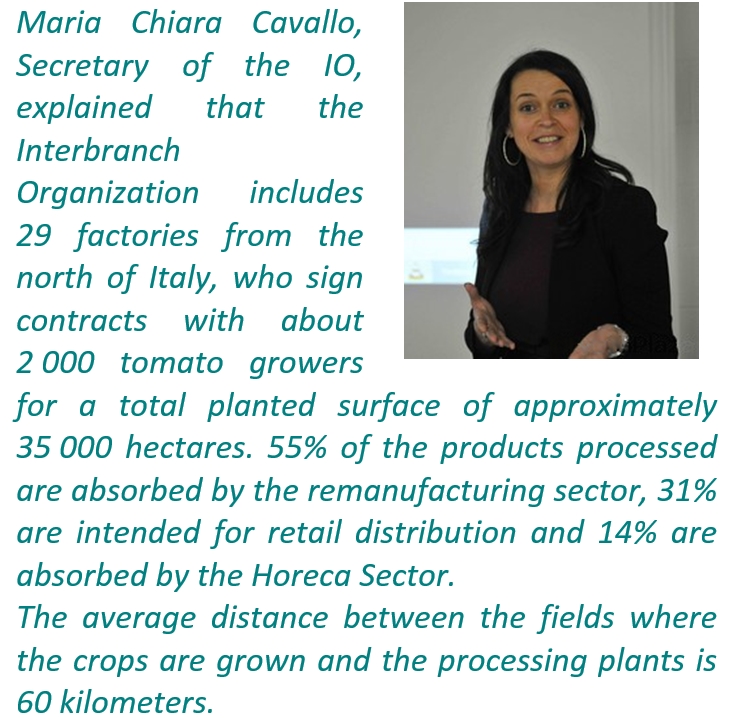

During the conference "Responsibility and transparency in the tomato processing industry of northern Italy", which was held in the context of the recent CIBUS (9-12 May, Parma, Italy), the IO Pomodoro Industria Nord Italia confirmed the excellent state of health of the Italian tomato products export sector, which shipped for more than EUR 1.5 billion in 2015.

"

Do not believe those who talk of an invasion of Chinese tomatoes in Italy", stated Guido Conforti, representing the northern Italy interbranch organization, "

when it is paradoxically rather the opposite that is likely happening, with an invasion of Italian tomatoes in China."

The head of the tomato products sector for the AIIPA (Associazione Italiana Industrie Prodotti Alimentari) and member of the coordination committee for the northern Italy IO clarified several aspects of the industry's current situation, and carried on by reminding participants that "

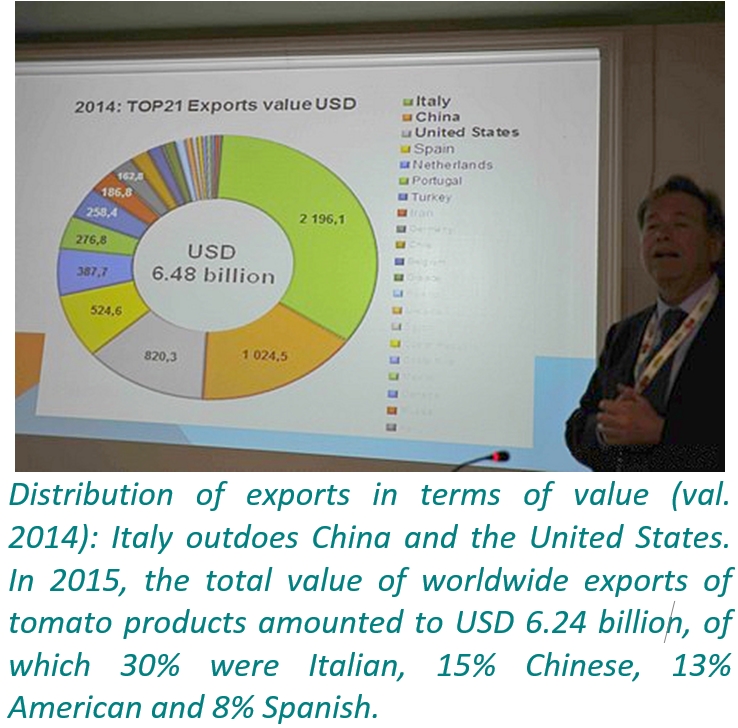

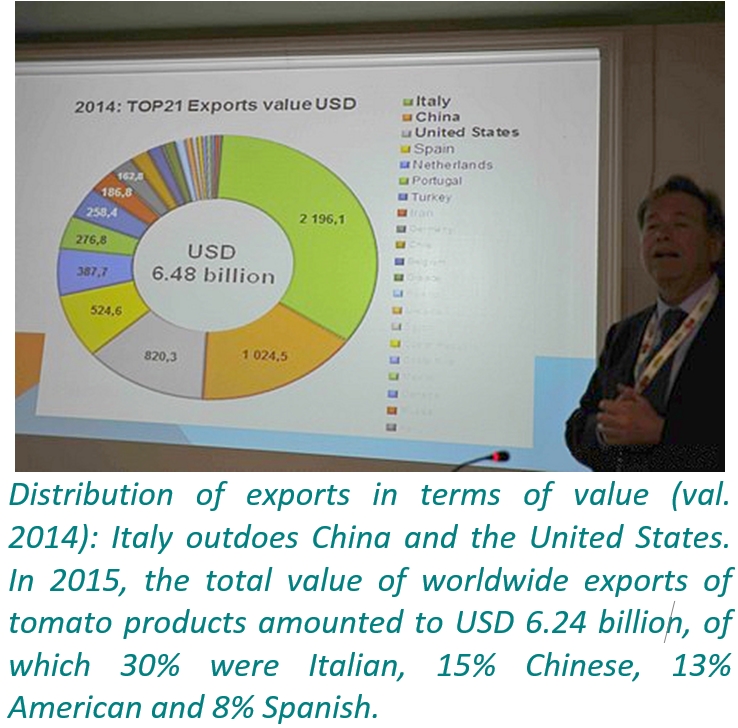

many people are not aware that Italy is the world leader for tomato product exports, ahead of China whose turnover is only half as much, and ahead of the United States whose business is three times less than ours. This reality is unfortunately often ignored: we rank second in terms of volumes, but first in terms of sales revenue. This means that the products we export have an undeniable value." Since 2000, continued Mr. Conforti, "

exports of canned tomato have been growing, as have those of sauces: we supply major consumer countries like Germany, the United Kingdom, France, the USA, Japan, the Netherlands and many other countries around the world. We export value, but also tomatoes: 60% of the tomatoes produced in Italy are shipped abroad (in processed form), which means that our country is self-sufficient to a level of 250%."

The effects of global competition are being felt

The conclusions of a recent analysis of the latest results for Italy's foreign trade in tomato products have shown, according to the Pomodoro Nord Italia, that

"the Italian tomato processing industry, despite heavy competition from worldwide markets and major tensions at the national level, is an essential player in the "made in Italy" field." During a coordination committee held at the end of March, the IO explained that an ISTAT study "

not only shows that Italy will still be able to largely satisfy the national demand for tobacco products, for a long time to come, but also that the turnover for exports and the trade balance have recorded regular growth, which has been obvious from 2011 until today".

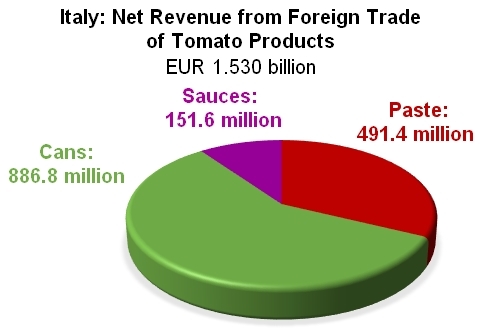

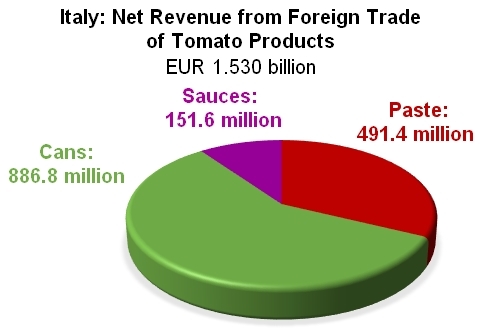

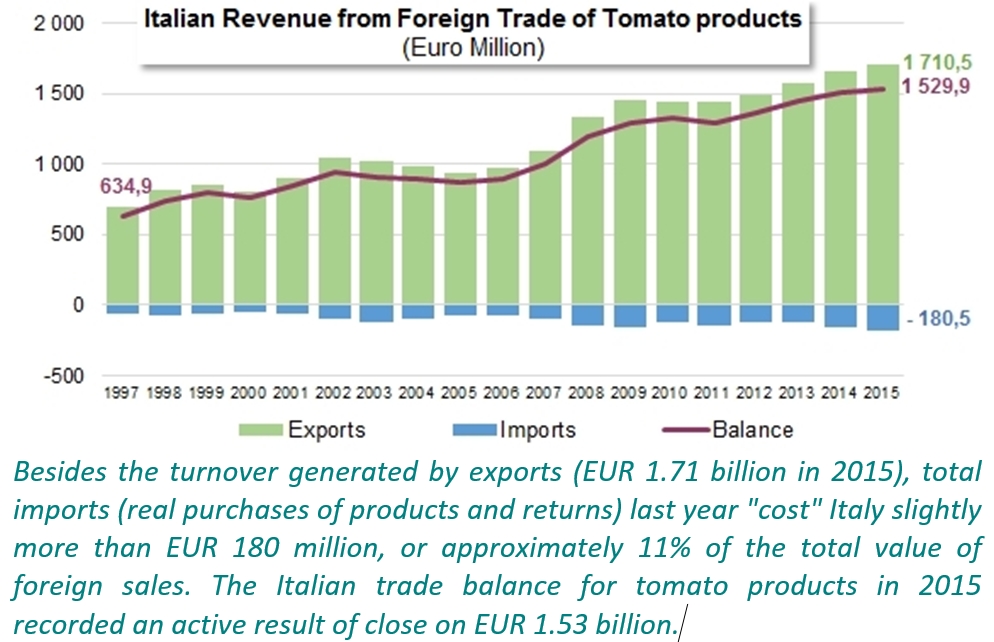

Indeed, net revenue from the Italian trade in tomato products (paste, canned tomatoes and sauces) reached the record level of EUR 1.53 billion (USD 1.697 billion) in 2015, with annual growth rates being recorded at 3 to 4% in recent years. In fact, not since the years 2003 to 2005 (when competition from other world-level industries, particularly Chinese, notably slowed Italy's foreign trade) has there been an obvious, though temporary, drop in the turnover. Since that time, the total value of Italy's foreign trade balance for tomato products has continued progressing almost continuously, increasing by 77% (EUR 665 million!) since its last slowdown, in 2005 (EUR 865 million, USD 1.077 billion).

