Part 1/3

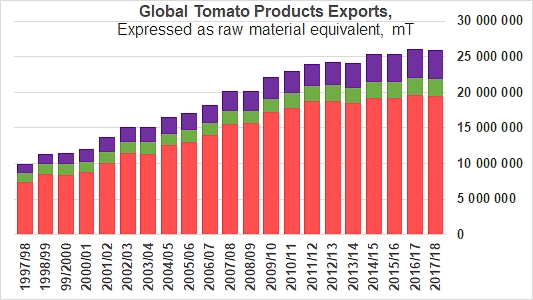

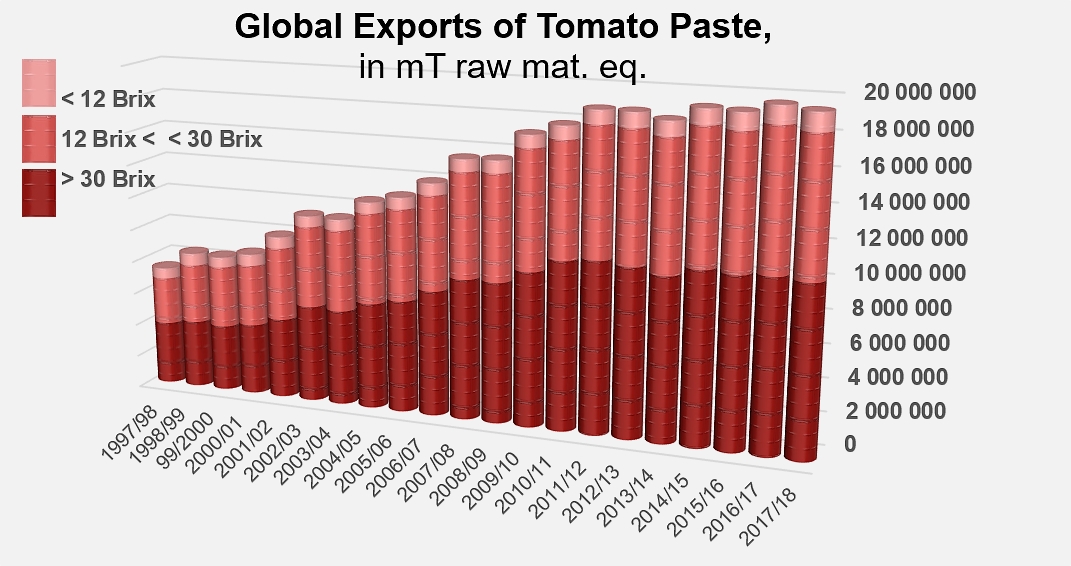

Over the past two decades, the volumes of tomato products exported by the world's main industrial tomato processing regions have more than doubled. In addition to domestic processing activities, which are often insufficient to cover local requirements, consumption needs have increasingly and generally been met by products manufactured on the processing lines of national industries with a global reach like Italy, California, China, Spain, Portugal and Chile. From less than 10 million metric tonnes (mT) in farm weight equivalent in 1997/1998, the volumes shipped abroad have increased almost regularly at an annual rate of 4.9% over the past twenty marketing years, which is a faster rate than the growth of volumes processed around the world, to the point of exceeding 26 million mT in 2016/2017 before dropping back slightly in 2017/2018 to just below that level.

However, in 2019, the growth rate on which worldwide industry operators previously depended to consolidate their development is no longer what it was in 2009, particularly in the specific sector of tomato pastes. The geography of worldwide demand has shifted, the expectations of consumers have evolved, the requirements of remanufacturing operators have changed and competition has been harder to pin down as local initiatives have developed. The industrial and commercial context of "consistent long-lasting growth", in which companies operated in the main processing countries between the middle of the 90s and the beginning of the 2000s, has turned into a context of sluggish growth in which the preeminence of the biggest operators has been progressively eroded by local protectionist measures and the development of processing activities in regions or countries that had previously depended on imports. So the supremacy of a few leading countries of the sector, who had been supplying up to 98% of the world's overall requirements until just before the crisis of 2009, has weakened relatively in recent years: foreign sales of the world's TOP12 exporters only accounted in 2017/2018 for approximately 95% of the world's international paste trade, thereby bringing that group of countries back to the position it occupied on the worldwide scene in 1999/2000.

