ANICAV, the Italian National Association of Canned Vegetable Industries, with about 100 member companies - among which are some of the major groups in the agro-industrial sector not only at the national but also at the EU level - is the largest association representing tomato processing companies in the world in terms of number of members and quantity of processed product.

Its member companies represent 3/4 of Italy's tomato processors (with a total annual turnover of 2.9 billion euros, more than 1.9 billion of which comes from exports) and legume processors (0.6 billion euros).

Its member companies represent 3/4 of Italy's tomato processors (with a total annual turnover of 2.9 billion euros, more than 1.9 billion of which comes from exports) and legume processors (0.6 billion euros).ANICAV supports its members in their entrepreneurial action by defending the interests of the canning industries sector, promoting the development of an economy that translates into growth opportunities for the entire community. Enterprise culture, aggregation, legality, transparency, respect for workers' rights and respect for the environment guide the lives and actions of ANICAV’s member companies and represent inalienable values.

In recent years, the Association has changed the paradigm of its actions by adjoining to its lobbying activities, typical of a representative association, advocacy activities that can lead to raising awareness and making consumers more conscious of the reality of the sector.

At the national level, ANICAV is a member of Confindustria and Federalimentare, while at the international level it is a member of the Mediterranean International Association of the Processed Tomato (AMITOM), the World Processing Tomato Council (WPTC), Tomato Europe and PROFEL.

The processing tomato in Italy

The tomato processing sector represents an excellence of the Italian agri-food industry both in terms of turnover and quantity produced and plays an important strategic and driving role in the national economy.

It is one of, if not the most, important Italian processed fruit and vegetable supply chain that, due to its strong vocation for export, is identified as one of the symbols of agri-food “Made in Italy” in the world.

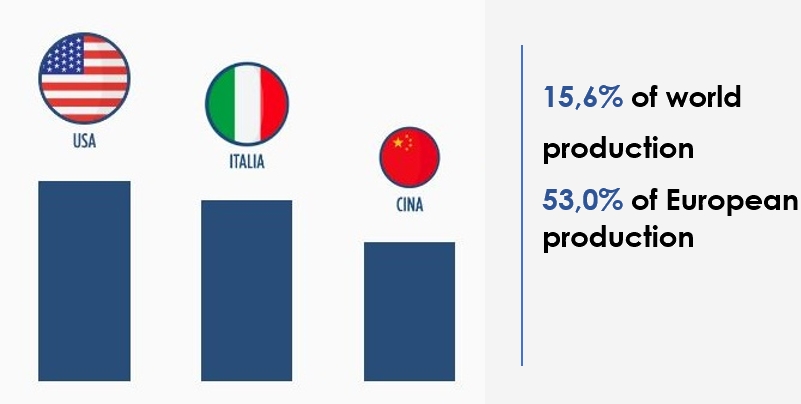

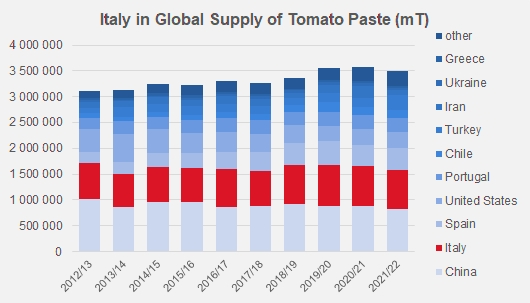

In 2021, Italy was the world's second largest processor after the U.S. and well ahead of China, accounting for 15.6 % of world production and 53 % of European production.

There are two production basins in Italy: one in the South-Centre, with the highest concentration of processing companies in Campania and agricultural production companies in Puglia, and one in the North, concentrated especially in the provinces of Parma and Piacenza.

The 115 companies operating in Italy employ about 10,000 permanent workers and 35,000 seasonal workers, both direct and indirect, plus the workforce of allied industries (packaging, distribution and logistics, seed companies).

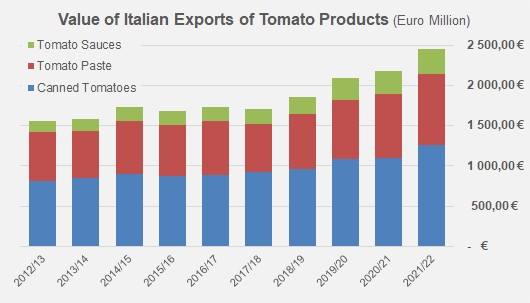

In 2021, the turnover of the tomato processing industry was 3.7 billion euros, of which more than 1.9 billion came from exports.

The supply chain is organized into two Interprofessional Organizations with the character of an economic district: the IO Processing Tomato North and the IO Processing Tomato South-Centre.

INTERVIEW

GIOVANNI DE ANGELIS – ANICAV General Director

INTERVIEW

GIOVANNI DE ANGELIS – ANICAV General Director

What are the first data points from the 2022 harvest year? How many hectares have been put into cultivation? Have they increased from last year? What was the average crop yield?

What are the first data points from the 2022 harvest year? How many hectares have been put into cultivation? Have they increased from last year? What was the average crop yield? “For the 2022 crop year, final Italian production will reach about 5.4 million tonnes, a reduction of about 10 % from last year when just over 6 million tonnes of tomatoes were processed. A figure that basically reflects that of the hectares invested in Italy, which, for this campaign, totalled 65.180 (71.217 in 2021), including 37.024 in the North basin and 28.156 in the South -Central basin.

In any case, this year, especially in the Southern basin, processors will have to deal with industrial yields that are decidedly different from those achieved in the 2021 campaign, which resulted in producing, for the same amount of tomatoes, less products.

What is the trend in production and sales in Italy? What is the scenario in GDO and what is the scenario in out-of-home?

What is the trend in production and sales in Italy? What is the scenario in GDO and what is the scenario in out-of-home? From the data for the first half of 2022, there are negative signs - compared to the same period in 2021 - in volume (-3.6%), but the value remains stable. Of course, there is a better performance of prices, which, to some extent, could contain the significant price increases experienced by the industry in the last period.

Which market segments perform best, and which are the most promising?

