High costs for the worldwide industry

A long time before the particularly adverse weather conditions of spring and summer 2021 disrupted harvest operations and jeopardized industrial processing programs, the worldwide industry knew that it was heading into a particularly difficult year in economic terms as it approached the 2021 production season.

As early as the fall of 2020, when the CoVid pandemic was imposing unprecedented constraints on all industries throughout the world and causing radical shifts in lifestyle and consumption habits, it became obvious that the global health crisis and the early signs of recovery that followed were occurring in the context of rises in the costs of production and processing that had virtually never been seen before, affecting plant-health inputs, tomato raw materials, energy, labor, packaging, polymers, wood, transport, various industrial chemical substances, environmental constraints, etc.

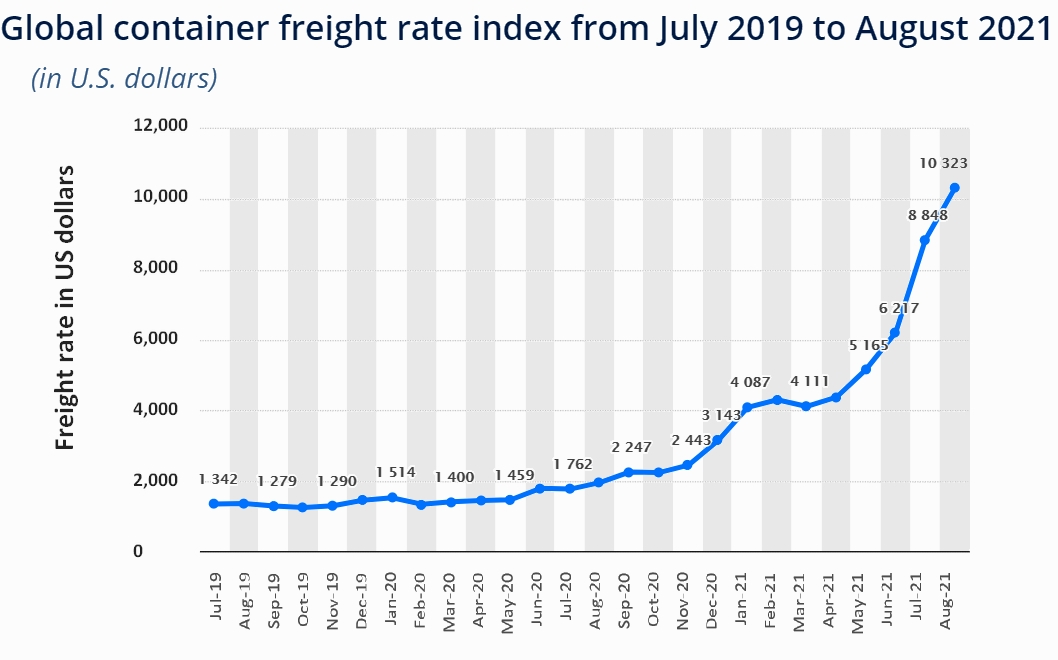

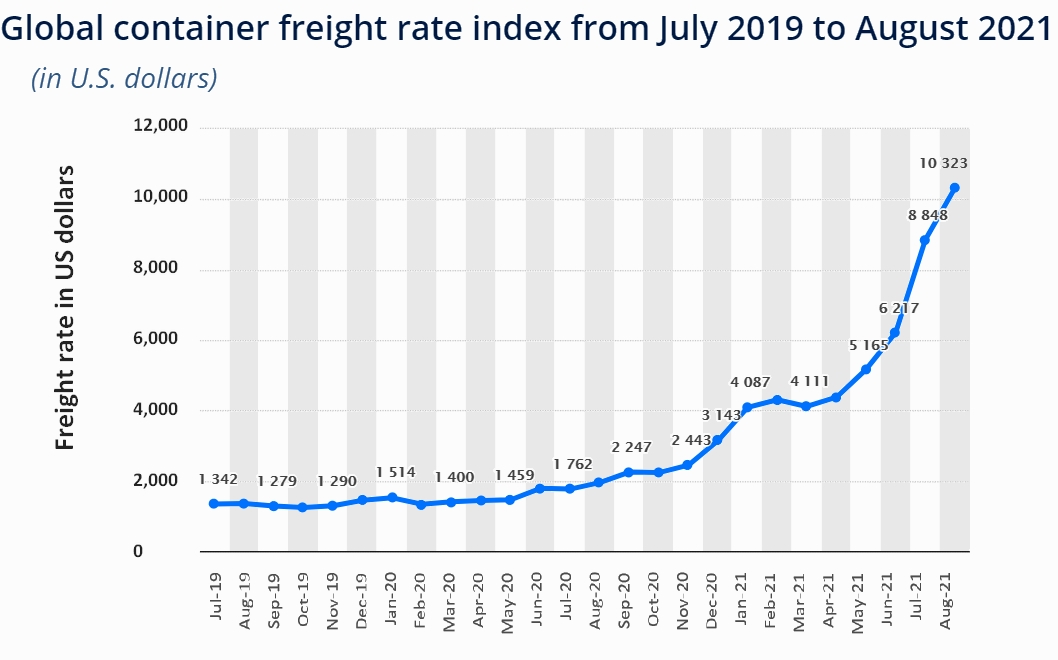

Maritime transport: with the pandemic, costs have exploded

One of the most "obvious" effects of the recovery that got underway at the end of 2020, if not the one with the highest impact, has been the soaring costs of maritime transport over just a few months. Renting a container for transfer between China and Europe cost four times more in October 2020 than in November 2019. This explosion in costs can be explained by the very high demand for manufactured products shipped from Asia. The main items have been medical material, masks, medicines, etc., as well as items of electronic equipment in response to the newly popular trend of working from home. Consequently, the demand for shipping all these products has taken off, and the availability of containers has shrunk considerably. This is all the more true for the fact that restrictions linked to the Covid-19 health situation have also disrupted the world's shipping trade in terms of human labor, leading to major delays in ports, just when they were no longer being affected by dockers' strikes.

