2016/2017: 2% better than in 2015/2016

Notable drop in operations recorded over the first six months of 2017

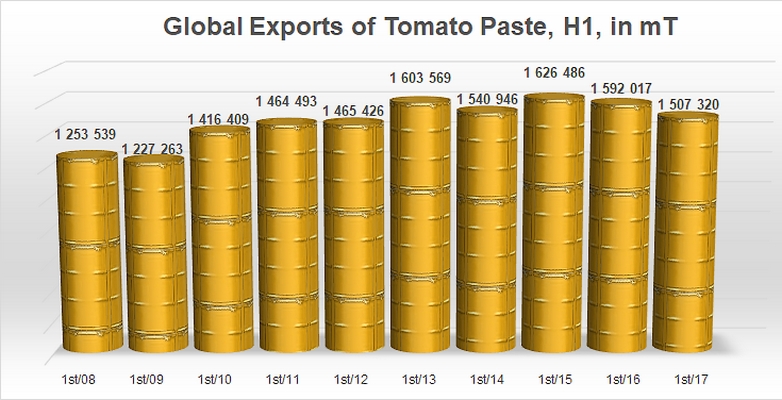

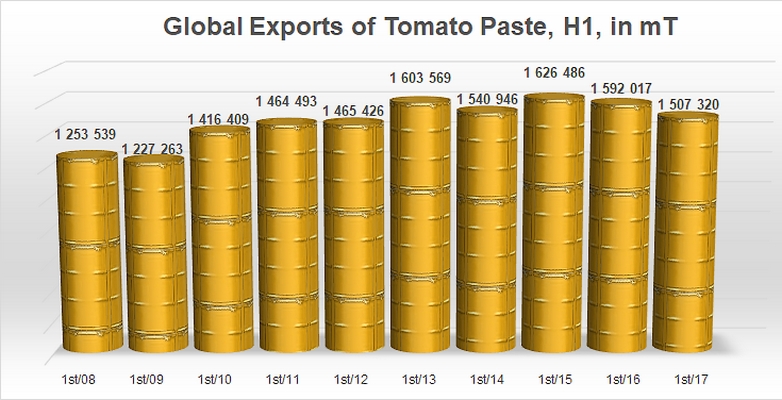

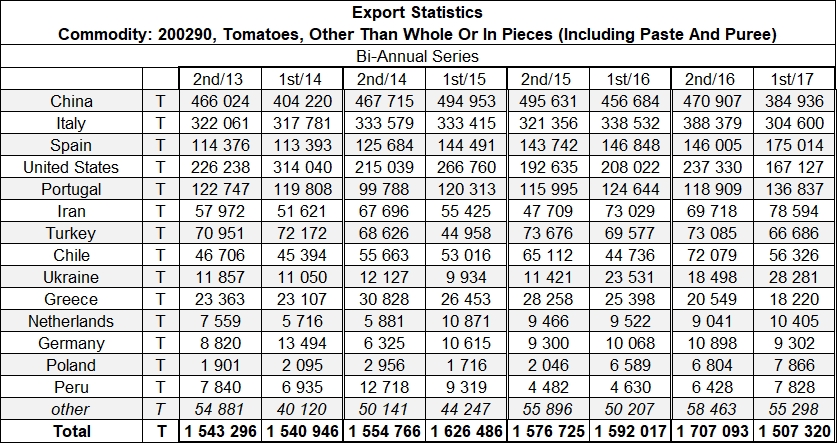

Worldwide paste exports collapsed once again during the first semester 2017. The volumes shipped abroad by the eighty main paste-exporting countries of the world dropped by close on 85 000 metric tonnes (mT) of finished products over the first six months of the calendar year, falling from 1.592 million mT during the first semester 2016 to 1.507 million mT during the first semester 2017, which represents a drop of approximately 5% between January-June 2016 and January-June 2017. This drop in performance during the first semester is the second such drop after about 10 practically consecutive increases.

