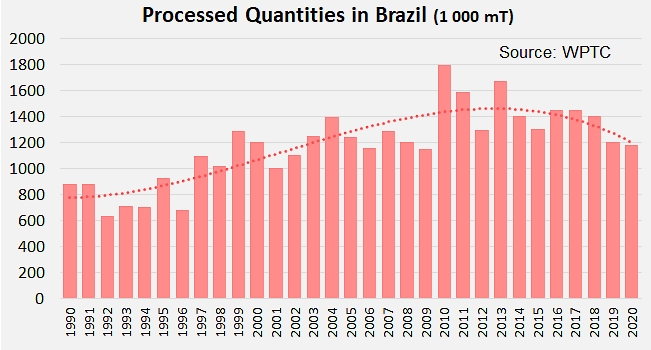

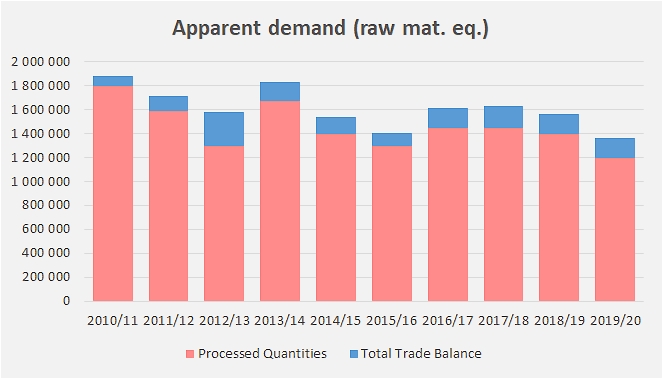

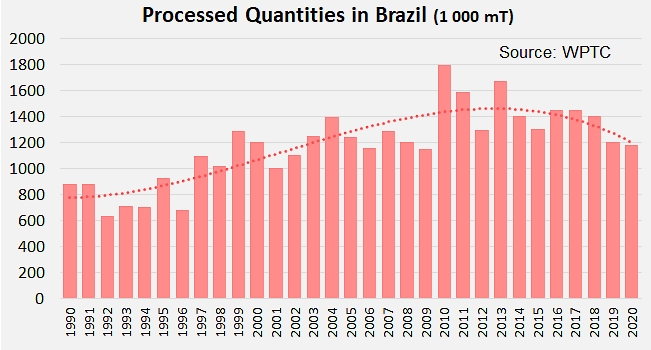

The quantities of tomatoes processed by the Brazilian industry (see also our referenced articles) have been declining steadily for about ten years. Close to 1.8 million metric tonnes (mT) at their peak in 2010, the volumes processed decreased to around 1.2 million mT last year (1.18 million mT), a level that corresponds to close on the average level of operations of the preceding decade (2000-2010). Going against the trends observed at a global level, this decline has been accompanied by a slowdown in the country's apparent consumption (see the appended information at the end of this article), so more than 90% (on average) of the requirements of domestic demand have been met, despite a slight decline in recent years, by the Brazilian sector itself over the past five years.

The explanation for this seemingly paradoxical dynamic probably lies in the weakness of world prices for tomato products in recent years, particularly with regard to concentrated tomato purees, which may have made imports more economically attractive than locally processed products. This can be seen in the relatively large and steadily developing supplies shipped in, not only from neighboring Peru or Chile, but also from more distant origins such as the United States and Italy.