In January 2021, 20-feet containers shipping between China and Europe cost USD 4,400, according to the Shanghai Containerized Freight Index (SCFI), whereas they were being negotiated for USD 1,000 in July 2020, and the price for 40-feet containers had jumped to more than USD 9,000. However, at the time, there was a distinct shortage of available containers and shipping capacity.

Three factors explain this situation, according to one expert in maritime transport and logistics: "a decrease in the number of available containers, a sudden increase in demand over the second semester of the year and, above all, the fact that trans-Pacific freight was absorbing all of the world's capacity. Furthermore, a lot of containers were blocked in the United States, but also in Australia where container-carriers were hampered in their movements by labor strikes, and in China due to the temporary closure of a number of maritime terminals because of the strict enforcement of control measures against the Covid-19 pandemic."

"During the first semester of 2020 and over the confinement period, shipping companies reduced their capacity by 30%. And time was needed to get container-carriers back to sea. Suddenly, demand took off, causing a real disruption in the international markets with regard to required services," explained the head of a users' association of shipping transport clients. "Consequences have been huge for shippers (processors and distributors, freight company clients). The increase in the price for shipping containers between China and Europe has impacted most of the industrial sectors, both in terms of import and export. Furthermore, some of the shipping companies have stopped responding, response delays have increased considerably, and this has imposed on shippers the need to book 50 days in advance instead of the usual 10 days."

"During the first semester of 2020 and over the confinement period, shipping companies reduced their capacity by 30%. And time was needed to get container-carriers back to sea. Suddenly, demand took off, causing a real disruption in the international markets with regard to required services," explained the head of a users' association of shipping transport clients. "Consequences have been huge for shippers (processors and distributors, freight company clients). The increase in the price for shipping containers between China and Europe has impacted most of the industrial sectors, both in terms of import and export. Furthermore, some of the shipping companies have stopped responding, response delays have increased considerably, and this has imposed on shippers the need to book 50 days in advance instead of the usual 10 days."

Industry professionals have reported "a generalization of the increase in shipping costs, which has hit all maritime routes." In August 2021, while shipping operators responsible for 90% of the world's exchange of goods could still not respond to the demand driven by the recovery of the economy, freight prices were multiplied by five compared to the beginning of the health crisis.

Boosted by this intense situation in terms of maritime transport, industry results literally exploded. According to one cabinet expert, "the profession recorded in 2020 almost $16 billion of profits, which is approximately twice the total amount generated over the five previous marketing years."

This invoice was previously paid by relevant companies, but it could, in the end, also have an impact on the spending of consumers.

According to the Mintec assessment released in late August, the cost of containerized freight has reached an all-time high.

The global shipping composite index (based on 11 east-west trade routes) reached a monthly average of USD 8,796 per 40-foot container in June. This is up +24% month-on-month, and up a "staggering" +309% year-on-year.

"Shipping rates are poised to remain elevated for the foreseeable future," says Mintec. "Bimco, the world’s largest international shipping association, expects firm prices to prevail through Q4 2021 at least, and most likely through H1 2022, stating that high freight costs are still being priced into contracts for the next 6-12 months."

"Additionally, experts predict that it could take at least until late Q4 2021 to clear the port backlog at some of the key trade hubs. This scenario presents upside price risk, particularly for goods moving from Asia to Europe and the Americas, such as coffee, prawns, mangoes and rice..."

The index represents a market rate for freight for any given shipping lane for a 40' container.

(Source: Statista)

