The covid effect seems to be lasting into 2021

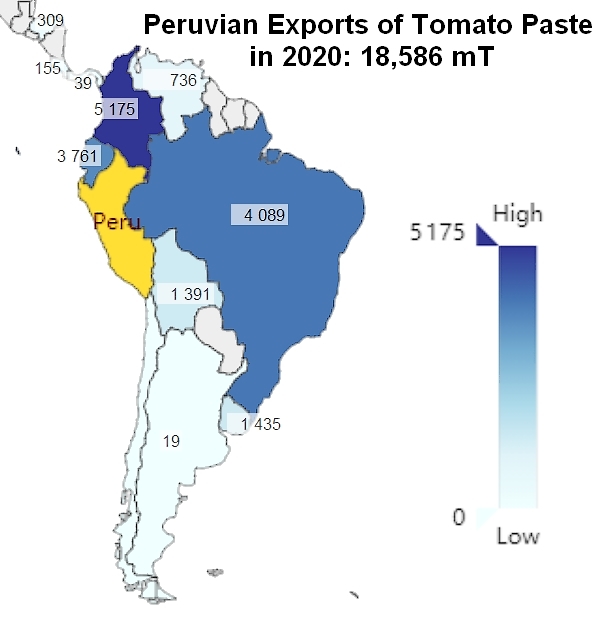

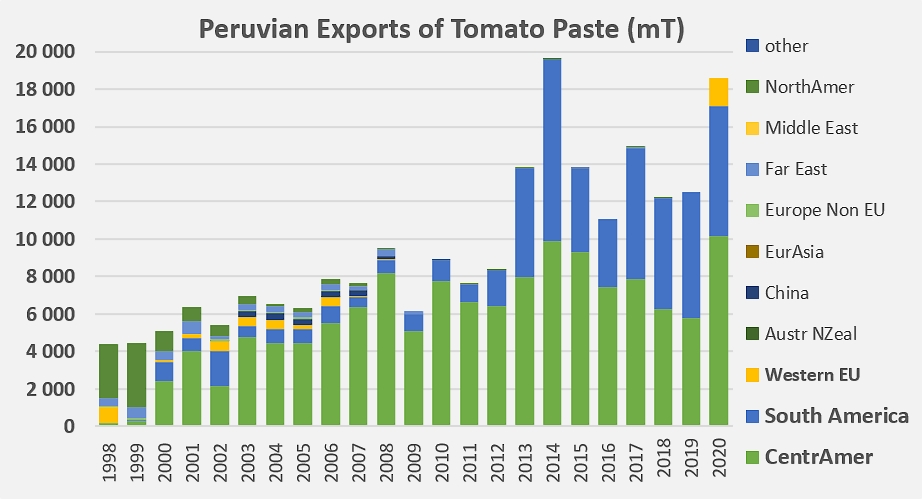

With slightly more than 18,500 mT of finished products exported in 2020, Peru occupied 11th place last year in the worldwide ranking of countries that export tomato paste, behind Greece (36,500 mT) and the Netherlands (33,900 mT).

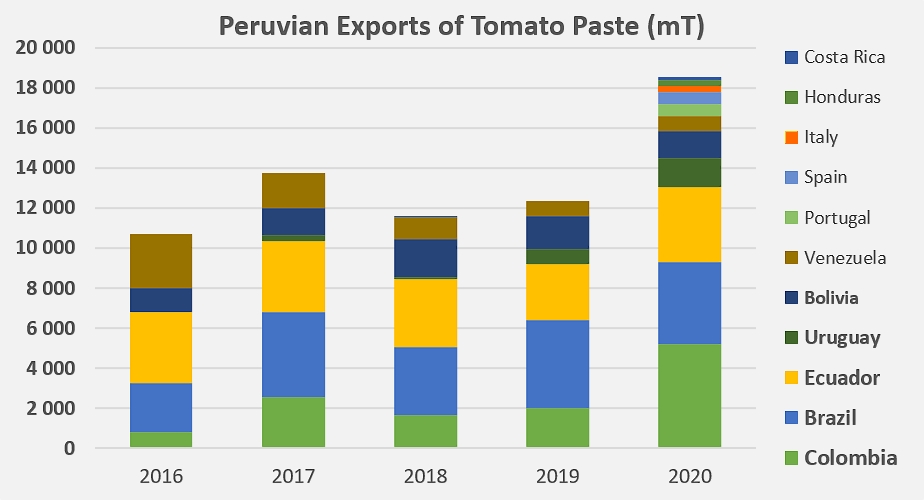

The quantities absorbed grew by 48% compared to 2019 results (12,500 mT) and by 41% compared to the average performance of the three previous years (13,200 mT, over the period running 2017-2019).

