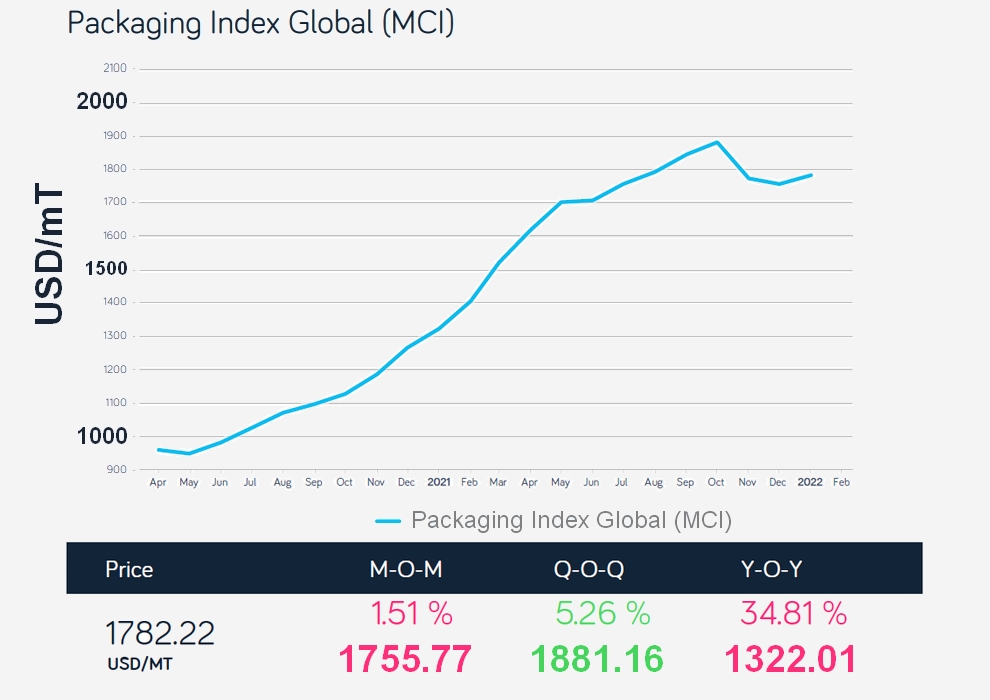

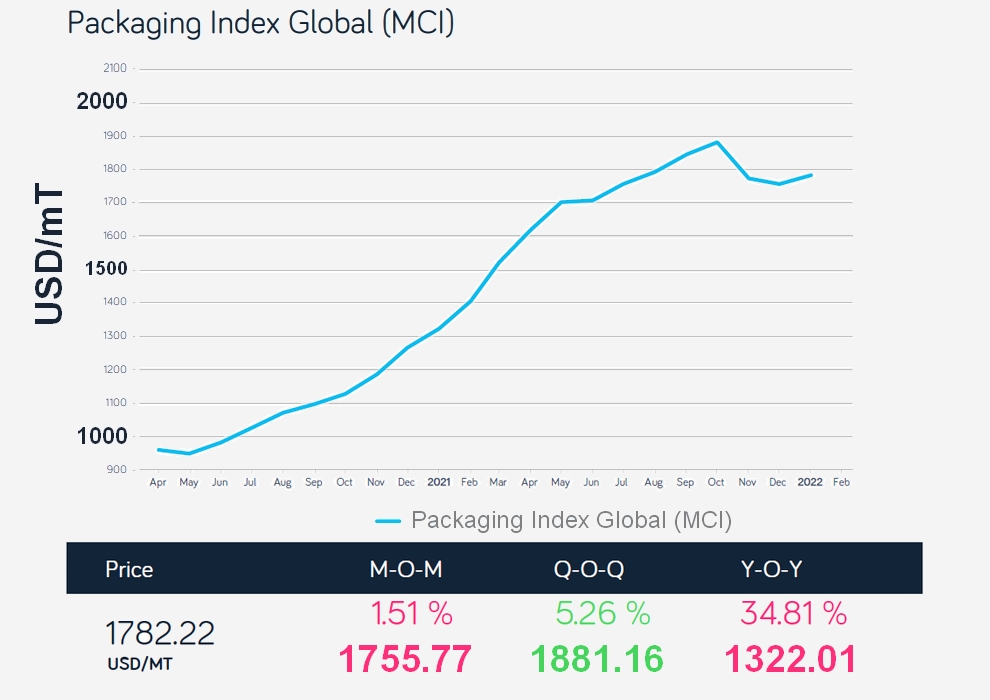

Mintec Global Packaging Index rose by 2.6% in January.