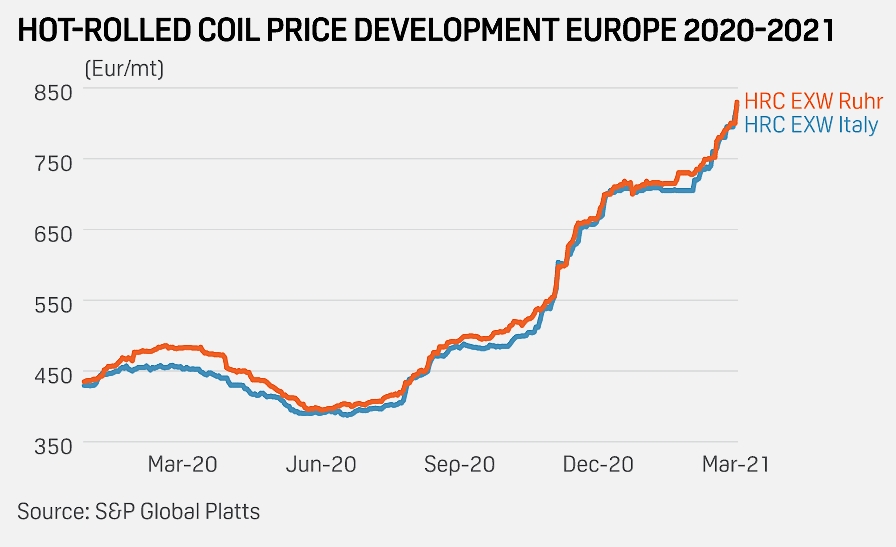

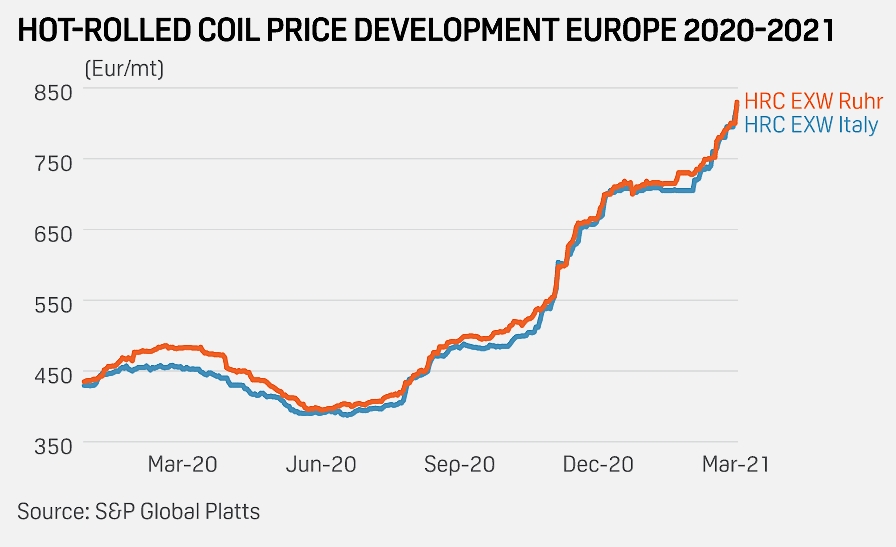

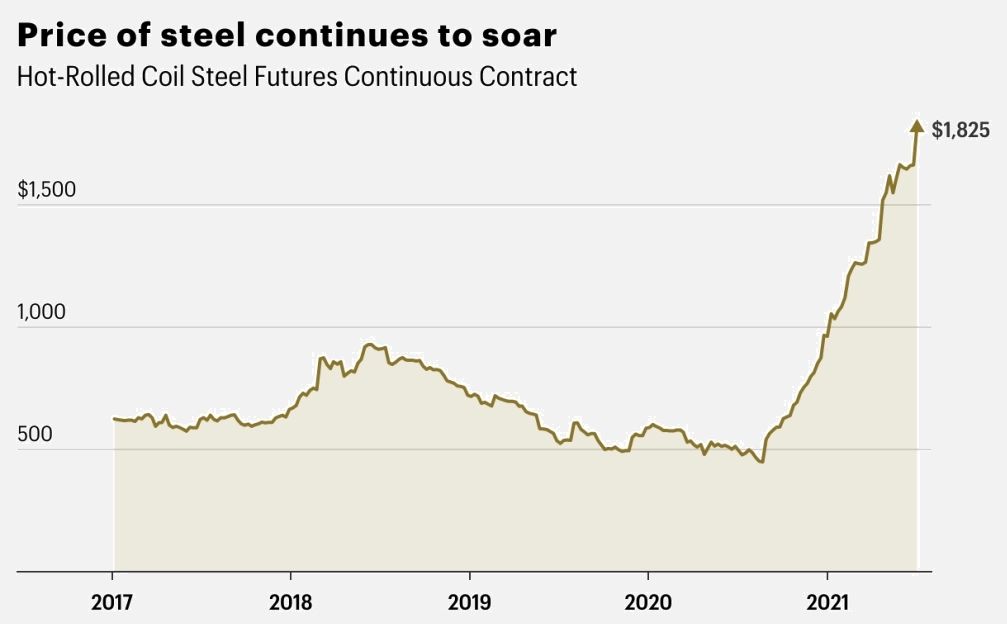

Steel: why have prices taken off?

The tomato processing industry, which is a major user of equipments and containers in steel and tin, is particularly vulnerable to incidents occurring within the industrial metal sector. In fact, the brutal increase in the price of steel in recent months has also caused a number of concerns as the processing season gets underway.

Whereas the price of steel recorded a decrease throughout 2019, right up until the third term of 2020, prices then jumped by 15 to 25%. "I believe that we have not known such a sharp and sudden increase since the crisis of 2008," stated an expert of the metal industry in February 2021. "There was an initial increase in prices in November (2020). Then we saw a sharp acceleration of this increase in December, and it continued into the new year." It was mainly supply delays that got longer. "After what used to be an almost immediate availability, we shifted to much longer delays, up to three or four months for certain categories of products," confirmed the same source.

Whereas the price of a tonne of steel from blast furnace installations was recorded at approximately EUR 250 before November, the same quantity was being negotiated at around EUR 600 during the first semester of 2021.

A discrepancy between offer and demand

"With the health crisis, the sudden interruption of industrial processing in Europe around mid-March, and a collapse of end-demand, the major steel operators decided to stop blast furnace operations," explained an expert of the steel market. "About a dozen of these installations were shut down, accounting for about 50% of Europe's output! With the economic relaunch during spring, as long as demand remained weak, current stocks were sufficient," continued the same source. "The situation reached a certain balance at the approach of summer, and there was a progressive recovery of demand as September 2020 got underway. But at the same time, manufacturers decided not to restart the blast furnaces. Surplus stocks ran out while demand continued to grow, with a further takeoff in supply needs at the end of the year. This discrepancy between the lack of supply and a very heavy demand created tensions for the prices under negotiation for over-the-counter transactions on a month by month basis." So the brutal rise in prices was also accompanied by a shortfall of available products, leading to a major lack of several particular product ranges.

According to operators of the steel industry themselves who were questioned last spring regarding the evolution of the situation, "the possibility of a return to normal is not an option for the near future. Some manufacturers [...] announced that they intended to restart their blast furnaces. But such installations require several weeks to restart properly. It is expected that the impact will be felt during the second term, provided of course that demand remains high."

