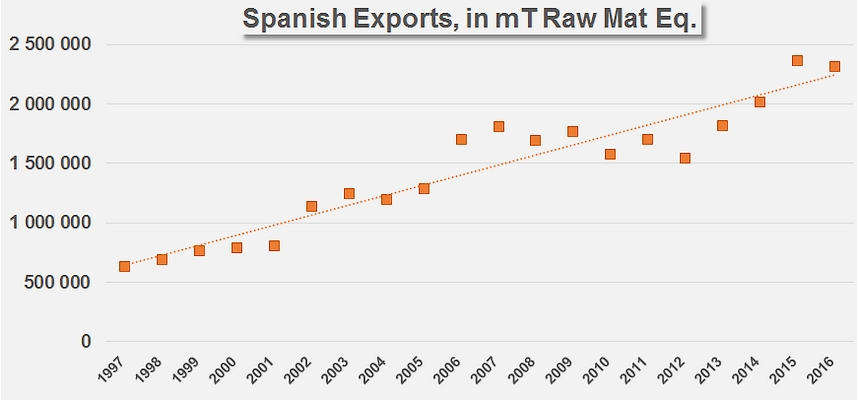

For several years, the Spanish industry has led us to expect annual performances that are constantly more impressive in terms of its exports of tomato product. After a long period of stagnation between 2006 and 2012, during which export volumes of pastes, canned tomatoes and sauces (expressed in farm weight equivalent) struggled to stay within a 1.6 to 1.8 million tonne range, the volumes shipped outside of Spanish borders have taken off spectacularly over the past four years. In 2013, 2014 and 2015, foreign sales broke three successive records, with 1.8 million tonnes, 2 million tonnes and 2.37 million tonnes, to the point that last year's performance of 2.3 million tonnes – a slight drop of -2% against 2015 results – seemed to indicate a slowdown in the growth dynamics that have strongly impacted the recent situation of the European market.

Some sectors are dynamic, others are slowing

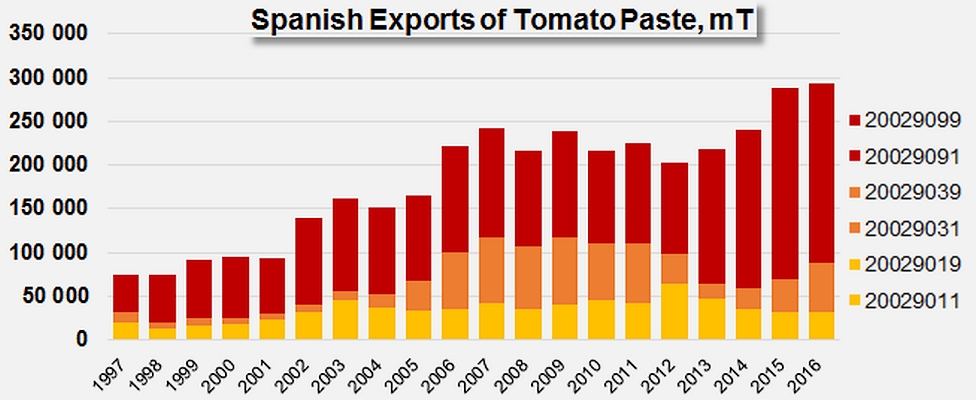

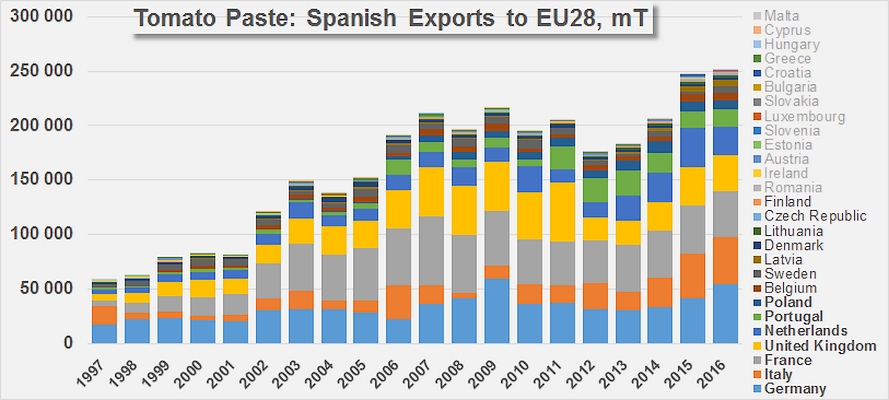

Despite clearly stated commercial ambitions in the sectors of canned tomatoes and sauces, both at a European level and worldwide, the Spanish industry mainly based its recent trade development on the export of traditional commodities. In less than five years, annual exports of tomato pastes leaped from approximately 215 000 mT for the period running 2011-2013 to more than 290 000 mT, growing at the impressive rate of 8% per year.

