Foreign sales of tomato products grow by 4%

Against all expectations, results of Chinese exports for the past six months were made available mid-November, making it possible to bring to a close the results of the 2017/2018 marketing year and opening prospects for 2018/2019.

According to a press release published on 7 November by the General Administration of [Chinese] Customs, “from 1 November 2018, the public can check online at the Customs Administration's portal for import and export commodities, import country of origin (region), export destination country (region), customs statistics and trade methods, as well as import and export goods and consignors […] and other statistical items classified and summarized [regarding] import and export goods trade statistics.”

Tomato news has evaluated the data published on the Chinese Customs Administration website, and concluded that the extent and acquisition capacities of the data on this site are sufficient to draw up a detailed analysis of export operations carried out by the Chinese industry over the past marketing year.

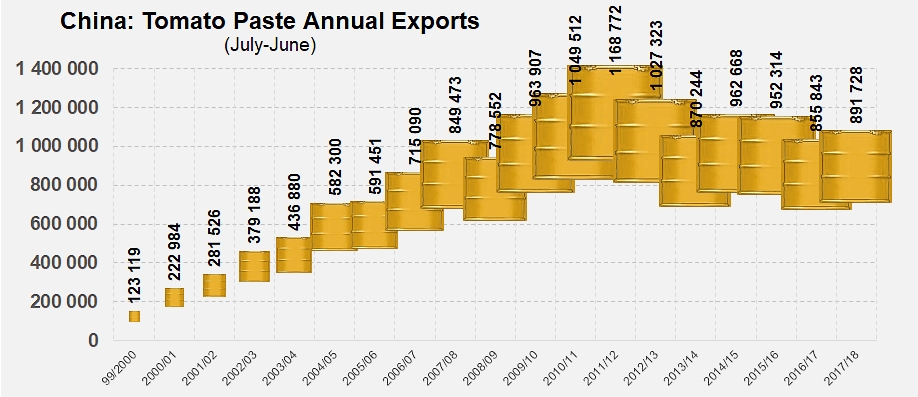

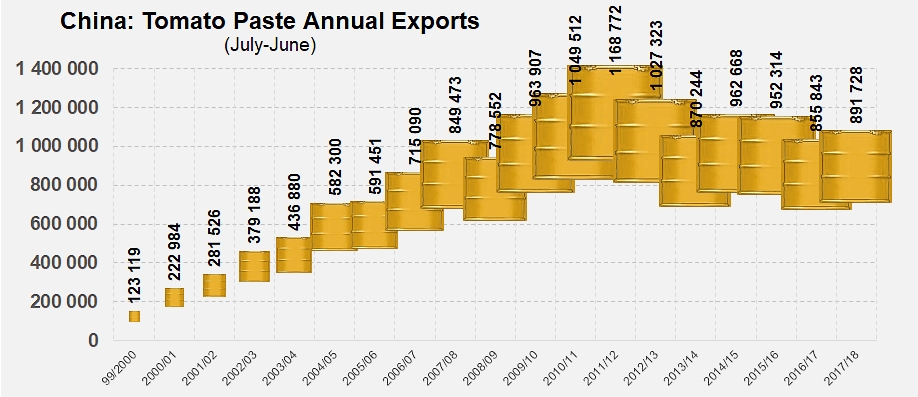

A number of general information points were also deduced from the material supplied by these official sources. Firstly, the available data shows that China's foreign sales results for the 2017/2018 marketing year (891 728 mT, of which 888 111 mT come under the classification of codes 20029011 and 20029019) have actually matched expectations (with a slight increase of approximately 4% compared to the results of the previous marketing year (855 843 mT)). These figures also confirm our estimates (890 000 mT) published on 20 September.

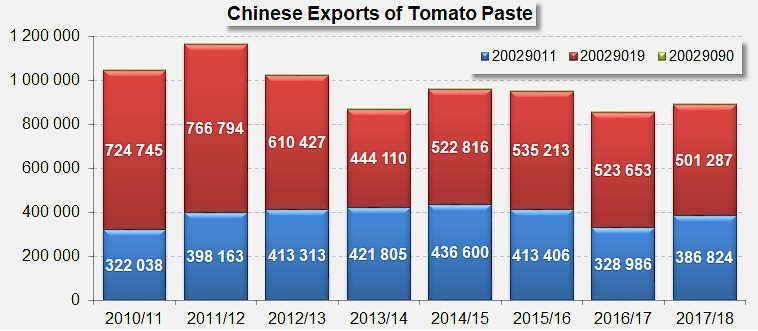

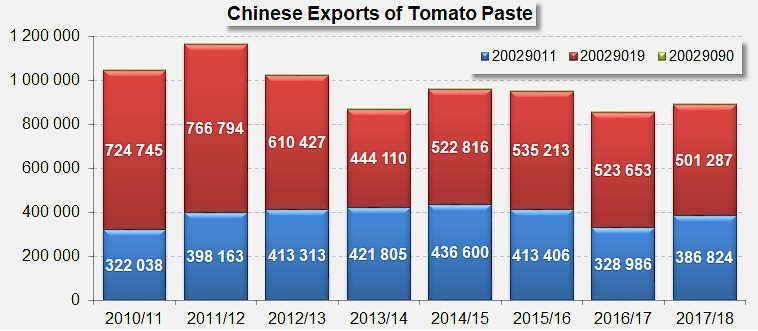

The distribution of paste exports according to product type and conditioning in 2017/2018 does not indicate any great changes compared to previous marketing years: with close on the 387 000 mT shipped over that period, paste in "industrial pack" (tariff code 20029011) intended for industrial use accounted for approximately 43% of the total, which is considerably up on the results of the previous marketing year (329 000 mT and 38% of the volume of the sector). However, this proportion almost identically matched the average pattern of the past three marketing years: it would seem that foreign sales for 2016/2017 focused unusually on products conditioned in catering and retail packs (more than 61% of the volumes shipped), while the 2017/2018 marketing year signaled a return to a more usual dynamic, with 56% (close on 502 000 mT) of the volumes shipped and a long-term pattern that has seen tomato products intended for industrial use progressively lose ground to products that are mainly aimed at end consumers.