At the beginning of summer 2021, it was obvious that the situation was not improving. According to sources within the worldwide metal industry, the rise in the cost of raw materials was hindering any recovery. The decrease in production, the increase in requirements linked to European recovery plans, the positioning of China and the United States on premium markets – all this led to an explosion of demand and a significant rise in prices.

"Even for the metal industry, it is a hard blow at a time of post-Covid recovery. Raw material costs have increased between 30 and 100%. We had already seen increases for special steels and processed steels, but in this instance, the increases have affected basic steel as well; it affects everyone," noted the head of a steel industry association. "During the confinement, steel manufacturers shut down the blast furnaces. It takes several months to start them up again. So production is very insufficient." With Chinese activity picking up again ahead of the European economy, which has benefited from stimulus plans, global demand has literally exploded.

In its information regarding the situation on the flat steel market, the SEFA (European Association of Steel Drum Manufacturers) wrote on 25 March 2021 that "experts had already suspected in January 2021 that the situation on the European flat steel market could become even worse. This has [finally] happened and [was] likely to continue throughout the year." At this time, SEFA said its industry would "continue to be affected by these extraordinary supply shortages in the coming months," adding that this would "continue to put a strain on the thoroughly tense relationship between manufacturers of steel drums and their customers. The situation of supply shortages on the flat steel market described in January [had] developed into a threatening shortage in recent weeks. Steel users in all market segments [faced] insufficient availability of steel supplies from steel mills and service centers. There [were] shortfalls and delays in current contracts. Covering replacement volumes and additional quantities [was] becoming increasingly difficult because there [were] hardly any stocks left. The spot market [was] empty and there [was] a lack of sufficient supplies from the mills. This situation [affected] the entire flat steel market, whereby the situation [was] particularly critical for hot-dip galvanized sheet according to existing reports. And so, the manufacturers of steel drums [were] not isolated from this unexpected and unique situation. Relevant steel market experts described that the supply shortage in the European steel market would continue at least until the end of this year (2021)."

According to SEFA, "the most important cause for this situation [was] the asynchronous development of supply and demand. The production of the EU plants [was] still not sufficient to cover the customers' needs, while expansion of production by ThyssenKrupp Steel or Salzgitter AG in Germany, and by Arcelor Mittal in Italy encountered technical or legal obstacles."

German steel market analyst Andreas Schneider summed up the consequences of the shortage: "Steel is no longer sold in many cases, but allocated – In the case of new inquiries, delivery times in the 4th quarter are already being quoted, binding delivery dates are scarce. Even nine months after the start of the upswing in demand, EU producers are not managing to meet their customers' demand."

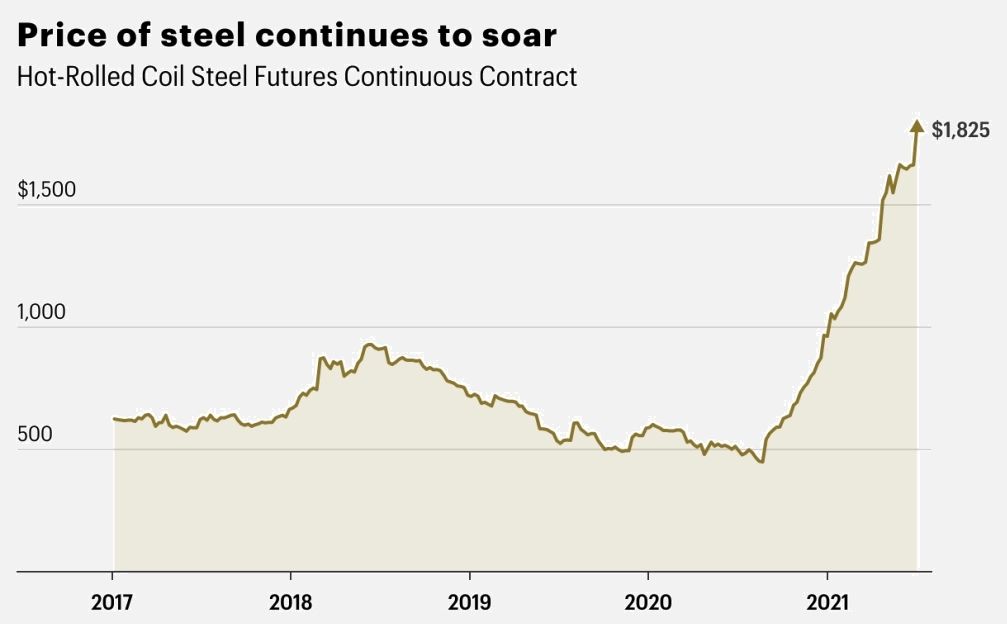

US steel prices up over 200% and expected to remain high into 2022

According to comments published in the US press in late July, US steel prices traded between USD 500 and USD 800 in March 2020, prior to the Covid-19 pandemic. During the initial months of the pandemic shutdowns, many steel mills in the United States halted production under the assumption that the world was heading into a deep recession. However, the decline in demand for iron ore and steel did not last long at all.

The change in spending habits and patterns of consumption due to the pandemic has caused a far greater demand than expected in the steel industry. This, combined with a very limited supply due to the closing of many steel mills, led to the price of steel skyrocketing, with the futures price of hot-rolled steel up over 200% trading at USD 1,800 as of July 2021.

At this time, prices were expected to remain high due to the massive outstripping of demand vs supply, and the time it will take for supply to catch up and replenish depleted steel stockpiles.