However, the reality of 2015 is slightly less obvious and more complex than it appears at first glance. Pastes and canned tomato (peeled, whole, diced, sliced, in pieces, crushed, etc.) are not the only products concerned by Italy's foreign trade. Trade cannot be reduced merely to exports, and the increase in turnover cannot hide the fact that the Italian balance for tomato products is having trouble getting going again in terms of quantities...

Pastes, canned tomato... but also sauces

Along with the impressive export flow that makes Italy the world's second biggest player for pastes and the world's first player for canned tomato (and, in the end, the worldwide leader for tomato product exports (both in terms of volume and value)), Italy's foreign sales of tomato sauces & ketchup position the country in third place behind the USA and the Netherlands. Last year, in addition to the

656 000 mT of paste and 1.226 million mT of canned tomato delivered outside of its borders, the Italian industry also shipped close on

110 000 mT of sauces & ketchup. The performances achieved in this sector have represented, on average over the past five years, 7% of the volumes traded at the worldwide level (against 17% by the Netherlands and 23% by the United States). In 2015, sauces and ketchup generated 10% of the total turnover from Italian exports, a considerable contribution that has seen practically no change over the past three to four years.

Exports... but imports too

Although it ranks as one of the leading countries for the worldwide supply of tomato products, Italy nonetheless sees its industry putting a lot of effort into importing various tomato products. Last year

175 000 mT of tomato paste were imported to Italy, along with

5 000 mT of canned tomato and

21 600 mT of sauces & ketchup.

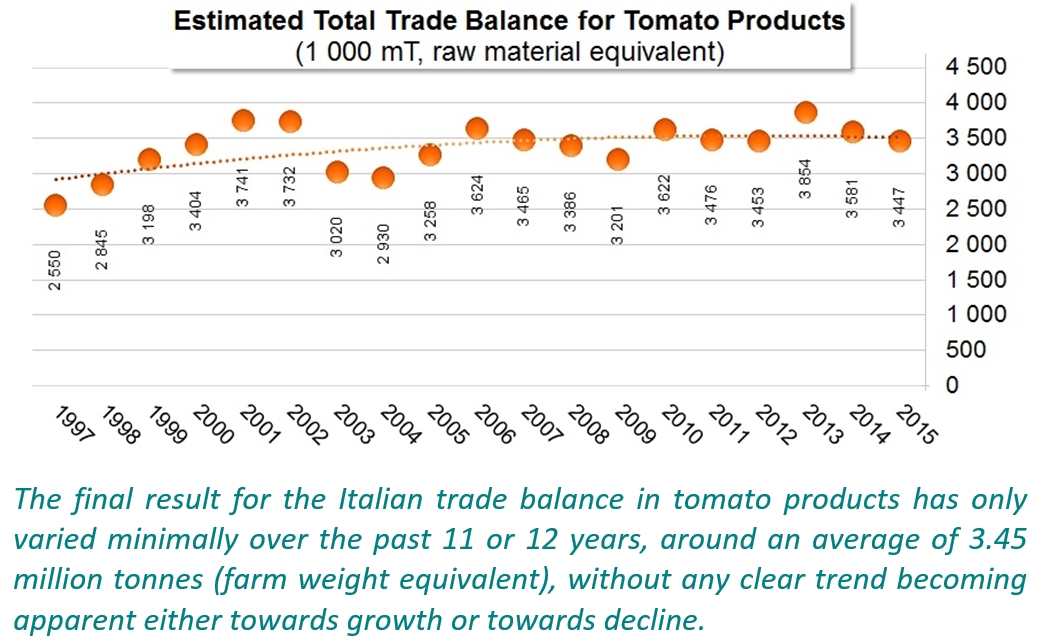

The quantities mobilized by the various trade flows coming in and going out – expressed in farm weight equivalent – are impressive in terms of their importance compared to the quantities processed annually: in 2015, Italian exports of paste (all categories overall) can be estimated at some 2.88 million tonnes of raw tomato, the equivalent of a very large half of the volumes processed during the 2014 and 2015 seasons. In a similar way, it can be estimated that imports accounted for the equivalent of 1.23 million tonnes of raw materials (approximately one third of the volumes processed in Italy). The categories of canned tomato and sauces absorbed slightly less than 1.54 million mT and 257 000 mT of raw materials, respectively, resulting in a trade balance for Italian tomato products that ended 2015 on a naturally active result estimated at 3.45 million mT.

Growing turnover but a hesitant trade balance

As pointed out by the IO, the trade balance (EUR 1.53 billion) is largely active, and indicates a remarkable progression compared to 2014, given that the turnover increased by 1.6% (approximately EUR 24 million). This improvement in the result is even more noticeable compared to the three previous years (2012-2014), as it reaches EUR 89 million in value and more than 6% in proportion.

The legitimate satisfaction of Italian processors should not however hide the fact that this

good financial result is largely linked to the depreciation of the European currency against the US dollar (but not against the Chinese yuan) and to the very acceptable results for the foreign sales of canned tomato, which is the flagship sector of the Italian industry. However, the improvement in the turnover only reflects a measured progress of the performance in terms of quantities. And finally, it is important to note that the overall good results in terms of quantity actually hide considerable differences between the various categories.

In a global context that was fairly favorable to the growth of the worldwide trade in tomato products last year (+3.5% for the paste sector alone), Italian performances remained lackluster despite the competitive advantage provided by the currency differential with the US dollar for a large part of the year. Unlike the considerable progression recorded in 2015 by Chinese exports (+14%), Spanish exports (+20%) and Portuguese exports (+8%) (

see our articles in the February, April and May 2016 issues of Tomato News), the

fairly average results of Italian paste exports (+4 910 mT, at 656 000 mT, which is up only 0.8% compared to 2014) have shown no real sign of recovering after the slowdown in trade observed during the previous marketing years, and they have remained noticeably lower than the best performance levels reached in 2011 (703 000 mT).

This particularly small progress in the volume of shipments has furthermore seen a parallel considerable increase in

imports (+27 000 mT compared to 2014), with the result that in 2015, for the second year running, the paste balance recorded a notable fallback (22 000 mT of finished products, or 4.4%) compared to the previous year. Results for the paste category in 2015 were even 5.5% (28,000 mT) lower than the average for the period 2012-2014... So with a net result of EUR 491 million, the turnover for the paste category has dropped by slightly more than EUR 6 million (-1%) compared to the results of 2014, and it has stagnated (-0.4%) compared to the average of the three previous years.

In line with what was stated at the end of March in the press release of the IO Pomodoro Nord Italia, the good news came from the

canned tomato category, with export tonnage that further increased by more than 39 000 mT (+3.3%, to 1.226 million mT) and a turnover of some EUR 8 million in 2015, but also from the sauces category whose exports increased by 11 500 mT (+12%) and which brought in EUR 12 million more than in 2014. The importance of this last category is particularly relative compared to the impressive volumes involved in Italy's foreign trade overall, notably in view of the fact that the volumes of products imported have also grown: in total, the Italian trade balance for sauces & ketchup in 2015 improved by 7 300 mT (+9%) on the results of 2014 and progressed by almost 19 000 mT (+27%) compared to the average for the years 2012-2014.

The sauces & ketchup sector is increasingly becoming a reliable and regular contributor to the positive trade balance of Italian tomato products. But the real strength of the Italian processing industry undoubtedly remains the canned tomato category, whose good performance on the export markets – along with a low level of imports (returned products) – largely compensates for the disappointing results of foreign paste sales. The trade dynamics of the canned tomato sector last year led to an improvement in results of 63 700 mT (5.5%) compared to 2014, which is 53 500 mT higher than the result for the period running 2012-2014. With almost EUR 887 million, the net turnover generated by this sector has grown by 2% (EUR 18.3 million) compared to 2014, but more importantly by 8% (EUR 62.5 million) compared to the average results for the period running 2012-2014. That said, these good performances remain insufficient in terms of quantity: although it is largely active, the final trade balance expressed in quantities of raw materials absorbed by Italian exchanges of tomato products was stated in 2015 at about

3.45 million tonnes, a sharp drop compared to the final balance of 2014 (3.58 million mT). This result is also 5% lower than the average results for the period running 2012-2014 and does not indicate any notable progression compared to the average balance for the 12 previous years (3.41 million mT).

Consequence of global competition or industrial strategy?