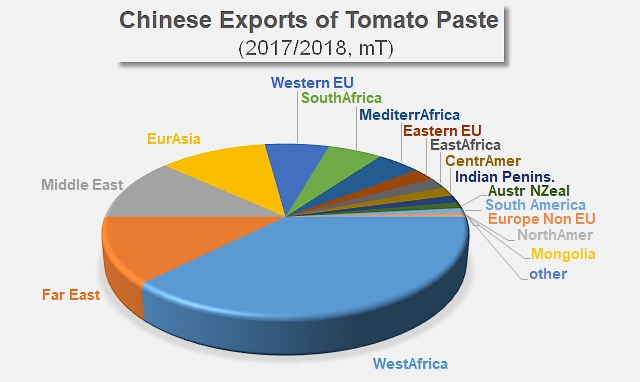

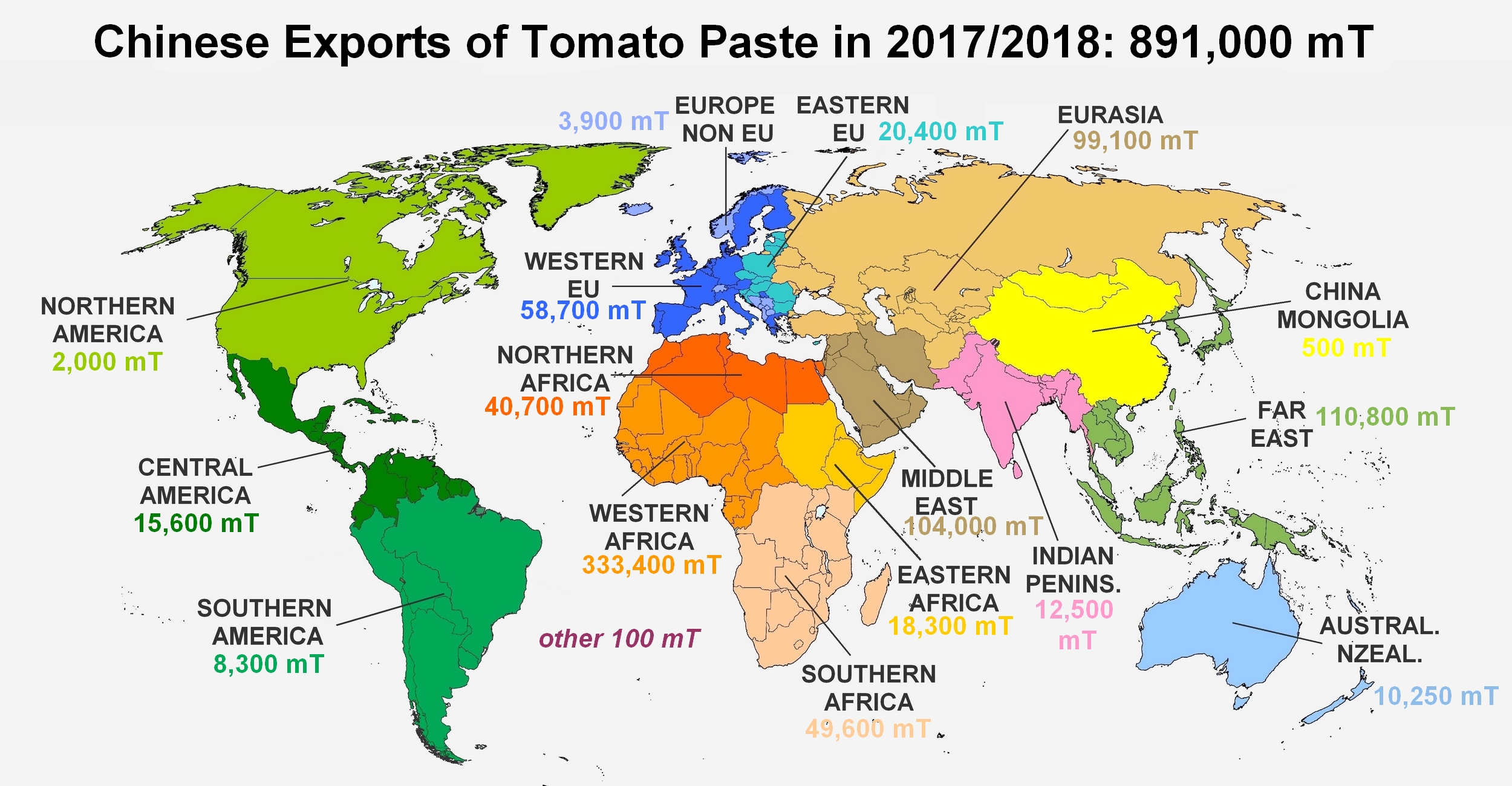

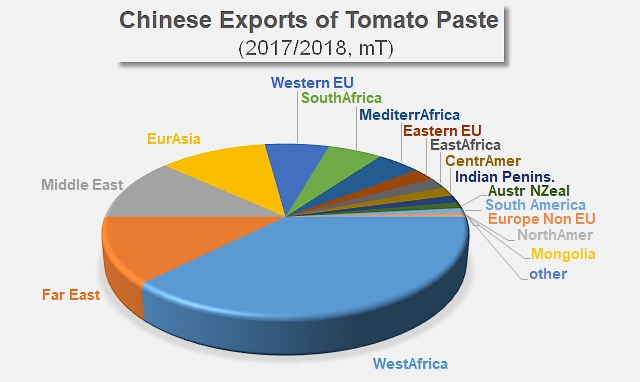

The primary destinations for Chinese paste sales remain the twenty or so destination countries of West Africa (38% of the quantities in 2017/2018), including Nigeria (despite the embargo decreed by the Nigerian government), Ghana, Togo, Benin and Côte d'Ivoire, which make up the main outlets for Chinese products. Over the past marketing year, more than 333 000 mT of finished products were shipped to this region, which is 11% more than during the previous year, but right in line with the average of the three preceding marketing years.

Last year, countries of the Far East, the Middle East and Eurasia confirmed the major role they play in China's export dynamics. Each of these three regions absorbed between 12.5% and 11.2% of the volumes of Chinese products exported in 2017/2018: 111 000 mT were shipped to the Philippines, Japan, South Korea, Malaysia, etc., 104 000 mT were shipped to Saudi Arabia, Yemen, the Emirates, Oman, etc. and slightly more than 99 000 mT mainly to Russia and Kazakhstan.

The Chinese industry achieved about three quarters of its foreign sales in these four regions, with it completed with further shipments of sizable quantities to countries like Italy (36 000 mT), Algeria (34 000 mT), the United Kingdom (10 000 mT), Poland (8 700 mT), Australia (8 300 mT), etc. However, it is important to note that although the 2017/2018 marketing year featured notable improvements for Chinese performances on the markets of the Far East and the Middle East (respectively 7% and 17% compared to the average result of the three previous marketing years – 2014/2015, 2015/2016 and 2016/2017), Chinese operators also recorded notable drops on several major markets like Eurasia (-17%) or Western Europe (-42%, mainly Italy and Germany).