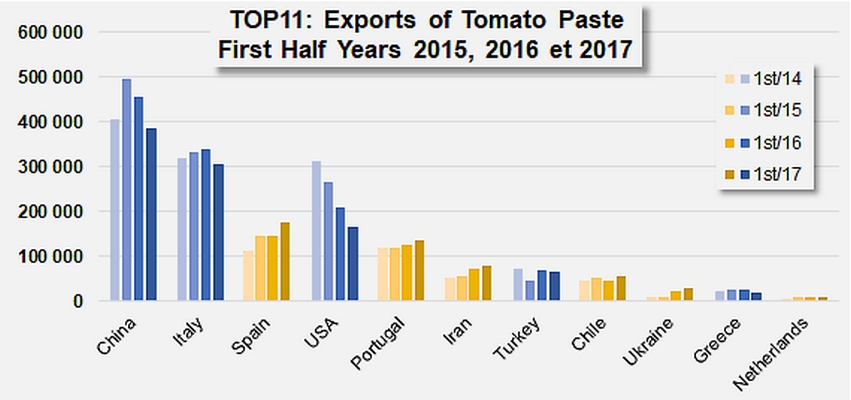

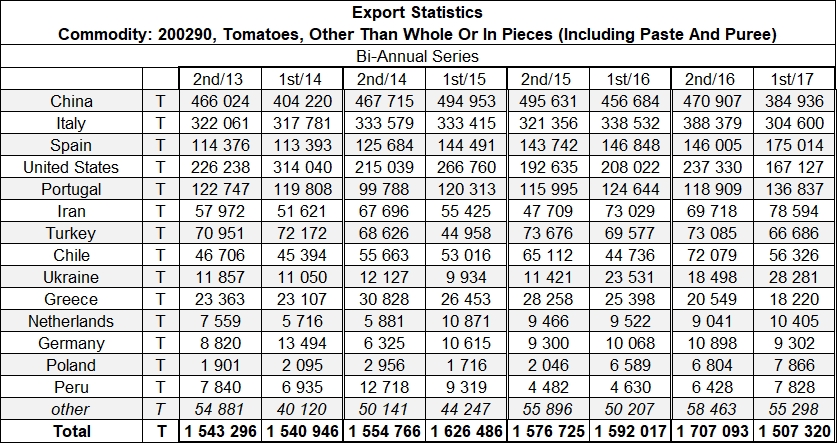

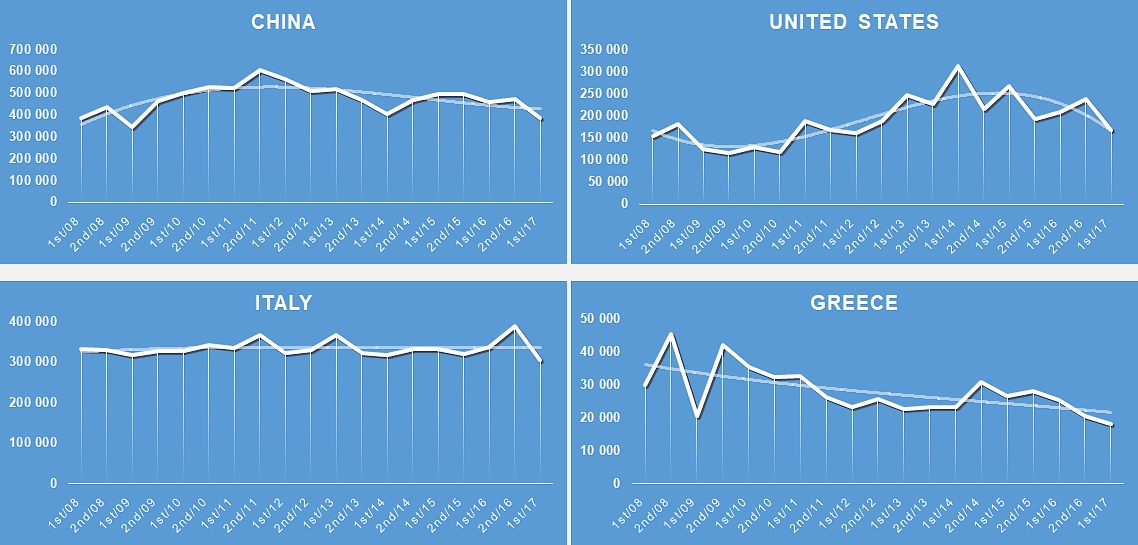

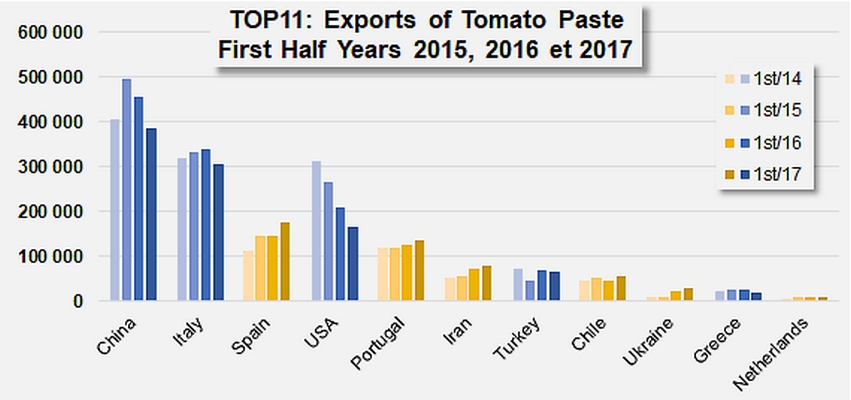

The Chinese industry has paid the highest price this year for the difficulties and ongoing tension affecting the trade context. Foreign sales of Chinese paste from January to June 2017 (385 000 mT) plummeted by almost 72 000 mT (-16%!) compared to those of the same period in 2016 (457 000 mT). This drop is similar to the drops recorded in recent years (first semesters 2014-2016) of approximately 68 000 mT (-15%), with overall results indicating deeper dynamics whose roots date back to the 2011/2012 marketing year. This half-yearly result nonetheless places China at the top of the list of global paste exporters, with 855 843 mT shipped out over the 2016/2017 marketing year.

Different mechanisms in specific contexts have had similar effects on the US performance. With only 167 000 mT of paste reported, half-yearly results for the Californian industry plummeted in early 2017 compared to the levels reported for the first semesters of 2014, 2015 and 2016 (-96 000 mT from the average of those three years, which is a drop of approximately 36%!). Although this decrease is drastic, the fallback compared to last year is less pronounced (-41 000 mT, or 20% less than the first semester 2016) and this drop could be considered as part of the efforts expected from Californian operators in order to improve the situation, driven by the relative weakening of the US currency which was recently commented by the CTGA (see our article on opening prices in Italy). The USA ended the 2016/2017 marketing year in third place amongst global exporting countries, with 404 457 mT exported.

With close on the 305 000 mT of paste exported during the first semester 2017, Italy has achieved its worst result for the same period since 2005 (299 000 mT). However, this counter-performance has been recorded after a second semester 2016 that was particularly plentiful (388 000 mT), amounting to a 20% increase in operations compared to previous years, so this "mediocre" result for the beginning of 2017 should probably be seen as a simple adjustment of Italian dynamics, which have been particularly regular over the past 20 years. In the final count, Italy exported 692 979 mT of pastes in 2016/2017, the second best performance worldwide for this category.

Greek exports also suffered during the first semester 2017, with a drop of approximately 7 000 mT in exports, both compared to the first semester 2016 and to the average of the matching period over the three previous years (2014 to 2016). This further decrease is part of a regular erosion of Greek performances abroad, which have gone from an annual 35 000 mT around 2010 to 25 000 mT over the most recent marketing years, ranking the country in tenth place among the world's paste exporting nations.

