The effects of global competition have been compounded by shrinking market outlets and deteriorating prices around the world.

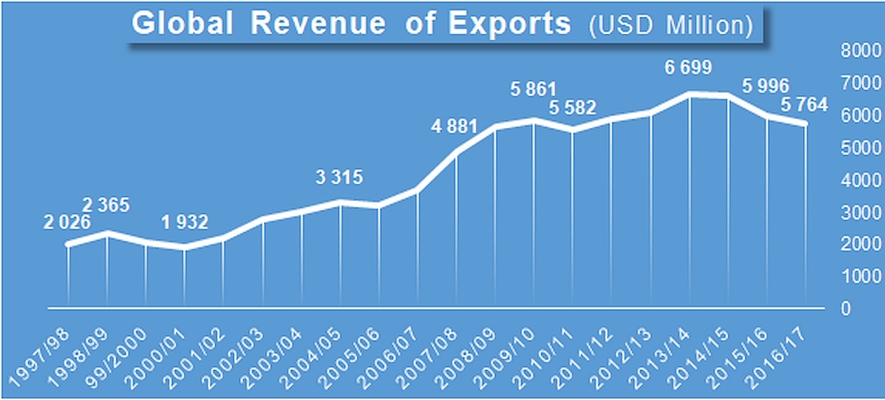

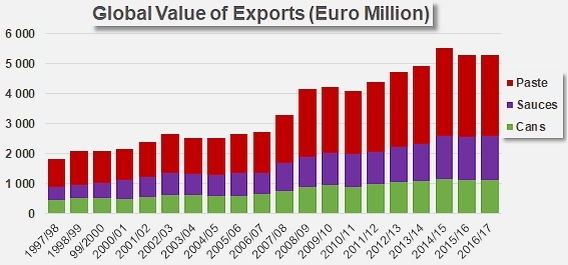

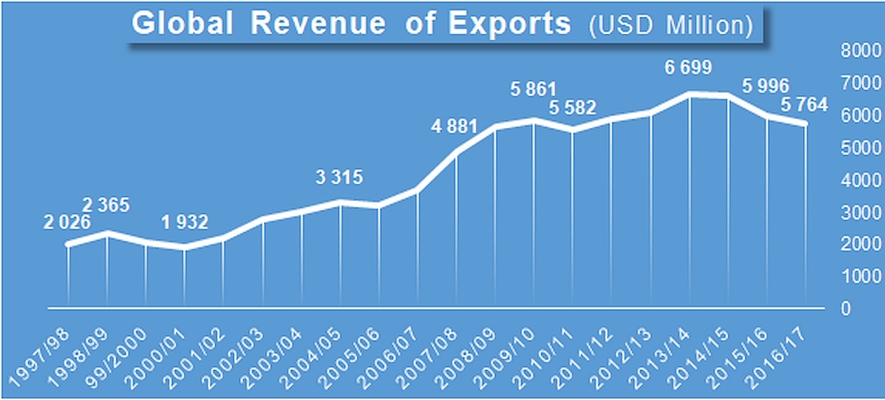

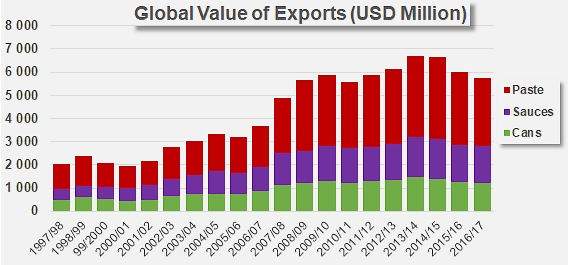

For the third year in a row (which is unprecedented in the history of the industry worldwide), the overall value of tomato products dropped in 2016/2017. This worrying trend can be attributed both to the slowdown in worldwide trade as well as to the continual erosion of product prices around the globe. And the drop recorded over the past marketing year (July 2016 / June 2017) is considerable: since the peak reached in 2013/2014 of close on USD 6.7 billion, the value of products traded at the worldwide level has decreased by 14% (approximately USD 935 million) and fallen to USD 5.76 billion in 2016/2017. This figure is the consequence of a 4% drop between the past two marketing years. It is also more than 10% lower than the average of the three previous marketing years (2013/2014, 2014/2015 and 2015/2016) (USD 6.44 billion).

