The main operators responsible for the new dynamics

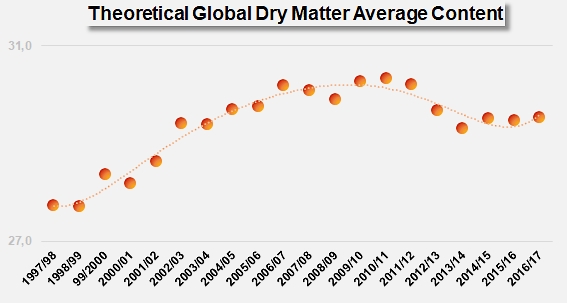

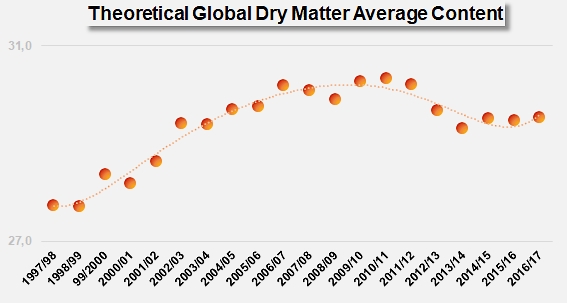

Along with the slowdown in the growth rate of trade that has been observed in recent years, a second phenomenon has been recorded that concerns the "quality" of the products traded rather than the quantities involved, and which has amplified the effects of that slowdown.

This second mechanism, which no doubt started even before the excess production of 2009, has directly affected the volumes of raw materials shipped in the context of the global paste trade. Consequently, it sheds new light on the way we measure the volumes of tomatoes consumed in processed form according to "farm weight equivalent" or "raw materials".

"The Brix Effect" and "the Tonnes Effect"

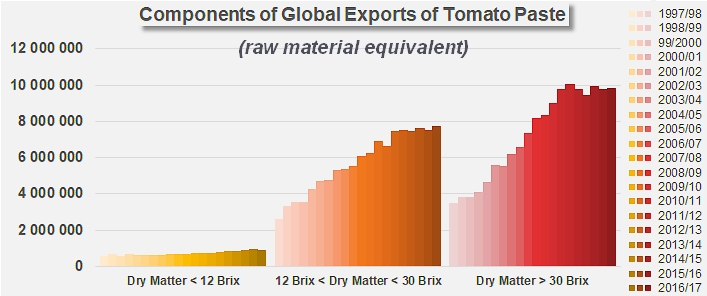

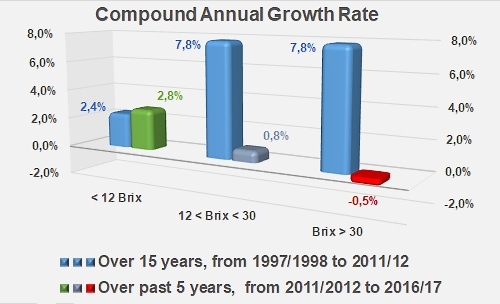

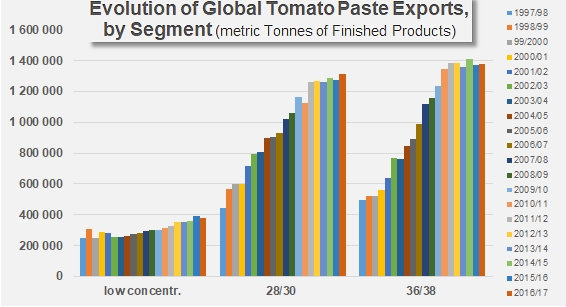

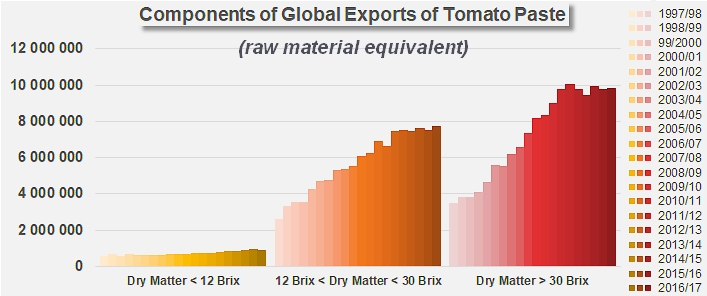

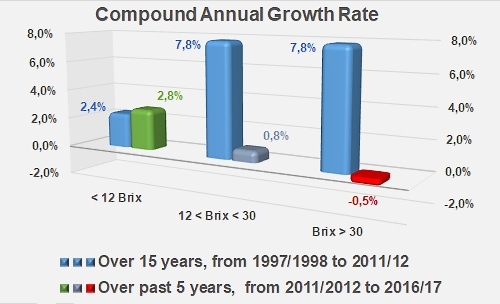

For several years now, research into the profitability of the paste processing sector has focused on commercial and technical decisions that attempt to break away from the constant race to produce bigger annual volumes. Growing numbers of processors tend to prefer adding value to existing capacity as a vector for improving profitability, rather than increasing the quantities processed. Environmental, economic, energy-related and regulatory concerns and constraints have all contributed to a general context that no longer favors "high concentration" products, which had previously been privileged because of reduced transport costs, thereby currently promoting a relative development of "low concentration" products. Over the past six or seven marketing years, a subtle evolution has been observed, which has noticeably modified the distribution of the components of the global paste trade. A finer analysis of foreign sales of the 15 leading countries in this sector shows that the preeminence of highly concentrated products (more than 30°Brix) has progressively decreased over the period, giving the opportunity to low- and medium-concentration products (below 12°Brix and between 12° and 30°Brix) to occupy an increasingly important place in worldwide trade patterns.

Everything tends to indicate that the average concentration of exported products has dropped slightly: the quantities of raw materials that would have been absorbed by exports in the prevailing context until 2008 or 2009 have been lower than expected, simply due to the new focus of industrial and commercial decisions. The volumes of raw tomato used by processors for the export markets have been eroded by this "Brix effect" to the point that for the 2016/2017 marketing year, the resulting "growth dip" has been estimated at approximately 0.75 million tonnes (farm weight equivalent).

As for the "cost" of the slowdown in the growth rate of the volumes traded – the "tonnes effect" –, it has amounted to approximately the processed equivalent of slightly more than 2.25 million tonnes of raw tomato. But the synergistic effect of these two joints dynamics (slower growth of export volumes and lower soluble solids content of the shipped products) has noticeably accentuated the "export shortfall" with which the category's leading countries have had to deal. In the final count, the slack recorded during the 2016/2017 marketing year in the context of these new global export dynamics amounts to the processed equivalent of some 3.4 million tonnes of raw tomatoes, a volume on which processors can no longer depend in order to consolidate their profitability or acquire new market shares.

Over the past five marketing years, total paste volumes (finished products) exported have grown almost 3.5 times faster (CAGR 0,64%) than the corresponding volumes of raw materials used (CAGR 0,18%).

The main operators responsible for these new dynamics

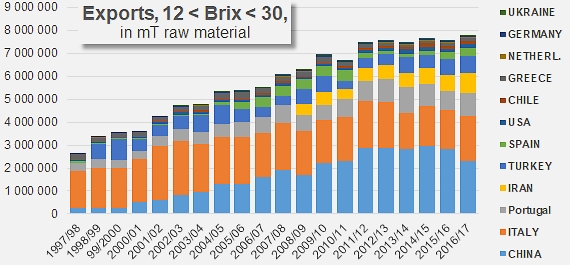

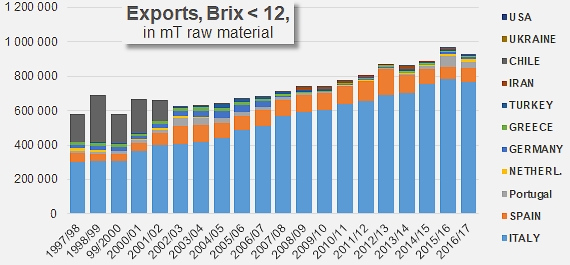

As expected, all the countries do not play the same role in each of the subcategories. For instance, global exports of "low concentration" purées can mainly and increasingly be attributed to Italian operators who were responsible in 2016/2017 for close on 83% of the movements in this sector (369 000 mT on average between 2012/2013 and 2016/2017). Spanish products and, to a lesser extent, Portuguese ones have been the only serious competition in this category, which recorded last year its first notable drop since the 2002/2003 marketing year.

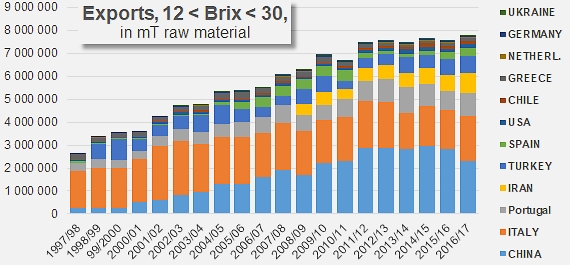

The distribution of worldwide exports in the segment of 12-30°Brix paste (1.28 million mT of finished products on average over the past five marketing years) is more balanced, with contributions in 2016/2017 from China (30% of the total), Italy (25%), Portugal (13%), Iran (11%), Turkey (10%) and Spain (4%), with other national industries (USA, Chile, Greece, Netherlands, etc.) only accounting for about 7% in total of worldwide trade. The volumes absorbed by this subcategory have recorded a notable slowdown in growth in recent years, initiated progressively as early as 2002/2003 by the Italian industry and becoming more noticeable after 2011/2012 with a drastic reduction in foreign sales from China and Spain. Conversely, several countries have recently invested (Iran, Turkey, USA, etc.) or reinvested (Italy, Portugal, Spain) this subcategory, but with growth over recent marketing years that remains "sluggish".

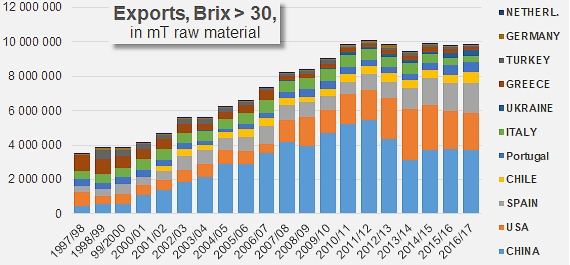

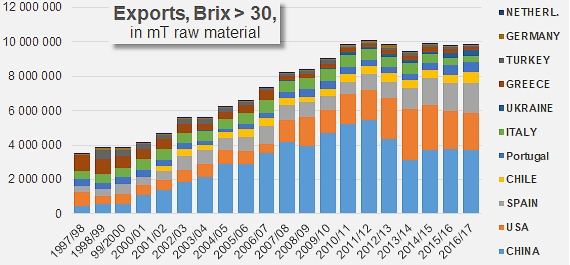

Although they still represent a large majority of the annual worldwide trade movements for this sector, the volumes of higher concentration paste (more than 30°Brix) exported worldwide have been stagnating for the past five or six years at around 1.83 million mT of finished products. Most of the trade in this subcategory involves products from China, the USA, Spain and Chile, with other national industries (Portugal, Italy, Ukraine, Greece, etc.) sharing approximately 16% of the market.

Italian processors were once again the first to modify the pattern of their exports, after 2010/2011, by noticeably reducing the volumes of paste above 30°Brix shipped outside of their borders. But the most remarkable decreases of this category segment have since been recorded for Chinese products and, more recently, Californian ones. The Chinese industry followed the Italian example as early as 2011/2012 and drastically slashed the volumes exported each year, taking them from 700 000 mT of finished products to 470 000 mT per year, which is the level that has been recorded over the past three marketing years. US exports, which have been penalized by the stronger US dollar, also recorded a spectacular contraction after 2014/2015. The hinge period around the 2011/2012 marketing year provided an opportunity for several Spanish operators to occupy the space left vacant by their Italian, Chinese and US competitors, and they were able to spectacularly promote their foreign sales of "high concentration" products.

For this subcategory, the volumes have not increased since the 2011/2012 marketing year, and have in some cases slightly dropped, according to an annual rate close to -0.5%. By comparison, the growth rates of the "less than 12°Brix" and "12-30°Brix" subcategories have respectively accelerated over the past five years by +2.8% and +0.8%. The negative dynamics of "high concentration" product exports is all the more significant for the fact that at the same time and unlike other subcategories, exports of "less than 12°Brix" paste have been the only ones to progress faster over the past five marketing years than they did before 2011/2012.

Two issues must now be confronted. The first is understanding whether this pattern as a whole actually indicates a real shift in the focus of processing operations, and therefore of consumption patterns, towards products that require lower volumes of raw materials. If this is indeed an accurate reflection of consumers' expectations, the second issue will be understanding how this new pattern is likely to evolve and impact global demand for tomato products over the coming years.

Source: IHS, Tomato News