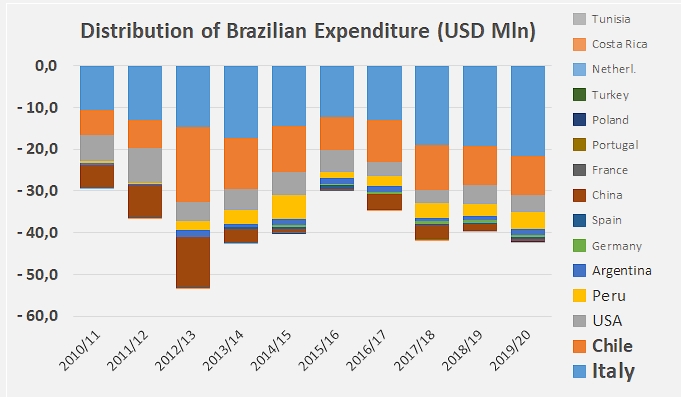

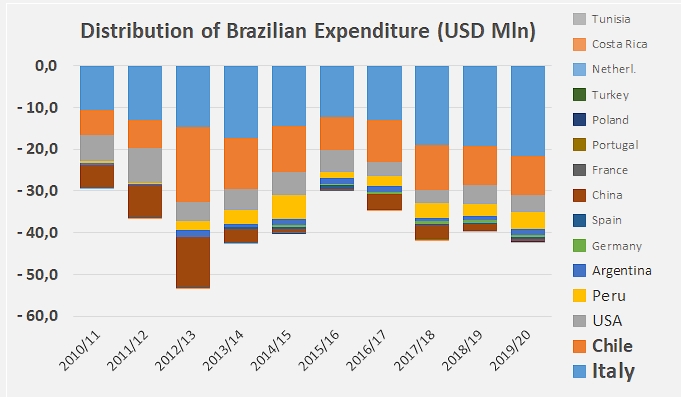

These four countries alone have ensured over the last five years more than 98% of the Brazilian market's supplies in the paste category. Of the 25,000 to 26,000 mT imported annually, over 40% come from Chile, almost a quarter from Italy, 20% from the United States and around 10% from Peru. As for Chinese products, apart from some notable forays into the Brazilian market between 2009 and 2012, they represent only a marginal share of Brazilian purchases.

