Special report

The world's second biggest import destination absorbs 9% of worldwide trade

Ranking second worldwide behind the supply volumes of the EU15, the quantities of tomato products imported each year by countries of the Far East make the region an extremely important market outlet for the global industry and an essential focus point for worldwide trade.

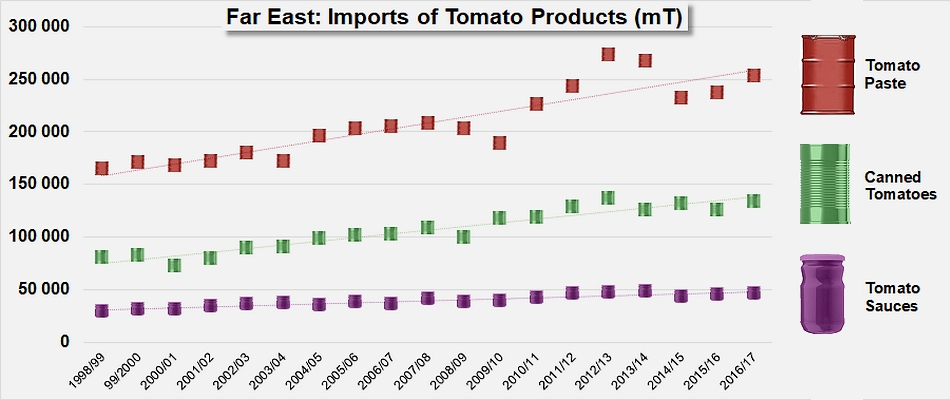

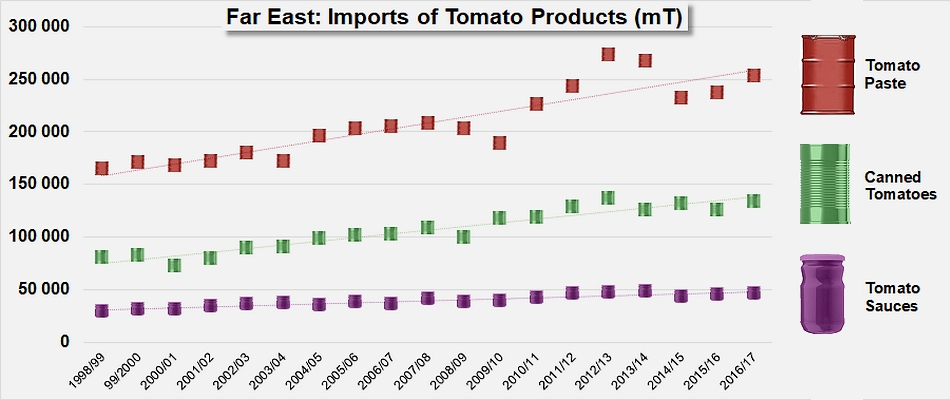

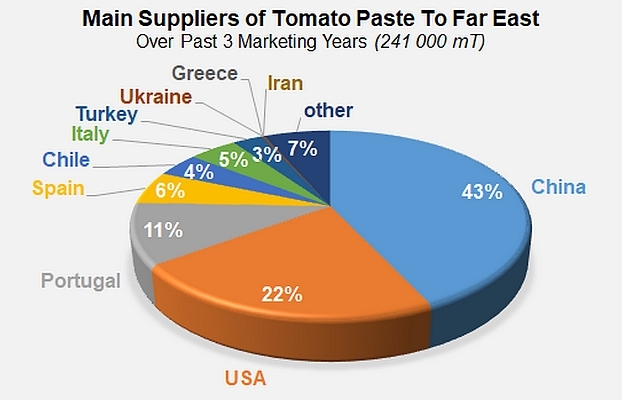

The region does not include many countries that actually process tomatoes, and the volumes produced in Japan, Taiwan or Thailand (290 000 mT of tomatoes processed on average over the past three seasons) are clearly insufficient with regard to demand. Over the past three marketing years (July/June, in 2014/2015, 2015/2016 and 2016/2017), the region's foreign purchases of paste amounted to close on 241 000 mT on average, an official figure that does not include the marginal volume of approximately 6 000 mT imported each year by countries that do not feature in the official statistics. Over the same periods, at least 130 000 mT of canned tomatoes and 45 000 mT of sauces and ketchup were also imported. In total, it is estimated that in the recent past, more than 82% of the region's requirements in terms of tomato products were supplied thanks to foreign sources.

Over the past three or four years, Far-Eastern purchases of tomato products have recorded a clear decrease. In the paste sector, peak levels for imports were reached during the 2012/2013 marketing year, with close on 270 000 mT, at the outcome of a period of strong growth that was followed by a noticeable drop. The same marketing year 2012/2013 also signaled the peak period for imports of canned tomatoes and sauces, although to a lesser extent. In the end, despite the slight increases observed over the three categories, supply volumes over the past three marketing years have remained below those of previous years: 12% less in the case of paste and close on 5% less for canned tomatoes and sauces.