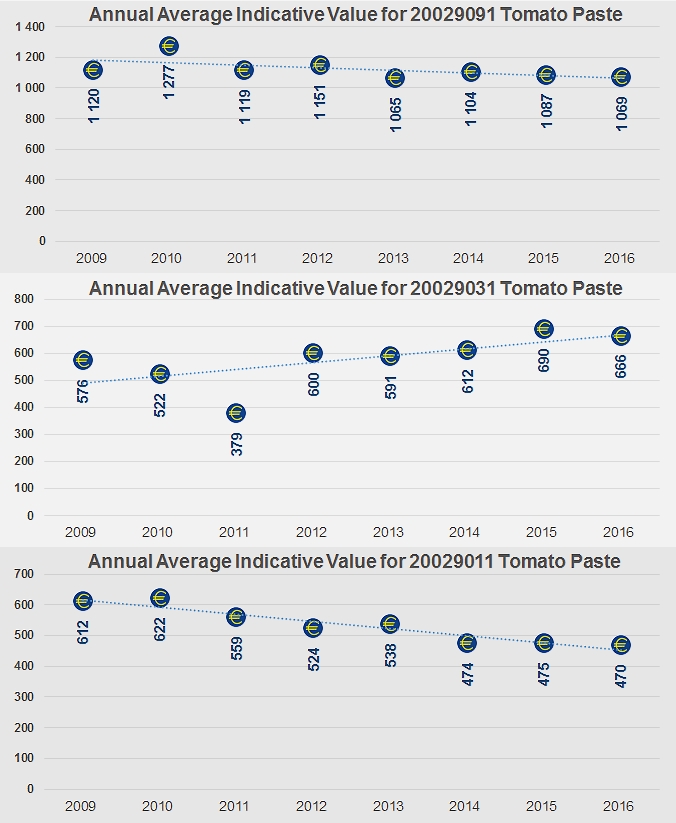

- Despite the interest shown by several major operators, the "lower concentration" products segment (tariff codes 20029011 and 20029019, with less than 12% soluble solids) have borne the brunt of this shift, with export quantities of these categories dropping from more than 50 000 mT per year on average to 31 000 mT last year. This slowdown was more noticeable for "industrial pack" products than it was for catering or retail formats.

- The purées segment, with soluble solids contents ranging from 12% to 30% (tariff codes 20029031 and 20029039) modestly contributed to the increase recorded in recent years. With a sharp decline between 2011 and 2013, foreign sales of these market categories, particularly the category of products in industrial pack formats (20029031), progressed at a fairly consistent rate (9.5% per year), reaching more than 60 000 mT in 2016.

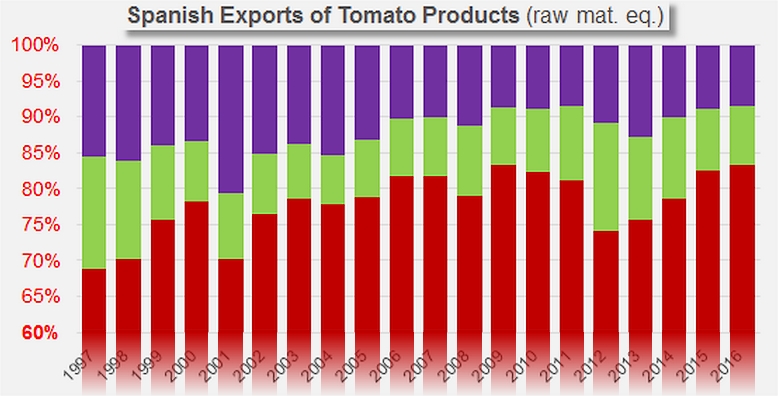

- But it is the highly concentrated products (tariff codes 20029091 and 20029099, with more than 30% soluble solids), particularly pastes intended for remanufacturing, that have driven the largest part of the development of Spanish exports in recent years, with volumes that have grown from less than 125 000 mT per year between 2011 and 2013 to more than 210 000 mT over the past two years (an average annual growth rate of close on 14%!). With this growth, pastes of more than 30% soluble solids have recovered the predominant position among export categories that they had progressively lost to "12-30%" pastes at the beginning of the 2000s.