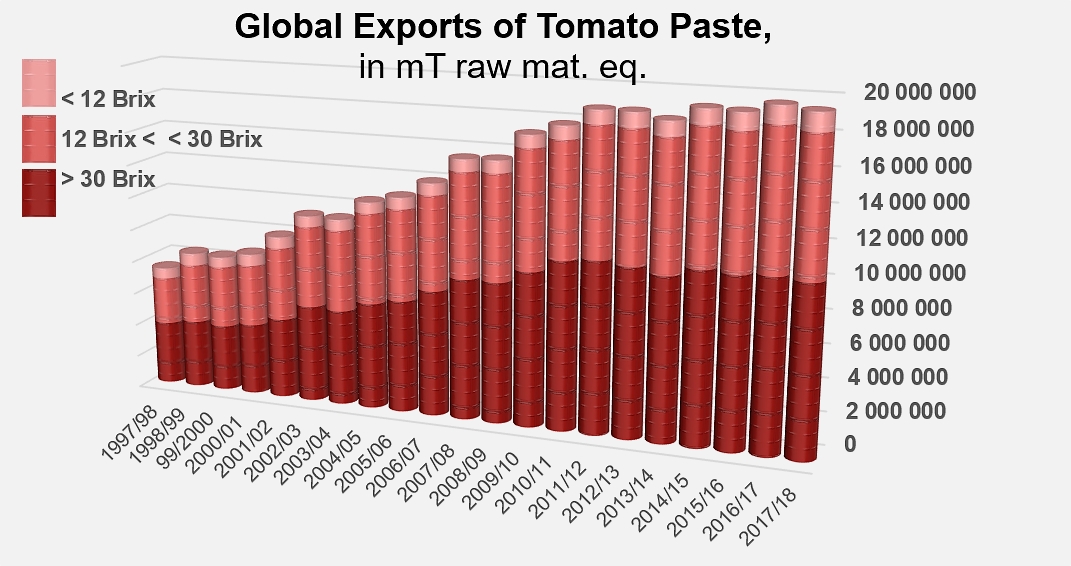

At the moment, the market's continuous expansion model that resulted in the increase of processed quantities in the main exporting countries over the past twenty years no longer seems to be applicable. Growth strategies for industries and companies, particularly in the paste sector, can be considered at best as stagnating in the global context, possibly even as decreasing, in the worst-case scenario. This situation, which aggravates competition because growth can only be pursued by taking over pre-existing market shares at the expense of other industrial operators, does seem to be what has determined the context of worldwide industry operations for the past five or six years. In 2017/2018, for the sixth consecutive year, worldwide exports of paste only grew at a rate of 0.5% in volume, whereas the average annual growth rate almost reached 7% for the fifteen previous marketing years. More worrying still, the volumes of raw materials absorbed by these big trade movements – in other words, the production of the agricultural upstream and the very basis of our industry – saw virtually no growth last year. They only amounted to 19.4 million mT in farm weight equivalent, which also just corresponds to the average of the three previous marketing years.

For the TOP12 worldwide paste exporters, the conclusion is even harsher: for the past half dozen years, operations have remained constrained within a range of 18.2 to 18.7 million mT (farm weight equivalent), and the result of the 2017/2018 marketing year (18.45 million mT) has only confirmed the weak dynamics of that group of countries.

Total volumes absorbed at a worldwide level by the production of paste for export has hardly varied over the past four marketing years, remaining close to an average annual volume of some 19.4 million tonnes (farm weight equivalent). These volumes had grown from 7.4 million mT to 18.9 million mT between 1997/1998 and 2011/2012.

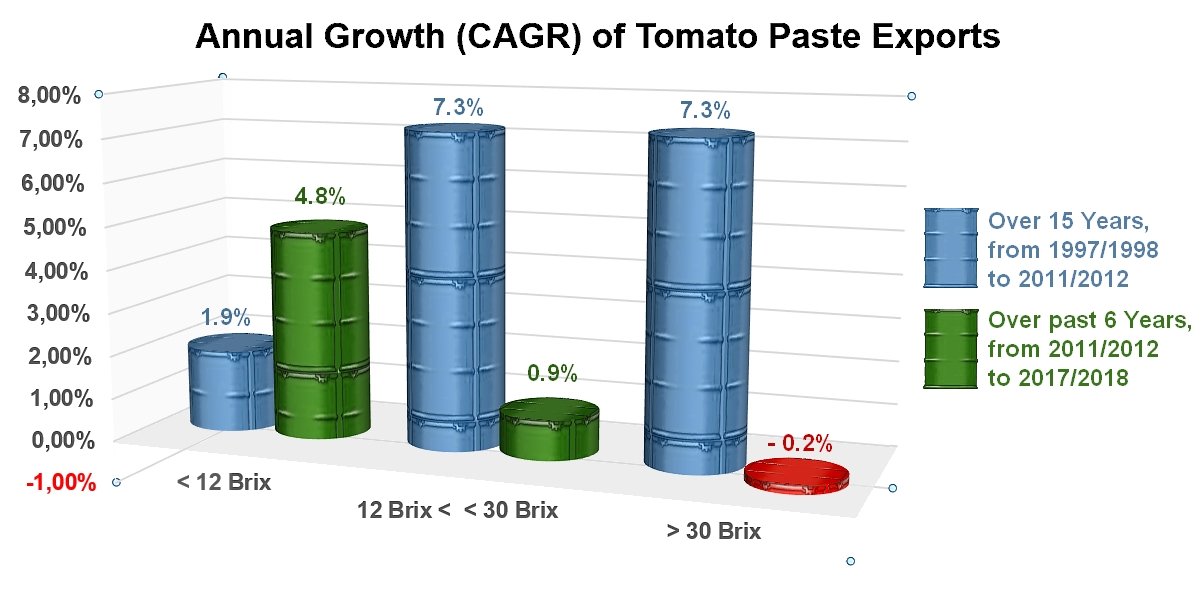

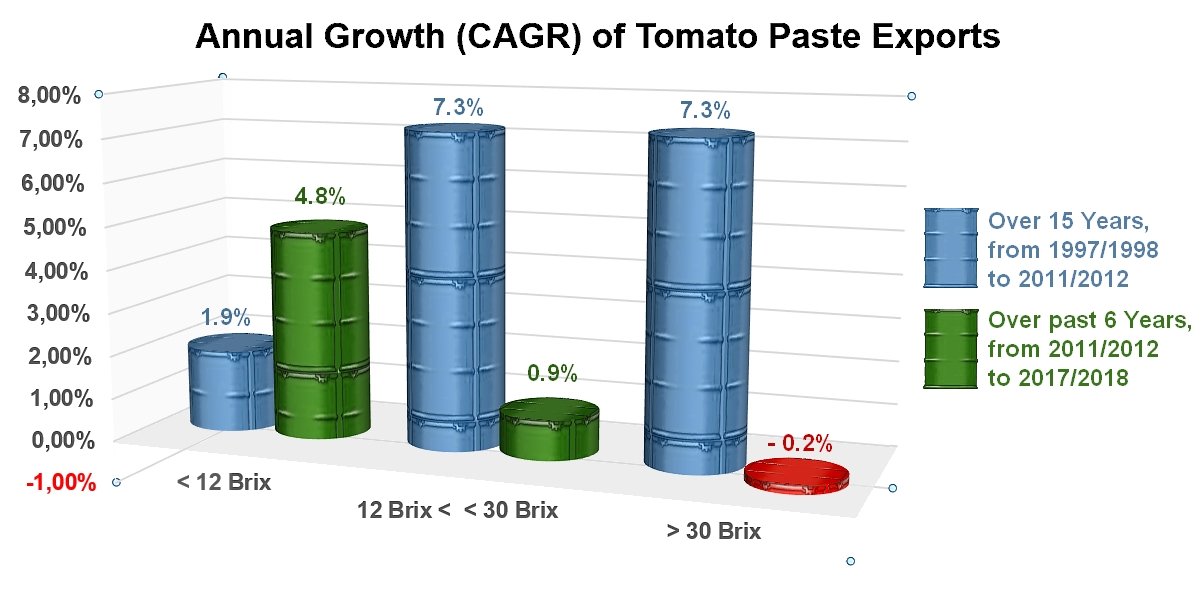

The different market segments did not evolve in the same way over this period of twenty years, and neither have they evolved together in recent marketing years: whereas worldwide paste exports of 12-30° Brix and of over 30° Brix (20029031, 20029039 and 20029091, 20029099) recorded spectacular growth (CAGR above 7%) and were driving the development of the paste sector as a whole until 2011/2012, exports of low-concentration tomato purée (less than 12° Brix, customs codes 20029011 and 20029019) only increased slowly, at an average annual rate of about 1.9%. Trade dynamics have shifted radically since 2011/2012, with a sluggish growth rate (even negative at times) for the traditional drivers of the segment over the past six marketing years (less than 1% per year for 12-30° Brix pastes, and even -0.2% per year for pastes of more than 30° Brix), while exports of low concentration products (less than 12° Brix) have accelerated and are now growing at an annual rate that is getting closer to 5%. The direct consequence of this shift in demand and dynamics is a notable reduction in the volumes of raw tomato being absorbed by worldwide trade patterns, the effects of which can be measured by the extremely slow growth in the volumes processed in recent years, as well as by the previously unseen slowness in the recovery of worldwide prices for pastes intended for export, after the price crisis that started in the summer of 2014.

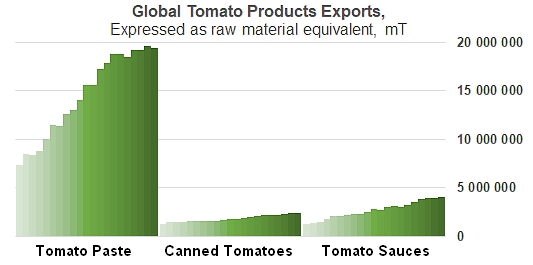

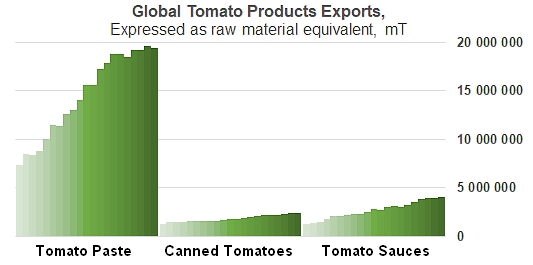

The 2017/2018 marketing year only saw limited change compared to our previous market overviews. Among the three main product categories, exports of sauces seem to have done better than other categories at resisting the slowdown in dynamics. The development of global exports for this kind of product has been practically linear over the past 20 years, at an average annual rate of close on 5.8%. In 2017/2018, the worldwide trade for sauces shifted 1.38 million mT of finished products (up by 1.8% against the average (1.35 million mT) of the three previous marketing years (2014/2015, 2015/2016 and 2016/2017)), which is the processed equivalent of slightly more than 4.0 million tonnes of raw tomato.

As for exports of canned tomatoes, their growth has been slower (3.3% per year) over the past twenty marketing years and they have absorbed lower volumes of raw materials than the two other sectors. During the latest marketing year (2017/2018), the global trade in canned tomatoes shipped 1.74 million tonnes (approximately 2.45 million mT in farm weight equivalent), which is a remarkable increase of 6.8% compared to the average of the three previous years (1.63 million mT). This recovery in operations can probably be explained by the weak dynamics that governed exchanges over the five previous years.

The final result is that the volumes of tomatoes exported during the 2017/2018 marketing year amounted to the equivalent of 25.9 million mT of raw tomato, which is a slight decrease compared to the global performance of the previous year, but still significantly up (+2.5%) compared to the average of the volumes shipped during the three previous years (25.6 million mT in farm weight equivalent). The annual growth rate over the past six marketing years reached approximately 1.3%, well below the 6.5% that drove the sector's growth between 1997/1998 and 2011/2012.

Combined growth of worldwide exports in the three main categories of tomato products (pastes, canned tomatoes, sauces), expressed in farm weight equivalent.

The second and third parts of the dossier "Architecture of the worldwide trade of tomato products in 2017/2018" will be published shortly.