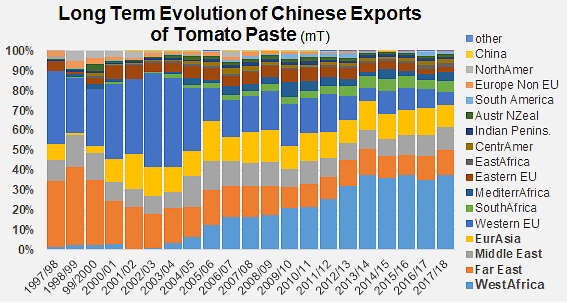

(See appendix for the long term evolution of Chinese tomato products exported under codes 20029011 and 20029019).

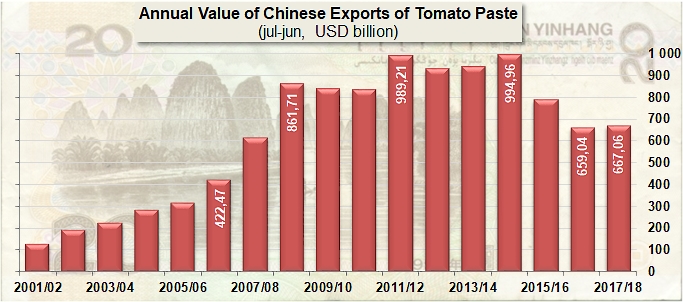

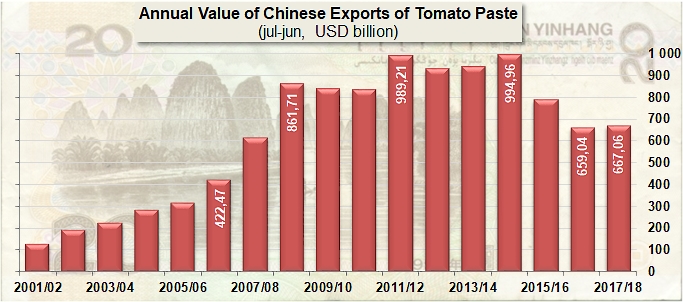

In a particularly deteriorated trade context, the total value of Chinese paste exports during the 2017/2018 marketing year, despite being bolstered by an increase of approximately 4% in volume, only grew by 1%. The year ended on a result of close on USD 667 million. The result of the previous marketing year amounted to USD 659 million.

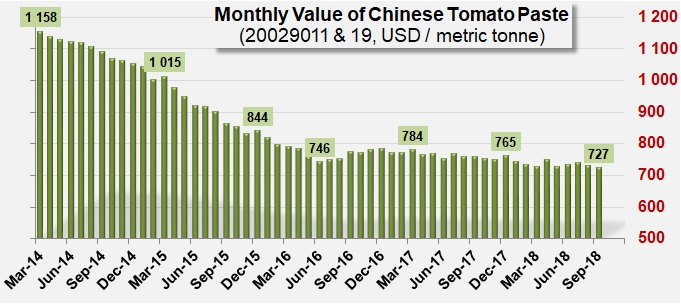

It is noteworthy that the average monthly value of goods shipped by the Chinese industry under customs codes 20029011, 20029019 and 20029090, which had already depreciated at the time when publication of customs statistics was suspended last April, continued its downward slide until June, and even beyond. This value should be differentiated from the monthly quotations made available notably for products from the new 2018 harvest, and it retrospectively applies to export volumes already shipped, but that may have absorbed, over the period considered, products from stocks built up during the previous season and therefore valued at a lower rate than the 2018 harvest. This crop was estimated at close on USD 765 /tonne in December 2017, but dropped to below USD 738 /tonne last June.

For the first three months of the new marketing year (2018/2019), the volumes officially declared to the Chinese customs services amounted to slightly more than 207 000 mT as of 30 September 2018, which is 3% down on the quantities recorded at the same date last year (213 700 mT) and close on 19% lower than those exported during the first term of the 2016/2017 marketing year.

The average monthly value of the products exported, after climbing slightly in July, dropped once again to a level close on USD 727 /tonne in September.

Evolution of the average monthly value of Chinese paste exports.

Source: IHS, Tomato News