The Global Packaging Mintec Category Index (MCI) rose by 2.6% month-on-month (m-o-m) and 36% year-on-year (y-o-y) to USD 1,801/mT in January. Soaring aluminium and EU paper prices mainly drove this increase. Steel prices in the US and EU continued to decline in January 2022 due to limited spot market activity and downstream demand.

Metals Market

Steel prices in the US and EU continued to decline in January 2022 due to limited spot market activity and downstream demand. However, the aluminium LME 3-month price increased on the back of output curtailments amid high energy prices, fuelling concerns about potential shortages.

The US steel hot-rolled coil (HRC) price on the CME decreased by 16.2% m-o-m in January but was up by 5.4% y-o-y to a monthly average price of USD 1,150/mT. The US HRC prices continued to decline as lower-priced offers were reported, and the spot market activity remained limited.

Lead times continue to decline and are currently at 3-4 weeks. Additionally, escalation of the Russia-Ukraine political conflict could have a ripple effect on the US steel industry. US steelmakers rely on Russian and Ukrainian pig iron and steel slabs shipments, used to produce raw steel and for rollers to make flat-rolled products. The escalation of this conflict could disrupt trade and lead to supply shortages of steelmaking raw materials in the US. In January, the Northern Europe steel HRC price decreased by 3.6% m-o-m and increased by 35.7% y-o-y, to EUR 936/mT, due to a slowdown in demand. The automotive industry continued to struggle with global semiconductor shortages that curtailed car production substantially in 2021. Two factors will likely determine 2022 steel supply and demand: material uptake by the automotive industry and the outcome of trade barriers, such as import quotas and anti-dumping duties on steel imports into the EU. Also, a significant escalation of the Russia-Ukraine political tensions could impact both the fundamentals and sentiment for the EU steel market.

The LME aluminium (3-month) price increased in January by 10.5% m-o-m and by 49.7% y-o-y, to a monthly average price of USD 2,991/mT, as surging energy prices have raised concerns of higher production costs and aluminium smelter shutdowns. The gas price surge has inflated Europe's power costs and caused some aluminium production curtailments in Europe. The high-power costs are expected to fuel further rises in aluminium prices in the short term.

Plastics Market

In January 2022, the trend in the EU plastics market reversed, compared to the previous month, with a marginal decrease in the prices of most plastics. However, US plastics prices maintained a downward trend, with a sustained decrease in prices of most plastics due to ample supply.

EU HDPE and LDPE prices fell by 0.7% m-o-m, to EUR 1,856/mT and EUR 2,293/mT, respectively. Similarly, the EU PP price fell by 0.6% m-o-m but remained up by 50.9% y-o-y, at EUR 1,868/mT.

The marginal decline in prices in the EU PE and PP markets is attributable to a slight improvement in supply conditions and increased import availability. According to market participants, despite maintenance shutdowns, EU PE and PE supplies were sufficient in January, as producers had built a reserve inventory ahead of planned turnarounds. In addition, buyers had reportedly purchased high quantities in the past months, to curtail further logistics disruptions. The majority of EU plastics prices declined marginally except PET, which continued a six-month upward price trend in January. Due to continued strong demand for PET by the consumer goods industry as a sustainable plastic alternative, EU PET prices rose by 2.5% m-o-m and by 89.7% y-o-y, to EUR 1,637/mT.

US plastics prices continued on a downward trend in January, on the back of improved supply conditions, with market sources reporting an oversupply of the US PE polymers, in particular.

Accordingly, HDPE and LDPE prices fell by 13.9% and 14.1% to USD 2,111/mT and USD 2,579/ mT, respectively. The US PP market followed the trend in the US PE market, falling to a seven month low at USD 2,772/mT (down by 15% m-o-m but up by 30.3% y-o-y). Despite ample supply, logistical disruptions continued to pose a challenge for US PE and PP producers and sellers in January. However, US PET prices remained stable month-on-month amid a boost in supply and robust demand.

Paper Market

The European paper packaging market prices continued on an upward trend for most of the grades in January 2022 on the back of solid demand, limited availability and rising production costs (energy prices, freight).

The January price of GD2 increased by 7.6% m-o-m and by 56.4% y-o-y, to EUR 1,415/mT, driven by strong demand (from the e-commerce and food industries), high production costs (for energy, fibre, and transport), and tight supply in the market (raw material availability). Since the production stoppages caused by the insolvency of one main manufacturer in Germany, the cartonboard market in Europe has become very limited. The January price of EU GC2 also increased by 7.7% m-o-m and by 30.4% y-o-y, to EUR 1,825/mT. Several European cartonboard producers have announced further price increases in March and April 2022.

Sources: Mintec