Argentina, Paraguay, Venezuela, Serbia, Iran, Kazakhstan, Pakistan, India, the Philippines, Egypt, Kenya, Ghana, Nigeria, Namibia, Zimbabwe, Togo... This list of countries that have planned to set up – or have actually set up – tomato processing plants in recent years is a long one, and far from comprehensive (see our related articles below). It is accompanied by the long list of countries that have been increasing or reorganizing the capacity of their existing plants, and testifies to the implementation all over the world of industrial approaches aiming to develop local agricultural production, as well as to the desire of politicians to free themselves from food dependency, sometimes even hoping to achieve self-sufficiency.

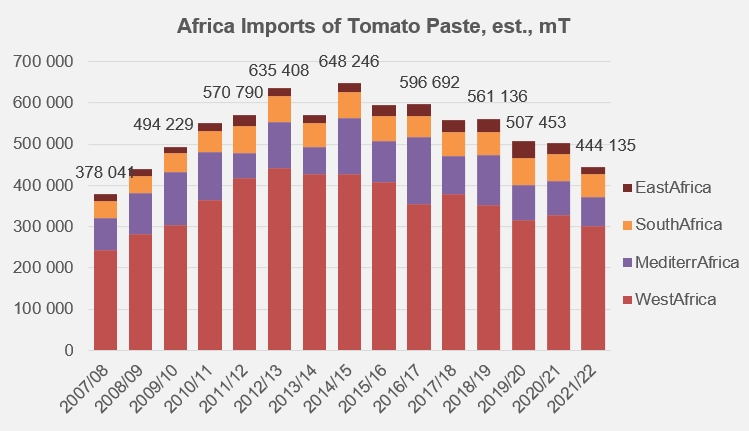

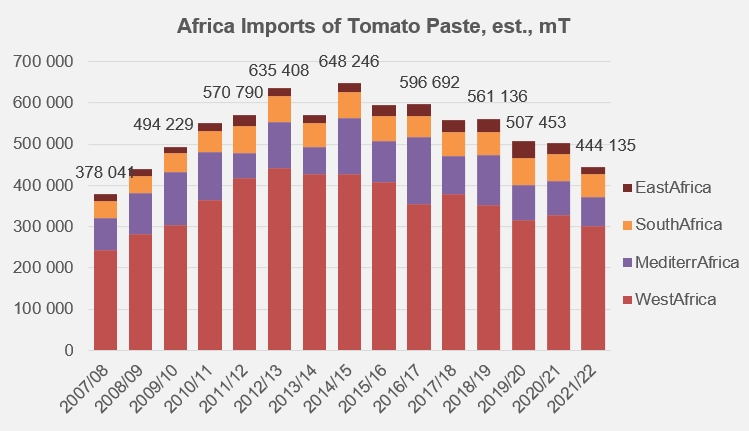

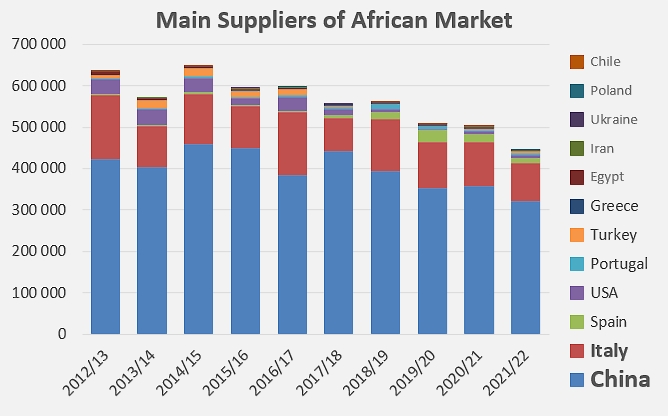

Africa is home to many of these countries and is a good indicator of these developments that have contributed to an erosion of the export operations of the major leading countries of the sector in recent years. According to a conservative estimate based on the customs statistics of the twelve largest processing and exporting countries, the quantities involved over the past fifteen years show that the steady growth in sales of paste to African countries came to an end in 2013/2014 and gave way to an equally steady decline that has continued since that date. African imports of pastes peaked at around 650,000 mT in 2014/2015; over the past seven years, they have fallen by almost a third, and amounted to only a little over 444,000 mT over the past marketing year.