Supply sources

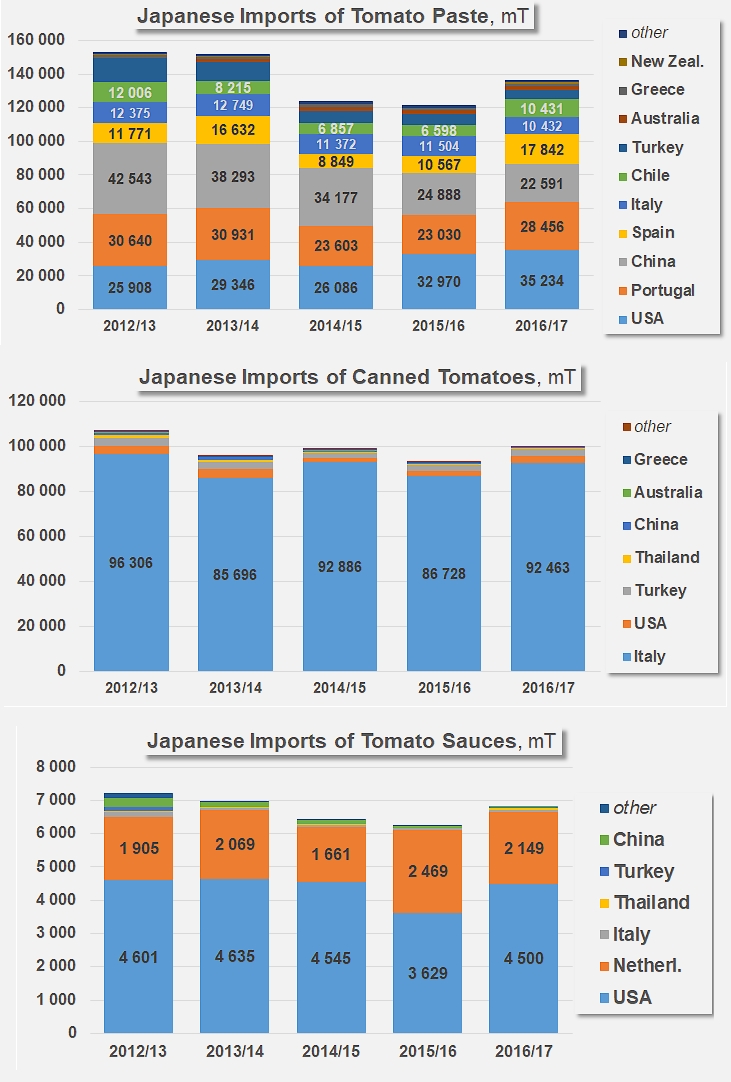

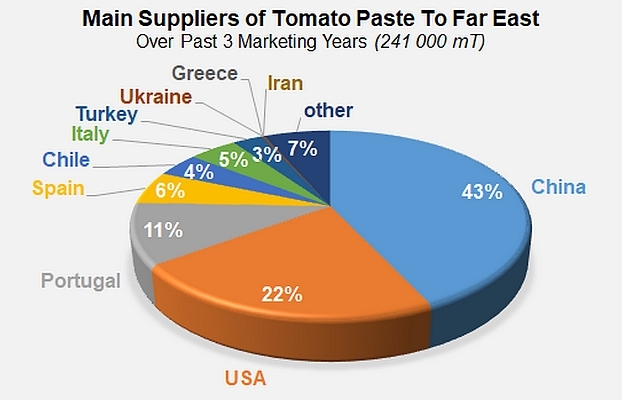

Chinese suppliers have claimed the lion's share of the main market outlets of the region. With almost 104 000 mT of pastes exported to countries of the Far East over the past three marketing years, China claims 43% of the market, considerably ahead of the United States (22% and 53 000 mT), Portugal (11% and 26 000 mT), Spain (6% and 14 000 mT) and Italy (5% and 11 000 mT). Chilean and Turkish products close the list with 10 000 mT and 7 000 mT, respectively 4% and 3% of the region's foreign purchases. Quantities from Portugal, Spain and Chile have grown in recent years, at the expense of shipments from China and the USA.

The canned tomato category in the Far East is unsurprisingly dominated by Italian operators, who hold close on 93% of the market (more than 120 000 mT). US products (less than 9 000 mT on average over the past three marketing years) and Turkish products (less than 3 000 mT) respectively account for less than 7% and less than 2% of the region's purchases.

