…and shrink farm profits

A European Union policy goal to increase organic farming to 30 percent of all agricultural production by 2030 — a significant expansion compared to where the EU is today — is expected to also be considered by California Gov. Gavin Newsom for next year’s budget. However, a new economic analysis says such a plan would dramatically increase the price of food for many consumers and jeopardize the solvency of organic farms.

The study, titled Economic Considerations for Conceptual Organic Policy Targets, was done Californians for Smart Pesticide Policy, a coalition of farmers and businesses the rely on farmers, focused on educating policymakers on the benefits of modern scientific agricultural tools. It was undertaken on behalf of the California Bountiful Foundation, the 501(c)(3) science and research arm of the California Farm Bureau.

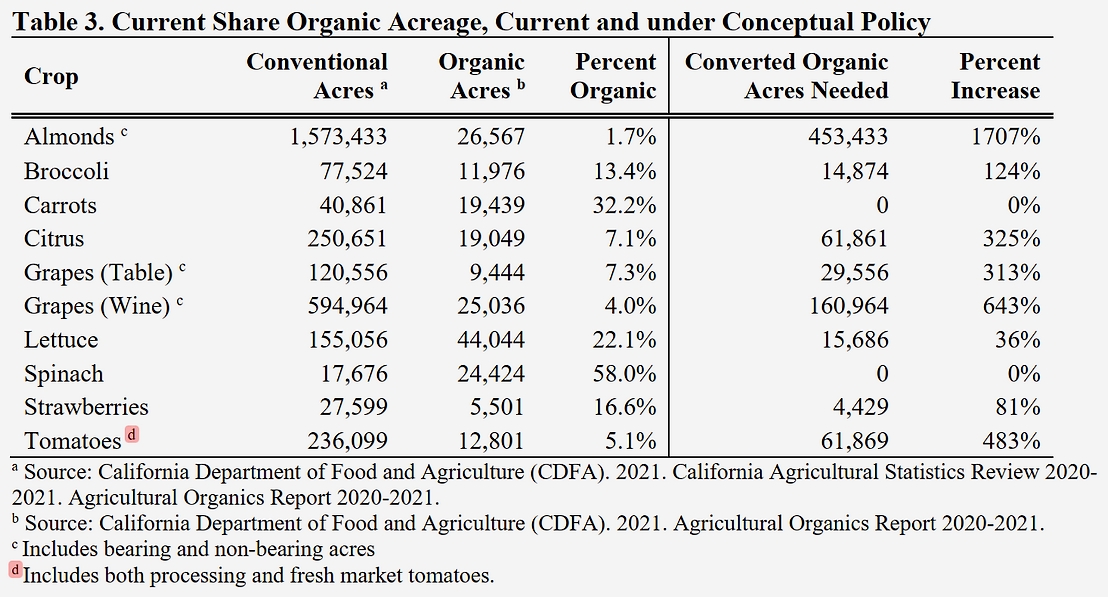

California currently has an estimated 7.35 million acres of irrigated cropland, of which 460,000 acres — or 6 percent — is certified as organic, and not all of that is farmed in any given year. A preliminary analysis by ERA Economics, a Davis-based consultancy specializing in the economics of agriculture and water resources in California, focused on the potential challenges of applying the EU standards to one California crop. This technical memorandum published in August 2022 describes the conceptual policy and its implications for California growers, other businesses, individuals, and food prices. It describes both general economic effects (e.g., how changes in organic production affect crop prices) and specific potential impacts based on an economic analysis of a representative crop/industry: processing tomatoes. The state produces 95 percent of America’s processing tomatoes and the total annual tomato crop is valued at USD 1.2 billion.

Only 5 percent of California’s 228,000 processing tomato acreage is currently needed to meet consumer demand for organic. The study found that reaching 30 percent organic production by 2030 would cause substantial disruptions to the market. The farm gate price of conventional tomatoes was estimated to rise by more than 11 percent. And, importantly, the price for organic tomatoes was estimated to fall by 28 percent at the farm gate level — potentially putting the market price below the cost of production.

That could mean organic farmers would be forced to cease production, sell, or farm something else — a result that could potentially crash the organic market and ultimately drive-up consumer prices. Mandating an increase in organic acreage without a clear connection to consumer demand could result in market disruptions that would hurt farmers, farm employees and consumers alike, the study noted.

