Ag Alert

, François-Xavier Branthôme

-

The impact of the COVID-19 pandemic on California agricultural businesses was severe, unprecedented, and will continue to affect the industry for the coming months and years. The report issued by ERA Economics LLC summarizes an evaluation of its impact on California agricultural industries. The study focuses on producers, but also describes and quantifies impacts to other businesses in the integrated agricultural supply chain. Direct economic impacts are reported both for current year-to-date (YTD) changes and for expected annual 2020 changes under two alternative industry recovery scenarios.

This 65-page study should be viewed as an initial assessment based on the data available at the time the study was conducted (late April and May 2020). The pandemic and the resulting associated global slowdown in economic activity continue to change daily. Therefore, these impacts will change and should be updated as additional industry information becomes available. For example, timely access to crop protection products during the upcoming season was noted as a point of concern for the industry. If interruptions in this input supply chain prevent applications during the summer growing season, additional crop damage and losses would occur that are not considered in this analysis. Interruptions in available labor supply due to another wave of the pandemic or localized outbreaks within specific industries (or regions or operations) would also substantially increase estimated impacts.

This 65-page study should be viewed as an initial assessment based on the data available at the time the study was conducted (late April and May 2020). The pandemic and the resulting associated global slowdown in economic activity continue to change daily. Therefore, these impacts will change and should be updated as additional industry information becomes available. For example, timely access to crop protection products during the upcoming season was noted as a point of concern for the industry. If interruptions in this input supply chain prevent applications during the summer growing season, additional crop damage and losses would occur that are not considered in this analysis. Interruptions in available labor supply due to another wave of the pandemic or localized outbreaks within specific industries (or regions or operations) would also substantially increase estimated impacts.The analysis uses a combination of industry production, export, and price data available through early May 2020, extensive industry interviews, and surveys sent to key businesses. Around fifteen interviews and informal conversations were conducted and survey information was gathered from over two dozen agricultural businesses. These data were used to calculate the direct economic impact of the COVID-19 pandemic on 14 commodities/market segments representing the majority of the agricultural value in the state.

Direct economic impacts represent the year-over-year (YOY) change in conditions using the most relevant base period (either 2019, pre-pandemic 2020, or a historical average, as appropriate). It is important to note that other factors, such as tariffs, are affecting industry conditions at the same time as the COVID-19 pandemic. These factors are described for each crop, but there are insufficient data at this time to complete an appropriate analysis that would decompose changes into the various components. Direct economic impacts are presented for total YTD and projected annual impacts under two scenarios to give the reader a sense of the range of potential impacts.

The analysis benefited greatly from growers and other industry experts that participated in the series of interview, calls, and surveys. These data were critical for quantifying the changing, dynamic nature of the pandemic and its effects on the industry. This also provided context for the specific impacts of the pandemic to individual businesses and industries that are obscured in aggregate industry statistics.

Here are following some of the conclusions of the economic impact analysis regarding specific tomato processing sector:

Most of the direct crop losses were to fresh fruit and vegetables that were in season when the COVID-19 pandemic hit. Other crops have seen export market impacts. It is also important to note that some commodities have seen an uptick in demand under the pandemic. This includes shelf-stable items such as rice and processed tomato products.

Most of the direct crop losses were to fresh fruit and vegetables that were in season when the COVID-19 pandemic hit. Other crops have seen export market impacts. It is also important to note that some commodities have seen an uptick in demand under the pandemic. This includes shelf-stable items such as rice and processed tomato products.