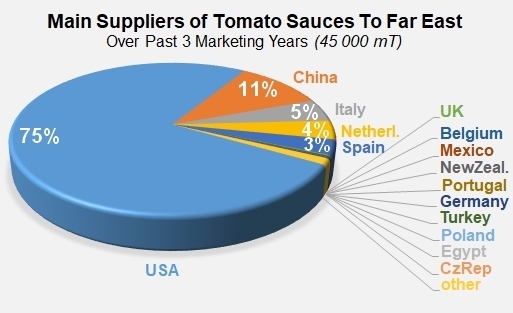

Competition is also highly polarized for the sauces and ketchup category, with three quarters of supplies being provided by US products (43 500 mT on average over the past three marketing years). The Chinese industry has been selling sauces in recent years in sufficiently large quantities to claim second position, with slightly less than 6 100 mT (11% of total) on average over the past three marketing years. Italy, the Netherlands and Spain complete the group of the region's main sauce suppliers, with respectively 2 800 mT (5%), 2 300 mT (4%) and 1 800 mT (3%) over the same periods.

Market patterns

The very idea of a "Far Eastern market" includes a number of highly contrasted realities that vary according to the product category.

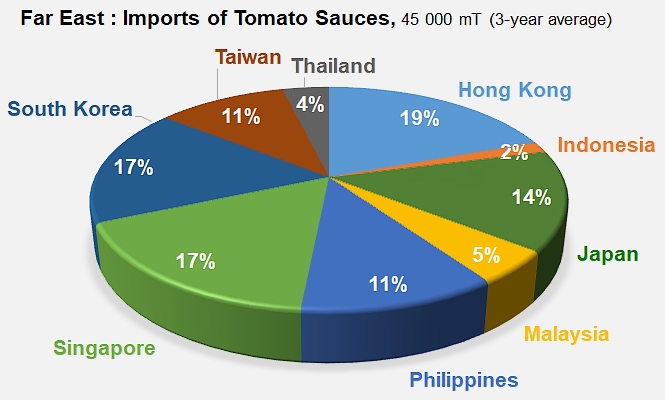

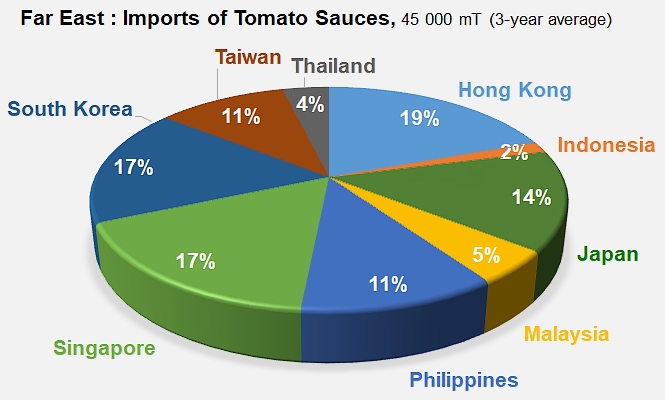

With a distribution of quantities in which no one country absorbs more than 20% of the total imports of the region, the sauces and ketchup market is by far the least polarized of the three product categories. The three main outlets have been, by order of importance, Hong Kong, Singapore and South Korea, which respectively imported an average over the past three years of 9 000 mT, 7 700 mT and 7 600 mT. Japanese purchases accounted for 50% of the quantities imported at the regional level, but several other countries deserve a mention, with 4 900 mT imported by the Philippines, 4 800 mT imported by Taiwan, 2 000 mT imported by Malaysia, and additional shipments to Thailand, Indonesia, etc.

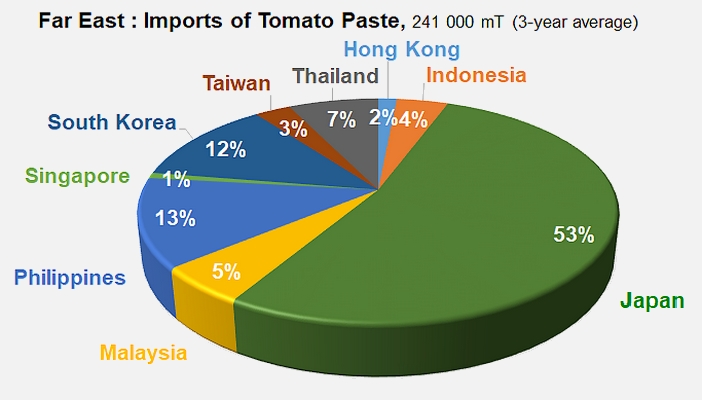

Imports of paste were mostly intended for the Japanese market: in recent marketing years, more than half (53%) of the quantities shipped to the Far East (241 000 mT) were absorbed by Japan (127 000 mT), with no other country importing more than 12% or 13% of the total purchases of this category in the region (30 000 mT to South Korea and 29 000 mT to the Philippines). Other countries of the region nonetheless represent important outlets: over the past three marketing years, Thai imports of paste have amounted to close on 18 000 mT, those of Malaysia have exceeded 12 500 mT, and Indonesia and Taiwan have imported respectively 10 200 mT and 7 600 mT. For this category, Hong Kong and Singapore remain secondary destinations (see infographics at the end of this report).