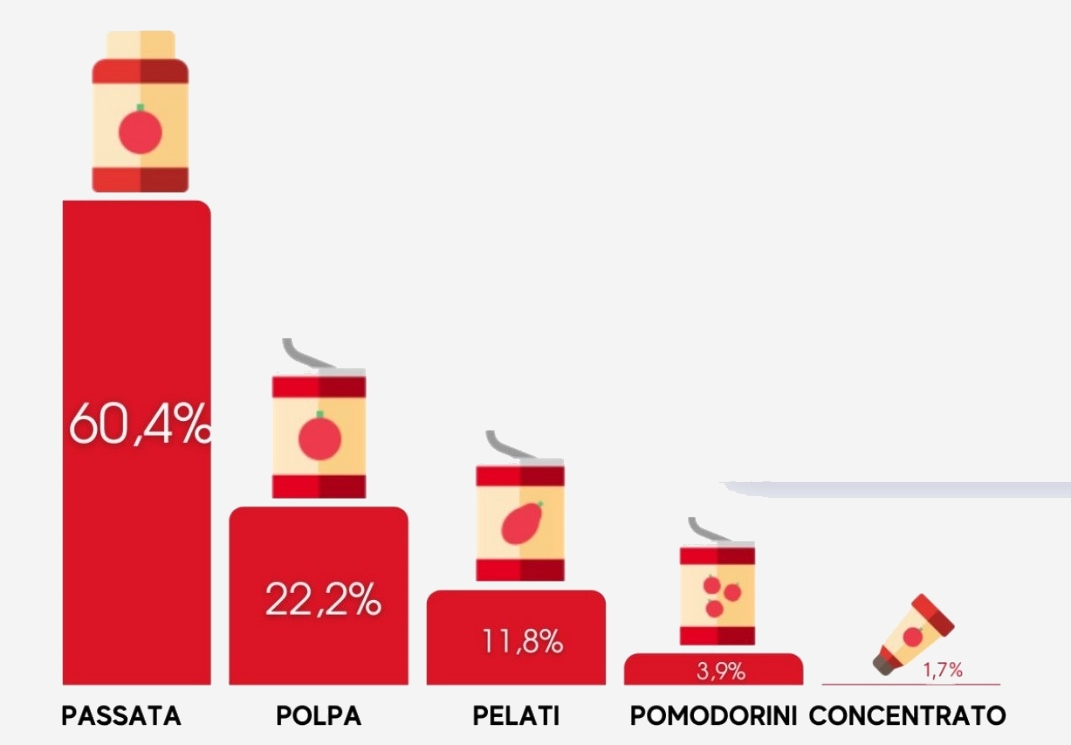

Which market segments perform best, and which are the most promising? The best-selling product on the shelves of our supermarkets in the first half of 2022 is confirmed to be tomato passata (accounting for 60% of the market), followed by diced tomatoes (22 %), peeled tomatoes (12 %), cherry tomatoes (4 %), and concentrate and others (2 %). For the foreign market, on the other hand, whole and non-whole peeled tomatoes continue to register the highest liking. Thus, consumer attention to the quality of our products is confirmed. It is, moreover, growing consumer interest in organic tomato derivatives.

What is the percentage of organic tomatoes grown in Italy currently? Has the increase in this production for tomatoes for industrial processing increased in the last year?

What is the percentage of organic tomatoes grown in Italy currently? Has the increase in this production for tomatoes for industrial processing increased in the last year? In recent years, in order to meet the needs of consumers who are increasingly sensitive to quality and environmental protection, organic tomato production is becoming more widespread. In the last three years, growth has been about 15 %, with an increase in value of more than 20 %, demonstrating consumer interest in this product. In 2021, in Italy, the production of tomato derivatives from organic farming was more than 450 thousand tonnes or 7.45% of total production, with more than 6.000 hectares invested. A growth trend that will surely be confirmed by the 2022 figures. As ANICAV we have constituted, for a few years already, a specific product section dedicated to organic with the aim of flanking and supporting our companies in governing the growth of production and always improving to give guarantees to the consumer.

The tomato canning industry has always been export-oriented. What is the export trend of made-in-Italy red canned tomatoes in early 2022?

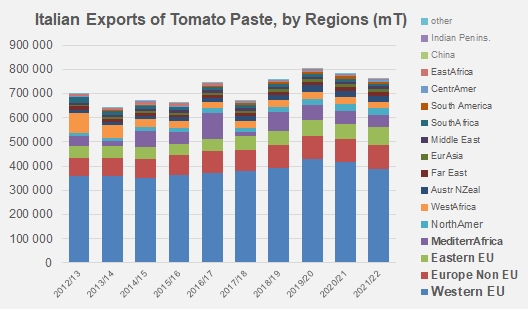

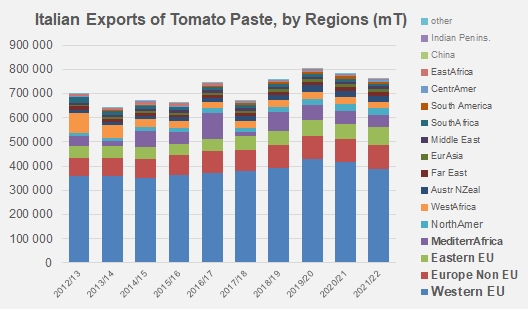

The tomato canning industry has always been export-oriented. What is the export trend of made-in-Italy red canned tomatoes in early 2022? Italy has always been the leading exporter of tomato derivatives destined directly to the final consumer. In 2022, foreign markets showed very positive signs in both volume (+10.26%) and value (+23.24%). A better price performance is also confirmed for exports. Europe, with Germany and the United Kingdom in the lead, are once again confirmed as the main outlet markets for our derivatives. This is followed by the United States and Japan. The best-selling products are whole and non-whole peeled tomatoes.

