The tomato paste trade in 2016/2017

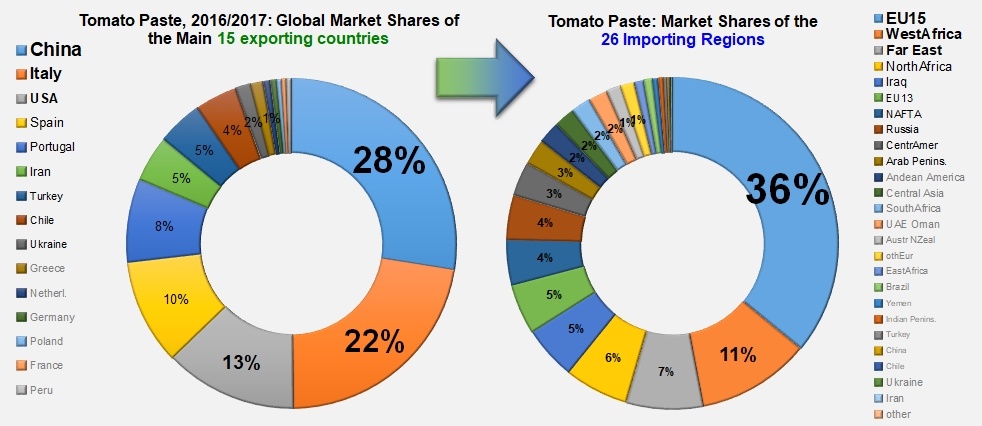

15 countries shared 97% of worldwide supplies in 2016/2017 (3.2 million mT) of tomato paste, with a 1 to 60 ratio between the 1st global paste exporter (China) and the 15th (Peru). Two countries, China and Italy, "control" half of the world's supplies in this category, a portion that increases to close on 80% of the worldwide total if US, Spanish and Portuguese activities are taken into account.

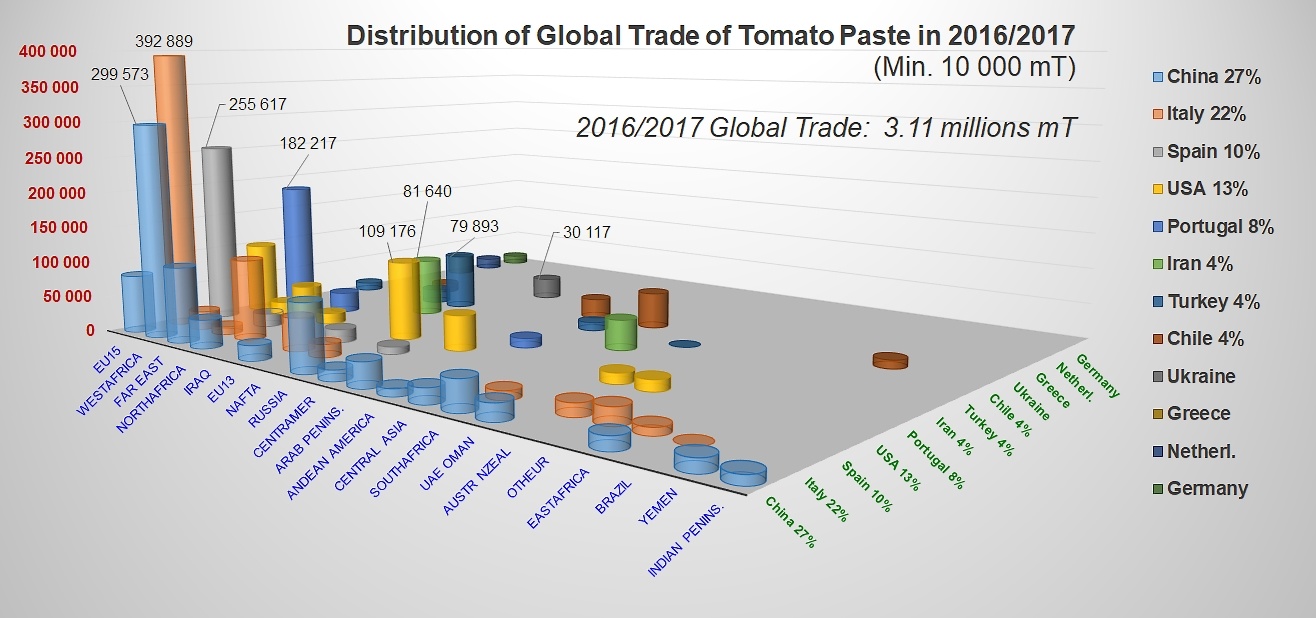

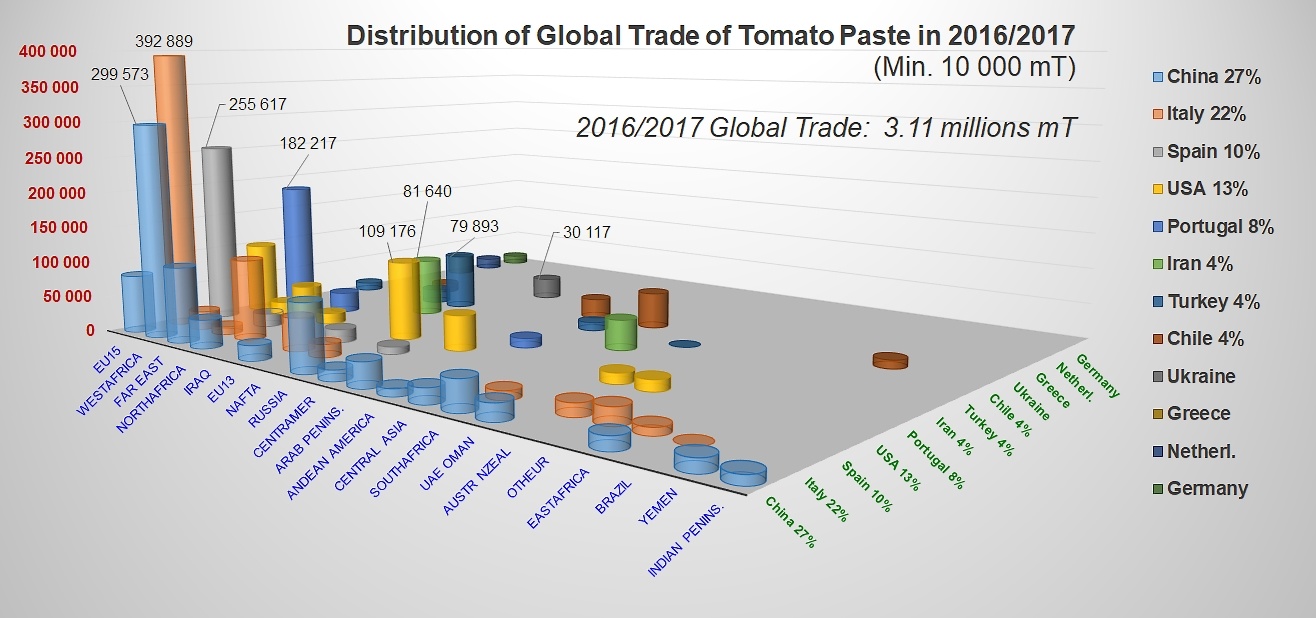

Contributions of the 15 biggest paste supplier countries to the total supplies of the 26 main destination regions.

For these 15 supplier countries, the volumes exported were practically identical in 2016/2017 (+0.3%) to what they had been the previous year (2015/2016). This lack of growth at the worldwide level is the result of a slowdown in trade in a number of importing regions (West Africa, Turkey, Emirates, Southern Africa, EU13, etc.) that has been barely compensated by a limited number of significant increases: North Africa, Andean America, Far East.

Two processing regions have been particularly affected by the slowdown. China's sales to West Africa, the UE15, Southern Africa, the Emirates and the EU13 have decreased sharply. Greece has been mainly affected by a shift in European purchases towards competing providers (the USA, Spain, Portugal), a shift that has also affected Italian exports in this category.