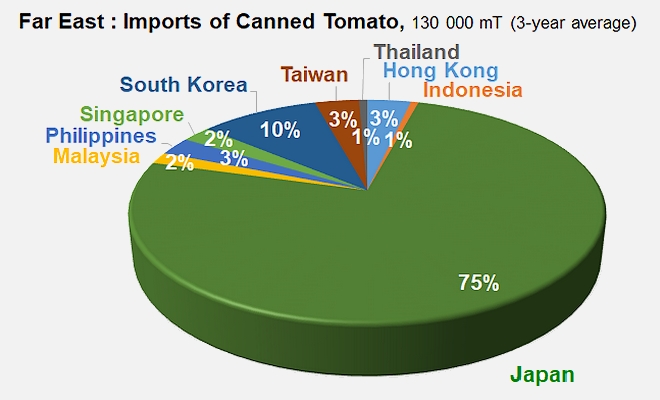

As for imports of the canned tomatoes category, Japan is clearly the leading outlet of the region: 75% – approximately 97 000 mT – of the volumes imported by the region as a whole – approximately 130 000 mT over the past three marketing years – have been shipped to Japan. South Korea, which is the region's second biggest outlet, only imported 12 600 mT on average over the same period (almost eight times less than Japan). Canned tomato purchases from other countries of the region did not exceed 4 700 mT (Taiwan and Hong Kong) and mostly stayed well below that level.

What impact for the EU-Japan Free Trade Agreement?

