Press release

, François-Xavier Branthôme

-

Unexpected rebound in global automotive industry causes shortage

For several months, players in the metal packaging manufacturing industry, including manufacturers of steel drums for tomato paste, have been worried about the sharp rise in the prices of flat steels used by their industry.

In November, the European Association of Steel Drum Manufacturers (SEFA) drew the attention to the situation on the European flat steel market, which was likely to affect its industry and consequently our tomato processing industry as well in the coming months.

In November, the European Association of Steel Drum Manufacturers (SEFA) drew the attention to the situation on the European flat steel market, which was likely to affect its industry and consequently our tomato processing industry as well in the coming months.At this time, there were increasing reports of long delivery and lead times at steel mills and delays in the delivery of steel quantities already ordered. For example, the situation was discussed in a contribution by steel market analyst Andreas Schneider: “Steel processors rub their eyes in amazement: while the demand for steel in Germany this year falls to its lowest level in eleven years, steel procurement in the market segment for flat products is currently a challenging task“. Hot-dip galvanized sheet, but also hot-rolled wide strip and cold-rolled sheet are the most affected. Several local steelmakers are completely booked up until March 2021, reports the renowned company MEPS2.

The reasons for the current situation could be summarized as follows:

The demand in some segments of the steel market, in particular the automotive industry, recovered since the summer faster than many had expected. In addition, many companies were replenishing previously reduced material stocks. By contrast, blast furnace-based steel production, which is relevant for flat steel, was only very slowly getting back on track. MEPS reported that volumes were being diverted from other applications to the automotive industry. In view of the fact that only a very low percentage of the world steel production goes into the packaging industry, it was to be feared that shifts would also affect the production of steel drums.

The demand in some segments of the steel market, in particular the automotive industry, recovered since the summer faster than many had expected. In addition, many companies were replenishing previously reduced material stocks. By contrast, blast furnace-based steel production, which is relevant for flat steel, was only very slowly getting back on track. MEPS reported that volumes were being diverted from other applications to the automotive industry. In view of the fact that only a very low percentage of the world steel production goes into the packaging industry, it was to be feared that shifts would also affect the production of steel drums. Driven by the strong Chinese market, steel prices in Asia were significantly higher than in Europe for much of the year. Together with the import restrictive measures imposed by the EU, this led to a significant drop in the volume of imports from third countries this year.

Driven by the strong Chinese market, steel prices in Asia were significantly higher than in Europe for much of the year. Together with the import restrictive measures imposed by the EU, this led to a significant drop in the volume of imports from third countries this year. This development was supported by high raw material prices. In particular, iron ore prices reached their highest level in six years.

This development was supported by high raw material prices. In particular, iron ore prices reached their highest level in six years.

Due to the tight supply situation and the significant increase in spot market prices in recent months, a risk of a noticeable rise in contract prices for flat steel products in 2021 appeared to be emerging. Specialist services were already reporting price announcements by manufacturers. Given the currently increasing corona-related restrictions that might dampen demand again, it remained to be seen to what extent this apparent price risk will materialize in individual negotiations.

In its recent update (22 January 2021), SEFA said that unfortunately, its concern expressed in November about the threat of supply shortages in the flat steel market has come true. The tightness has become even more prevalent in recent weeks. Steel processors in every segment of the market are very concerned over the availability of steel supplies from mills and service centers. Manufacturers of steel drums are not isolated from this unexpected and unique situation.

In its recent update (22 January 2021), SEFA said that unfortunately, its concern expressed in November about the threat of supply shortages in the flat steel market has come true. The tightness has become even more prevalent in recent weeks. Steel processors in every segment of the market are very concerned over the availability of steel supplies from mills and service centers. Manufacturers of steel drums are not isolated from this unexpected and unique situation.“There are a number of suppliers who are unable to deliver the requested quantities”, German steel market analyst Andreas Schneider confirms. “Not only is the procurement of additional quantities extremely challenging. There are also delays and under-allocations in the case of framework contracts that have already been concluded. Further on, companies are complaining on volumes that are re-directed to the automotive segment of the market.”

In recent weeks, a number of market participants have voiced their concerns. Leading daily newspapers have reported on the topic. "Processors in all segments are very concerned about their ability to deliver in the coming months because the steel required is so scarce", according to German steel processing association WSM.

The supply tightness facing the EU steel market was initially a result of coronavirus pandemic-induced steel production cuts, followed by unexpected automotive demand that mills have struggled to accommodate.

However, the current problems are not only emerging in the EU but worldwide. In many countries, demand recovery was faster than expected and supply is lagging behind. Low raw material stocks at steel producers and low steel inventories at steel traders and processors have contributed to the current situation as well.

Raw material prices, which were already high, almost exploded in December 2020. Iron ore and scrap prices have reached their highest level since 2011 now. This fueled an already hot steel market.

Consequently, the flat steel market faces very significant price increases. Steel prices have not only surpassed the pre-corona levels but have reached long-term or even historic highs. This applies worldwide. On the spot market in Europe, prices for products such as hot-dip galvanized sheet, hot-rolled wide strip and cold-rolled sheet have been pushed to 13-year highs. Contract prices for flat steel products in 2021 have also risen significantly, according to Andreas Schneider.

Steel supply is expected to remain an issue for the coming months so this is not a short term problem.

Producers of steel products currently have to source steel wherever possible in order to meet critical requirements. Even for pure contract customers with guaranteed quantities, the market is experiencing unprecedented price increases for steel. The situation is even more challenging on the spot market, where premiums are requested above those prices indicated in the trade indices.

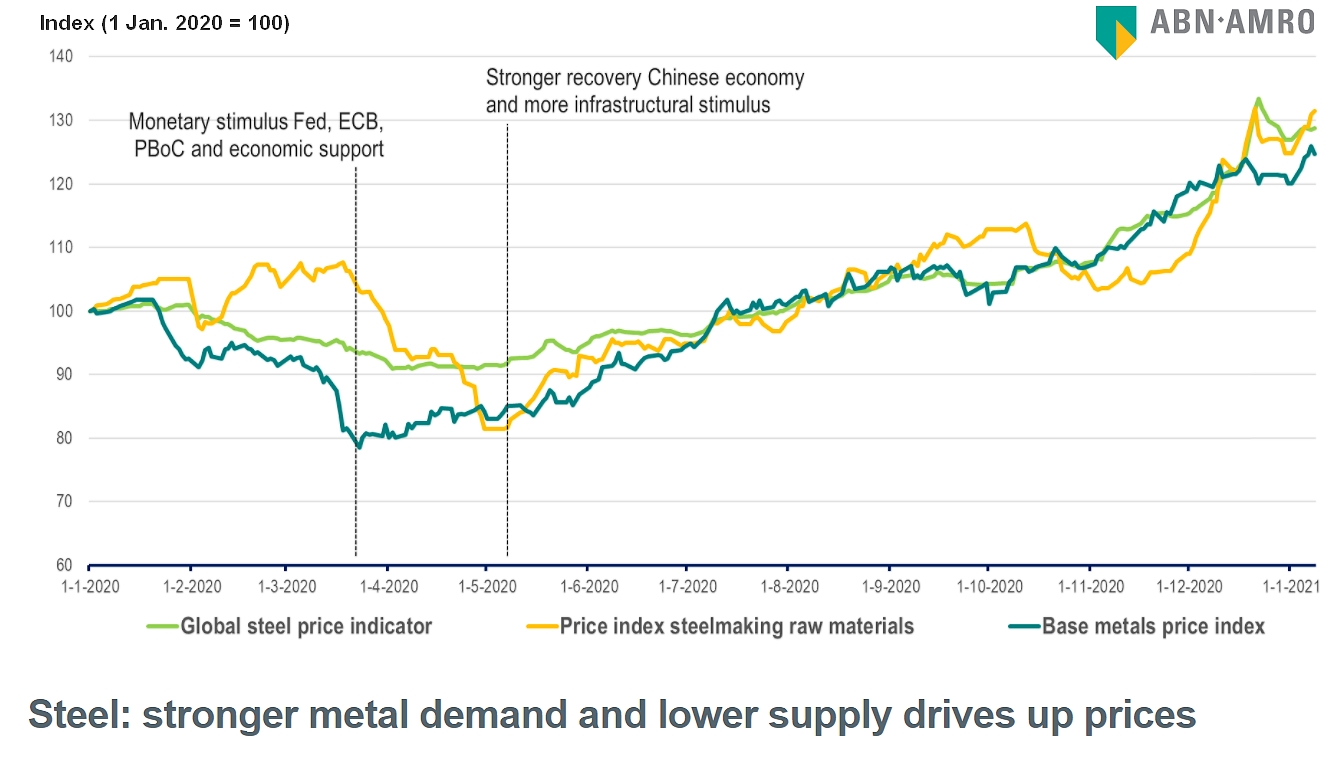

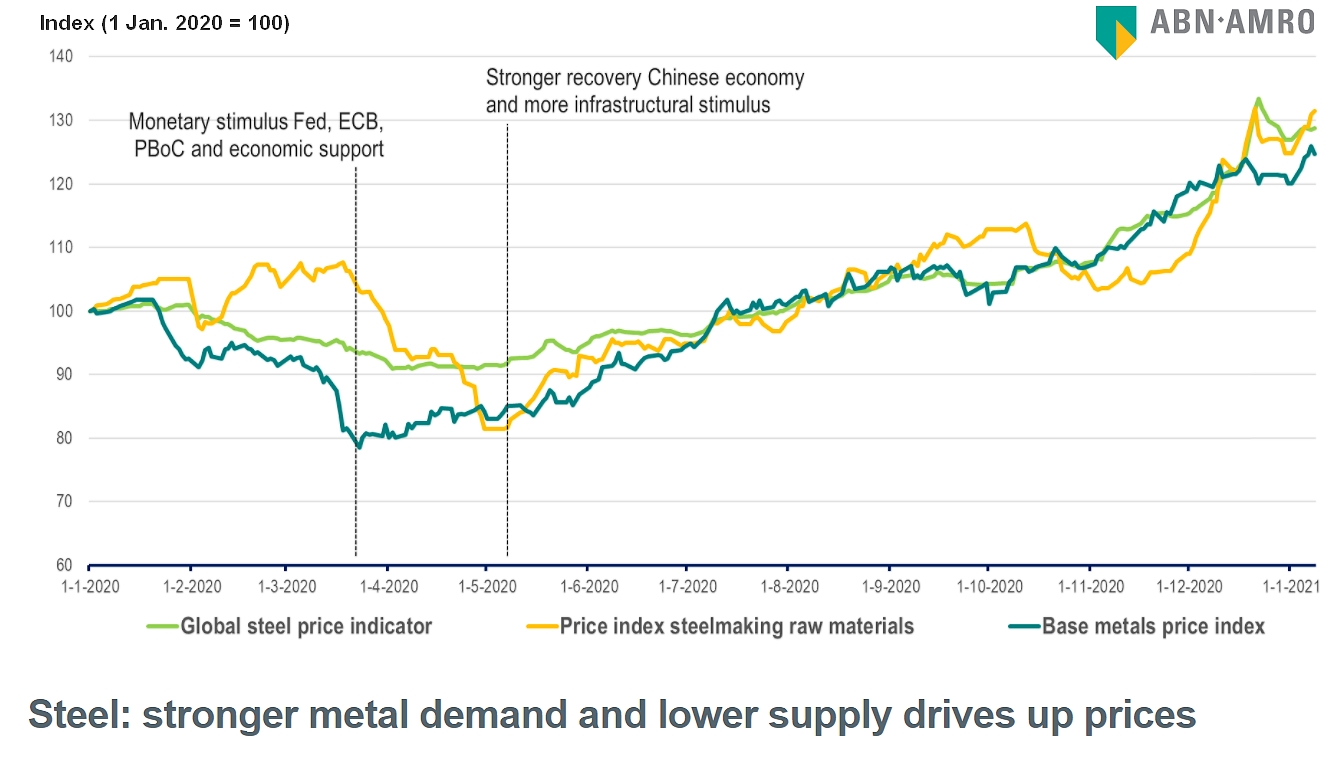

According to a recent analysis report issued in January by the Dutch bank ABN-AMRO, “the corona crisis had a major impact on the metal sector in 2020. Demand for industrial metals weakened abruptly, while a supply response only started late. This resulted in higher inventories. Fortunately, this did not turn into a millstone for the sector. After all, the resilience of the industrial activity proved to be high. Today, we see that the global recovery is becoming more and more widely supported. The economic recovery is gaining strength, demand for metals is increasing and sentiment about industrial metal markets is optimistic. Under these circumstances, metals prices will continue to rise in 2021.

Demand for steel-intensive consumer goods, such as cars and white goods, is currently strong in several markets. Market sentiment is positive and activity is improving at a better-than-expected rate. In particular, car sales in China sharply increased in the last five months of 2020. Demand recovery in Europe and the US is somewhat slower but on its way up.

Many steel end users are increasing restocking efforts. As a result, supply is struggling to keep up with the rapid recovery in demand, resulting in price increases. The increased costs of making steel - mainly due to the higher prices of iron ore and scrap – are also contributing to higher steel prices. This year, steel prices will remain relatively high”.

Some complementary data:

Some complementary data:In order to keep you informed of the evolution of the flat steel markets, Tomato News will set up in the coming weeks a follow-up of the essential indicators of this sector, in a graphical form similar to those already presented for the prices of tomato derivatives or for trade statistics. This new section will be announced in a future article.

Sources: sefa.be, insights.abnamro.nl, metalbulletin.com

In November, the European Association of Steel Drum Manufacturers (SEFA) drew the attention to the situation on the European flat steel market, which was likely to affect its industry and consequently our tomato processing industry as well in the coming months.

In November, the European Association of Steel Drum Manufacturers (SEFA) drew the attention to the situation on the European flat steel market, which was likely to affect its industry and consequently our tomato processing industry as well in the coming months.

In its recent update (22 January 2021), SEFA said that unfortunately, its concern expressed in November about the threat of supply shortages in the flat steel market has come true. The tightness has become even more prevalent in recent weeks. Steel processors in every segment of the market are very concerned over the availability of steel supplies from mills and service centers. Manufacturers of steel drums are not isolated from this unexpected and unique situation.

In its recent update (22 January 2021), SEFA said that unfortunately, its concern expressed in November about the threat of supply shortages in the flat steel market has come true. The tightness has become even more prevalent in recent weeks. Steel processors in every segment of the market are very concerned over the availability of steel supplies from mills and service centers. Manufacturers of steel drums are not isolated from this unexpected and unique situation.

Some complementary data:

Some complementary data: