We have moved on some weeks since I wrote to you last and we now see a gradual lifting of restrictions on movement and commerce.

Governments anxiously watch the rate of new infections and as these start to rise we will inevitably see the re-imposition of some restrictions.

As the economic devastation of the Pandemic becomes more apparent, our economists debate whether we will see a V a U or perhaps even W shaped recovery.

It is now clear that we face a year or more adapting to a new reality where our Politicians face difficult choices in trying tailor their Macro-economic stimulus policies in response to:

- The numbers of the recently unemployed, the dramatic increase in the poor and the destitute,

- The gradual increasing acceptance by public opinion of the large numbers of those dying with this disease,

- The fear that health facilities will once more be overwhelmed, which will act as a tragic reminder and generate panic if we become too complacent.

I continue to wish that you and your families are all safe & well and to remind you that we humans are the vehicle of transmission of this disease and this Virus Pandemic has demonstrated that it is unforgiving!

I had indicated to you that I would follow up on my original Editorial with a look at Global Supply and demand for Processed tomatoes with a particular emphasis on N. America and the balance of Tomato supplies there.

It is already clear to us all that we have seen major changes in the Global patterns of consumption, where, as I mentioned previously:

- Sales of pasteurized, long life, sterilized or frozen tomato products or products with Tomatoes as a key ingredient have surged to unprecedented levels, with Home deliveries of ready-made Pasta or Pizza remaining strong in many markets.

- Ho-re-ca – The Food Service Sales to Hotels, Restaurants, Catering and School-meals Businesses have shrunk dramatically.

The immediate impact on our industry has been significant, as those in the supply chain for the first group see an increase in demand whilst those who supplied the second have seen an equal and opposite fall in consumption.

There is news that consumers are now adapting their purchasing patterns to this new normal and shopping less frequently for larger quantities.

Importantly, we now start to have data to back up our opinions and the astonishing Mid-March surge in sales (nearly double of that seen in 2019) has now slowed, but the characteristic upturn at month-end April suggests home stock levels are being replenished in what could be an emerging pattern.

These numbers in May and then June will provide important indicators.

The April Sales increase vs 2019 are smaller than those seen in March but nonetheless impressive, with increases in sales of Packaged Preserved Food by 31.4%, Frozen Food by 50% and Frozen Pizza (within the Frozen Pizza category) a remarkable 53%.

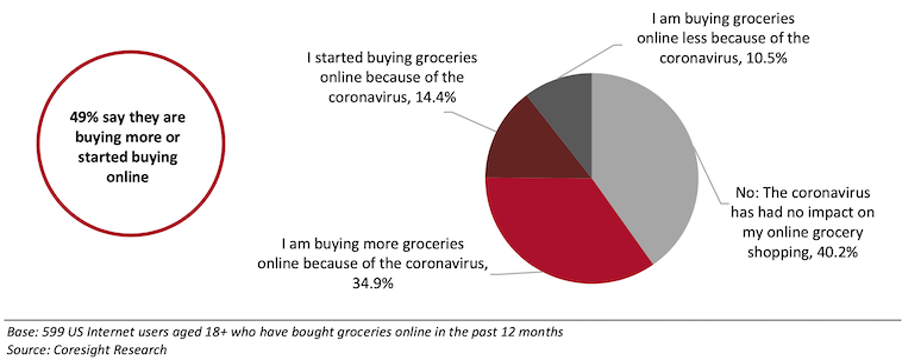

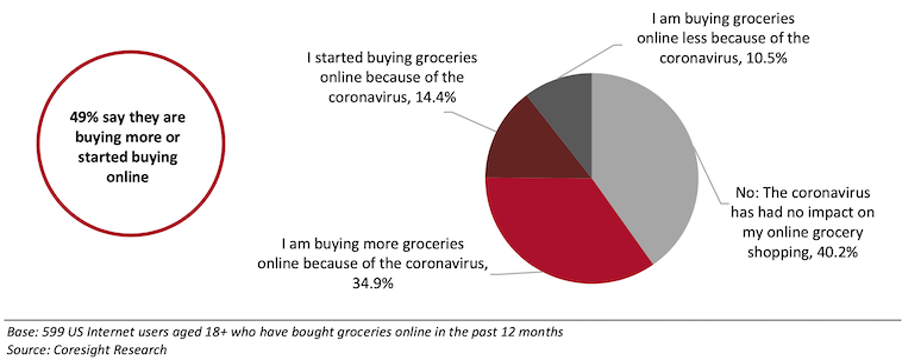

The progressive move to online Grocery purchases has also seen significant increases in almost all global markets.

Grocery Shoppers when asked whether the coronavirus outbreak had impacted their online grocery shopping habits? (% of Respondents)

Will these patterns of consumption remain the same?

The April sales numbers suggest that Consumers have now built a level of Grocery stock at home and are likely, whilst uncertainty persists, to consume and maintain it.

Working from Home encourages eating at Home and reinforces this trend.

If we are realistic, the current tense situation will remain largely unchanged until either a therapy emerges to minimize the virulence of the illness and / or an effective vaccine is developed.

We will also soon learn the answer to the question as to whether infection rates with this Covid 19 virus will be similar to influenza and reduce significantly during the summer months only to re-emerge in Autumn.

The recent resurgence of infections in Singapore, S. Korea and China is a clear reminder that widespread immunity does not yet exist and that the relaxation of lockdowns and Social distancing has a price.

For our Tomato World that means that we will not only have to grow and process this 2020 crop but also to plan and execute the 2021 crop with these issues in mind and as a background.

Most Importantly, in a time of rapid changes of behavior, we must be attentive, watch, record, innovate and adapt as new patterns of consumption appear.

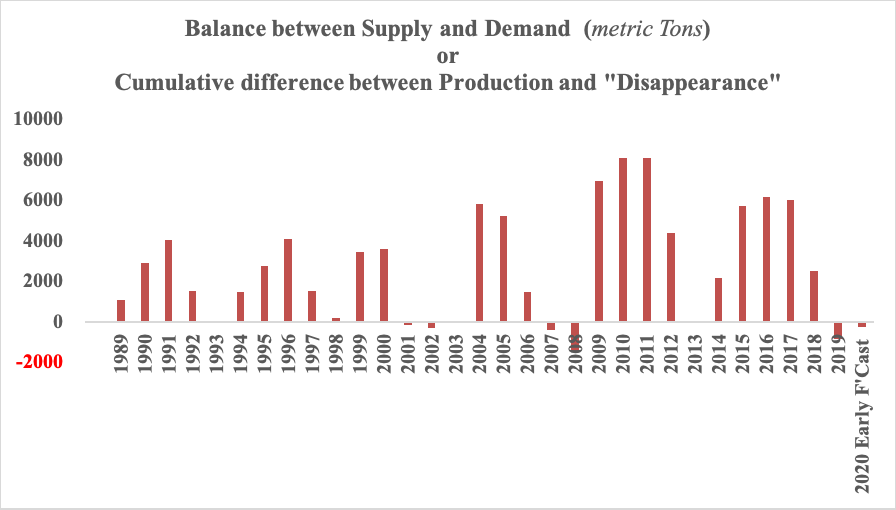

With regard to the most recent forecasts for Global production and the balance between Supply and Demand

On the Supply side, there are currently suggestions that continuing rain and difficult planting conditions in Iberia could reduce the Crop there by 200 to 300 000 tons vs 2019.

There is also a strong rumor that the planted area in California could reduce by 5 - 8 000 acres or 300 to 400 000 short tons as some Companies have re-adjusted volumes to compensate for losses in sales.

With regard to Demand, whilst it is clear that the Pandemic and Eating at Home has promoted the consumption of traditional Tomato products, it is at the moment unclear as to how long this pattern of consumption will continue, whether it will be part of the new normal and whether it will remain unaffected by the economic crisis which is unfolding.

Historically our Tomato products have sold well in times of crisis, they are inexpensive, represent great value and eating at home is cheaper than eating out!

Should this pattern of consumption continue strong it could well boost global annual consumption rates beyond the current 38 to 39 M Tons and disturb the current delicate balance between supply and demand.

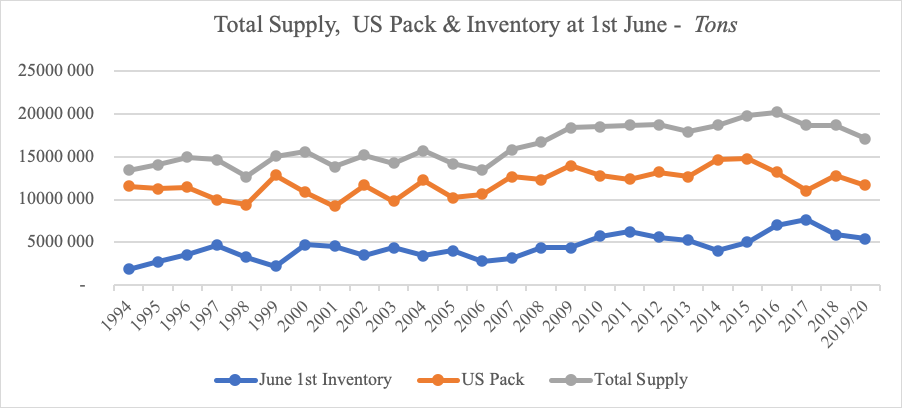

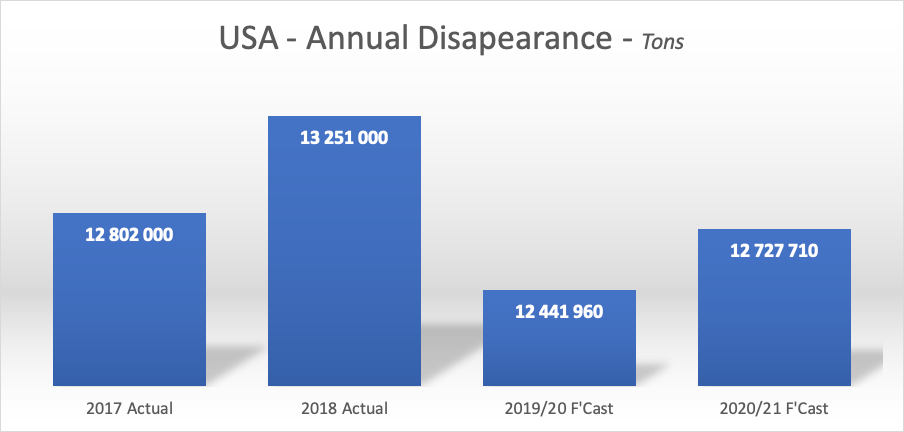

In N America, California dominates the production of Processing Tomatoes with an annual production of around 12 Million Tons and with the further production of 0.5 Million tons in Ontario, Canada and 0.5 M Ton the Mid-West USA.

What could happen to the balance of Supply and Demand for California (& N America) faced with the impact of the Pandemic?

We should assume that:

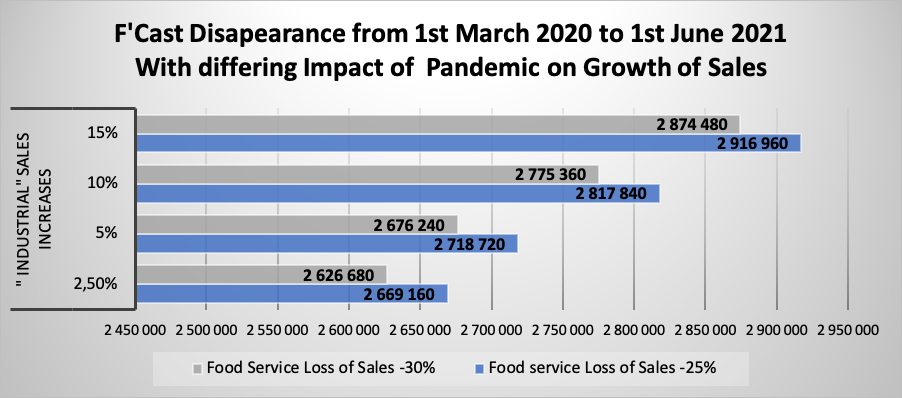

1. Food Service has recently come to represent around 30% of Processed Tomato Consumption in N America.

2. The Covid Pandemic has caused changes in behaviour which have led to a significant increase (>10%?) in the “Disappearance” of Long shelf life or Frozen Tomato products and a decrease (>25%?) in consumption of Food Service products destined to the Restaurant/Hotel and Catering markets.

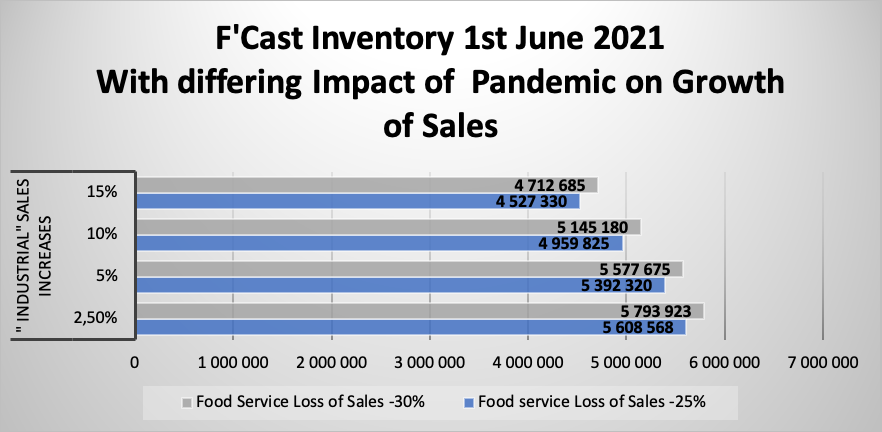

The combination of various percentages of increase in consumption of “Industrial” Tomato products (destined for the production extended shelf life consumer packs) by:

a. 2.5%, 5%, 10% and 15%

And the decrease in Food Service sales by:

b. 25% or 30%

Would cause the Disappearance over the last Quarter the crop year from March 2020 to 1st June 2020 to change as shown below:

If we were then to assume that these patterns are reflected over a full year, we could see the one of the following impacts on the closing inventory at June 1st 2021.

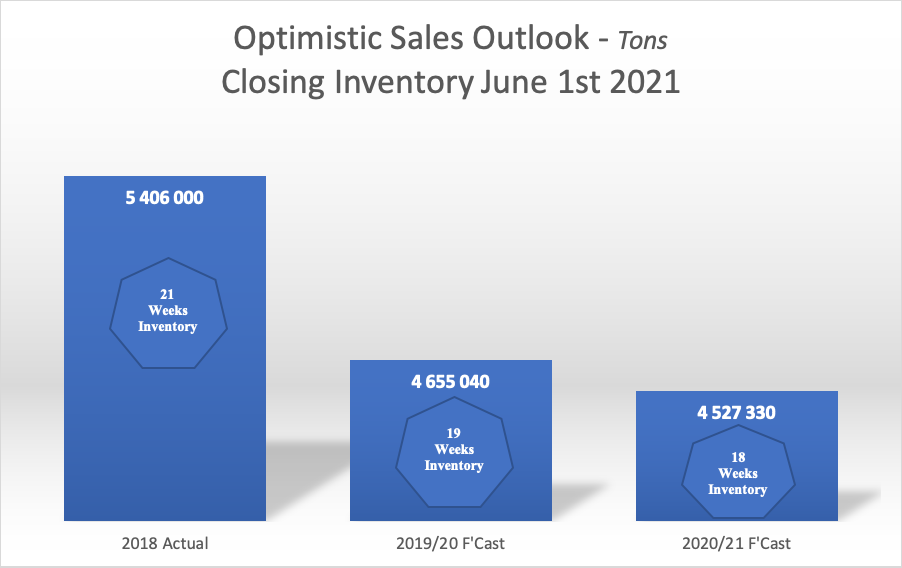

With such rapid and dramatic change, it is obviously difficult to forecast accurately, but the 1st June Inventory numbers which should be available and be announced soon, will provide an important and valuable indication of what is happening.

If, as I expect, the June 1st inventory value is close to 4 650 000 Tons and the strong rumor, that the planted acreage in California has been cut back by processors adjusting volumes to market requirements, is confirmed. This will add weight to my suggestion that although Food Service sales have decreased, the supply of Industrial Tomato products used to manufacture frozen and Long shelf-life Grocery consumer goods are up significantly and the likelihood that June 1st inventory in 2021 will drop to 18 Weeks from the 21 weeks of June 1st 2019.

For those who believe this is too optimistic a scenario it is worth being reminded of the Annual Disappearance of recent years:

My very best wishes to you all, Keep Safe, don't become complacent and continue to take care!

Martin Stilwell, President, Tomato News SAS