Results for the past five marketing years indicate that China has lost part of its influence on the worldwide paste markets (from more than 33% of global trade in this category in 2012/2013 to less than 27% last year), while its main competitor – Italy – struggles to maintain its share at approximately 22% of the global market. US products have suffered from the shift in currency exchange rate that has been more favorable to the euro than to the US dollar.

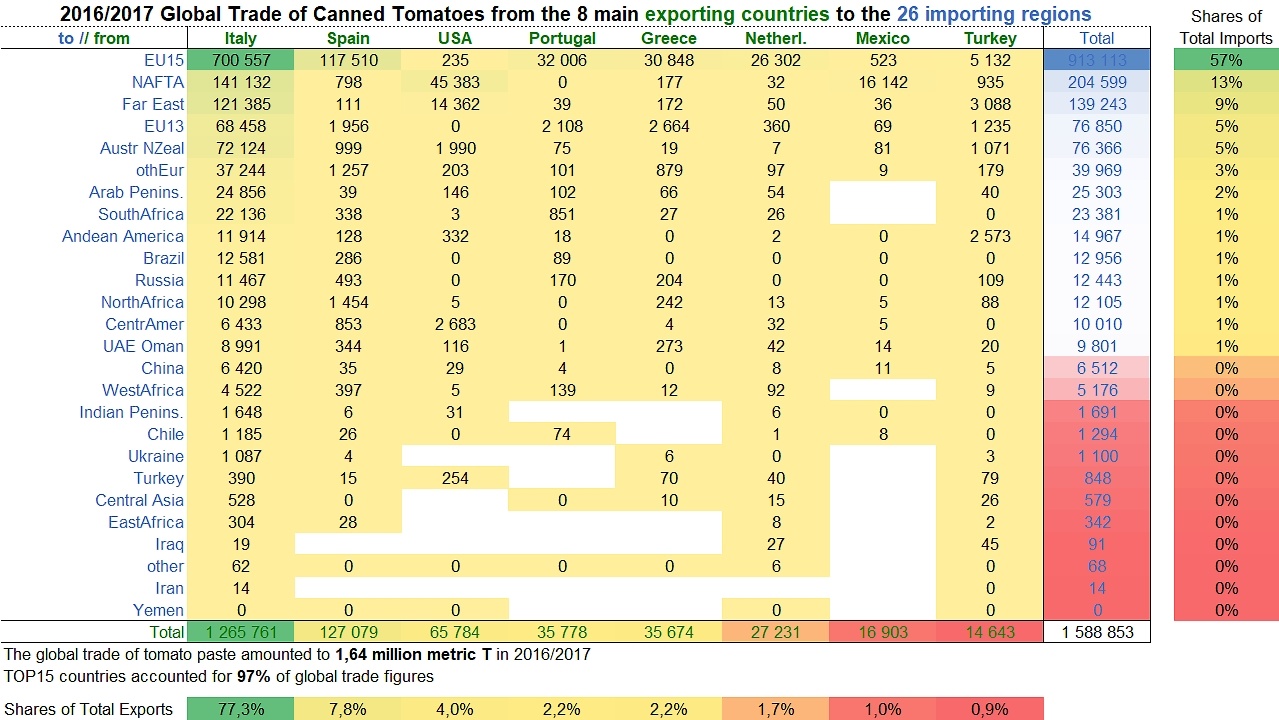

Coming soon, Part 3: The canned tomato trade in 2016/2017

Source: IHS, Tomato News

You can find a more detailed version of this article in the TOMATO NEWS “2018 Processed Tomato Yearbook”. This 100-pages publication gives a comprehensive picture of the global tomato processing industry in 2018 with detailed production figures, a description of the industry in each of the main processing countries, a detailed analysis of trade statistics, the latest WPTC consumption study, prices of tomato paste, a summary of all articles published online in the last year and the complete industry directory.

Copies of the YEARBOOK, which was distributed to all attendees at the 13th World Processing Tomato Congress, can be purchased at a cost of 75 euros (+VAT if applicable but including global postage) from

http://www.tomatonews.com/en/get-listed_5.html