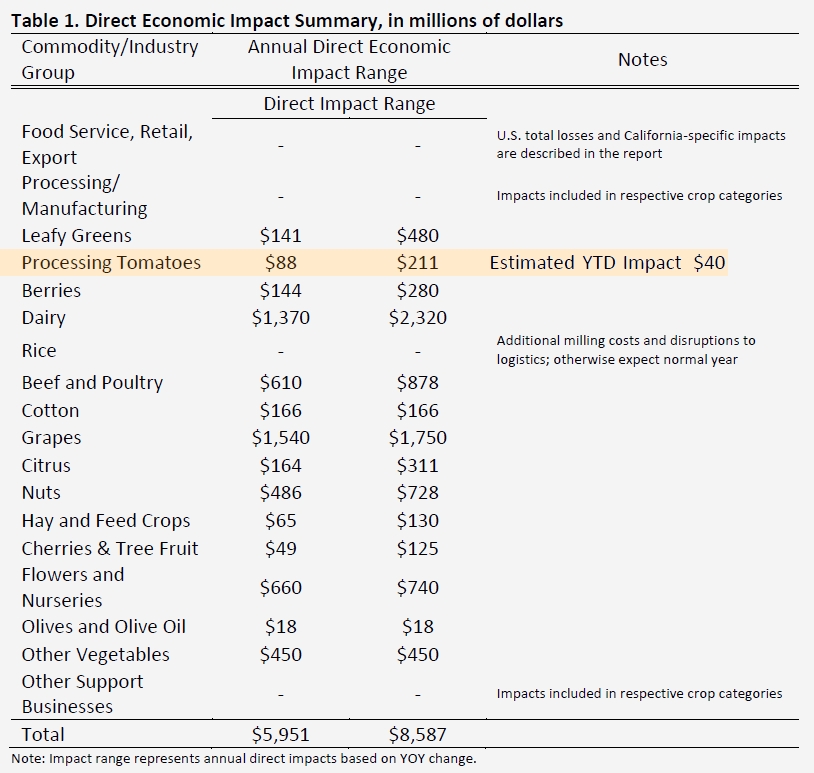

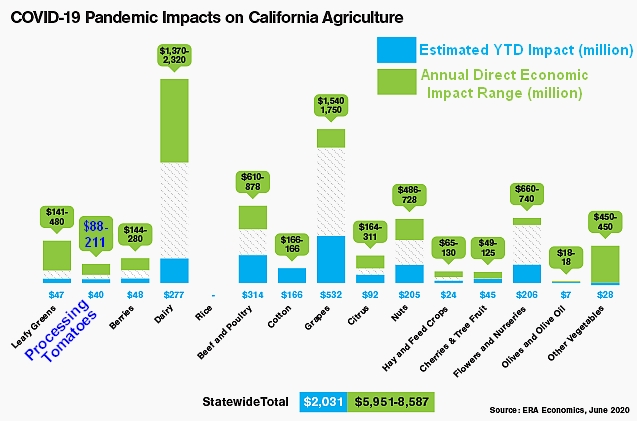

Table 1 summarizes the direct economic impacts of COVID-19 pandemic on California agricultural industries for each crop sector included in the analysis, projected for calendar year 2020.

The timing of impacts varies by commodity and region. Areas like the Imperial Valley and Central Coast that were in the middle of harvest and planting decisions incurred proportionally higher impacts than areas that were not making planting decisions when the shutdown occurred. Other crops that were not yet planted, such as processing tomatoes, saw impacts as contracts were cancelled or revised down. Yet other industries, such as export nuts realized impacts as shipments were delayed, transportation costs increased, and some ports were shut down (e.g., India). The hope is that some of these disruptions are temporary. Finally, other industry impacts are uncertain.

Some industries have benefited from the changes in consumer purchases of shelf-stable items. For example, representatives from the dry beans industry reported that YOY sales were up as much as 20 percent during April and early May. Rice, canned fruit, and processed tomato products have also reported an increase in retail sales that offset some of the losses in the food service market. In addition, some of the impacts of the pandemic in other countries may indirectly benefit California producers by reducing the supply of competing products and/or increasing demand for California products.

Some industries have benefited from the changes in consumer purchases of shelf-stable items. For example, representatives from the dry beans industry reported that YOY sales were up as much as 20 percent during April and early May. Rice, canned fruit, and processed tomato products have also reported an increase in retail sales that offset some of the losses in the food service market. In addition, some of the impacts of the pandemic in other countries may indirectly benefit California producers by reducing the supply of competing products and/or increasing demand for California products.