For their part, Chinese steel prices have traded up consistently since April 2020, with a short decline period around December 2020. Around mid-May (2021), all forms of Chinese steel prices peaked, as demand continued to soar in the country. Steel demand in China has increased in the past few months, with the government implementing its economic recovery plan, which includes infrastructure spending.

At the end of May, Chinese prices were "regulated" by government measures intended to curb excessive speculation. After Chinese prices corrected, they continued to go up but at a slower rate, closing May at CNY 6,060 /mT (ca USD 949) from CNY 6,100 /mT (USD 949) at the end of April. Since then, they continued to increase the first week of June but remained below the CNY 6,250 /mT (USD 978) level.

According to professional sources, traders in Europe appear to be buying large volumes out of China at the moment, regardless of China’s cancellation of its export tax rebate, as steel from there is cheaper than what is rolled in Europe.

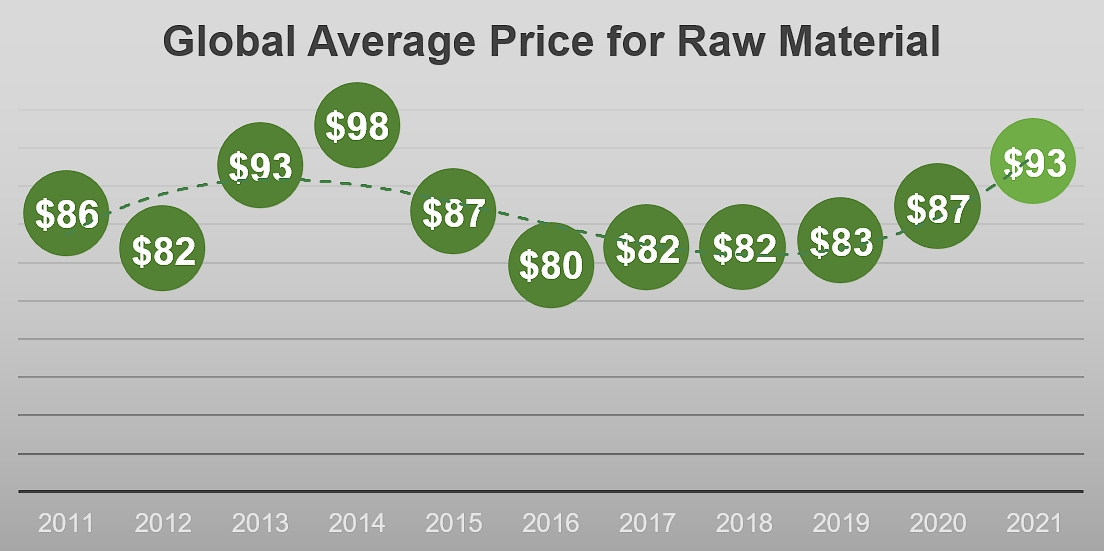

2021: sharp increase in the cost of raw materials

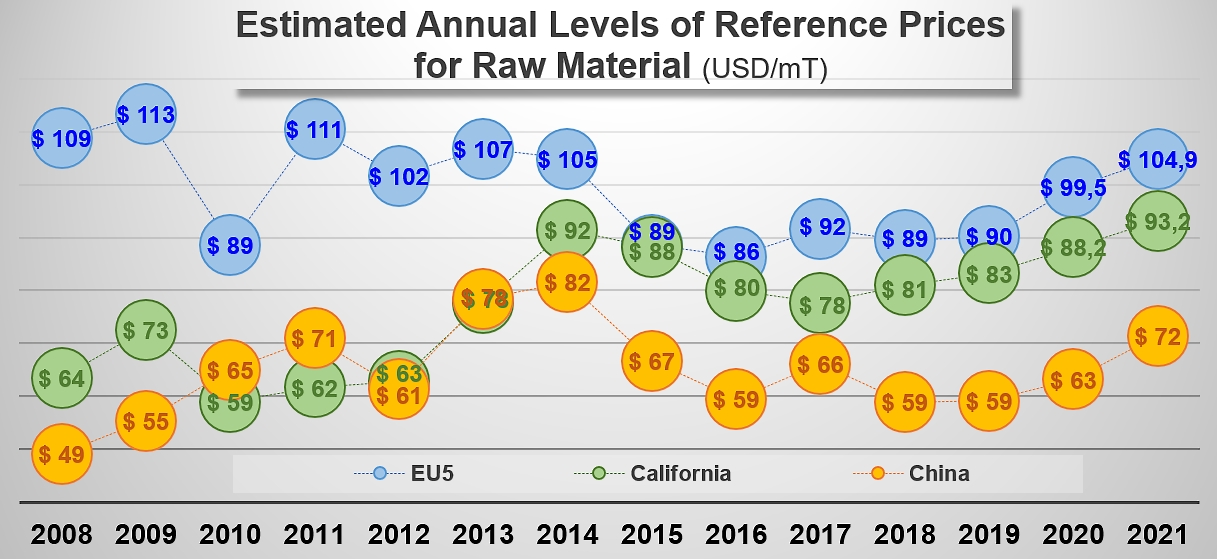

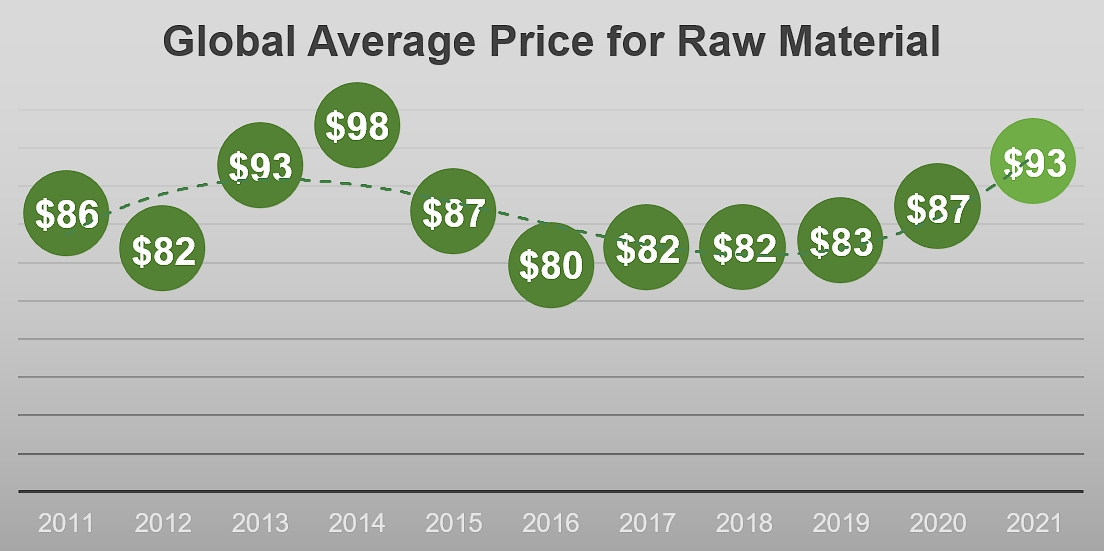

Processing tomatoes 10% more expensive than during three previous seasons

Information relating to reference prices gathered before the season by the WPTC show that 2021 prices for raw tomatoes have risen significantly from their 2020 level. This increase in the value of raw materials follows a 2020 campaign that was unsatisfactory in terms of volumes and therefore of income for growers, in a general context of rising prices and, in some cases, of a scarcity of inputs of all kinds – energy, plant-health-products, water, transport, packaging, etc.