How is the entire industry moving to encourage increasingly sustainable production? Are there any nationally practices/systems adopted to point out?

How is the entire industry moving to encourage increasingly sustainable production? Are there any nationally practices/systems adopted to point out? On the side of ethical sustainability, since the tomato industry has been for years improperly called into question whenever there is talk of “caporalato” - despite the fact that the issue concerns the agricultural world and the harvesting of processing tomatoes is nearly exclusively carried out mechanically - as ANICAV in recent years we have promoted a dialogue between all stakeholders, companies, professional agricultural organizations, industrial associations, large-scale retail trade unions and institutions, in the conviction that only through the involvement and empowerment of each one is it possible to find a solution to the problem, working on both fronts of raising the awareness of all parties involved, through sharing the problem among the different levels of representation, and of consultation with national and regional institutions. Environmental sustainability is also at the heart of the action of the processing tomato supply chain, which has implemented a series of virtuous behaviours aimed at responsibly safeguarding of the territory and the environment in which we operate. Our companies, while managing production processes with a low environmental impact that don’t generate toxic-harmful pollutants, are committed to paths of waste reduction and energy and water efficiencies by investing in process innovations aimed at lower CO2 emissions, water recycling, lower waste production and greater waste recovery, and the use of recyclable packaging according to the principles of the circular economy. Much has been done, but much remains to be done.

How are ANICAV and companies of the sector moving to provide more assurance to consumers?

How are ANICAV and companies of the sector moving to provide more assurance to consumers? As Association, our total commitment to maximum transparency to protect consumers is well known, as also witnessed over the years by the positions taken in support of the introduction of mandatory origin labelling for all tomato products. We are committed to carrying out, in synergy with the Stazione Sperimentale delle Conserve (SSICA) and the ICQRF of the MiPAAF, an important work for the characterization of the macro and micro mineral elements present in tomatoes aimed at the identification of the area of origin of the tomato products, which, once implemented, can be a fundamental tool in the defence of our productions and in the protection of the final consumer.

ANICAV is a partner of BMTI in the project called Fi.Le. Filiera Legale. What is the balance of the project? Are there any numbers that can be highlighted?

ANICAV is a partner of BMTI in the project called Fi.Le. Filiera Legale. What is the balance of the project? Are there any numbers that can be highlighted? Fi.Le. Filiera Legale is an ambitious project that seeks to combine the need to mitigate a serious blight - labour exploitation in agriculture - with the use of technology. Transportation to and from the fields, housing and the juncture of labour supply and demand are the points on which the project is developed, which, as ANICAV, we immediately championed by supporting BMTI from the phase of identifying the activities to be put in place to their implementation. The Association has made available all the satellite mapping data of the areas cultivated with the tomatoes for processing in the province of Foggia and has developed a specific app that will enable the identification in a timely manner of the surfaces planted with tomatoes and verify the state of maturity of the crops in order to know in advance where and when there will be a need for labour to allow the organization of transportation and housing solutions. Our activity, of course, is part of a broader work involving all the partners in the project. We hope that, through strong awareness-raising activities and the implementation of structural interventions, we can achieve the overcoming of critical issues and improve the agricultural production system, promoting legality.

Are there any projects in progress or about to be launched dedicated to tomato in Italy and/or abroad? If so, which ones? With what objectives?

