"A highly worrying exponential increase in imports of peeled tomato"

The tomato processing industry in Argentina is more specifically focused on the production of canned tomatoes for historical reasons. Only 30% of the volumes harvested are intended for processing into paste. Over the past few years, Argentinian processors have invested in modernizing their equipment, particularly in the area of technology for the production of peeled and chopped tomatoes, and in conditioning equipment, rather than in developing their capacities, which are already higher than the volumes available for processing. Over the past three years, processed quantities have amounted to an average of 476 000 tonnes, and production prospects for 2018 are stated at 420 000 tonnes.

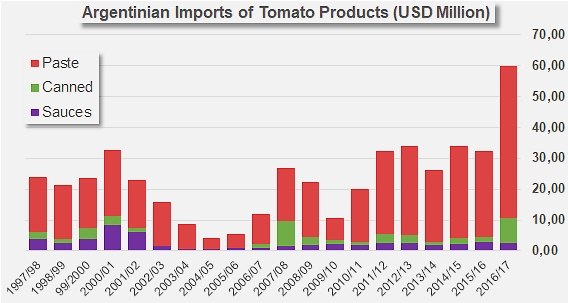

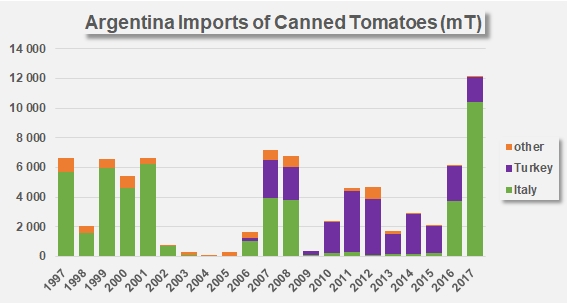

Argentina's annual demand, which is estimated at approximately 620 000 tonnes, must regularly call on imports from abroad, mostly from Chile. Until recent years, these relatively high volumes of imports (more or less considered as a necessary evil) were mainly tomato pastes, which are produced in insufficient volumes by the country's own industry and at a price that cannot compete with the price of imported products. But early March, a dispute arose between the Argentinian government and the UIA (Argentinian Industrial Union) caused by unfortunate pronouncements by the Minister of Production Francisco Cabrera, which openly revealed a deeper issue that has led to a brutal increase in foreign purchases of canned peeled tomatoes, taking competition with foreign products into terrain that had previously been "protected". The production of peeled tomatoes is "a specialty of the Cuyo region (San Juan, Mendoza and La Rioja), where they are grown to excellent quality standards, according to the most demanding international criteria, and able to stand up to competition."

(Source: Association Tomate 2000)

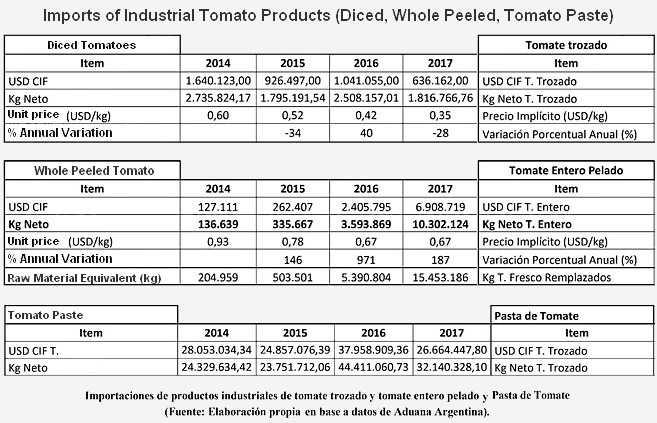

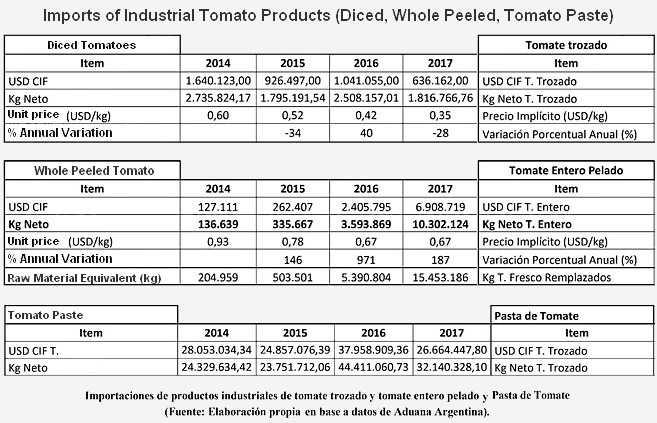

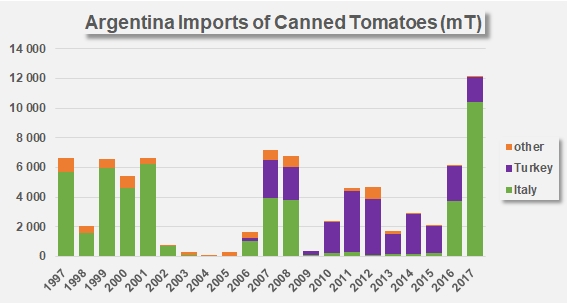

In its comments on the statistics, the UIA states that "of the 44 000 tonnes imported in 2017, 32 000 tonnes [of paste, editor's note] are used as raw material for other products, and are not produced in Argentina but are needed by the industry for its own processing activities, a fact that demonstrates the depth of the crisis affecting the sector." But the industry claims to be much more worried about the "approximately 10 300 tonnes coming in from Italy, which are intended for direct sale to final consumers", as well as by the recommendations of the Minister who suggested that the prices of retail products should be lower, in a context where the practices of large retail chains in Argentina in terms of imports and labeling are the topic of major debate.