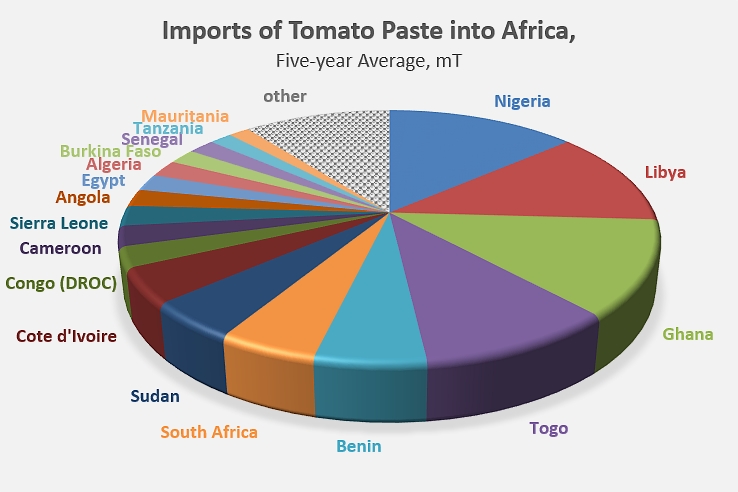

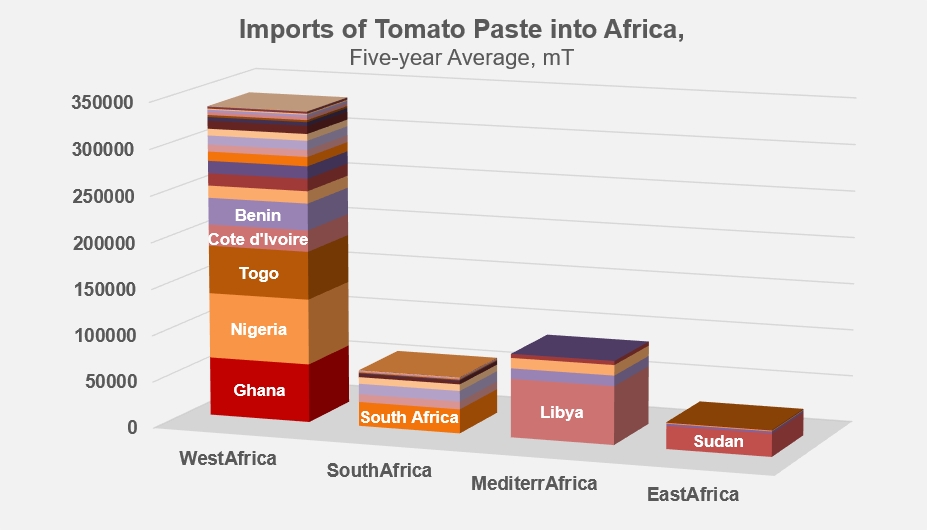

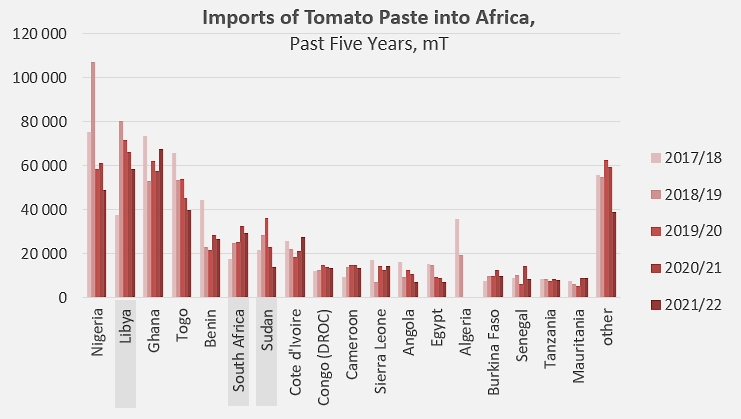

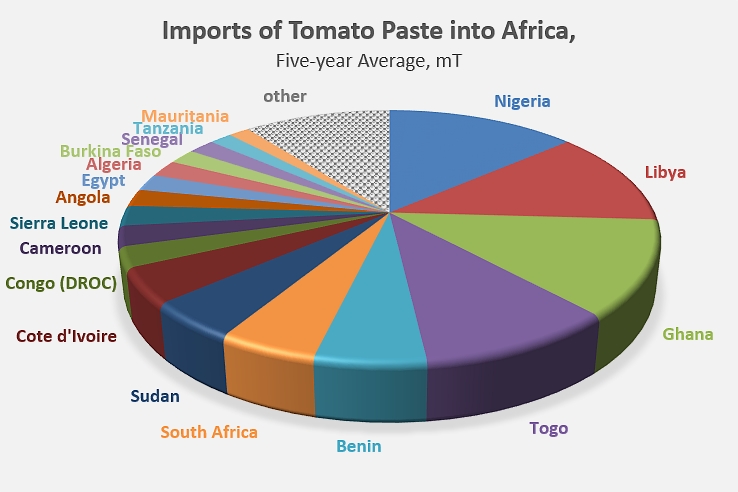

Some fifteen destination markets account for the bulk of the total quantities imported on the continent (nearly 90% on average over the last five years), with great disparities between the largest (Nigeria, Libya, Togo, etc.) and the smaller ones (Senegal, Tanzania, Mauritania, etc.). However, apart from Sudan, Libya and South Africa, all the main importing countries (Ghana, Nigeria, Togo, Cote d'Ivoire, Benin, Sierra Leone, Cameroon, Congo (DRC)) belong to the West Africa region, which, despite the marked decline in its imports, has nevertheless accounted for two-thirds of the continent's total purchases over the last ten years. Developments in recent years have been extremely variable depending on the countries considered and, despite some notable and isolated increases (Ghana, Benin, South Africa, Côte d'Ivoire), decreases have prevailed, among which several have proved decisive (Nigeria, Libya, Togo, Sudan, Angola, Egypt, Algeria, etc.) (See additional information at the end of this article.)

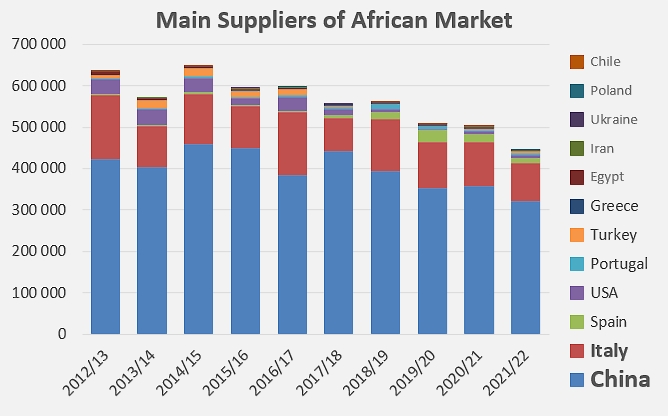

The decline in African purchases has impacted virtually all countries supplying pastes to the African market, with the notable but perhaps momentary exception of Spain, whose privileged ties with Morocco and recent development of shipments to South Africa led to significant increases