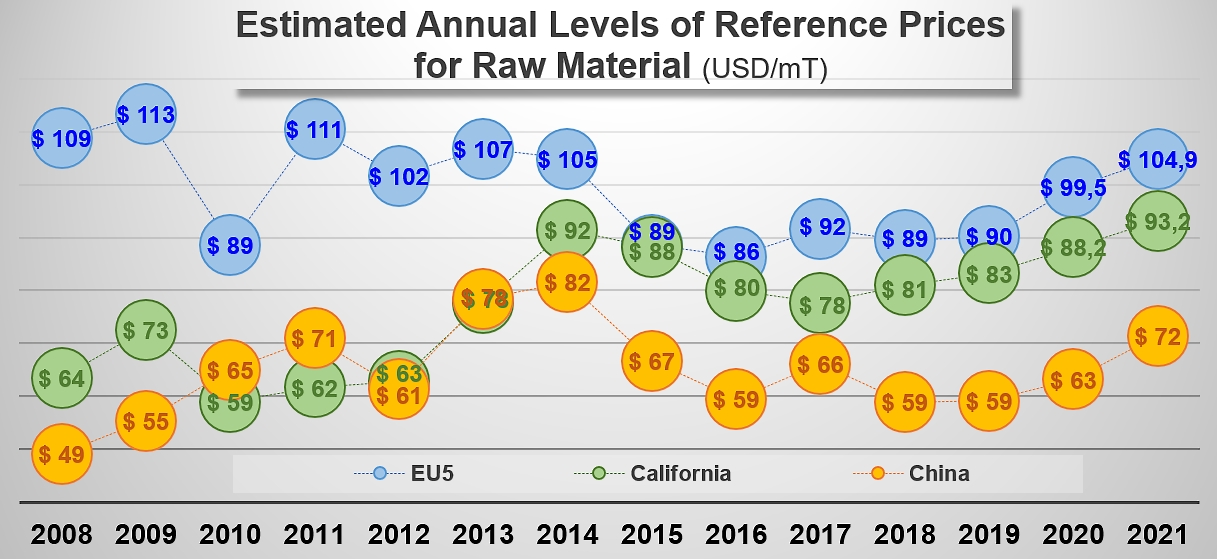

The overview of prices for processing tomatoes relates to about 72% of the processing intentions expected for the 2021 harvest, and it includes information stemming from all the main processing and supply regions. The combination of the volumes involved (27.6 million mT out of the 38.5 million mT forecast as of 3 September) and the prices concluded in the EU (Italy, Spain, Portugal, Greece and France), in California, in China, as well as in Hungary and Turkey, results in a weighted global value of approximately USD* 93 /mT, which is a 7% increase compared to the indicative value recorded last year (USD 87.1 /mT). This progression is even clearer when compared to the previous harvests, as the 2021 price level (valued 3 September) is 11% higher than the average reference price for the period running 2018-2020 (USD 84 /mT).

Among the raw materials absorbed by global exports of tomato paste, Chinese processing tomatoes remained the cheapest in 2021 (at approximately USD 72 /mT). According to local sources: "the price of raw tomato in China is RMB 450-480 /mT, which is RMB 30 /mT higher (almost 7%, 4.6 USD) than in 2020. According to the US dollar exchange rate (as of 15 March 2021), it is EUR 60 /mT or USD 71.5 /mT. The prices in the three regions are the same."

As for California, the reference price for processing tomatoes there (excluding late-season incentives and other specific modalities) has been stated this year at approximately USD 84.5 /short ton, which is just above USD 93 /mT, a 5 to 6% increase compared to the price of 2020.