Are there any projects in progress or about to be launched dedicated to tomato in Italy and/or abroad? If so, which ones? With what objectives? On the internationalization front, the two promotion projects, carried out under Reg. 1144/2014, aimed at supporting member companies in the route of valorisation and promotion of Italian tomatoes in the world, have just ended: one for the U.S. market and one for the Asian market, which covered China, South Korea and Japan, with the primary objective of educating on the consumption of tomato products and increasing and consolidating exports in these areas. The two projects were developed in the midst of a pandemic, which made it more difficult to carry out some of the activities particularly in the field, some of which suffered various postponements or cancellations. The goals we had set for ourselves were achieved with an important increase in exports to the target countries and with a massive media and social presence on which we worked particularly hard in view of the limited action on in-person activities. We are already working on two new projects on some markets that we hope will be able to gather approval from the European Commission”.

INTERVIEW

MARCO SERAFINI – ANICAV PRESIDENT

INTERVIEW

MARCO SERAFINI – ANICAV PRESIDENT

Was there any particular critical issues during the course of this campaign?

Was there any particular critical issues during the course of this campaign? "We imagined that this tomato processing campaign would be characterized by great difficulties, but the reality has been far worse. The industry is literally on its knees because of production costs that are completely out of control. The staggering increase in energy prices is what immediately leaps out. The cost of diesel fuel has driven up the cost of transportation, but more than anything else, exponential increases, even over 1000%, in methane gas, the most widely used in tomato canning industries, have caused serious problems. And furthermore, steel, necessary for the production of the cans that are the main packaging for our products, glass, paper and paints for labels, cardboard, plastic and wood for secondary packaging - all have registered double-digit increases. Moreover, as if this was not enough, the temptation of speculation by the agricultural sector in the South Centre basin has also contributed to worsen a context already full of difficulties. We were forced to endure pressure from farmers who, despite the high average price of the raw material recognized, with increases in price unmatched in the history of our supply chain, advanced unjustified and unfounded requests for further increases, putting the entire sector at risk and fuelling an inflationary spiral to the detriment of the end consumer.

What has been the impact on companies?

What has been the impact on companies?We must consider that a highly seasonal system, such as ours, with production concentrated in only 45 to 60 processing days during which tomato is produced to be distributed over 12 to 14 months, tends to suffer even more damage than other sectors from a situation such as the one that has arisen. Specifically, the productions of our industries and, consequently, their consumption of gas and electricity are concentrated between the months of July and September, a period when this year energy costs have reached excessive levels with major repercussions on companies that have not been able in any way to postpone or suspend processing. Environmental sustainability is a priority for companies in our sector, which in recent years have made major investments aimed at both energy efficiency in plants and the construction of alternative energy plants. This is despite the fact that the cost of gas and energy, both direct and indirect, continues to be an important item in the company's income statement, and while before this situation, these costs accounted for between 4 and 5 %, they now weigh in at 20 to 22 %. This is certainly an extraordinary situation where, however, the speculative component is quite evident. A very complex situation, difficult to manage especially considering the obvious difficulties that our companies will have in transferring these increases to large retailers, therefore, how much this will affect the final consumer will also depend on the choices of all the players involved in the supply chain. However, it must be said that since ours is a cheap and low-cost product, even a large percentage increase would affect the value of the the shopping cart, in absolute value, only by a few euro cents.

What actions have you put in place to face these difficulties?

What actions have you put in place to face these difficulties?As ANICAV, and in support of the Italian processing industry, we loudly demanded concrete support from the Government that in some way could consider our condition as a highly seasonal sector. In addition to the cap on the gas price and the decoupling of renewable and fossil energies for energy pricing, which are, in our view, more than reasonable measures, we immediately demanded the doubling of the tax credit provided for companies with high gas and energy consumption and the extension of the terms of use with more favourable conditions, the zeroing or lowering of interest when payments are deferred, and the suspension of the ETS mechanism, proposals that would have been a real shot in the arm for companies. We have not been able to obtain any measures; even the improved tax credit conditions provided for in the “Aid Ter Decree” (exclusively on gas and electricity consumption in October and November) will not be able to bring any benefit to our companies that have concluded their processing activities at the end of September. In addition, our request to ARERA - the National Regulatory Authority for Energy Networks and Environment - for a review of the cost of allocating natural gas transportation capacity (so-called "fixed term"), is still pending. This has a significant impact on the costs of highly seasonal companies like ours whose energy needs are concentrated exclusively in the summer period, which is the one with the lowest consumption.