Regarding the specific California tomato processing activity, the study points out that it generates a farm-gate value between USD 0.9 and USD 1.0 billion annually (CDFA 2020). Processed tomato product exports (including paste, sauce, ketchup, diced, other misc. products) are valued around USD 700 million annually (USDA AMS 2020). Most acreage is planted under contract between March and June, with earlier and later plantings in some years depending on weather, market, and water supply conditions. Early industry reports were that 2020 was shaping up to be a normal year for the industry, with projected acreage comparable to last season (around 230,000 acres) (USDA 2020). One notable caution for that outlook is that water supply is below normal this year. Both the State Water Project and Central Valley Project have announced significant reductions in deliveries to their agricultural users.

Regarding the specific California tomato processing activity, the study points out that it generates a farm-gate value between USD 0.9 and USD 1.0 billion annually (CDFA 2020). Processed tomato product exports (including paste, sauce, ketchup, diced, other misc. products) are valued around USD 700 million annually (USDA AMS 2020). Most acreage is planted under contract between March and June, with earlier and later plantings in some years depending on weather, market, and water supply conditions. Early industry reports were that 2020 was shaping up to be a normal year for the industry, with projected acreage comparable to last season (around 230,000 acres) (USDA 2020). One notable caution for that outlook is that water supply is below normal this year. Both the State Water Project and Central Valley Project have announced significant reductions in deliveries to their agricultural users.

The COVID-19 pandemic coincided with the early part of tomato planting season. Most plantings are under contract with a processor that processes, markets, and sells a range of tomato products to retail, food service, and export markets. The immediate impact of the COVID-19 pandemic has been a reduction in food service demand for processed tomato products. Most processors are set up to produce bulk paste or diced products and would incur costs to shift facilities and produce for retail business. Domestic retail demand has increased as consumers purchase more center-of-store shelf-stable items, including canned tomato products.

The impact of the COVID-19 pandemic on tomato growers is felt through any changes in contracted acreage and price paid by the processors. Early industry reports based on interviews with industry experts indicate that some processors, particularly those more focused on the food service market, did reduce contracted acreage by a few percent in response to the dip in demand. It was also noted that planted acreage could have been reduced further, but most acreage is transplanted, and the plugs had already been produced and paid for at nurseries. If another wave of COVID-19 forces processors to shut down, affects labor availability, or otherwise disrupts the industry, additional impacts could occur during harvest. It is too early in the season to speculate on these potential impacts.

Direct economic impacts of the COVID-19 pandemic are estimated for growers and processors. The direct impact to producers is estimated as the change in planted acreage due to the COVID-19 pandemic. Based on industry feedback, a reduction in contracted acreage of 3-5 percent, or between 7,000 and 12,000 acres, statewide is applied. Using the 5-year historical average statewide price (USD 76.77/short ton in real dollars, or ca Euro/75 per metric tonne (mT)) and yield (49 short tons/acre, or 110 mT/ha) results in a direct impact to growers of between USD 26.3 and USD 45.1 million this year.

The impact of COVID-19 on processors is more difficult to assess. Tomato paste and canned products are storable. The immediate response to a drop in domestic or export demand is to increase inventories. However, increasing inventories incurs carrying costs, and the increase in total supply available puts downward pressure on prices in the future. Food service demand for processed tomato products is down, but retail demand is up because consumers are purchasing more storable food items. Industry sales and store scanner data necessary to quantify the net effect of these trends were not available for this study. Feedback from industry professionals is that, in aggregate, these effects in the domestic market are offsetting. However, the impact varies widely by individual processor.

The third market segment for California processed tomato products is exports. Export quantity is down for most tomato products through March 2020. The changes are driven by a combination of the COVID-19 pandemic and other market conditions, including carryover inventories, consumer demand in export markets, and production in other markets. For example, Italy was hit hard by COVID-19 and this may have affected tomato plantings this year. Italians consume sauce and canned products as staple ingredients in many dishes. Shelter-in-place orders shifted Italian consumers to retail purchases, including larger basket purchases at the store. Similar to the domestic market, tomato product sales in Italy have increased as a result.