In 2016, Spanish exports positioned the country in fourth place among worldwide paste exporting nations, accounting for slightly less than 9% of the volumes traded around the world.

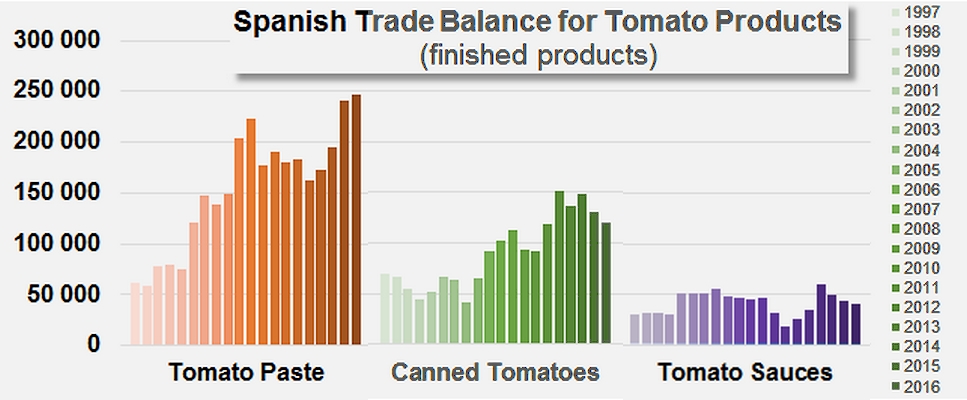

In contrast, and despite production and distribution strategies developed by several major operators, the country's industry was unable to keep up the dynamics that drove Spanish exports of canned tomatoes to their highest level between 2011 and 2013 (close on 166 000 mT); over the past four years, the volumes shipped abroad have dropped at an average annual rate of -4%, and "only" mobilized 135 000 mT in 2016. However, despite this erosion of results, in 2016, the Spanish industry kept its second place in the worldwide ranking of canned tomato exporting countries, with slightly more than 8% of total global trade.

In the extremely competitive context of a highly fragmented global market, the "weight" of Spanish exports of ketchup and tomato sauces remains insufficient to have a significant impact on worldwide dynamics for this category. Over the past 20 years, the volumes have generally increased, but with a lot of ups and downs over the years. The most recent drop has been recorded over the past three years, with foreign sales in 2016 (67 300 mT) barely exceeding the level they were at in 2008 (65 100 mT). This result, representing slightly more than 5.5% of global trade in this category in 2016, was nonetheless sufficient to rank Spain in fifth position worldwide among sauce exporting countries last year.

The Spanish trade balance for tomato products: recent growth has clearly been driven by the increase in foreign sales of pastes, despite the slowdown recorded for the canned tomatoes and sauces categories.

Since 2012, when results started indicating new growth for Spanish exports, the volumes of raw materials absorbed by exported products have increased at an average annual rate of close on 11%. Over the years and following variations imposed both at a national level and a worldwide level by the industrial, economic and commercial contexts, these volumes have absorbed an increasing share of the volumes processed by the Spanish industry. Indeed, quantities dedicated to making products for export have grown (though fairly irregularly) over the past 20 years, from 64% in 1997 to 80% of the tonnage processed in 2016.

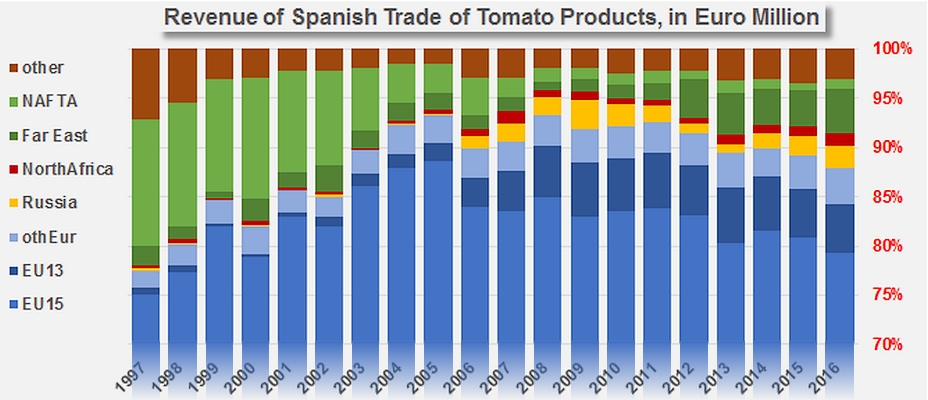

In 2016, the Spanish tomato products trade sector recorded an active balance of EUR 336 million (USD 372 million). This is slightly less than the previous year (2015), whose result (EUR 365 million) was just about three times bigger than the result recorded in 1997 (EUR 123 million).

Most of the turnover generated by the Spanish industry's export operations proceeds from the sale of pastes. On this point also, 2012 was a turning point, after which the paste sector accelerated its growth – along with a notable slowdown of other categories – thanks to a consequential decrease of the contribution to total revenue of canned tomatoes and sauce exports. Between 2014 and 2016, these two categories each only generated on average EUR 75 million per year, while the value of paste exports amounted to approximately EUR 263 million.

This polarization of Spanish export operations has been even more noticeable in geographical terms. 84% of paste sales, 94% of canned tomato sales and 82% of sauces sales have been "reserved" to the immediate geographical environment of the countries that make up the EU28. Over the past three years, Spanish exports of tomato products have generated an average turnover of EUR 413 million, of which 81% comes from countries of the EU15, 86% from the EU28 and 89% from the European continent as a whole.

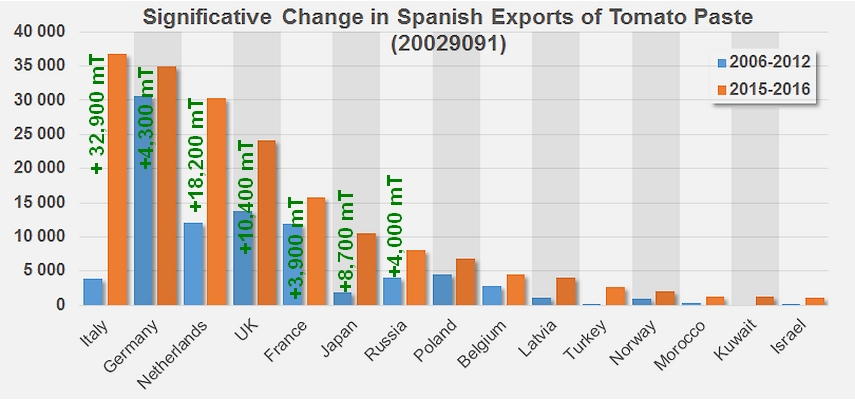

The development of the Spanish influence on more distant markets does not seem to be a major priority for the industry. Although a number of operators have been seeking new outlets "outside of Europe", in recent years, no major shifts have been observed in this area. Since 2008 or 2009, the geographic pattern of Spanish exports has only been marginally altered, with the timid emergence or measured progression of new destinations like Japan, Russia, Morocco and Israel. In 2016, sales to the Far East, Russia and North Africa respectively accounted for 4%, 2% and 1% of the total figure.

The main driving markets

Given the particularly European nature of Spanish export operations, it is not surprising that the spectacular development and sales observed over recent years has been largely based on EU countries. The most noticeable increases have been recorded by operations supplying 30% soluble solid content paste (20029091) to Italy, Germany, the Netherlands, etc., but several other destinations (Japan, Russia, Turkey, Morocco, etc.) have also contributed to this notable increase that has at least partly justified the development of the quantities processed and the extension of industrial capacities observed in Spain in recent years.

Sources: GTA/GTIS

Some complementary data

Over the past 20 years, Spanish exports of tomato paste have absorbed an increasing proportion of the raw materials dedicated to supplying foreign markets, at the expense of the canned tomato and sauces categories.

Available data regarding average annual prices for the different categories of Spanish paste exports for industrial use seems to indicate a notable downturn in recent years for pastes of less than 12% soluble solids (tariff code 20029011) and more than 30% soluble solids (20029091), and a clear consolidation for products of 12 to 30% soluble solids (20029031).

Most of the Spanish exports of tomato pastes are predominantly intended for approximately 10 countries of the EU28, the main ones of which are Germany, Italy, France, the United Kingdom, the Netherlands and Portugal.