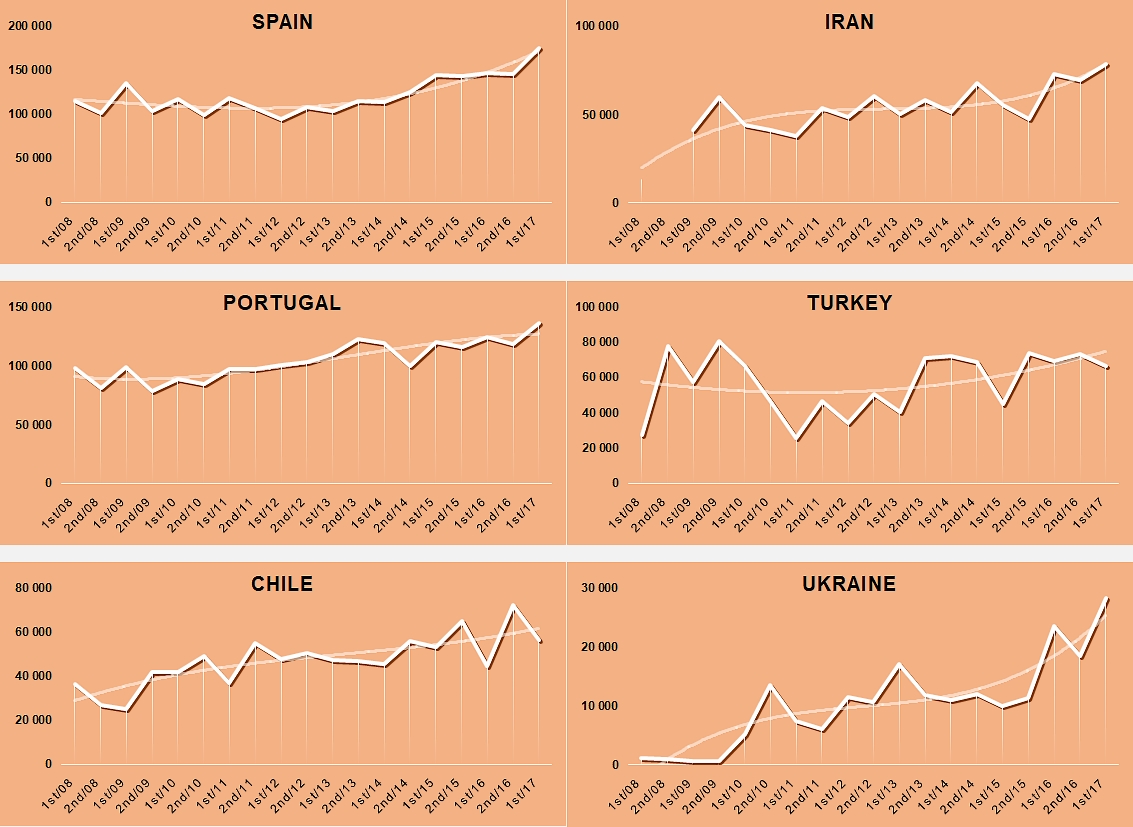

However, other national industries within the main processing regions have, on the contrary, considerably improved their results. This has been the case of Spain, whose paste exports (175 014 mT between January and June 2017) have been in some cases driven by a particularly aggressive trade policy and extremely attractive price quotations, which have led to a 28 000 mT increase (+19%) compared to the first semester 2016 and a whopping 40 000 mT (30%!) compared to the same period over the three previous years (135 000 mT). This latest performance also indicates a sharp acceleration in the volumes produced, which have been increasing noticeably since sometime during the 2011/2012 marketing year. With 321 019 mT exported in 2016/2017, Spain has consolidated its position as the fourth biggest exporter worldwide for the paste category, having taken over this position from Portugal in 2014/2015.

The first semester was good for several other national industries, some of which are also serious contenders on the worldwide markets. One of these is the Portuguese industry, whose first semester 2017 registered a gain of 12 000 mT (+10%) compared to 2016 and a gain of more than 15 000 mT (+15%) compared to the average performance of the first semesters 2014 to 2016. Like the neighboring Spanish industry, Portuguese results over the first six months of 2017 (136 837 mT) are to be considered in the context of long-standing dynamics that were initiated during the 2009/2010 marketing year and which have seen the country's annual exports of paste grow from 170 000 mT to more than 255 000 mT last year.

Chile has considerably increased its level of operations in recent years, and has also recorded good results for the first semester this year, even better than those of the Portuguese industry with which it entertains well-established links. From January to June 2017, Chilean foreign sales (56 300 mT) progressed by close on 12 000 mT (+26%!) compared to the corresponding period in 2016, but also by close on 9 000 mT (+18%) compared to the average results for the first semesters 2014 to 2016.

The difficulties linked to the drastic drop in processed quantities do not seem to have affected the capacity of the Iranian industry to develop its paste exports. Quantities shipped during the first semester (78 594 mT) confirm this excellence performance of foreign operations, with a progression of close on 6 000 mT (+8%) compared to last year, but more importantly close on 19 000 mT compared to the first semesters of 2014, 2015 and 2016.