over the 2019/2020 and 2020/2021 marketing years. To a lesser extent, a similar remark could be made about Portugal and the peak of its sales to Sudan in 2018/2019. But the last ten marketing years have been synonymous with decline for the sector as a whole, like for the two main suppliers of pastes to Africa, China and Italy, which have supplied more than 90% of the continent's imports for two decades, with a decline of more than 100,000 mT (-22%) for China and nearly 63,000 mT (-52%) for Italy. US products relinquished a little more than 28,000 mT (-82%) over this period (2012/2013-2021/2022), Turkey about 4,000 mT (-23%), and Egypt a little more than 7,800 mT. At the same time, Spanish products have increased by over 8,400 mT, while Portuguese paste shipments grew by 3,000 mT. In short, over the past ten years, the African market has contracted by a little over 190,000 mT, a decline in imports of about 30%.

Some complementary data

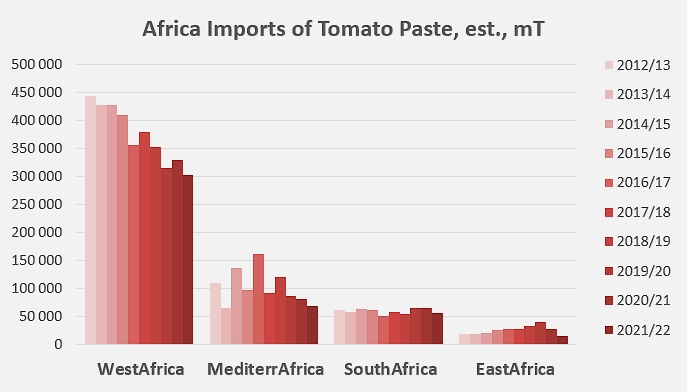

West Africa is the most important region in terms of imports, but it is also the one whose imports have declined most drastically. Developments in the other regions have been more erratic (Mediterranean Africa), relatively insignificant (Southern Africa), or of no particular impact (Eastern Africa).

Evolution of trade for the main African countries importing pastes over the last five years.

African imports of tomato pastes, by region and country, averaged over the last five years.

Sources: Trade Data Monitor