Any initial organic price drop would mostly benefit wealthier consumers who purchase organically grown products, with lower-income customers paying more for traditionally grown products. All tomato farmers, organic or not, could see reduced profits, according to the analysis.

The study coincides with other concerns that have been raised about organic production from independent third-party researchers, including that despite strong public perception of organic agriculture producing better environmental outcomes, data show that conventional agriculture often performs better on environmental measures including land use, greenhouse gas emissions, and pollution of water bodies.

The findings by ERA Economics include the following:

To increase organic acreage for processing tomatoes from an average of 4 percent to 30 percent would represent a five- to six-fold increase in current acreage. Tomato growers and processors interviewed for the analysis confirmed industry data regarding consumers’ finite desire to purchase organic tomato products.

To increase organic acreage for processing tomatoes from an average of 4 percent to 30 percent would represent a five- to six-fold increase in current acreage. Tomato growers and processors interviewed for the analysis confirmed industry data regarding consumers’ finite desire to purchase organic tomato products. Tomato growers may specialize in organic, non-organic or both, depending on market demands and conditions. By mandating a specific growing method, it could greatly impact the ability of farmers to keep their operation sustainable, both financially and as they encounter other challenges, such as climate change and pests and disease.

Tomato growers may specialize in organic, non-organic or both, depending on market demands and conditions. By mandating a specific growing method, it could greatly impact the ability of farmers to keep their operation sustainable, both financially and as they encounter other challenges, such as climate change and pests and disease. Both conventional and organic farmers of processing tomatoes face risks of economic losses. Conventional growers, with likely reduced acreage, could see a 17 percent potential downside cost from expected earnings.

Both conventional and organic farmers of processing tomatoes face risks of economic losses. Conventional growers, with likely reduced acreage, could see a 17 percent potential downside cost from expected earnings. Organic production presents greater risk of crop failure, higher production costs and lower crop yields. As a result, organic farmers are likely to see less stability. They face a potential downside cost of 36 percent of anticipated net returns, making it potentially unprofitable to grow organic processing tomatoes.

Organic production presents greater risk of crop failure, higher production costs and lower crop yields. As a result, organic farmers are likely to see less stability. They face a potential downside cost of 36 percent of anticipated net returns, making it potentially unprofitable to grow organic processing tomatoes.

Here are some key extracts and conclusions from the ERA study.

California processing tomato baseline overview

Processing tomatoes were selected as the representative crop for a more detailed economic analysis of the effects of expanding organic acreage for a specific industry.

California produces 95 percent of U.S processing tomatoes. Processing tomatoes are in the top ten of all California agricultural commodities by total gross farm gate sales. The supply chain for processing tomatoes consists of growers, processors, and buyers. Most raw processing tomatoes are processed into tomato paste, with the remaining processed in various products. Major tomato pastes buyers include large pizza restaurant chains, food manufacturing companies, and international buyers.

Currently about 5 percent of processing tomato acres in California are organic. Organic processing tomatoes are, like their conventional counterparts, largely processed into tomato paste. No (or very little) organic tomato paste is exported from the U.S.

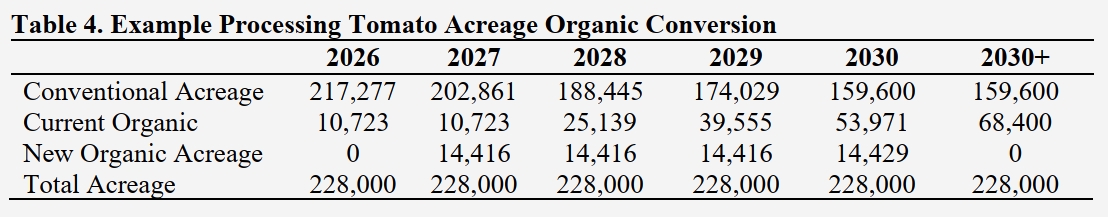

Average processing tomato acreage for the last three years was around 228,000 acres (92,300 hectares), of which 217,277 acres (88,000 ha) (95%) were conventionally farmed and 10,723 acres (4,340 ha) (5%) were organic. Total organic processing tomato acreage would need to increase by over 600 percent by 2030—over the next 8 years—to meet the 30 percent policy target.