The generalized increase has similarly affected the levels of prices paid for tomatoes as raw material in Europe also. Growth reached 5% in Northern Italy, exceeding 12% in Spain and 9% in Portugal, with the result that average values in Europe (approximately EUR 83.5 /mT) have risen in 2021 by 7% compared to what they were in 2020 and by 10% compared to the average of the three previous seasons (2018-2020). So the indicative reference price for processing tomatoes in Europe (expressed in USD per tonne) remains the highest throughout the world's main processing regions.

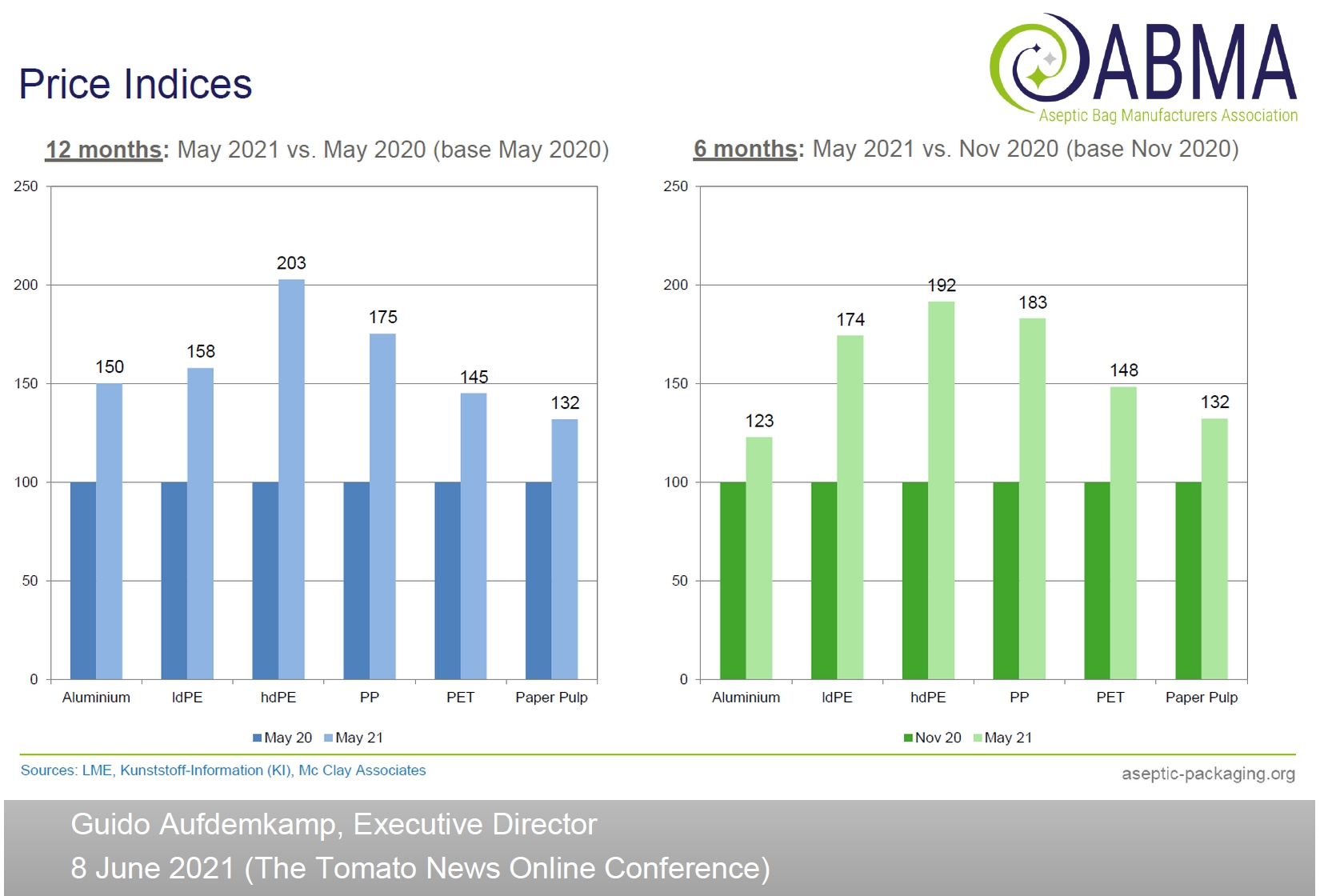

In conclusion, it is important to note that the increase in the price of tomatoes in 2021 has occurred in a general context of increased costs for production and processing. To quote the comments of an Italian processor before the season: "the pandemic has affected the global economy by reducing the GDP by more than 4% in 2020, slowing down and in some cases interrupting entire production sectors. The reduction of the economic cycle has led to an increase of all the commodities like iron, steel, copper, as well as wood, plastic and paper. Lack of flexibility in production capacity, sudden and huge requests from China and USA, sharp increases of freight rates in the area of international logistics, and speculative phenomena have been the main causes of these price increases."

According to the same source, between March 2020 and March 2021, prices increased for plastics by 120%, steel by 60%, wood by 130%, crude oil by 46%, energy (in general) by 12 to 15%, and carton-card by 10%. These increasing costs (as well as the increase in the price of tomatoes as a raw material) have been aggravated by the price of labor, environmental taxes, each tonne of CO2 emitted (in the European system for emissions rights), etc. The same observation was made also for other food industry sectors in Europe, and it was similar to what could be said of growers and processors in California.

As for the 2021 harvest season, the worldwide tomato processing industry actually is facing a completely unprecedented situation, positioned as it is between a marked and unexpected imbalance between production and demand and a spectacular increase in costs.