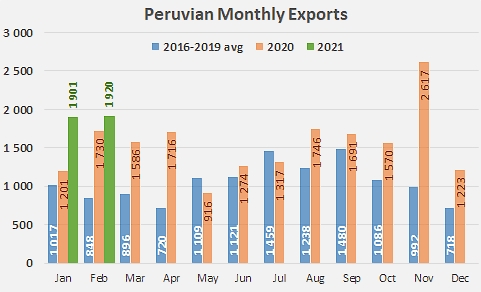

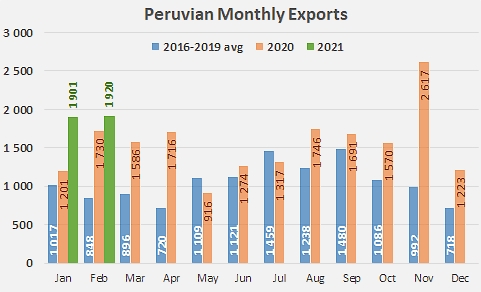

Independently from the counter-seasonal production/processing pattern each year, the acceleration of demand was recorded – like in all the relevant countries of the northern hemisphere – between February and April, then again between August and December 2020, which seems to confirm the hypothesis of a link with the CoVid pandemic. Early results for 2021 furthermore indicate that the high level of demand and foreign business has kept up, and even increased over this past January and February.

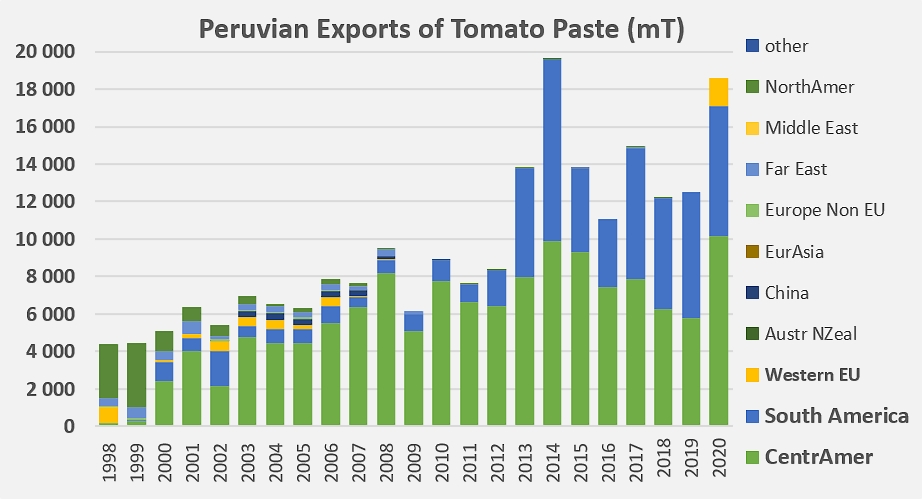

Almost all (more than 92%) of the quantities exported are shipped to nearby countries in Central America and South America. Among the main buyers of Peruvian products, just the six nations of Columbia, Brazil, Ecuador, Uruguay, Bolivia, and Venezuela absorbed close on 90% of the volumes of paste exported last year by the country’s tomato industry. In fact, all this export activity was recorded by the Icatom company, the only processing operator that makes tomato paste in Peru.

The increase in exported quantities, of some 5,300 tonnes approximately between 2019 and 2020, was mainly driven by an increase in Colombian and Uruguayan purchases, and to a lesser extent by those from Ecuador. “New” trade flows were also recorded to countries of the EU (Spain, Portugal, Italy) during spring and fall last year, totaling slightly less than 1,500 tonnes.

Overall, the value of Peru’s exports of tomato paste amounted in 2020 to approximately USD 16.3 million.

A previous spectacular increase in paste exports already occurred in 2014. Almost the same group of trading partners (Ecuador, Colombia, Brazil, Bolivia, Argentina, etc.) had at the time driven an increase of 5,800 tonnes, for a total of 19,600 mT exported between January and December.

Some additional data:

Peruvian exports of tomato paste over time

Sources: Trade Data Monitor, GTIS