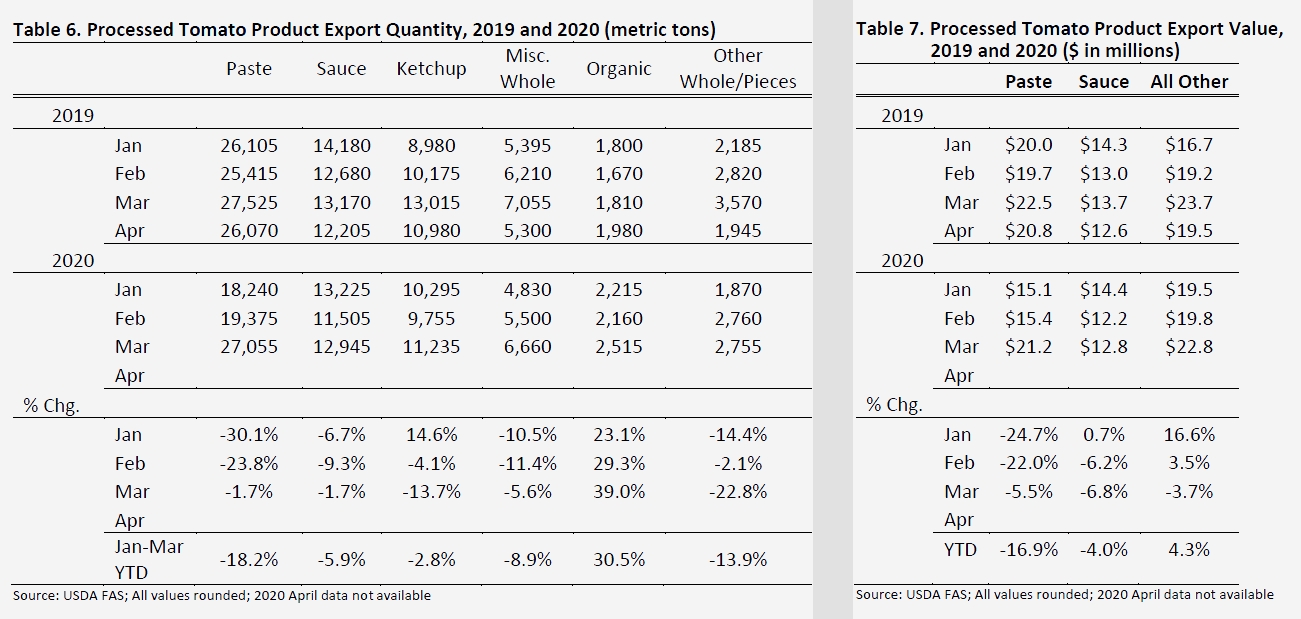

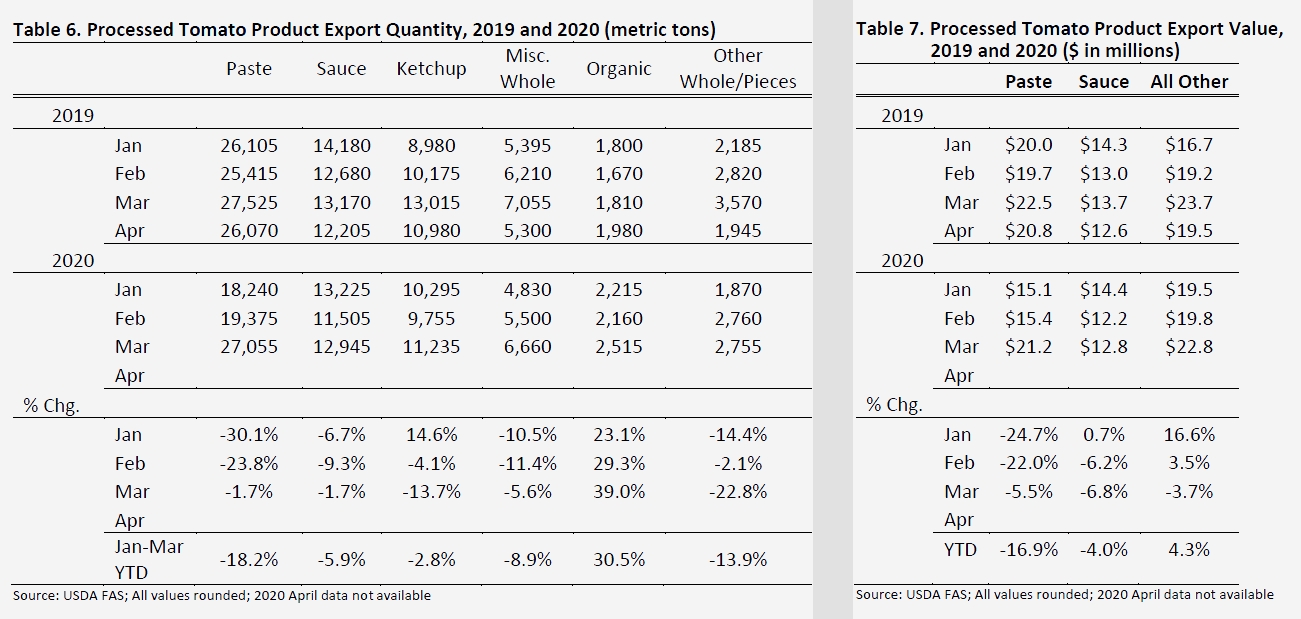

Table 6 summarizes 2019, 2020, and YOY change in export volume by product type. Export quantity is down for paste, sauce, and other tomato products. Organic exports are up YOY, but account for a small share of total export volume. Total January – March export volume is down approximately 10% YOY. January is included in the impact calculation because disruptions in export markets started in late January and early February as the pandemic spread through other parts of the world.

Tomato export prices are generally up since 2019. However, the increase in price does not offset the decrease in quantity, and as a result total export value is down. Table 7 summarizes 2019, 2020, and YOY change in export value by product. Paste and sauce are down 17% and 4%. All other products, including whole, pieces, organic, and ketchup, have increased by 4.3%. Total January – March export value is down by 5.9%, or USD 62 million. An industry summary prepared by Bruno and Evans (2020) (see attached articles below) provides additional discussion of ongoing and expected impacts.

Tomato export prices are generally up since 2019. However, the increase in price does not offset the decrease in quantity, and as a result total export value is down. Table 7 summarizes 2019, 2020, and YOY change in export value by product. Paste and sauce are down 17% and 4%. All other products, including whole, pieces, organic, and ketchup, have increased by 4.3%. Total January – March export value is down by 5.9%, or USD 62 million. An industry summary prepared by Bruno and Evans (2020) (see attached articles below) provides additional discussion of ongoing and expected impacts.

As noted earlier, changes in the export market are driven by other factors in addition to the COVID-19 pandemic. Expected impacts this year depend on the rate of recovery in the global economy, additional flareups of the virus, and shutdowns in the US and around the world. Since tomato products are generally storable and consumers are purchasing more shelf-stable items, it is likely that impacts will be less significant than for fresh produce.

To illustrate the range of potential COVID-19 impacts, YTD losses of USD 62 million are included and two scenarios are developed: one where the recovery starts in June 2020 and gradually increases through the end of the year, and another where consumer demand rebounds rapidly and the export market increases resulting in no additional losses. Both scenarios assume that the impact to the domestic food service market is fully offset by the increase in the retail market. Under these scenarios, estimated losses are between USD 62 and USD 166 million through the end of the year. Total losses to both processors and growers are estimated to be between USD 88.3 and USD 211.1 million through the end of the year.

Other direct production costs to processors and growers are similar to other industries and not quantified in this analysis. Social distancing, training, and additional sanitation add to processing/production costs. Growers have staggered planting crews to minimize contact and increased training to prevent potential transmission of the virus on the job or at home. Masks and other personal protective equipment are being issued at an additional cost. Other grower costs not quantified include education, planter partitions, training, and modifications to crew spacing and schedules. Looking forward, if the global food service sector remains weak, this would result in greater inventory of processed product, fewer tomatoes contracted next season, and lower demand for seed, transplants and other inputs for next year and into the future.

Source: Agalert.com

Further details in the attached document: