…almost entirely supplied by Europe’s leading industries

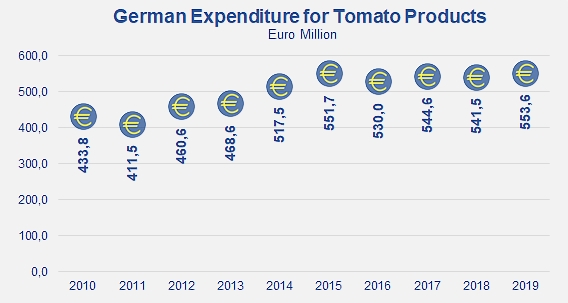

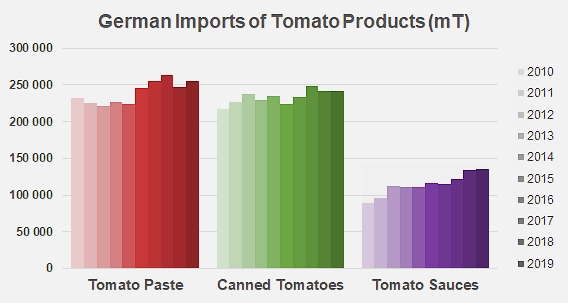

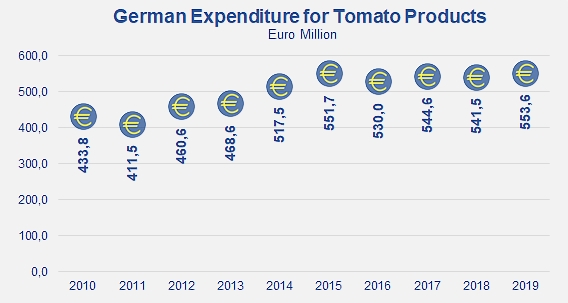

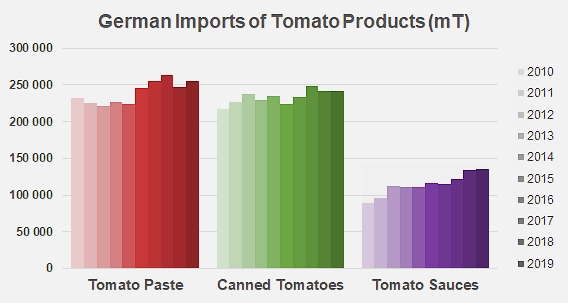

The total value of German annual imports of tomato products crossed the EUR 500 million mark in 2014 (EUR 517.5 million, or around USD 687 million, between January and December 2014) and has continued to increase since that date, reaching nearly EUR 554 million (USD 620 million) in 2019. The German market’s expenditure on its supply of tomato products was distributed last year according to a breakdown of 41% (EUR 228 million) for pastes (all categories combined) with the rest being shared almost equally between purchases of canned tomatoes (EUR 162.9 million) and imports of sauces & ketchup (EUR 162.3 million), each accounting for 29% of the total. Although the amounts spent on pastes still represent the main proportion of Germany’s expenditure, recent years have seen this sector lose its relative importance, since the share of German paste purchases went from almost 48% of total spending in 2010 to just over 41% last year. This relative decrease paralleled an increase in spending on the sauces sector (from less than 24% of total German expenditure in 2010 to more than 29% in 2019), while the share dedicated to the purchase of canned tomatoes remained virtually unchanged over the past ten years (around 29%), on an import market whose value has increased at an average annual rate of 2.75%.

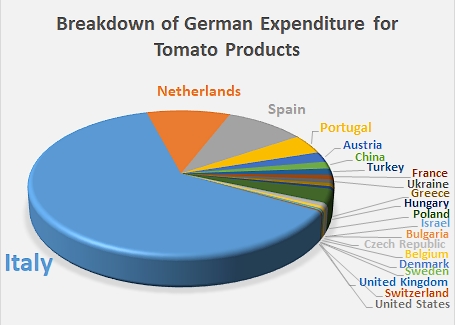

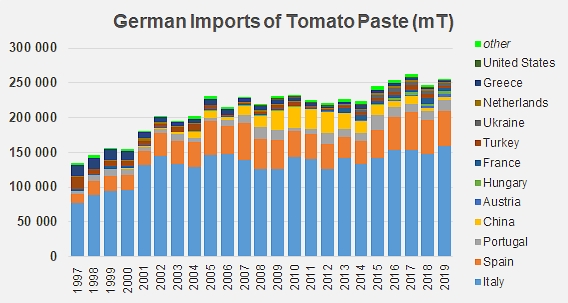

For obvious reasons, including proximity, Italy has been the main supplier of the German market: over the past five years (period running 2015-2019), Germany bought on average almost EUR 336 million of tomato products of Italian origin each year. Italian companies thus accounted for nearly 62% of German expenditure, far ahead of Dutch and Spanish operators whose sales only accounted for 10% (EUR 54 million) and 9.6% (EUR 52 million) of German expenditure, respectively. The performances of other countries like Portugal (EUR 23 million), Austria (12 million), China (8 million), Turkey (7.7 million) and France (5.3 million) made up most of the rest of German demand, which was also satisfied by products from Ukraine, Greece, Hungary, Poland, etc.

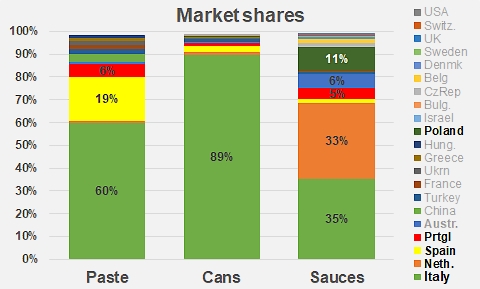

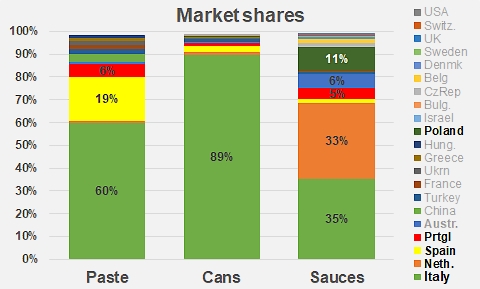

In a detailed breakdown, it is clear that Italy dominates the game for all categories of imported products, with average market shares (in terms of quantity) over the last five years of 60% in the pastes sector, 89% in the canned sector and 35% in the sauces sector. The Netherlands is the second largest supplier to Germany due to the strength of its activity in the sauces sector, which enables it to "hold" about a third of German supplies in the category. In third place mainly thanks to its “paste” dynamics, Spain has supplied on average over the last five years 19% of the quantities imported by Germany, far ahead of Portugal, the fourth largest supplier, active in the pastes category (6% of the market) but also in the sauces category (5%). In this latter category, which is traditionally more competitive than the canned tomatoes or pastes category, it is important to note the positions occupied by Poland (11% of German imports) and by Austria (6%).

The German market receives very few products from outside the EU. Over the past five years, the average annual quantities of pastes imported from China, Turkey or Ukraine have not exceeded 18 500 mT, out of a total trade-flow that amounted to more than 253 000 mT of finished products. On the canned tomatoes market, Italian domination has left little room for other countries to intervene, particularly in the case of countries outside the EU such as Israel or Bulgaria, whose annual sales to Germany only represented just under 1 900 mT out of a total that amounts to almost 234 000 mT of finished products. Finally, Switzerland and the United States were the only two countries outside the Community to supply some quantities of sauces, which did not exceed 800 mT per year over the period 2015-2019.

Some complementary data

Breakdown of German expenditure for imports of tomato products

Source: Trade Data Monitor LLC