General principles

In Europe, the rules on emissions of CO2 (carbon dioxide), N2O (nitrous oxide) and PFCs (perfluorocarbons) were instituted in 2003/2005 (Directive 2003/87/EC, which came into effect in 2005). The total volume of greenhouse gases that can be emitted over one trading round (a period of several years) by the industries covered by the system must be lower than a certain cap fixed by the EU. Within the limits of this maximum level, companies receive or buy emissions quotas that they can trade if they want. This system is known as the ETS, or Emissions Trading System, and it is similar to the "cap-and-trade" program used in North America and other systems in place in China, South Korea, Canada, Japan, New Zealand and Switzerland.

Major changes were implemented when the system started into its third round on 1 January 2013, including a progressive reduction of the maximum emissions level throughout the European Union (-1.74% each year) and the progressive shift away from a system of cost-free allocations intended to avoid the economic impact of universal and immediate implementation, towards the introduction of quotas sold at auction.

Since this date, companies must acquire an increasingly high proportion of their quotas or allowances, which are sold at auction: the percentage of quotas that are not granted on a cost-free basis has increased over the years, as their number has dropped at a faster rate than the cap. In total, the Commission estimates that 57% of the quotas will be sold at auction over the period running 2013-2020 (remaining quotas being allocated on a cost-free basis), and that the percentage of quotas that are allocated without cost will only account for 30% of the total by 2020. According to the proposals for this review of the EU's ETS, which was presented by the Commission in July 2015, the proportion of quotas to be sold at auction will be maintained at the same level for 2020.

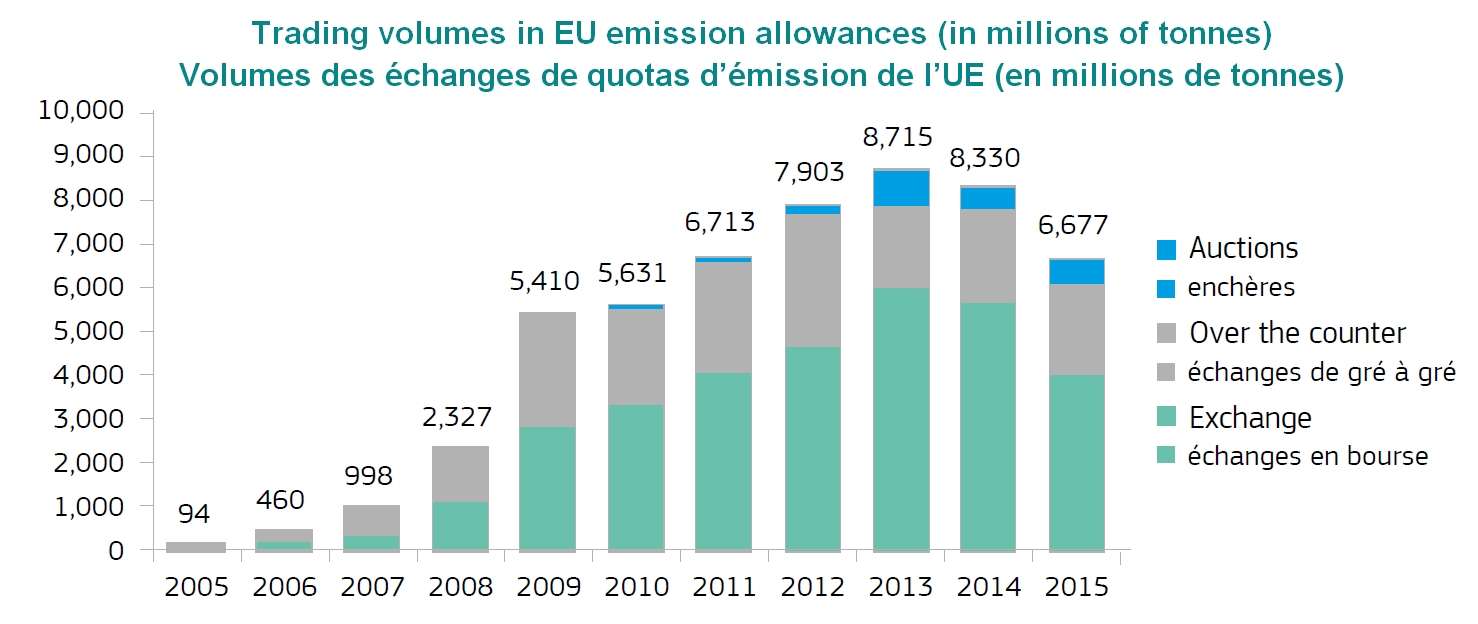

In total, 6.67 billion quotas were traded in the EU in 2015, for a total value of approximately EUR 49 billion.

At the close of the ETS third round (1 January 2020), greenhouse gas emissions should have dropped by 21% compared to what they were in 2005.

All industrial sectors are not concerned in the same way. The European system mainly targets emissions that can be reliably measured, declared and controlled. Furthermore, for a number of sectors, only the installations beyond a certain size are included in the scheme: in our "processing tomato" sector, the only companies concerned are those whose steam production installations record a nominal power of more than 20 MWth (thermal megawatts). In Europe, many smaller factories that produce sauces or "low concentration" products will not be concerned by this program.

This can be clarified by considering that an average factory processing between 100 000 and 200 000 metric tonnes of raw tomatoes into 28/13 paste releases approximately 8 000 to 10 000 tonnes of CO2 under normal conditions. According to industrial sources, the price that companies must pay for their emissions allowances is currently in the region of EUR 10, a level that is considerably lower than the one initially fixed by European authorities, due to an overestimation of requirements during the first round of the program (2005-2007) and to a drop in demand caused by the economic slump in the EU between 2008 and 2012. The cost of CO2 emissions rights has crumbled since its creation and the start of round 3 of the program. In the end, a total of almost 6.7 billion quotas were exchanged in this way in 2015 across the EU for all of the sectors concerned, for a total value of approximately EUR 49 billion (EUR 7.3 per quota). Since that date, the price of emissions quotas has recovered. The average cost for a company processing 150 000 tonnes of tomatoes into paste would amount today to approximately EUR 90 000 per season, which represents a considerable financial burden given the extremely narrow profit margins recorded for the sector.

The tomato industry and the risk of "carbon leakage"

In theory, companies that are active in the relevant sectors are required to take part in the EU's ETS. But public authorities can exempt certain smaller installations or adapt the scheme for sectors or industry segments that present serious risks of "carbon leakage". From the outset, Directive 2003/87/EC examined the case of the tomato paste subsector, which is highly exposed to international competition and which, due to the high power of its installations (often above 20 MWth), would have to face a "CO2 tax" that is incompatible with the long-term survival of the sector in the face of competition from companies in third-party countries where they are not submitted to this type of constraint. The expression "carbon leakage" refers to the situation where companies decide to relocate their production installations to other countries where legislation is less severe, in order to dispense with the costs linked to considerations of climate protection.

Sectors and subsectors that are considered as exposed to this risk feature on an official list set up for a period of five years, on the basis of clearly defined criteria. The current list is applicable from 2015 to 2019. When the first list of "sectors at risk from CO2 leakage" was set up, a high proportion of the industrial companies that release harmful emissions could hope to be included. Since the implementation of the European Directive on CO2 emissions, the tomato paste segment – and not the tomato processing sector as a whole – has been retained as sector presenting a risk of CO2 leakage.

Sectors and subsectors that are considered as exposed to this risk feature on an official list set up for a period of five years, on the basis of clearly defined criteria. The current list is applicable from 2015 to 2019. When the first list of "sectors at risk from CO2 leakage" was set up, a high proportion of the industrial companies that release harmful emissions could hope to be included. Since the implementation of the European Directive on CO2 emissions, the tomato paste segment – and not the tomato processing sector as a whole – has been retained as sector presenting a risk of CO2 leakage.Inclusion on this list does not mean that relevant companies benefit from cost-free emissions quotas for all of their requirements. Depending on a general benchmark, a comparative report on the efficiency of each factory (emissions assessment) is drawn up against a number of industrial installations that are used as reference plants for the sector, in order to guarantee that the highest performing plants are given more free allowances. Then, depending on the efficiency percentage results against the benchmark, shares of emissions allowances are allocated in smaller and smaller proportions.

Unlike the tomato paste subsector, the production of canned tomatoes and sauces is not included on the list of high risk sectors for CO2 leakage. Processing installations that operate in the sectors of tomato pulp, juice, sauces, chopped tomatoes, crushed tomatoes, etc. are included in the general European scheme for GHG emissions. In theory, those that reached the required reference level received 80% of their quotas cost-free for their needs in 2013. Installations that did not reach the required reference level received proportionately less quotas.

Tomato processing companies, whether they are listed among the high risk subsectors or not, operate in a general context that will see a progressive drop in the total number of emissions quotas granted in the EU (-1.74% per year until 2019, then -2.2% per year after 2021), as well as a progressive drop in the number of free quotas, which will not exceed 30% after 2020.

The difficulty in characterizing "risk"

According to the ETS Directive (Article 10a), "a sector or sub-sector is deemed to be exposed to a significant risk of carbon leakage if:

- direct and indirect costs induced by the implementation of the directive would increase production cost, calculated as a proportion of the gross value added, by at least 5%; and the sector's trade intensity with non-EU countries (imports and exports) is above 10%.

- or the sum of direct and indirect additional costs is at least 30% of the gross value added;

- or the non-EU trade intensity is above 30%."

Currently, and until 2021, clear exposure to one of the two most penalizing criteria (30% threshold) or to a combination of both (thresholds of 5% and 10%) is sufficient to determine that an industrial sector presents a high risk of carbon leakage. So as soon the CO2 emissions reduction policy was adopted, the European paste production sector was included on the list of "high risk sectors" because the intensity of trade between EU processing countries and non-EU countries amounted to approximately 40%, thereby defining a situation of high exposure on the international market.

In the context of studies carried out for the review of this Directive, applicable for the period running 2021-2030 (approved but not yet published), the criteria for defining a situation of risk have been modified and tightened. The added costs induced by implementation of the Directive or the intensity of exposure to international competition are no longer sufficient on their own to determine a situation of carbon leakage risk. From now on, the only criteria due to be taken into account are concurrent criteria of the intensity of emissions and the intensity of foreign trade, with reference to the "gross value added" (a measure of enterprise profitability), beyond a threshold of 20% (which makes these components particularly significant in economic and strategic terms for all companies in this sector).

In the future Directive, the risk of carbon leakage is clearly established if: EI x TI > 0.2, where:

• EI = intensity of emissions

EI = [direct emissions (kgCO2) + indirect emissions (kgC02)] / VBA (Euros)

• TI = intensity of trade

TI = (exports + imports) / (turnover + imports) (Euros)

and indirect emissions = determined according to power consumption.

If the result of these calculations is lower than 0.2, the European paste production sector will be required to return to the more constraining and costly framework of the general European scheme for emissions allowances.

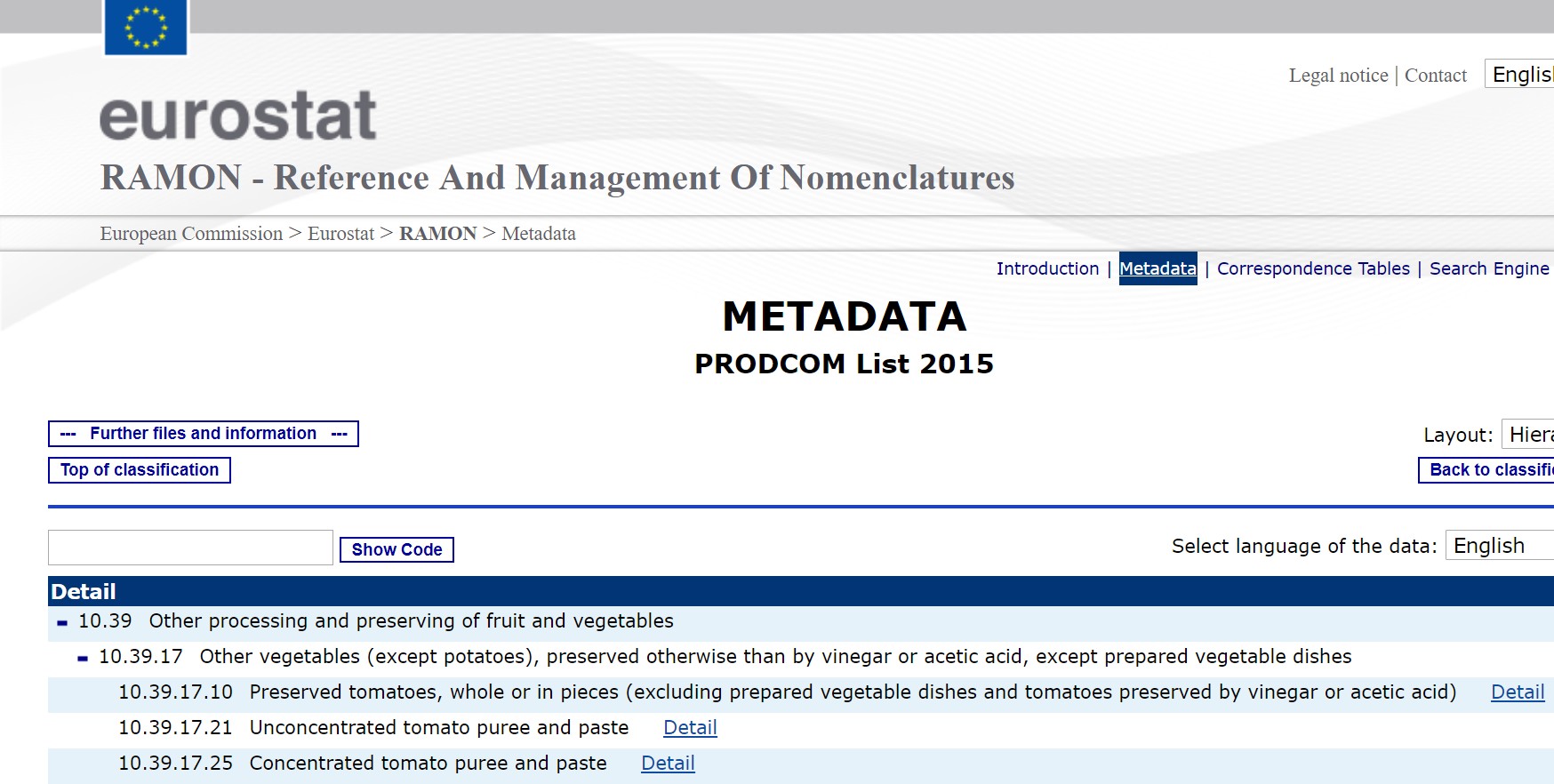

These difficulties linked to the policy itself are compounded by more "administrative" obstacles. During previous reviews of the emissions quota system, our sector was considered from the point of view of the Prodcom classification which, by way of the statistical information supplied, allowed a number of smaller-sized sectors like tomato processing to obtain an acknowledgment of the real risk provoked by the implementation of this Directive with regard to industrial and commercial considerations.

For this latest review of the ETS, the information supplied by the Prodcom8 classification is not relevant with regard to the criteria used for evaluating the risk threshold. The elements used in the scheme (criteria, formulas, calculations, thresholds, etc.) were designed to be applied to measurable data supplied by the sectors as defined in the Statistical classification of economic activities in the European Community (NACE4). The NACE4 classification defines larger sectors of activity. For the specific sector of tomato paste, the calculation would be applied to the general NACE code 1039 "Other processing and preserving of fruit and vegetables" (see appendix), whose study in terms of the intensity of emissions or involvement in the global markets could not objectively guarantee that our sector be kept on the list of sectors vulnerable to carbon leakage.

Without going into too much detail, the European tomato processing industry must now face a major challenge, which is to get the paste subsector recognized as an exception. Keeping this subsector on the list of high risk sectors for carbon leakage implies, among other complications, that data and methods (duly verified, audited and certified) be provided to the Commission, with regard to technical and economical results recorded over the past five years for the sector as a whole and throughout the European Union – despite the fact that some of this information is confidential to the company's concerned. The deadline for submitting requests has been fixed: 30 June 2018.

As things stand, a number of difficulties and uncertainties remain to be clarified. However, professional sources deem that it is still possible to get the paste sector registered on the list of high risk sectors for the next ETS trading round (2021-2030). This list is due to be published in 2019 with measures applicable in 2021.

The importance of the benchmark

Nonetheless, the Commission has already approved the necessary measures to implement an increase in the price of emissions quotas, withdrawing from the market a significant share of the quotas available each year. So it is not currently possible to forecast how this price is going to evolve over the next 5 to 10 years. In any case, the costs at stake are and will be considerable.

At the same time, the demands of the Commission in terms of "carbon performance" are going to become increasingly constraining, requiring companies to constantly improve their real efficiency, with the threat of being deprived of part of their free emissions quotas.

This underlines the vital importance of the benchmark level. The biggest industrial sectors (chemicals, cement, car manufacturing, etc.) already have their own reference system. Compared to these giants, the tomato industry is a "small sector" whose presence in this debate is solely due to the power of its furnace installations and the volume of its energy consumption. This relative weakness means that our sector is likely to be linked to the general benchmarks, which are neither specific nor representative of our activity, and for which emissions quotas are most often proportional to the combustion efficiency. The Directive includes the plan to collect information on a yearly basis regarding the technical evolution of each sector, in order to determine as objectively as possible a minimum threshold for progress in terms of performance. This variable will also determine the progressive decrease in the allocation of free quotas. Linking the paste sector to a general nonspecific benchmark makes our situation even more complicated and uncertain.

In the future, the paste sector will face increasing difficulties in justifying its inclusion on the list of high risk sectors for CO2 leakage. The current Directive, like the one that will be applicable after 2021, states that this list will exist as long as there are countries where emissions are not subjected to an equivalent taxation scheme.

In the future, the paste sector will face increasing difficulties in justifying its inclusion on the list of high risk sectors for CO2 leakage. The current Directive, like the one that will be applicable after 2021, states that this list will exist as long as there are countries where emissions are not subjected to an equivalent taxation scheme.But independently from the relative progress accomplished in third-party countries, it is likely that the European emissions allowances system will evolve in the coming decades towards a situation where no industrial sector is likely to be considered as presenting a high risk of carbon leakage. All sectors will then be included in the general ETS scheme.

Some complementary data

Links:

Documents:

Applicable Directive: Directive 2003-87 ETS

Decision modifying the applicable Directive:

ETS_Amendment_agreement_Nov17

In the future, the paste sector will face increasing difficulties in justifying its inclusion on the list of high risk sectors for CO2 leakage. The current Directive, like the one that will be applicable after 2021, states that this list will exist as long as there are countries where emissions are not subjected to an equivalent taxation scheme.

In the future, the paste sector will face increasing difficulties in justifying its inclusion on the list of high risk sectors for CO2 leakage. The current Directive, like the one that will be applicable after 2021, states that this list will exist as long as there are countries where emissions are not subjected to an equivalent taxation scheme.