Progression is less obvious for the export activities of the Turkish industry, whose past performances have often featured sudden variations both upwards and downwards. Despite having recorded a slight fallback (-2 800 mT) compared to the first semester 2016, Turkish foreign sales for the beginning of 2017 (66 686 mT) have nonetheless progressed by close on 4 500 mT compared to the same period of the three previous years.

The volumes exported by the Ukrainian industry are still relatively limited compared to those shipped by the big leading countries of the sector. But this only partly explains the impressive growth rates of this country's foreign operations, with sales for the first six months of 2017 (28 281 mT) that leapt 91% compared to the average of the first semesters of the three previous years (less than 15 000 mT).

Global export operations involve a number of other countries – only some of which are primary processors – like the Netherlands, Germany, Poland, Peru, France, Egypt, etc., and it is not possible to mention all of them. Altogether, the increases recorded during the first semester 2017 have clearly not been sufficient to compensate for the contractions that have particularly affected paste exports from three of the four main worldwide operators of this category. However, the drop in operations that can be observed for the first six months of 2017 follows a previous marketing year semester that saw sharp growth compared to previous semesters.

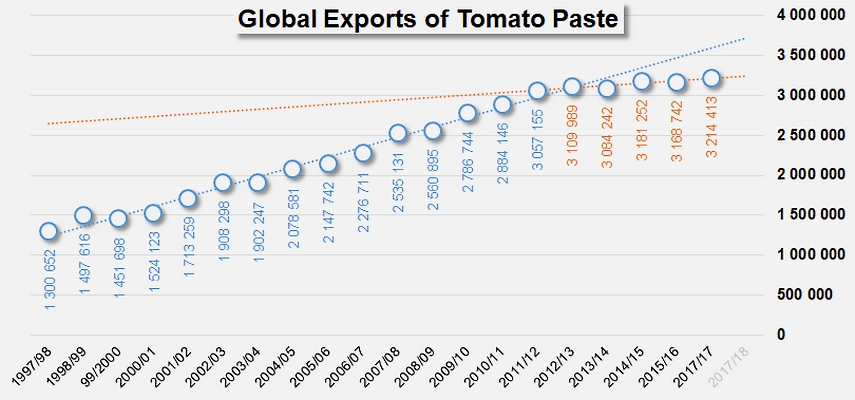

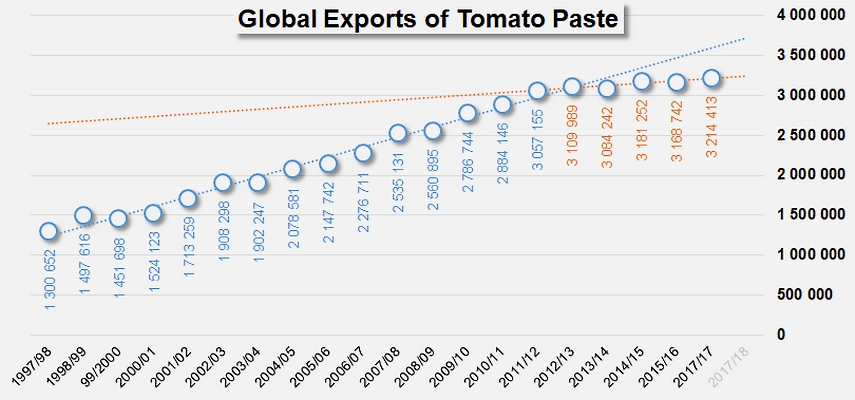

In the final count, the 2016/2017 marketing year ended on an encouraging note, with shipments that involve at least 3.215 million tonnes of finished products, up 2.2% compared to the three previous years (3.145 million mT on average from 2013/2014 to 2015/2016) and 1.4% compared to 2015/2016 (3.169 million mT). This result confirms the trend analyses commented in Tomato News for several years, which have clearly indicated an average annual growth rate of approximately 1% over the past five years (compared to 6% from 1997/1998 to 2011/2012). The worldwide industry has been operating since 2011/2012 in a context of "sluggish growth", which is not particularly favorable to spectacular increases in processing operations while also being a source of extreme tension in terms of commercial competition.

To follow shortly: final results for paste purchases over the first semester 2017 in the category's main importing countries.

Some complementary data

Half-yearly export patterns for the main paste exporting countries: progressing

Half-yearly export patterns for the main paste exporting countries: slowing

Sources: IHS, Tomato News