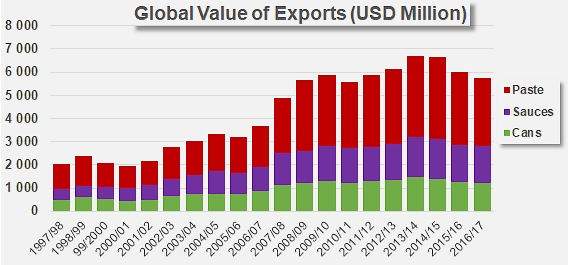

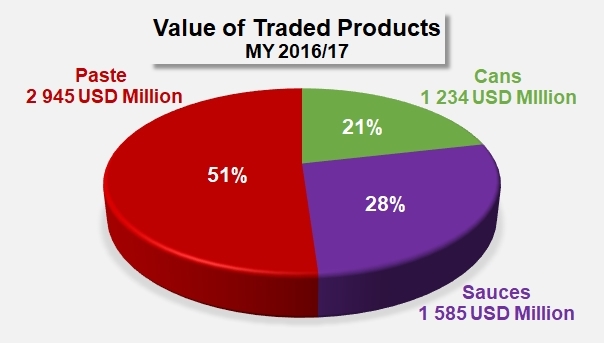

The trade in tomato pastes absorbed more than half of last year's expenditure at the global level: slightly less than USD 3 billion were spent on this category, with exports of canned tomatoes (USD 1.234 billion) accounting for approximately 21% of the total expenditure of the year, while those of sauces and ketchup (USD 1.585 billion) accounted for approximately 28% of the total.

Once again, the categories of products with the higher added-values resisted better than the other categories to the drop in revenue figures. Independently of the periods considered, tomato pastes are the category that has lost the most value on the export market. Expressed in US dollars, the total value of exports in this category for the 2016/2017 marketing year has been USD 446 million (-13%) below the average of the three previous marketing years. The fallback recorded by canned tomato exports around the globe is almost three times smaller, with a value that dropped by USD 153 million (-11%) compared to the average of the three previous marketing years. Finally, the sauces category has relinquished close on 5% (USD 78 million) compared to its previous performances, despite being far less impacted by the world's economic situation. Overall, almost USD 770 million were "lost" over the period between 2013/2014 and 2016/2017.