(Source: IHS)

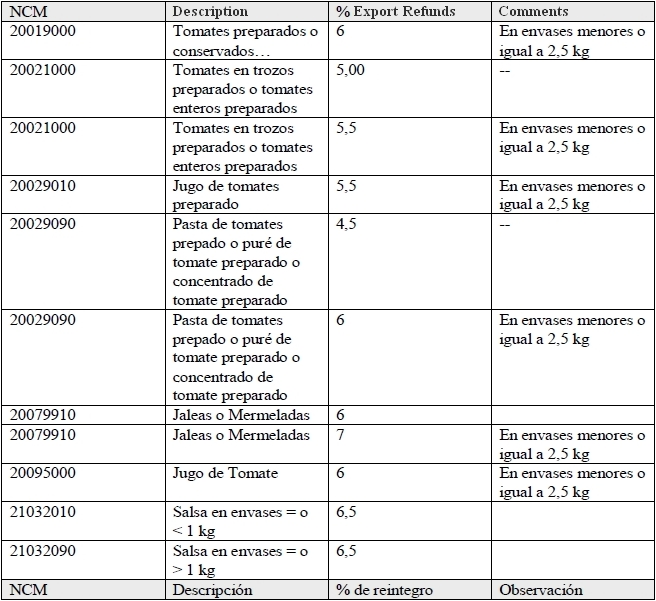

The Tomate 2000 association estimates that "one of the measures that might alleviate some of the problems of the sector would be to increase incentives for export activities, by improving the levels of restitution for exports," in order to support operations of the tomato industry. The Association also asked for the implementation of decisions concerning the application of "the reference value of USD 0.78 /kilo on imports of whole-peeled tomatoes" when their price upon entry into Argentina is lower than this threshold, in order to compensate for the advantages from which these products benefit in the form of subsidies received in their countries of origin (EU).

One third of growers may disappear

According to the local press, the CIPA (Chamber of food production industries) intends to meet the Minister of Production in order to "ask for the urgent application of essential measures aimed at preventing the disappearance of 35% of the country's tomato growers, concentrated in the regions of Mendoza, San Juan and La Rioja", which are reportedly threatened by the increase in imports of industrial tomato products.

According to the local press, the CIPA (Chamber of food production industries) intends to meet the Minister of Production in order to "ask for the urgent application of essential measures aimed at preventing the disappearance of 35% of the country's tomato growers, concentrated in the regions of Mendoza, San Juan and La Rioja", which are reportedly threatened by the increase in imports of industrial tomato products.

Investments in technology, the adoption of new varieties, the financing of the harvest season and increased competition from Chilean paste have all led to a hike in production costs and represent challenges that local growers must imperatively take up, even if this now means barely hanging on to their position at the national level. Industry operators are all the more concerned for the fact that Argentina's agricultural potential in terms of processing tomatoes has been progressing each year and is now clearly able to rival the potential capacity of the world's biggest production regions.

At the end of February, local professional sources were reporting good weather conditions, which could lead to a satisfactory 2018 harvest. The same sources explained that the two main production regions – Mendoza and San Juan – have each dedicated about 2 000 hectares to tomato processing crops, with the remaining 2 500 hectares shared between the regions of Rio Negro and La Rioja. Over the past five years, the province of Mendoza has lost close on half of the hectares of tomatoes that it used to cultivate (from 3 500 to 2 000 hectares approximately), whereas San Juan, which enjoys a more favorable dry climate and considerable financial aid from the provincial government, has been showing good growth. These regions report agricultural yields that are extremely satisfactory, between 65 and 80 mT/ha in Mendoza, and approximately 105 mT/ha in San Juan. In this last region, the weather factor is very important, but industry operators also point out that close on 90% of the growers have installed drip-irrigation systems, amongst other technological advances, a factor that has been decisive in the improvement of yields and profitability. "Despite the problematic weather conditions of recent years, our yields have reached international levels. The average was reported last year at 105 mT/ha, and some growers reach 130 mT/ha on a regular basis. That is our objective," stated Guillermo Quiroga, the President of the Tomate 2000 association. "Processing tomato is a costly crop. Currently, the cost of production per hectare represents the equivalent of 80 tonnes of tomato. But we do not control either the price of inputs, or the sales price, which is fixed by factories. So we must produce more than 100 tonnes per hectare in order to be profitable."

Despite this excellent performance, results are currently insufficient to allow Argentinian growers to be competitive in supplying the country's national market. Apart from a few exceptional harvest seasons, this situation is ongoing, and growers feel that the current scenario is even worse: "Imports that were once intended to fill in for the shortfall of self-sufficiency are now replacing the country's own production," one grower recently explained, during the traditional consultation day "Día de Campo de Tomate para Industria", organized by the Tomate 2000 association at the INTA station of La Consulta in San Carlos.

Some complementary data

Table indicating export restitutions

Evolution and nature of Argentinian expenditure on tomato product imports

Source: infobae.com, ambito.com, lavoz.com.ar

According to the local press, the CIPA (Chamber of food production industries) intends to meet the Minister of Production in order to "ask for the urgent application of essential measures aimed at preventing the disappearance of 35% of the country's tomato growers, concentrated in the regions of Mendoza, San Juan and La Rioja", which are reportedly threatened by the increase in imports of industrial tomato products.

According to the local press, the CIPA (Chamber of food production industries) intends to meet the Minister of Production in order to "ask for the urgent application of essential measures aimed at preventing the disappearance of 35% of the country's tomato growers, concentrated in the regions of Mendoza, San Juan and La Rioja", which are reportedly threatened by the increase in imports of industrial tomato products.