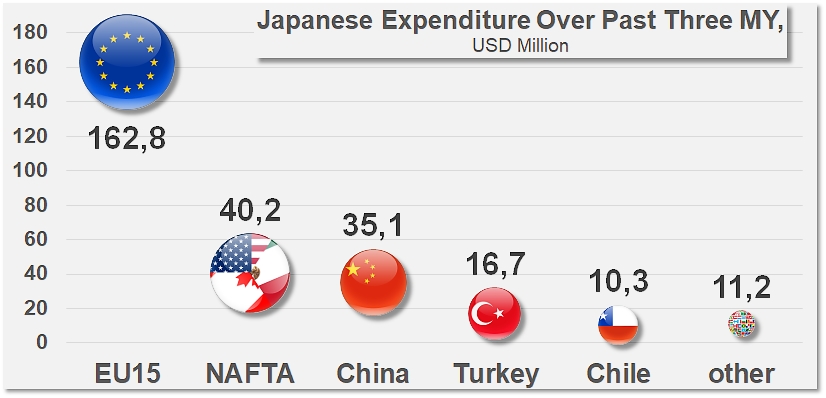

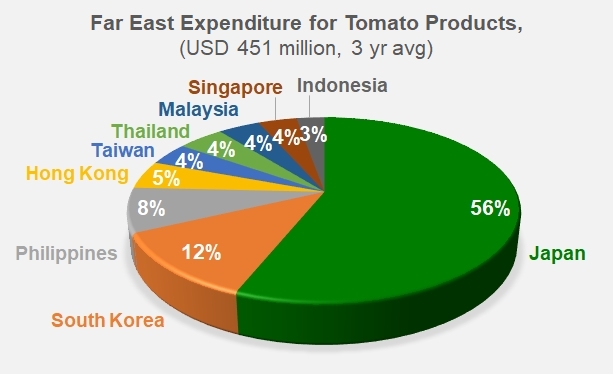

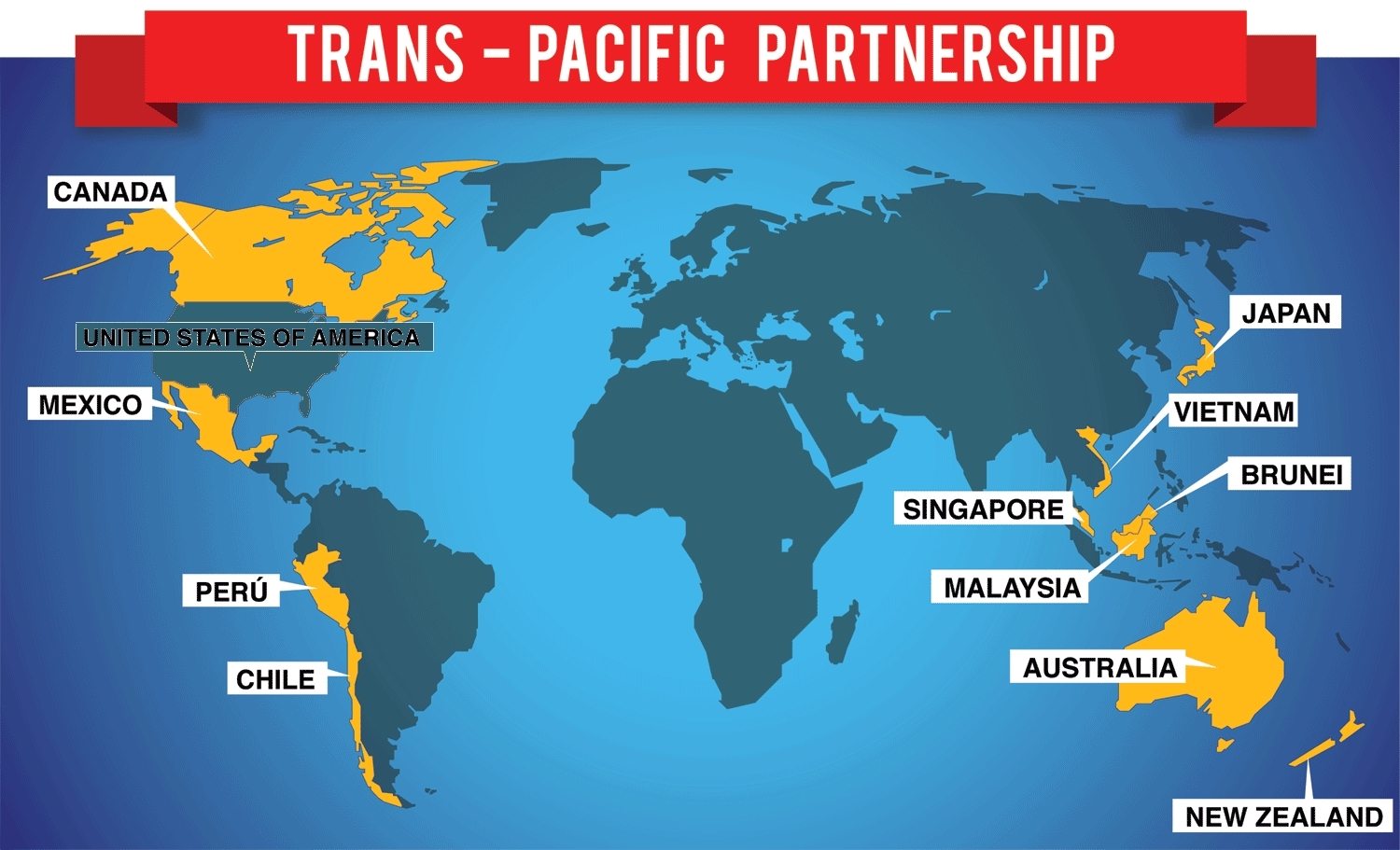

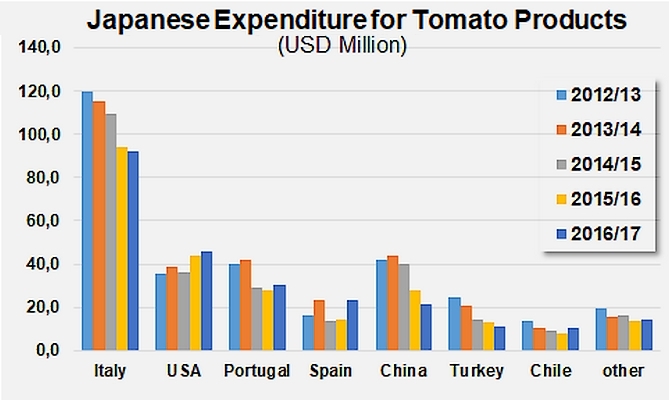

Clearly, Japan seems to be the main regional outlet for tomato products, with an average expenditure over the past three marketing years (2014/2015, 2015/2016 and 2016/2017) amounting to USD 253 million (56% of the region's expenditure – USD 451 million), well above those of neighboring countries (USD 53 million for South Korean purchases and 35 million for Filipino ones). After the United States withdrew from the Trans-Pacific Partnership negotiations, this dominant position has turned Japan into a partner of choice for setting up bilateral trade agreements, like the one that was signed early July by the Japanese Prime Minister Shinzo Abe, the President of the European Commission Jean-Claude Juncker and the President of the European Council Donald Tusk.

The EU-Japan Free Trade Agreement (FTA) will see EU exports of many ingredients benefit from significant quotas, either duty-free or reduced-duty. It will also scrap customs duties for processed food products such as prepared tomatoes, tomato sauce, pasta, chocolates, and many others. Under the agreement, Japan will recognize more than 200 European Geographical Indications for food and drink products.

The EU-Japan Free Trade Agreement (FTA) will see EU exports of many ingredients benefit from significant quotas, either duty-free or reduced-duty. It will also scrap customs duties for processed food products such as prepared tomatoes, tomato sauce, pasta, chocolates, and many others. Under the agreement, Japan will recognize more than 200 European Geographical Indications for food and drink products.

‘‘[This] means better prices for EU consumers and big export opportunities for EU Industry," said a statement issued by the European Commission.

The deal was widely embraced by Europe's food industry players. Mella Frewen, Director General of FoodDrinkEurope, the association that represents the interests of European food manufacturers, said such trade deals were "a catalyst for jobs and growth". "The agreement will help to level the playing field with other competitors and countries that already have preferential arrangements with Japan," she added. The Secretary-general of Copa and Cogeca, Pekka Pesonen, said he "hopes that the agreement [...] will deliver a better income for the farmers".

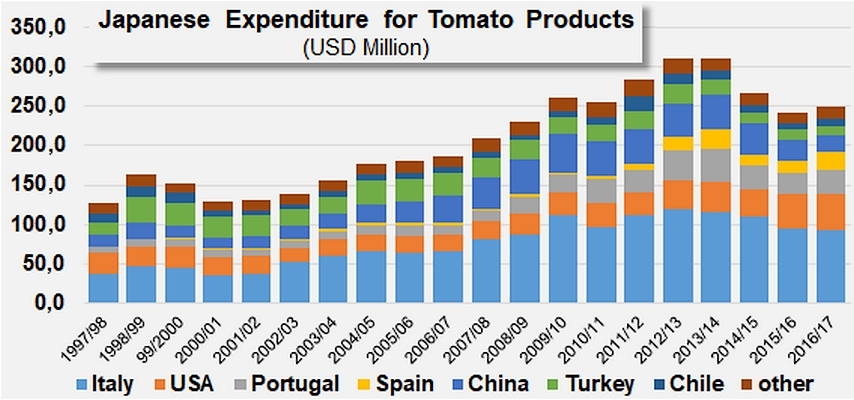

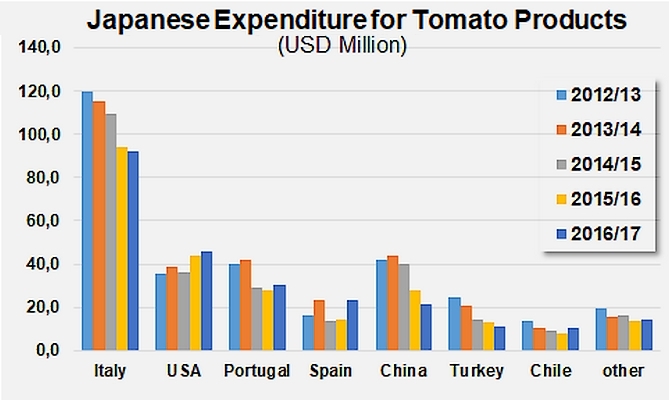

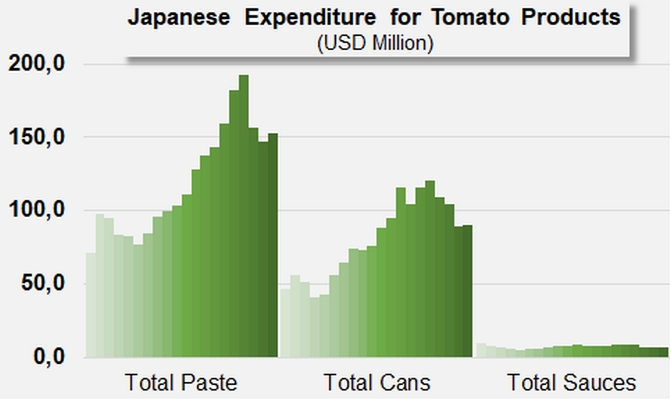

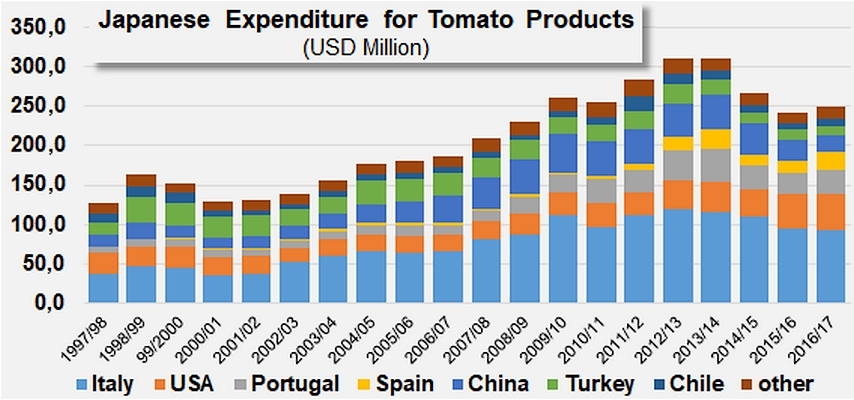

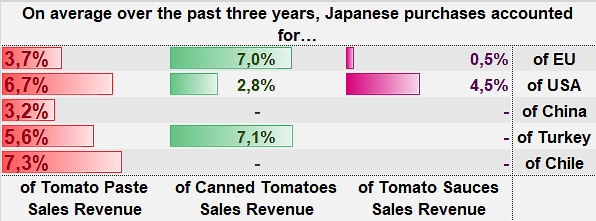

In terms of supply, Japan fits a very classic pattern regarding products and origins. Currently, most of Japan's expenditure (USD 253 million on average over the past three marketing years) goes on paste imports (USD 152 million, 60% of total expenditure) and canned tomato imports (USD 95 million, 37% of the total). Imports of sauces cost Japan less than USD 7 million (under 3% of the total amount) on average over the past three marketing years. This expenditure has dropped sharply in recent times, with all product categories being affected by the decrease in a similar way.

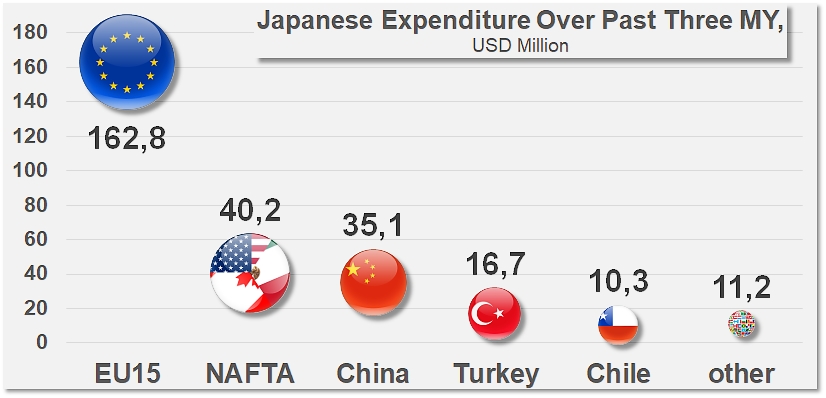

According to current agreements and product flow patterns, Italy claims the largest share – 39% – of Japan's expenditure on tomato products, with a turnover close on USD 99 million over the past three marketing years. Canned tomato sales make up the basis of this amount, with more than at USD 85 million (87%) over the period, with pastes accounting for approximately 13% of the total turnover.

Japanese imports have brought in USD 42 million for the US industry on average over the past three marketing years (2014/2015, 2015/2016 and 2016/2017), accounting for about 17% of total expenditure. 85% of this amount comes from the sale of pastes (USD 38.5 million), with canned tomatoes and sauces respectively accounting for USD 3.2 million and 3.9 million.