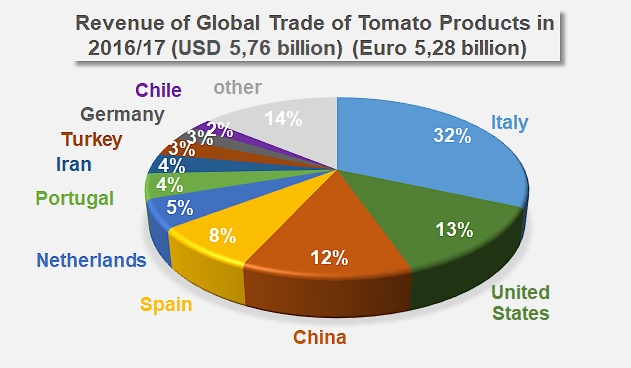

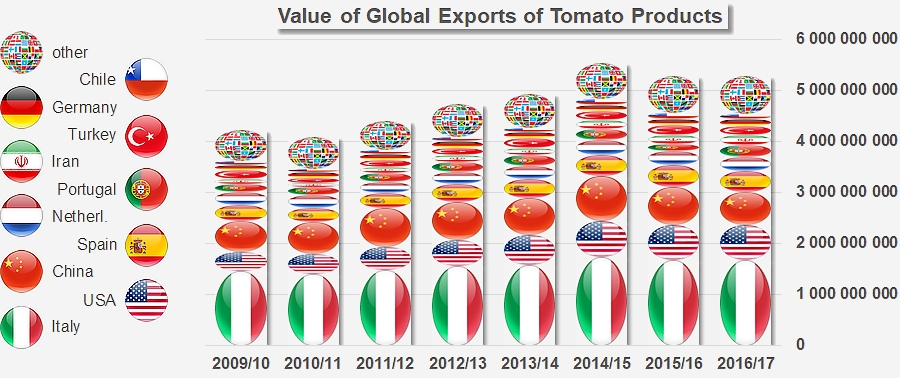

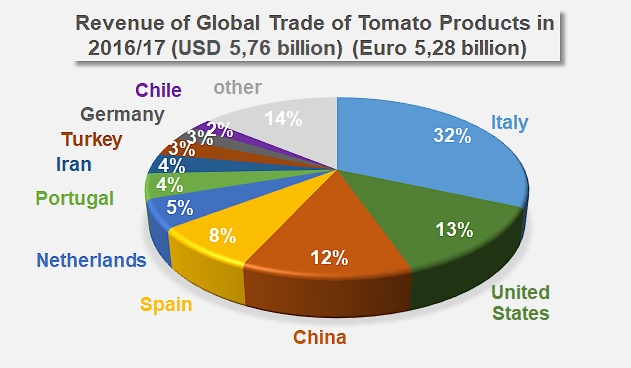

Italy, USA, China, Spain, the Netherlands, Portugal, Iran, Turkey, Germany and Chile make up the TOP10 list of exporting countries for 2016/2017

Other than this contraction in revenue, the TOP10 exporting countries in 2016/2017 have not introduced any great change from the previous marketing years. Thanks to its exports of canned tomatoes and its performance in all product categories, Italy remains the unchallenged leader of the worldwide export trade with a market share of 32% in terms of value (EUR 1.674 billion, or USD 1.825 billion). This Italian result remains very similar (-0.1%) to the result of 2015/2016, and very close to the average of the three previous marketing years (+0.8%). It also almost matches the total turnover recorded by the United States, China and Spain altogether. However, it is important to note that Italy's result mainly stems from the good performances of the paste sector (up EUR 18 million (+3%) on average over the past three marketing years) and of the sauces sector (up EUR 7 million, +4%), which compensate for the clear slowdown reported by the canned tomato sector (EUR -12 million, -1%).

The value of US foreign sales amounted to close on USD 702 million in 2016/2017 (equivalent to EUR 689 million), which is a 6% drop compared to the average of the three previous marketing years. Paste exports paid the highest price (-22%) for the current difficulties affecting the markets – losses that were partly compensated by positive results recorded by the foreign sales of canned tomatoes (+7%), but even more so by the sauces sector – the flagship category for US operators – whose results progressed by 12%. The share held by the United States amounted to 13% of the worldwide market last year.

Almost entirely focused on paste exports, Chinese revenue for 2016/2017 suffered majorly from the deterioration of world prices for this category, with an overall drop of close on USD 259 million compared to the previous three marketing years (USD 956 million on average), which is the biggest drop within the TOP10 list. The paste category relinquished close on USD 250 million (-27%), while canned tomatoes and sauces respectively dropped by USD 2 million (-35%) and by USD 7 million (-21%). The value of Chinese products exported in 2016/2017 amounted to slightly more than USD 697 million (or approximately EUR 638 million) (against close on USD 824 million / EUR 743 million in 2015/2016).

With close on EUR 440 million (USD 451 million) generated by exports in 2016/2017, Spain has seen its revenue grow by 1% compared to the average results of the three previous marketing years (EUR 408 million). Despite deteriorating paste prices, the Spanish industry achieved a small gain thanks to its performance in terms of foreign sales of pastes (EUR 13 million, an increase of 12%), which compensated for the notable decreases recorded by the canned tomatoes category (a drop of EUR 19 million (-24%) against the average of the three previous years) and by the sauces category (a drop of EUR 5.5 million, -7% compared to the average of the marketing years 2013/2014, 2014/2015, 2015/2016).