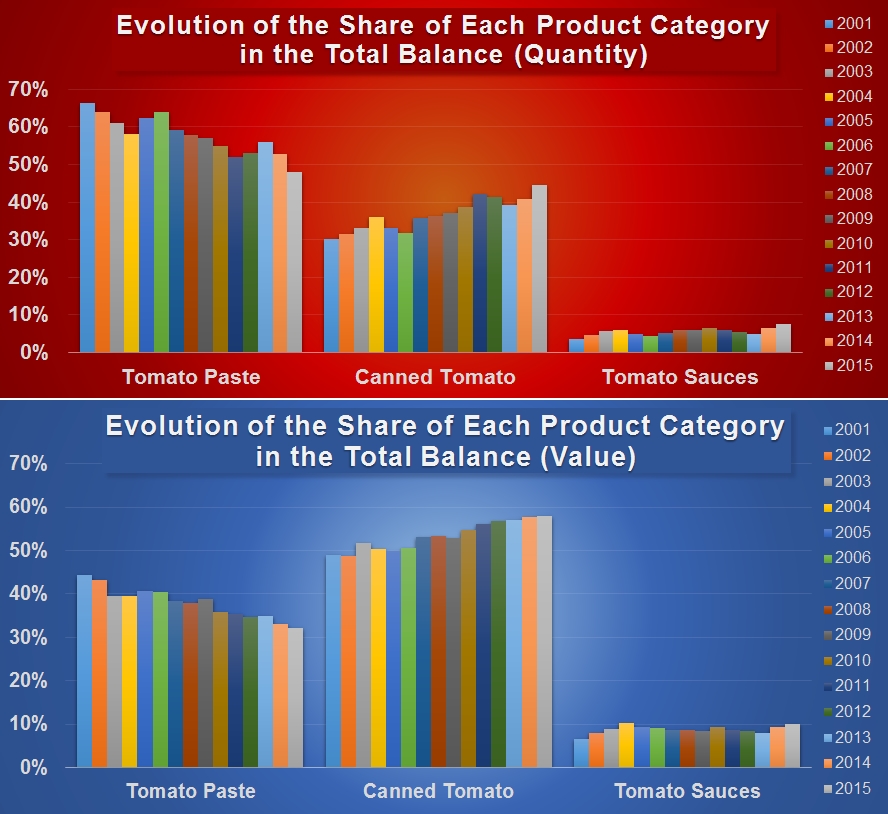

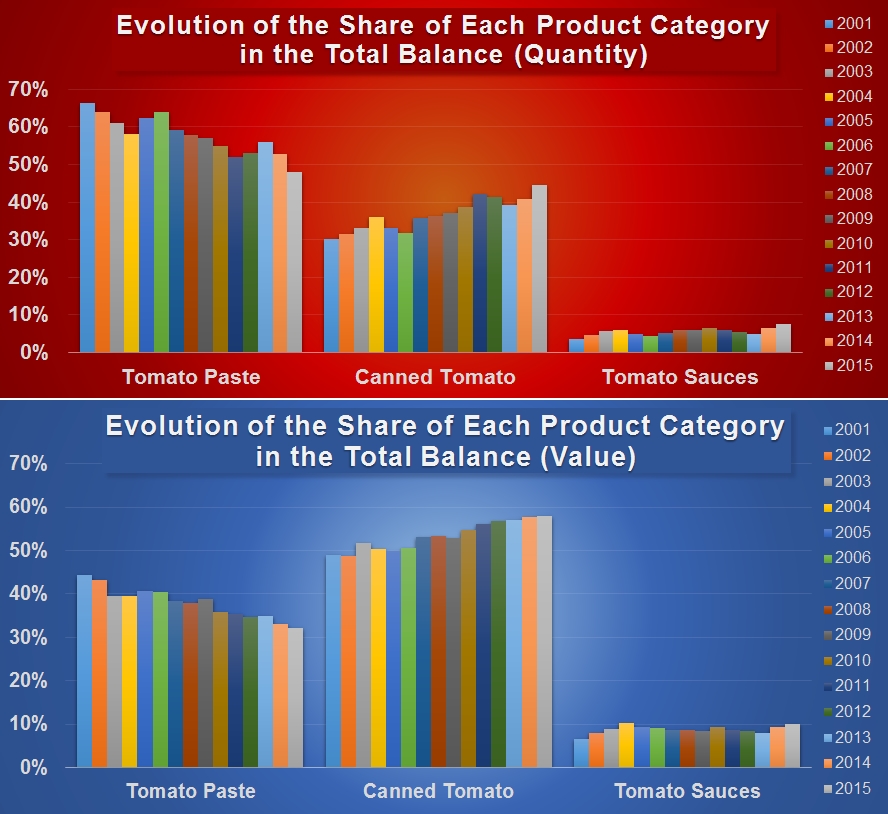

The proportional weight of canned products in the quantity and value balances of Italian tomato products is increasingly large: whereas it only represented, in 2001, 30% of the volumes exported (expressed in farm weight equivalent) and only generated slightly less than half (49%) of the net turnover from Italian exchanges of tomato products, the canned tomato category – which is increasingly popular with processors – has reached a decisive threshold in recent years, allowing it to absorb 45% of the volumes exported (farm weight equivalent) and to "produce" 58% of the total net value of exports in 2015.

This particular development has been accompanied by a parallel (though less pronounced) increase of sauces exports, which have grown from 3 to 7% of the volumes involved in export movements and accounted for 10% of the net revenue from exports last year, against less than 7% in 2001.

This industrial and commercial orientation has occurred over the past 15 years at the (relative) expense of the paste sector, whose importance in terms of contribution to the country's positive trade balance has dropped spectacularly from 66% of the volumes involved in exports and 44% of the net turnover in 2001 to only 48% of the volumes and 32% of the net turnover in 2015. A clearly preponderant share of Italian revenue from tomato product exports has, for the past 10 years, been attributable to foreign sales of canned tomato, for a quantity of raw materials processed that is proportionally much less important. The profitability ratio of canned tomato (contribution to revenue / share of raw materials mobilized) is considerably higher than the ratio of pastes, even taking account of a price for raw materials that is noticeably higher (officially, in 2015, EUR 105 /tonne in southern Italy, against EUR 95 /tonne for tomatoes intended for paste).

The recent evolution of export profiles and the circumstances caused by this evolution seem to be relatively independent of the various crises that have hit the worldwide industry over the past 20 years, and they seem to proceed, in their intensity and their regularity, from a confirmed industrial and commercial approach. It could be said that this orientation has been to the advantage of the canned tomato sector, whereas the positioning of part of the Italian industry in terms of the competition between paste producers at the global level remains uncertain.

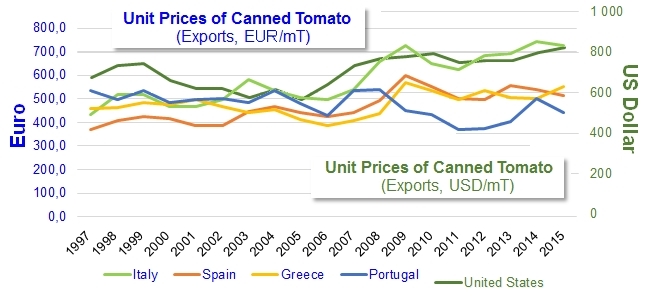

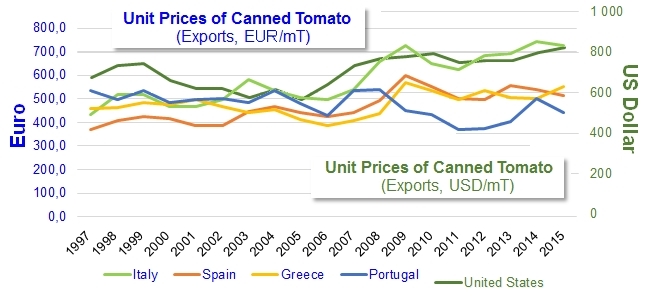

In the words spoken last March by Pier Luigi Ferrari, President of the IO Pomodoro Nord Italia, "it is not by chance that 2015 foreign sales of tomato paste and peeled canned tomatoes reached the record level of EUR 1.536 billion". While consolidating the good results recorded by the paste sector in 2014, the Italian industry essentially based its progression last year on canned tomato sales, despite the fact that world prices in that sector recorded a spectacular drop: globally, the

unit price for canned tomato (in US dollars) lost about 12% in 2015, but it is the prices in euros in the main exporting countries (almost all European countries) that most severely felt the effects of competition. Between 2014 and 2015, the fallback in the average value of the products exported amounted to 2% for Italian canned tomato (but in a more detailed analysis, some segments reportedly saw their unit price fall by 11 or 12%), close on 5% for Spanish canned tomato, and reached almost 12% for Portuguese canned tomato...

Due to a slight surplus in stocks (estimated by the ANICAV, as of 28 February, at about two months of apparent disappearance) and in the context of a demand that is described as stable, market experts have seen this drop as the result of a price war launched by Italian operators in order to re-appropriate market shares that had been lost to foreign operators. Faced by the increasingly confident competition from operators in other European countries, particularly in Spain, Italy has indeed been suffering, according to the terms of ANICAV director Giovanni De Angelis "from a lack of competitiveness that in the short term could jeopardize the country's leading position if the causes of the slower growth of Italian operations are not rapidly identified and dealt with."

Among the issues mentioned by the ANICAV, the weakness of the country's agricultural productivity and the very high levels of operational costs compared to those in competing countries, particularly the United States, China, Spain and Portugal, represent major priorities. According to Mr. De Angelis, among European countries, Italy is the one that records the lowest per hectare yields, of approximately 74 tonnes per hectare (mT/ha), whereas the same surfaces can produce 90 tonnes in Spain, 94 tonnes in China, 97 tonnes in Portugal and 105 tonnes in California. This differential, along with a price for raw materials that is noticeably higher in Italy than in the other European countries, largely accounts for what the director of the ANICAV describes as "a collapse in the competitiveness of the sector compared with other growing regions on the European market, particularly Spain".

The National Vegetable Canning Industry Association, based in Naples, considers that it is urgent to launch “a large project for research, experimentation and innovation, involving all partners and benefiting from as much national and European support as possible, in order to increase productivity and agricultural yields as rapidly as possible. The level of coupled aid for the tomato industry in Italy is the lowest in Europe. This is insufficient support for a sector whose low yields and high costs could rapidly lead to a major structural crisis."

The exceptionally long negotiations taking place within the Italian industry in order to fix the price of processing tomato crops for the 2016 season led the Italian Minister of agriculture Maurizio Martina, in the last few days of April, to delay the final deadline for contract submissions to 15 May 2016. The difficulties in finding an agreement are indicative of the issues and tensions that prevail this year during this particularly crucial stage of operations for the industry.

Some complementary data

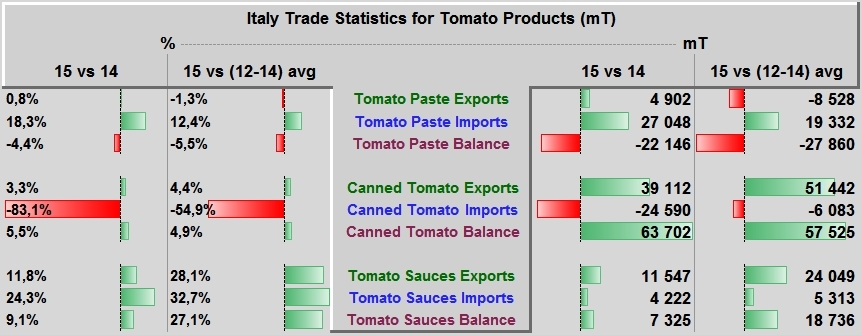

Table summarizing Italian performances over the past four years: comparison of 2015 results with results for 2014 and average results for the period 2012-2014.

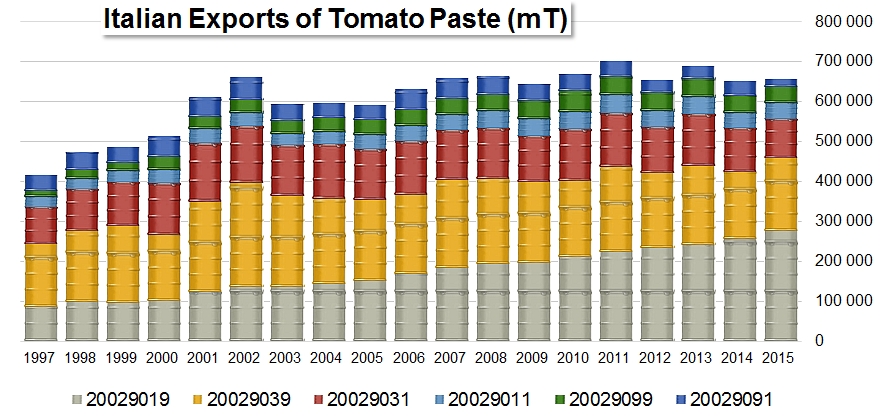

Italian tomato paste exports, by category: "low concentration" products in industrial conditionings and/or retail pack have acquired an increasing importance in Italy's foreign trade results.

The volumes exported each year have varied around an average of about 656 000 mT since 2005.

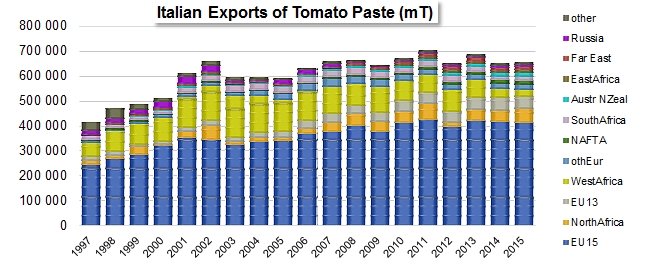

Italian tomato paste exports, by region of destination: EU28 countries invariably represent the main outlet for Italian products, ahead of the countries of North Africa and West Africa.

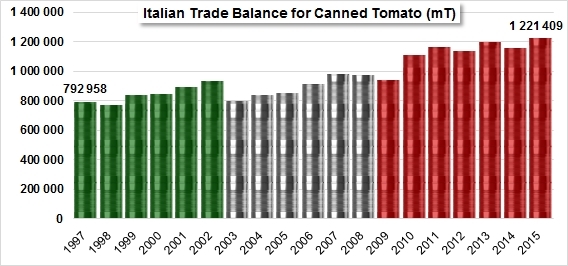

The turnover generated by canned tomato exports has more than doubled since 2005, and accounts for the largest proportion of growth in revenue from exports of Italian tomato products since that date.

Over the same 11 year period, the quantities of canned tomato exported by Italian operators increased by 43%.

The head of the tomato products sector for the AIIPA (Associazione Italiana Industrie Prodotti Alimentari) and member of the coordination committee for the northern Italy IO clarified several aspects of the industry's current situation, and carried on by reminding participants that "many people are not aware that Italy is the world leader for tomato product exports, ahead of China whose turnover is only half as much, and ahead of the United States whose business is three times less than ours. This reality is unfortunately often ignored: we rank second in terms of volumes, but first in terms of sales revenue. This means that the products we export have an undeniable value." Since 2000, continued Mr. Conforti, "exports of canned tomato have been growing, as have those of sauces: we supply major consumer countries like Germany, the United Kingdom, France, the USA, Japan, the Netherlands and many other countries around the world. We export value, but also tomatoes: 60% of the tomatoes produced in Italy are shipped abroad (in processed form), which means that our country is self-sufficient to a level of 250%."

The head of the tomato products sector for the AIIPA (Associazione Italiana Industrie Prodotti Alimentari) and member of the coordination committee for the northern Italy IO clarified several aspects of the industry's current situation, and carried on by reminding participants that "many people are not aware that Italy is the world leader for tomato product exports, ahead of China whose turnover is only half as much, and ahead of the United States whose business is three times less than ours. This reality is unfortunately often ignored: we rank second in terms of volumes, but first in terms of sales revenue. This means that the products we export have an undeniable value." Since 2000, continued Mr. Conforti, "exports of canned tomato have been growing, as have those of sauces: we supply major consumer countries like Germany, the United Kingdom, France, the USA, Japan, the Netherlands and many other countries around the world. We export value, but also tomatoes: 60% of the tomatoes produced in Italy are shipped abroad (in processed form), which means that our country is self-sufficient to a level of 250%." Indeed, net revenue from the Italian trade in tomato products (paste, canned tomatoes and sauces) reached the record level of EUR 1.53 billion (USD 1.697 billion) in 2015, with annual growth rates being recorded at 3 to 4% in recent years. In fact, not since the years 2003 to 2005 (when competition from other world-level industries, particularly Chinese, notably slowed Italy's foreign trade) has there been an obvious, though temporary, drop in the turnover. Since that time, the total value of Italy's foreign trade balance for tomato products has continued progressing almost continuously, increasing by 77% (EUR 665 million!) since its last slowdown, in 2005 (EUR 865 million, USD 1.077 billion).

Indeed, net revenue from the Italian trade in tomato products (paste, canned tomatoes and sauces) reached the record level of EUR 1.53 billion (USD 1.697 billion) in 2015, with annual growth rates being recorded at 3 to 4% in recent years. In fact, not since the years 2003 to 2005 (when competition from other world-level industries, particularly Chinese, notably slowed Italy's foreign trade) has there been an obvious, though temporary, drop in the turnover. Since that time, the total value of Italy's foreign trade balance for tomato products has continued progressing almost continuously, increasing by 77% (EUR 665 million!) since its last slowdown, in 2005 (EUR 865 million, USD 1.077 billion). The quantities mobilized by the various trade flows coming in and going out – expressed in farm weight equivalent – are impressive in terms of their importance compared to the quantities processed annually: in 2015, Italian exports of paste (all categories overall) can be estimated at some 2.88 million tonnes of raw tomato, the equivalent of a very large half of the volumes processed during the 2014 and 2015 seasons. In a similar way, it can be estimated that imports accounted for the equivalent of 1.23 million tonnes of raw materials (approximately one third of the volumes processed in Italy). The categories of canned tomato and sauces absorbed slightly less than 1.54 million mT and 257 000 mT of raw materials, respectively, resulting in a trade balance for Italian tomato products that ended 2015 on a naturally active result estimated at 3.45 million mT.

The quantities mobilized by the various trade flows coming in and going out – expressed in farm weight equivalent – are impressive in terms of their importance compared to the quantities processed annually: in 2015, Italian exports of paste (all categories overall) can be estimated at some 2.88 million tonnes of raw tomato, the equivalent of a very large half of the volumes processed during the 2014 and 2015 seasons. In a similar way, it can be estimated that imports accounted for the equivalent of 1.23 million tonnes of raw materials (approximately one third of the volumes processed in Italy). The categories of canned tomato and sauces absorbed slightly less than 1.54 million mT and 257 000 mT of raw materials, respectively, resulting in a trade balance for Italian tomato products that ended 2015 on a naturally active result estimated at 3.45 million mT.

This particular development has been accompanied by a parallel (though less pronounced) increase of sauces exports, which have grown from 3 to 7% of the volumes involved in export movements and accounted for 10% of the net revenue from exports last year, against less than 7% in 2001.

This particular development has been accompanied by a parallel (though less pronounced) increase of sauces exports, which have grown from 3 to 7% of the volumes involved in export movements and accounted for 10% of the net revenue from exports last year, against less than 7% in 2001.

In the words spoken last March by Pier Luigi Ferrari, President of the IO Pomodoro Nord Italia, "it is not by chance that 2015 foreign sales of tomato paste and peeled canned tomatoes reached the record level of EUR 1.536 billion". While consolidating the good results recorded by the paste sector in 2014, the Italian industry essentially based its progression last year on canned tomato sales, despite the fact that world prices in that sector recorded a spectacular drop: globally, the unit price for canned tomato (in US dollars) lost about 12% in 2015, but it is the prices in euros in the main exporting countries (almost all European countries) that most severely felt the effects of competition. Between 2014 and 2015, the fallback in the average value of the products exported amounted to 2% for Italian canned tomato (but in a more detailed analysis, some segments reportedly saw their unit price fall by 11 or 12%), close on 5% for Spanish canned tomato, and reached almost 12% for Portuguese canned tomato...

In the words spoken last March by Pier Luigi Ferrari, President of the IO Pomodoro Nord Italia, "it is not by chance that 2015 foreign sales of tomato paste and peeled canned tomatoes reached the record level of EUR 1.536 billion". While consolidating the good results recorded by the paste sector in 2014, the Italian industry essentially based its progression last year on canned tomato sales, despite the fact that world prices in that sector recorded a spectacular drop: globally, the unit price for canned tomato (in US dollars) lost about 12% in 2015, but it is the prices in euros in the main exporting countries (almost all European countries) that most severely felt the effects of competition. Between 2014 and 2015, the fallback in the average value of the products exported amounted to 2% for Italian canned tomato (but in a more detailed analysis, some segments reportedly saw their unit price fall by 11 or 12%), close on 5% for Spanish canned tomato, and reached almost 12% for Portuguese canned tomato...

The National Vegetable Canning Industry Association, based in Naples, considers that it is urgent to launch “a large project for research, experimentation and innovation, involving all partners and benefiting from as much national and European support as possible, in order to increase productivity and agricultural yields as rapidly as possible. The level of coupled aid for the tomato industry in Italy is the lowest in Europe. This is insufficient support for a sector whose low yields and high costs could rapidly lead to a major structural crisis."

The National Vegetable Canning Industry Association, based in Naples, considers that it is urgent to launch “a large project for research, experimentation and innovation, involving all partners and benefiting from as much national and European support as possible, in order to increase productivity and agricultural yields as rapidly as possible. The level of coupled aid for the tomato industry in Italy is the lowest in Europe. This is insufficient support for a sector whose low yields and high costs could rapidly lead to a major structural crisis."