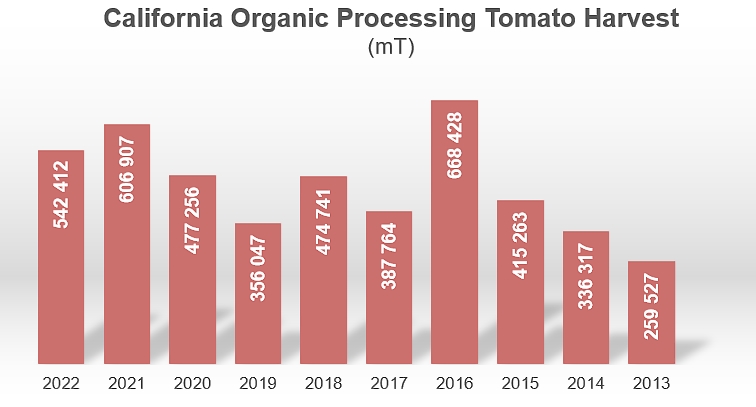

Table 4 shows example changes over time, assuming an even annual increase in organic acreage and decrease in conventional acreage. This assumes a linear increase starting in 2027 with conventional ground shifting to organic. By 2030, conventional acreage would be 159,600 (64,600 ha) (70%) and organic would be 68,400 (27,700 ha) (30%). That would represent a 638% increase in organic processing tomato acreage. The 68,400 acres of organic tomatoes, given a yield of 49 tons per acre (110 mT/ha), would increase organic production from a three-year average of 484,471 tons (385,000 mT) to 3,332,000 tons (3,023,000 mT), or an increase of 688%. For context, the largest organic processing tomato crop ever reported in California was only 737,000 tons (668,000 mT).

The expansion in organic production would require a year-over-year increase of approximately 25.5%. And this would need to happen for seven years in a row. This would represent an unprecedented increase in organic production.

An additional consideration is the location of organic processing production. The counties of Fresno, Kern, and Kings account for over 60 percent of the current organic processing tomato production. Water availability in those counties is likely to be substantially reduced over the next several years. Surface water supply is becoming more uncertain, and implementation of the Sustainable Groundwater Management Act (SGMA) will eventually reduce the amount of groundwater that will be available for crop production in those counties. This will increase the cost of water, which affects the cost to raise a crop, and ultimately grower production decisions.

In general, organic farming costs are higher, typically due to more farm labor input, the cost of organic inputs, and the direct plus opportunity cost of organic certification. However, growers interviewed for this study indicated that in years when pest (in processing tomatoes in particular, weed) pressure happens to be minimal, conventional and organic cash farming costs can be comparable. Growers and industry data show that organic crop yields are typically lower and exhibit much greater variability from year-to-year than conventional.

Based on information provided by surveyed growers, operating costs to produce organic processing tomatoes are approximately USD 500 per acre more than for conventional processing tomatoes. This difference is primarily due to alternative pest and weed protection practices used on organic fields. Growers interviewed noted that early season weed pressure is key for a successful organic crop. Late season rains that support weed growth before plants leaf out can result in substantial crop losses. In addition, growers noted that insect pressure can be problematic in some years. Growers try to locate organic fields in specific areas, such as farther away from waterways and near well-managed conventional fields, to avoid pest pressure that can result in crop losses.

In addition to direct farming costs there is an opportunity cost for certifying organic ground. It takes three years to convert a conventional field to certified organic. During the three-year period land can be fully rested, farmed organically but not certified (and therefore receive no price premium for the crop), or farmed in an alternative crop. The opportunity cost of organic certification was not monetized as part of this reconnaissance-level assessment. In addition, the cost of organic was not monetized as part of this initial assessment. However, tomato processors interviewed for this study indicated that lines are managed to process organic at one time and separate from conventional to avoid intermittent shutdowns and cleanouts. These shutdown/clean out costs can amount to several hundreds of thousands of dollars per occurrence.

Here are some summary conclusions of the analysis.

The economic analysis of the processing tomato industry was developed to illustrate the changes in grower costs, supply and demand for organic and conventional crops, and the effects on equilibrium price and quantity. These changes affect growers’ net returns and risk, and ultimately affect consumer food prices.