The progress recorded during the 2016/2017 marketing year by Portugal ranks this country as the best performer among the world's TOP10 operators on the export market. The EUR 240 million (approximately USD 261 million) of revenue from foreign sales – mainly pastes – corresponds to a 70% increase compared to 2015/2016, which was a very bad year for the Portuguese industry, both in terms of production and in terms of trade. But this result also marks a 24% progression (close on EUR 47 million) compared to the average of the three previous marketing year. This increase is all the more significant for the fact that it impacts all the categories to a similar level, with an increase of EUR 38 million (+24%) of the revenue from exports of paste, EUR 5 million (+24%) from the sauces category and EUR 3.3 million (+29%) from the canned tomatoes category.

For the first time in many years, the total value of Iranian exports has been higher than the value of Turkish exports, which ranks Iran and Turkey respectively in 7th and 8th place among the TOP10 exporters of tomato products. Iran's results virtually match its figures for paste exports (99% of the overall total): at USD 207 million (EUR 190 million), Iran has improved its performance by 10% compared to the average of the previous three years. Iran holds a 4% share of the global market.

More than three quarters of the 2016/2017 revenue for Turkey (USD 193 million, approximately EUR 177 million) are attributable to the paste category, with canned tomatoes contributing 13% and sauces contributing 9% of the total value of exported products. After three relatively plentiful marketing years, the value of exports has dropped by over USD 41 million (-18%), mainly due to the major decrease in foreign sales of pastes (USD -30 million, -17%) and of sauces (USD -9 million, -34%).

With USD 119.9 million of exports in 2016/2017, Chile has practically carried over the same results as the previous marketing year (USD 118.6 million), as well as the average of the three previous years (USD 120.3 million). More than 95% of the value corresponds to paste exports and 5% to exports of sauces, which have not recorded any significant variation over the period considered.

Two countries of the Euro Zone also feature in the TOP10 list despite not being primary processing countries. The Netherlands mainly operate in the sauces sector, with exports in that category accounting for 84% of the country's turnover for 2016/2017 (EUR 274.5 million, or USD 299 million). Like with Chile, this last result is close to the result of 2015/2016 and to the average of the three previous marketing years. This apparent stability actually hides a notable deterioration of the Dutch performance in its main product category – sauces – whose turnover fell back EUR 17 million (-7%) compared to the average of the three marketing years 2013/2014, 2014/2015 and 2015/2016. This major decrease has been almost entirely compensated by spectacular improvements in the other categories of the Netherlands' production (EUR +10.8 million and a doubled performance for the canned tomato category, EUR +6.1 million and +35% for exports of pastes).

Germany has recorded a good performance by taking its result to more than EUR 137 million (USD 150 million) in 2016/2017. A good performance in the sauces category, which increased by 73% the results of the last marketing year, has taken the total value of exports to slightly more than EUR 10 million, while the paste category relinquished about EUR 1 million.

Countries of the TOP10 accounted for exactly 86% of the value generated in 2016/2017 by exports of tomato products. This proportion amounted to USD 4.956 billion (EUR 4.545 billion) Over the three previous marketing years, the share of the worldwide market held by countries of the TOP10 had accounted for more than 87% of the total value of global exports, and amounted to more than USD 5.8 billion. The previous two marketing years, 2015/2016 and 2016/2017, were indeed years of major "shrinkage" in terms of value and revenue.

The increasing intensity of competition can be attributed to the development of local agricultural and industrial production, protectionist national policies, the sluggish growth of global consumption, and the decrease in the value levels of tomato products.

Even in the best possible scenario, this situation encourages a stagnation of prices and an attempt at immediate profitability in the context of a currently hazardous inflation of volumes. This is a potentially destructive downward spiral.

Sources: IHS

Some complementary data