Respect for your privacy is our priority

The cookie is a small information file stored in your browser each time you visit our web page.Cookies are useful because they record the history of your activity on our web page. Thus, when you return to the page, it identifies you and configures its content based on your browsing habits, your identity and your preferences.

You may accept cookies or refuse, block or delete cookies, at your convenience. To do this, you can choose from one of the options available on this window or even and if necessary, by configuring your browser.

If you refuse cookies, we can not guarantee the proper functioning of the various features of our web page.

For more information, please read the COOKIES INFORMATION section on our web page.

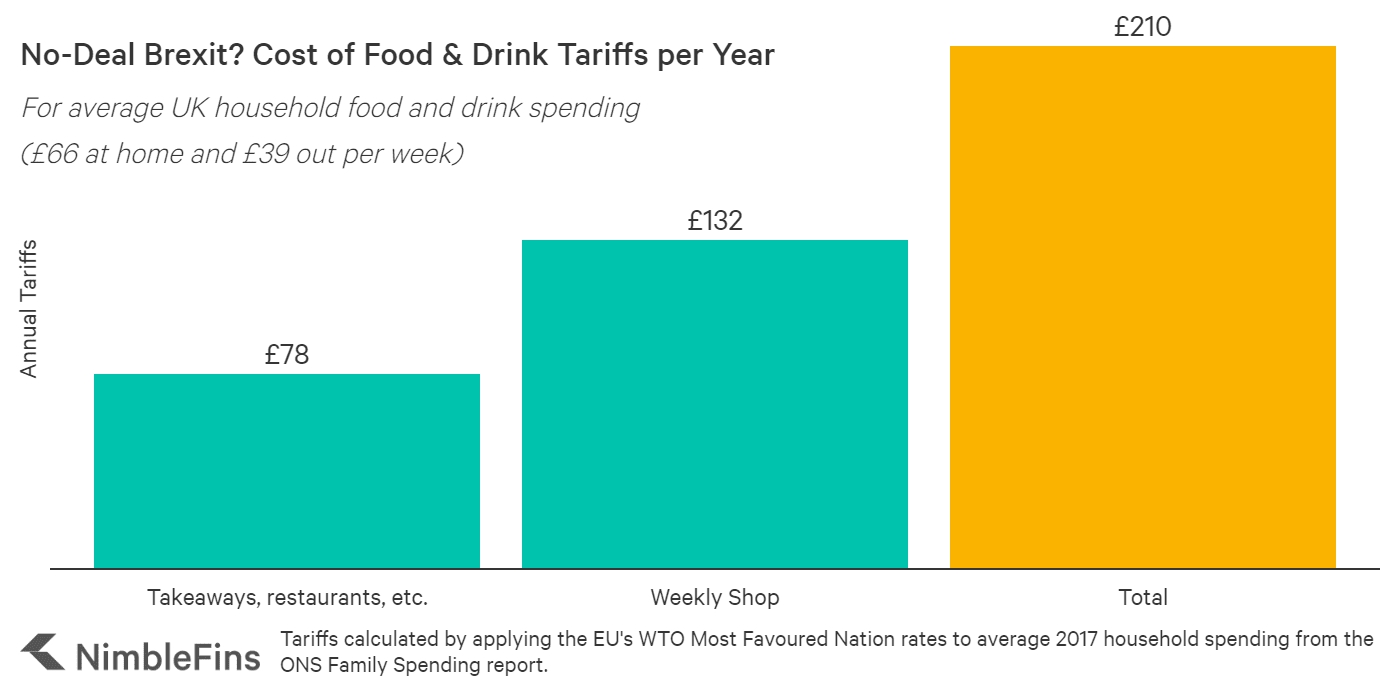

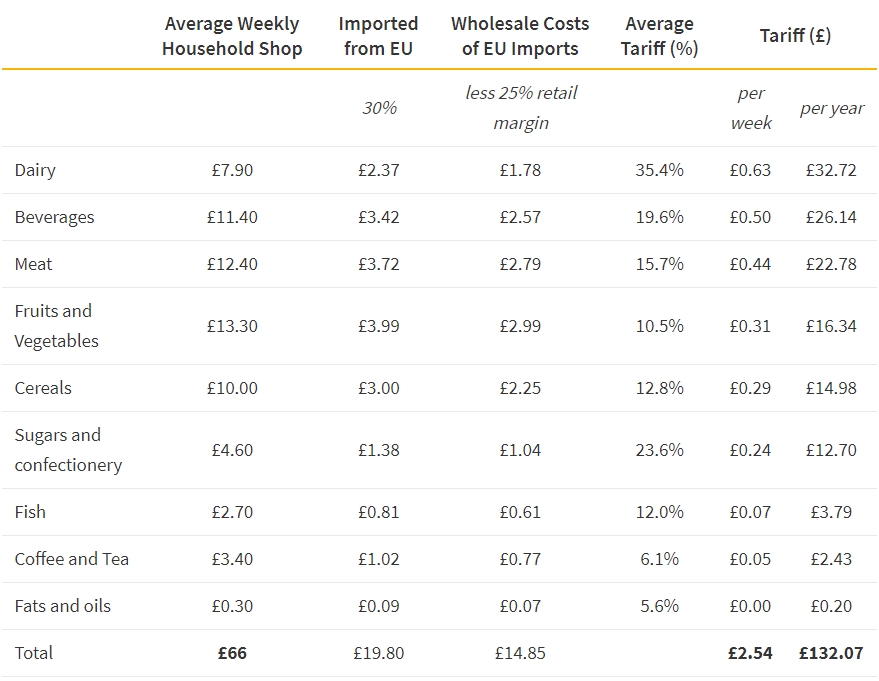

In meetings in early ebruary with the Commission's chief negotiator Michel Barnier, representatives of the European food industry urged the EC to take unilateral action to keep the food trade flowing, something it is believed will only happen if the UK takes similar steps. The delegation included representatives from Copa and Cogeca, CELCAA and Food Drink Europe (FDE). During the meeting – and in a follow-up joint letter signed by the three organisations – the food sector stressed the need to avoid a no-deal Brexit scenario and deliver "an orderly Brexit" to ensure trade between the EU and the UK "remains as frictionless as possible".

In meetings in early ebruary with the Commission's chief negotiator Michel Barnier, representatives of the European food industry urged the EC to take unilateral action to keep the food trade flowing, something it is believed will only happen if the UK takes similar steps. The delegation included representatives from Copa and Cogeca, CELCAA and Food Drink Europe (FDE). During the meeting – and in a follow-up joint letter signed by the three organisations – the food sector stressed the need to avoid a no-deal Brexit scenario and deliver "an orderly Brexit" to ensure trade between the EU and the UK "remains as frictionless as possible".

EC presentation on Brexit withdrawal agreement

EC presentation on Brexit withdrawal agreement