China and Portugal are neck and neck in terms of results for the period considered: sales to Japan brought in USD 29.7 million and 29.2 million for these countries (slightly less than 12% of total Japanese expenditure). In both cases, pastes made up the largest proportion of profits (100% in the case of Portugal), with China adding some volumes of canned tomatoes (less than 3% of the total turnover) and sauces (less than 0.3%) to its sales.

This top group of countries absorbed close on 79% of Japanese expenditure over the past three marketing years. Other countries deserve a mention: Spain with USD 17 million (of which 99.9% comes from paste sales, accounting for 7% of Japanese expenditure), Turkey with USD 13 million (of which 11 million generated by paste sales and 2 million by canned tomato sales) and Chile with USD 9.2 million (all of which was generated by paste sales). This group of seven countries has absorbed more than 94% of Japanese expenditure in recent years.

In terms of country of origin, the slowdown recorded since 2012/2013 has not affected all the countries in the same way. The sharp depreciation of the Japanese currency between the end of 2012 and summer 2015 ended up having a bigger impact in terms of quantities and value on trade flows from Italy, Portugal, China and Turkey than on US products and, to a lesser extent, Spanish products.

In the case of canned tomatoes, which remain Italy's main trade category, the dip in Japanese imports mostly affected the turnover (-15% between 2012-2014 and 2015-2017), while the volumes involved remained virtually unchanged (-0.5%). In total between the two periods considered, the turnover for the Italian industry on the Japanese market dropped from over USD 115 million to less than USD 99 million.

The decrease has been more brutal for the Chinese industry, whose total revenue on the Japanese market has shrunk by 31%, dropping from USD 43 million in 2011/2012-2013/2014 to USD 29 million in 2014/2015-2016/2017. China ranks third among Japan's paste suppliers, and has seen the sales of its flagship product drop by almost 15 000 mT (-35%) between the two periods, with the corresponding turnover shrinking by 28% (USD -11 million). Chinese sales of canned tomatoes to Japan have also recorded sharp drops, both in terms of quantity and value.

As for Portugal, the country has seen its exports of paste – the only trade flow that this country has with Japan – drop by 10% (approximately 2 700 mT) between the two periods, while the corresponding revenue has dropped by 21% (USD 7.8 million).