* (1 USD = 0.847466 Euro, average value July 1st – September 1st, 2021)

Some additional information

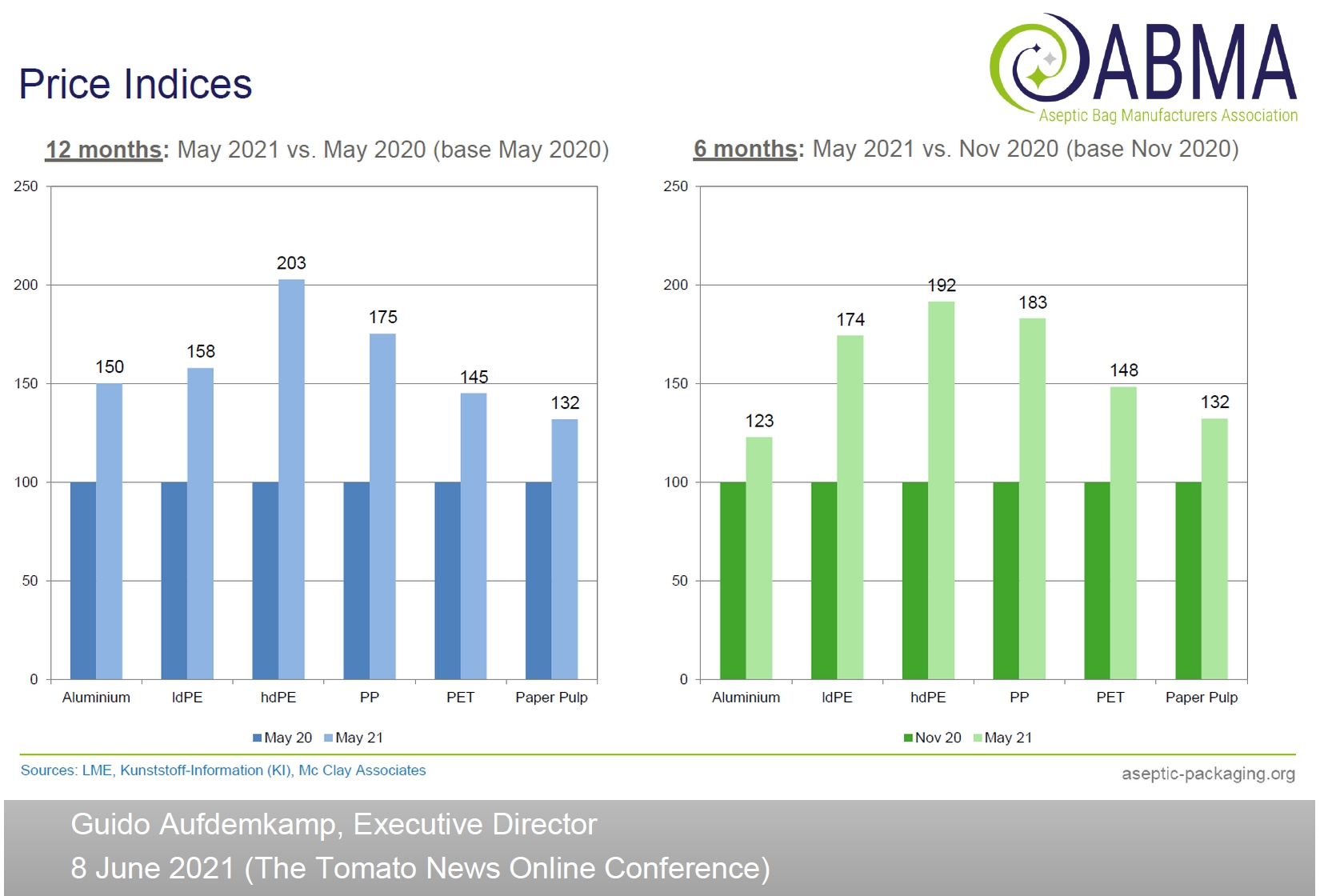

Guido Aufdemkamp, ABMA at Tomato News (June 8, 2021)

Indicators for the price of paper pulp, aluminum, polymers – price indexes (aluminum, ldPE hdPE, PP, PET, Paper Pulp).

Sources: rfi.fr, usinenouvelle.com, statista.com, lessor42.fr, lemoniteur.fr, sefa.be, metalbulletin.com, mining-technology.com, agmetalminer.com, Financial Times, TomatoNews, WPTC, OANDA

Further details in attached documents and connected events:

Several presentations also dealt with these topics during the Online Conference organized by TomatoNews on 8 June this year, which can be consulted on the following link: "The global tomato processing industry in 2021: Balanced supply amid rising costs"

"During the first semester of 2020 and over the confinement period, shipping companies reduced their capacity by 30%. And time was needed to get container-carriers back to sea. Suddenly, demand took off, causing a real disruption in the international markets with regard to required services," explained the head of a users' association of shipping transport clients. "Consequences have been huge for shippers (processors and distributors, freight company clients). The increase in the price for shipping containers between China and Europe has impacted most of the industrial sectors, both in terms of import and export. Furthermore, some of the shipping companies have stopped responding, response delays have increased considerably, and this has imposed on shippers the need to book 50 days in advance instead of the usual 10 days."

"During the first semester of 2020 and over the confinement period, shipping companies reduced their capacity by 30%. And time was needed to get container-carriers back to sea. Suddenly, demand took off, causing a real disruption in the international markets with regard to required services," explained the head of a users' association of shipping transport clients. "Consequences have been huge for shippers (processors and distributors, freight company clients). The increase in the price for shipping containers between China and Europe has impacted most of the industrial sectors, both in terms of import and export. Furthermore, some of the shipping companies have stopped responding, response delays have increased considerably, and this has imposed on shippers the need to book 50 days in advance instead of the usual 10 days."