The economic analysis of the processing tomato industry was developed to illustrate the changes in grower costs, supply and demand for organic and conventional crops, and the effects on equilibrium price and quantity. These changes affect growers’ net returns and risk, and ultimately affect consumer food prices. The organic policy target represents a substantial increase in organic acreage over current conditions for California in total, and for most individual crops. For processing tomatoes, achieving 30 percent organic acreage would represent a 5- to 6-fold increase over current conditions. That is, based on historical data for the processing tomato industry, organic production has never represented more than 3-5 percent of total acres in the state. Growers and processors interviewed for this study confirmed what is obvious in industry data: there is simply a limited consumer willingness to pay a premium price for organic tomato paste and associated products.

The organic policy target represents a substantial increase in organic acreage over current conditions for California in total, and for most individual crops. For processing tomatoes, achieving 30 percent organic acreage would represent a 5- to 6-fold increase over current conditions. That is, based on historical data for the processing tomato industry, organic production has never represented more than 3-5 percent of total acres in the state. Growers and processors interviewed for this study confirmed what is obvious in industry data: there is simply a limited consumer willingness to pay a premium price for organic tomato paste and associated products. Consumer demand drives production decisions and innovation, including potential changes in organic production. The processing tomato industry offers a useful case study. Organic production increases and decreases over time in response to processor demand for organic tomatoes. A large organic crop in 2016 led to large organic carry-over inventory, which pushed organic contracts and prices down in subsequent years. In short, substantial expansion in organic production can only be achieved if there are consumers that want to buy it. Regulatory policies that conflict with consumer demands and preferences are likely to be ineffective and/or expensive and disruptive. For the California processing tomato industry, organic production is typically less than 5 percent of total production. Both organic and conventional global processing tomato consumption is stable and has been for more than the last decade. Increasing organic consumption would require consumers to substitute away from conventional to organic processing tomatoes, but current demand patterns do not indicate that they would willing to pay the price premium.

Consumer demand drives production decisions and innovation, including potential changes in organic production. The processing tomato industry offers a useful case study. Organic production increases and decreases over time in response to processor demand for organic tomatoes. A large organic crop in 2016 led to large organic carry-over inventory, which pushed organic contracts and prices down in subsequent years. In short, substantial expansion in organic production can only be achieved if there are consumers that want to buy it. Regulatory policies that conflict with consumer demands and preferences are likely to be ineffective and/or expensive and disruptive. For the California processing tomato industry, organic production is typically less than 5 percent of total production. Both organic and conventional global processing tomato consumption is stable and has been for more than the last decade. Increasing organic consumption would require consumers to substitute away from conventional to organic processing tomatoes, but current demand patterns do not indicate that they would willing to pay the price premium.

In the words of the US press, “it’s surprising that a state in the U.S. would seek to follow the EU on agricultural policy. The track record in Europe isn’t particularly sound. In one recent example, plans for the EU to adopt a Farm to Fork strategy that included the use of fewer crop protection products and fertilizers, along with a significant transition to organic production, was widely criticized for the likelihood of much lower food production across the continent and damage to overseas virgin rainforests, which would take the brunt of demand for new farmland (and greater carbon emissions) to make up for the lack of output on European soil”.

“Farming works when we are able to grow what the consumer actually wants and not what government mandates. California consumers are already struggling to afford higher prices for food than other states because of government mandates and these types of proposals just make things worse,” said Jamie Johansson, president of the California Farm Bureau. “When the government increases the price of food, it acts like a regressive tax, hurting lower- and middle-income families the hardest. At the end of the day, the government needs to let organic markets grow organically.”

“Farming works when we are able to grow what the consumer actually wants and not what government mandates. California consumers are already struggling to afford higher prices for food than other states because of government mandates and these types of proposals just make things worse,” said Jamie Johansson, president of the California Farm Bureau. “When the government increases the price of food, it acts like a regressive tax, hurting lower- and middle-income families the hardest. At the end of the day, the government needs to let organic markets grow organically.”

Some complementary data

For the complete “Economic Considerations for Conceptual Organic Policy Targets” study, click here.

Sources: agdaily.com, zohoexternal.com, cfbf.com, californiaagtoday.com