The decrease in Japanese purchases has had a major impact on the Turkish industry, which has seen its volumes and turnover shrink by half for the paste category and by more than 20% for the canned tomatoes category. In the final count, the three marketing years of the period running 2014/2015-2016/2017 saw a drop in income from the Japanese markets of close on USD 10 million compared to the period running 2011/2012-2013/2014 (-44%).

Part of the drop in tonnage from Italy, China, Portugal and Turkey has been picked up by other supply sources that are more attractive in terms of price or less costly in terms of shipping.

US operators, particularly Californian ones, have known how to take advantage of this situation in a context that has generally been to their disadvantage over the periods considered. Their total revenue, mainly generated by paste sales, has grown from USD 34.8 million for the period running 2011/2012-2013/2014 to USD 41.9 million for the period 2014/2015-2016/2017 (+20%). So sales of US paste to Japan have grown by 6 000 mT (24%) and approximately USD 8.5 million (+31%). This improvement has largely compensated for the slight dip recorded in other categories, with sales of canned tomatoes dropping 1 200 mT and a few hundred thousand US dollars and those of sauces dropping by a few hundred tonnes.

Spain is the only EU country to record growth in terms of quantity and turnover for the periods considered. Spanish results on the Japanese market are almost exclusively based on sales of paste, which increased by 1 200 mT and USD 1.6 million over the period, or approximately 10% to 11% in terms of volume and value.

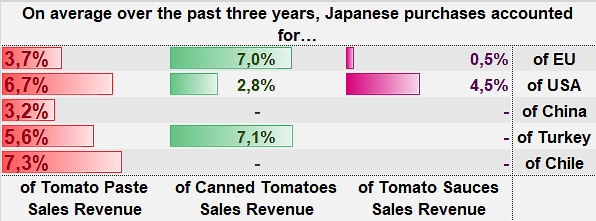

Over the past three marketing years, Japanese purchases have accounted in terms of value for 3% of the revenue generated by tomato paste sales from China, 4% of revenue from the European Union, 5% of revenue from North America, 6% of Turkish revenue for the category and 7% of Chilean revenue.

Given the recent withdrawal of the USA from the future Trans-Pacific Partnership agreement, in which Japan plays a major role, and the current pattern of trade flows from the EU feeding part of Japan's requirements, it is clear that Italy, Portugal and Spain will feature among the main beneficiaries of the future free trade agreement between the EU and Japan, once it has been finally ratified.

Japan and EU agree on efforts toward early conclusion of FTA

On 15 November, Japanese Foreign Minister Taro Kono and European Union Trade Commissioner Cecilia Malmström shared the view that the two sides will continue to make their utmost efforts to conclude the Japan-EU Economic Partnership Agreement (EPA) as early as possible. They also shared the view that Japan and the EU would continue to cooperate, the ministry said in a statement after the talks. Japan and the 28-country bloc launched the EPA negotiations in 2013, which will affect some 30% of the world's gross domestic product.

Both parties will now try to resolve all outstanding technical details, before submitting the final text to member states and the European Parliament for approval. The two sides aim to bring the trade pact into effect in 2019.

In the meantime, it will be necessary to take account of fluctuations in the Japanese currency, which has become notably weaker against the euro and the US dollar in recent months, and estimate the gain that will be achieved by the suppression in two years' time of customs tariffs for products entering Japan.

Sources: foodnavigator.com, kuna.net, IHS, Tomato News

Detailed statistical data is available on request by using the "contact us" tab on the website www.tomatonews.com.

Some complementary data

The USA control 75% of the sauce supplies to the Far East.

Japan accounts for more than half of the region's imports of tomato pastes.

Only one quarter of the region's foreign purchases of canned tomatoes are not shipped to Japan.

Japanese expenditure accounts for 56% of the region's total spending on foreign purchases of tomato products.

Countries involved in negotiations for the Trans-Pacific Partnership agreement after withdrawal of the USA.

Volumes of tomato products imported into Japan over the past five marketing years, by country of origin.

Composition of Japanese expenditure according to product category over the past 20 marketing years.

Countries of the Far East that publish official statistics for the tomato products trade.

The EU-Japan Free Trade Agreement (FTA) will see EU exports of many ingredients benefit from significant quotas, either duty-free or reduced-duty. It will also scrap customs duties for processed food products such as prepared tomatoes, tomato sauce, pasta, chocolates, and many others. Under the agreement, Japan will recognize more than 200 European Geographical Indications for food and drink products.

The EU-Japan Free Trade Agreement (FTA) will see EU exports of many ingredients benefit from significant quotas, either duty-free or reduced-duty. It will also scrap customs duties for processed food products such as prepared tomatoes, tomato sauce, pasta, chocolates, and many others. Under the agreement, Japan will recognize more than 200 European Geographical Indications for food and drink products.