The tomato processing sector is an export-oriented sector. Do you find particular critical issues in exporting to certain countries?

The tomato processing sector is an export-oriented sector. Do you find particular critical issues in exporting to certain countries? In the recent period, the increase in the cost of sea freight, especially for exports to the U.S., is causing some problems for companies. Increases of up to 300%, not justified by current market prices, are creating an unsustainable situation for companies when the low value of our products in taken into consideration (production costs are, today, almost equivalent to those of the freight rates) and the fact that the United States are the first non-European destination market for tomato products. This situation could lead, in the medium term, to a loss of market share since the end consumer, although willing to pay a premium price for the quality of Made In Italy products, will not be inclined to pay a further price increase linked to freight rates, thwarting the efforts made by our industrial system in recent years to counteract the problem of Italian Sounding in a country, such as the United States, which is historically the world's leading producer of processed tomatoes.

Is the problem of "selling at the right price" still to be solved? Which actions could be taken?

Is the problem of "selling at the right price" still to be solved? Which actions could be taken? The need remains to "move" the tomato away from the concept of a low-cost commodity, focusing on the right information and the education of an aware consumer who is willing to pay a premium price that, in addition to the great quality of our products, recognizes the efforts made by the supply chain in terms of ethical, social and environmental sustainability and the great attention that the agri-food industry has for food safety and for the safeguarding of a product, with recognized health qualities, which, thanks to the processing industry, maintains all the characteristics of the fresh product. It is time to change the paradigm: it is impossible to have the best product at the lowest price and the consumer must be aware of this.

Our challenge for the coming months will be to consolidate the consumer's newfound appeal for canned tomatoes in the pandemic period in order to be able to improve our margins and be able to redistribute it throughout all the supply chain.

It will be essential to work towards a more and more organized and cohesive supply chain by consolidating the relationship between the industry and the agricultural side and by strengthening the dialogue with the large-scale distribution, which will not be able to consider always and no matter what simply the "price". We are, however, aware of the difficulties we will be have to overcome by having to deal with increases in the prices of raw materials and energy in particular, to which will inevitably be added a worrying inflationary context.

ANICAV supports medical research in collaboration with the Fondazione Umberto Veronesi to fund pediatric cancer studies. Can you tell something about this initiative?

ANICAV supports medical research in collaboration with the Fondazione Umberto Veronesi to fund pediatric cancer studies. Can you tell something about this initiative? Our Association, and especially our Young Entrepreneurs Group, has always been involved in social initiatives. In this context, we imagined, already six years ago, to set up a project that on the one hand would highlight the health properties of our tomato, unanimously recognized by the scientific community, and on the other hand could satisfy our desire to give a serious and concrete contribution to scientific research. Thus, from the collaboration with Fondazione Umberto Veronesi - which enthusiastically welcomed our proposal - and thanks to the partnership with the RICREA Consortium, in 2018 the project "Il Pomodoro per la ricerca. Buono per te, buono per l’ambiente" (Tomato for research, Good for You, Good for the environment) to raise funds for scientific research in the field of paediatric oncology was born".

Source: ANICAV

Article extracted from The 2022 Processed Tomato Yearbook which was distributed free of charge to the attendees of the Tomato News & Il Filo Rosso Conference organized in Parma as part of the CibusTec Forum on 25 October 2022.

Article extracted from The 2022 Processed Tomato Yearbook which was distributed free of charge to the attendees of the Tomato News & Il Filo Rosso Conference organized in Parma as part of the CibusTec Forum on 25 October 2022.

The magazine can be ordered at a price of 100 euros (inc. p&p) from here