Export performances have dropped by a third compared to the three previous marketing years

In 2019, the Customs Administration of the Islamic Republic of Iran (IRICA), which usually publishes Iranian trade statistics, decided to suspend the publication of new data until further notice.

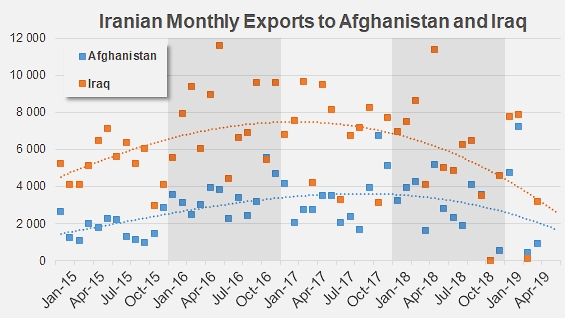

The latest results communicated by the Iranian customs services actually date back to April 2019. They show a further drop in Iranian export activity in the paste sector. A comparison of the performances recorded over twelve months (period running May-April) over the last four years demonstrates a gradual decrease of Iranian products on the markets where they usually occupy a privileged place (Iraq, Afghanistan, and to a lesser extent, Russia).

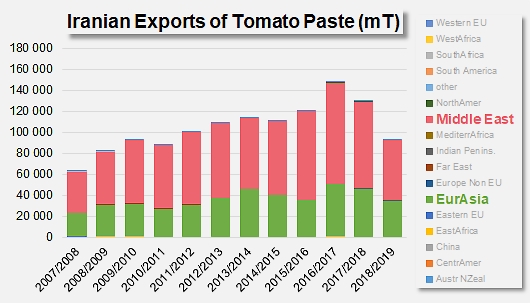

Real data until 2017/2018, extrapolated for May and June of 2018/2019 marketing year.

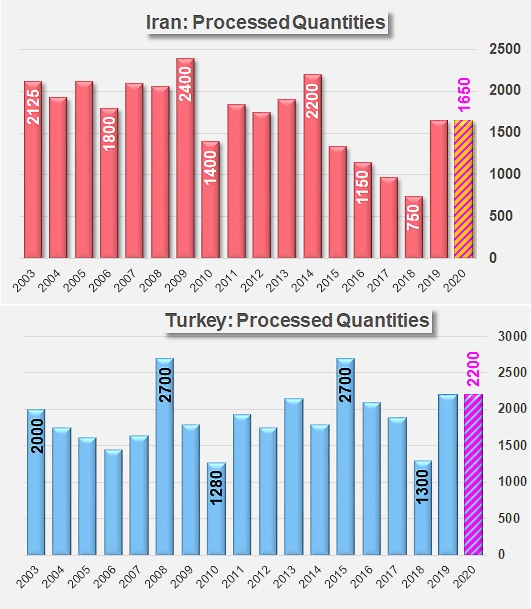

On its own market as well as on foreign markets, the Iranian tomato processing industry is facing difficulties that are among the reasons behind reorganization measures recently decided by the Iranian Ministry of Agriculture and implemented by the Central Organization of Rural Cooperatives (see our article “Iran: agro-industry is being reorganized”). Within the limitations of available data, it can be estimated that the quantities exported in 2018/2019 (extrapolated for the needs of this article and probably close to 95 000 metric tonnes of finished products) have been reduced by 30% compared to those of the previous marketing year (around 130 000 mT), with this latter figure itself being down 13% compared to the quantities absorbed in 2016/2017 (more than 148 000 mT). These successive reductions are linked to the difficulties and disturbances that have affected recent seasons for several processing countries in the region and have led, in Iran as in Turkey, to dramatic decreases in the quantities processed and therefore in the volumes available both for the domestic markets and for exports.

The Iranian commercial sphere, essentially confined to a few nearby markets, showed a clear contraction over the last marketing year, particularly in the trade-flows to Iraq and Afghanistan, with decreases compared to the average trade-flows for the three previous marketing years that can be estimated respectively for these two destinations at around 26 000 tonnes (-32%) and 5 000 tonnes (-14%). Afghanistan and Iraq had been absorbing approximately 90% of Iranian paste exports in recent years. So declining business in these two key markets accounted for most of the downturn in Iranian foreign sales in 2018/2019, to which can be added the decreases recorded on the Russian, Emirati and Kuwaiti markets, to mention only the most significant.

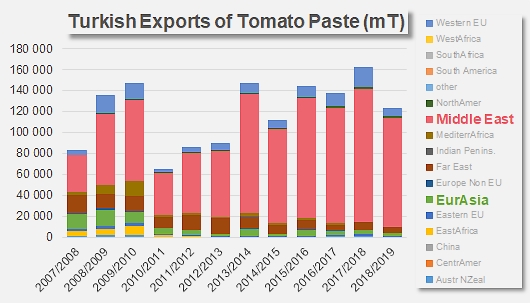

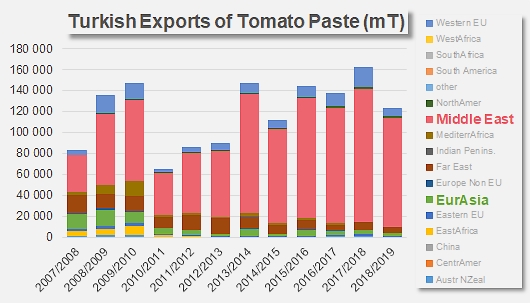

Turkey, which is a major regional competitor of Iran, has been able to take advantage of the slowdown in Iranian activity, despite its own difficulties encountered in recent seasons (between 2016 and 2018). Faced with shrinking outlets itself (see our article "Turkey: an increasingly restricted commercial context"), the Turkish industry has taken over the unclaimed trade volumes and has grown in strength on the Iraqi market. In just a few years, the Middle East region has become, if not the only buyer, at least the main one for paste produced by the Turkish processing sector. Whereas in the early 2000s, it absorbed little more than 14% of Turkish sales with less than 21 000 mT per year, the Middle East now accounts for more than 80% of trade-flows from Turkey, with volumes that vary between 110 000 and 115 000 mT annually.

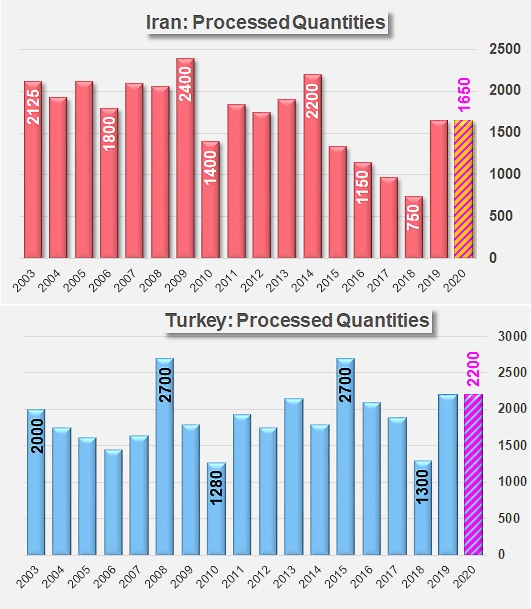

For both Iran and Turkey, export flows are of paramount importance. The approach taken by the Iranian government is a confirmation of this, as it aims at rationalizing and supporting production and processing within the country and facilitating sales on foreign markets. In this sense, in order to regain a foothold on the global markets, Turkey and Iran (to an even greater extent) need to increase the quantities processed to the same levels of operations that they recorded in 2014 or 2015. This was already the case during the 2019/2020 season, and the coming season should return to the levels already reached last year.

Some complementary data

Over the past four or five years, the quantities processed in Iran and Turkey have dropped sharply. In 2019, Iran processed 1.65 million tonnes of tomatoes, a quantity likely to put the country back in competition as a supplier for several major countries in the region. Information regarding Iranian export activity remains unavailable for the time being, but we will return to the situation of this region if the Iranian decision were to change.

Evolution of Iran’s monthly paste exports to Afghanistan and Iraq, until April 2019.

Source: Trade Data Monitor LLC