncovered a vast digital restructuring of the commercial food system, including AI, robots, drones, blockchains,” he said. “Concerns include manipulating customers, taking decision-making away from farmers, replacing and algorithmically controlling food chain workers, and the climate costs of the data use.”

Food companies argue that their use of such technology makes for far greater efficiency, enabling them to use less of valuable resources such as water, fertilizer and pesticides, and streamlining operations to reduce costs for consumers.

Some complementary data

For Agro-Chemicals & Seeds Full Report, click here;

For Agro-Chemicals & Seed Summary Report, click here.

For Food & Beverage Processing Full Report, click here;

For Food & Beverage Processing Summary Report, click here;

Sources: etcgroup.org, theguardian.com