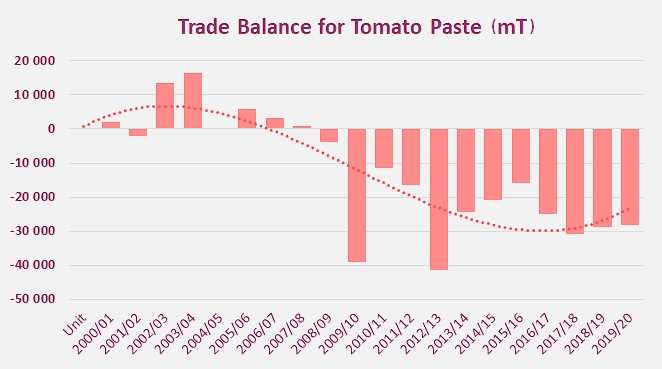

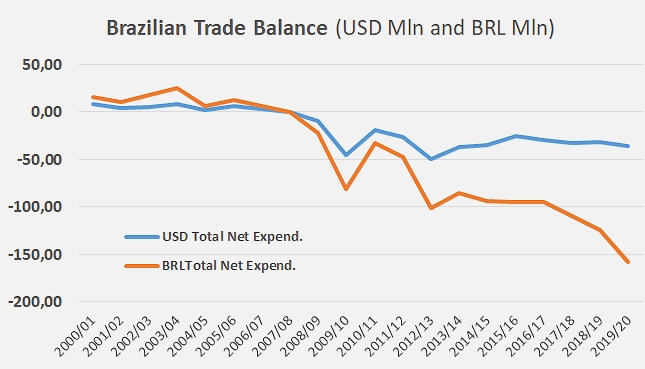

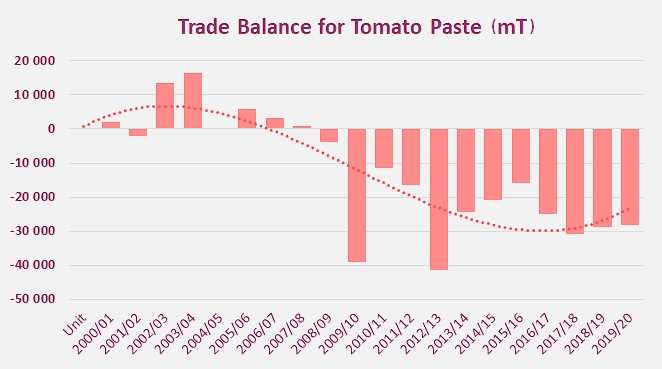

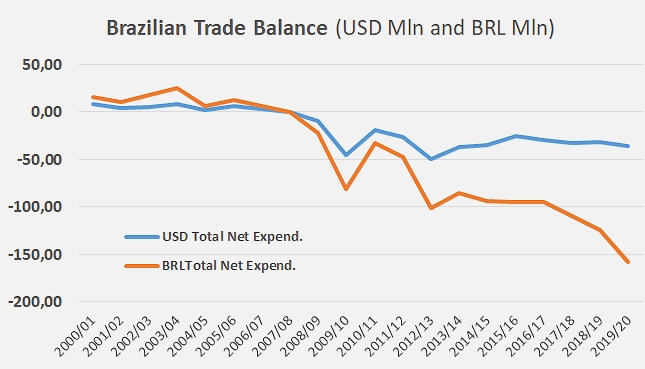

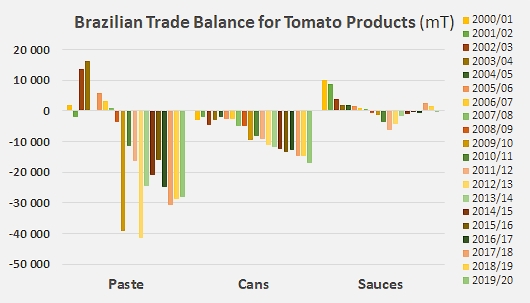

It is also important to note that Brazil's export activity enabled the country to post a positive (albeit irregular) trade balance in this sector until 2006 or 2007, with trade flows of a few thousand tonnes destined for neighboring countries (Argentina, Uruguay, Paraguay and Bolivia). Since that date, the Brazilian paste balance has been chronically in deficit. However, even if net imports seem to be stabilizing or declining in recent years, the amounts paid to external suppliers continue to deteriorate. Successive currency depreciations of the Brazilian real against the US dollar or the euro (see additional information at the end of this article) have had aggravating effects on Brazil's spending in recent years. Practically stable at around USD 33 million for the past six or seven years, the total “price” of foreign supplies of tomato products grew over the same period from BRL 85 million to nearly BRL 160 million.

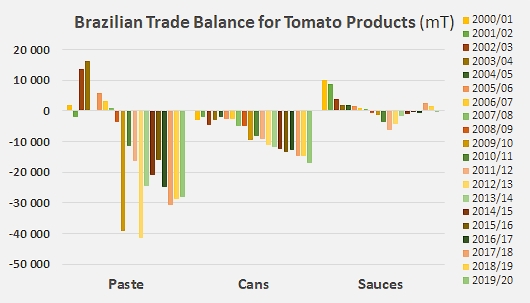

Satisfying Brazilian domestic demand essentially requires the import of pastes and canned tomatoes. The trade balance for the sauces category, for its part, has fluctuated irregularly around its point of balance in recent years, with purchases of Italian, Chilean or Spanish products more or less offsetting sales of Brazilian sauces on the Paraguayan, Argentinian, Venezuelan, Uruguayan, Bolivian, Cuban, and Cape Verdean markets.

So Brazilian expenditure over the last five years has mainly focused on concentrated purees and canned tomatoes, which have respectively accounted for around 65% and 34% of total expenditure. Unsurprisingly, Brazilian canned tomato imports (14,000 to 15,000 mT annually over the last five years) have mainly involved products of Italian origin and, to a lesser extent, from Argentina. This latter category has taken on a considerable importance in the Brazilian tomato products balance in recent years, with annual growth (CAGR) of more than 15%.

All in all, only a fairly small number of countries feature on the Brazilian expense sheet. While it is possible to mention about fifteen national industries that are active on this market, only four or five of them actually achieve a significant turnover in Brazil. One of these is Argentina, which invoiced an average annual amount of USD 1.1 million for its sales of canned tomatoes in Brazil over the past three marketing years. The same can be said for Peru, which exclusively exports tomato pastes, for an average annual amount of USD 3.5 million. Pastes are also the main trade category for shipments from the USA to Brazil, with annual values close to USD 4 million on average over the period considered. More substantial and mostly based on paste sales, the annual Chilean turnover generated by exports of tomato products to Brazil (pastes and sauces) has come close to the threshold of USD 10 million. But it is the Italian industry, thanks to its exports of canned tomatoes (more than USD 10 million per year over the last three years), pastes (USD 6.5 million) and sauces (nearly USD 3.2 million) that claims leading place in the Brazilian market's supply chain, with an annual figure of around USD 20 million, recording an almost uninterrupted increase over the past fifteen years.

Some complementary data

Evolution of apparent disappearance in Brazil, with estimations based on volumes processed by the country's industry overall, and on net imports of tomato products. Over the past nine years, Brazilian demand seems to have been decreasing at an average annual rate of 3.5%.

Variations in the USD / BRL and EUR / BRL exchange rates

Source: Trade Data Monitor LLC

Further details in linked documents: