Tomato production in South America

From the Conference presented by João Tavares Correia (CCO Sugal) during the TomatoNews Online Conference held on 17 November 2020.

“I will give you an update about the tomato production in South America.

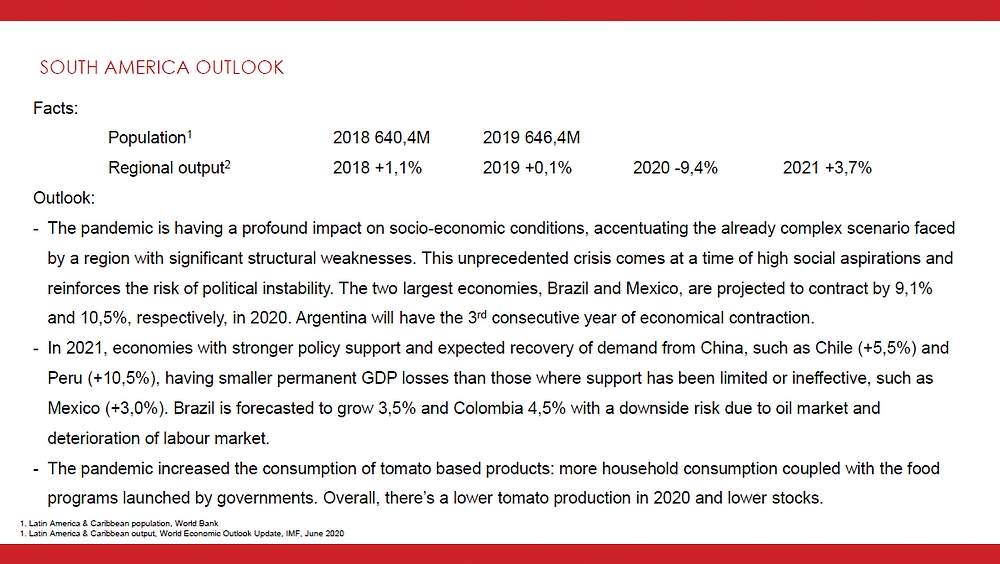

If you look at the South American market, we were already experiencing the beginning of a crisis back in 2019, with a slowdown towards the end of the year that can be seen in regional outputs. We definitely entered the pandemic with a decrease in the GDP that grew up to 9% in economies like Brazil.

Currently, how do we see the future? We see an increasing risk of political instability in some of the economies where there is a stronger growth, due to robust government policy support, but they are exposed to exports from China, particularly in economies like Chile and Peru.

Now from the standpoint of tomato processors, we have been experiencing increases in costs over the last few years, and in order to ensure the long-term sustainability of both processors and farmers, we will need to balance the value creation downstream moving forward.

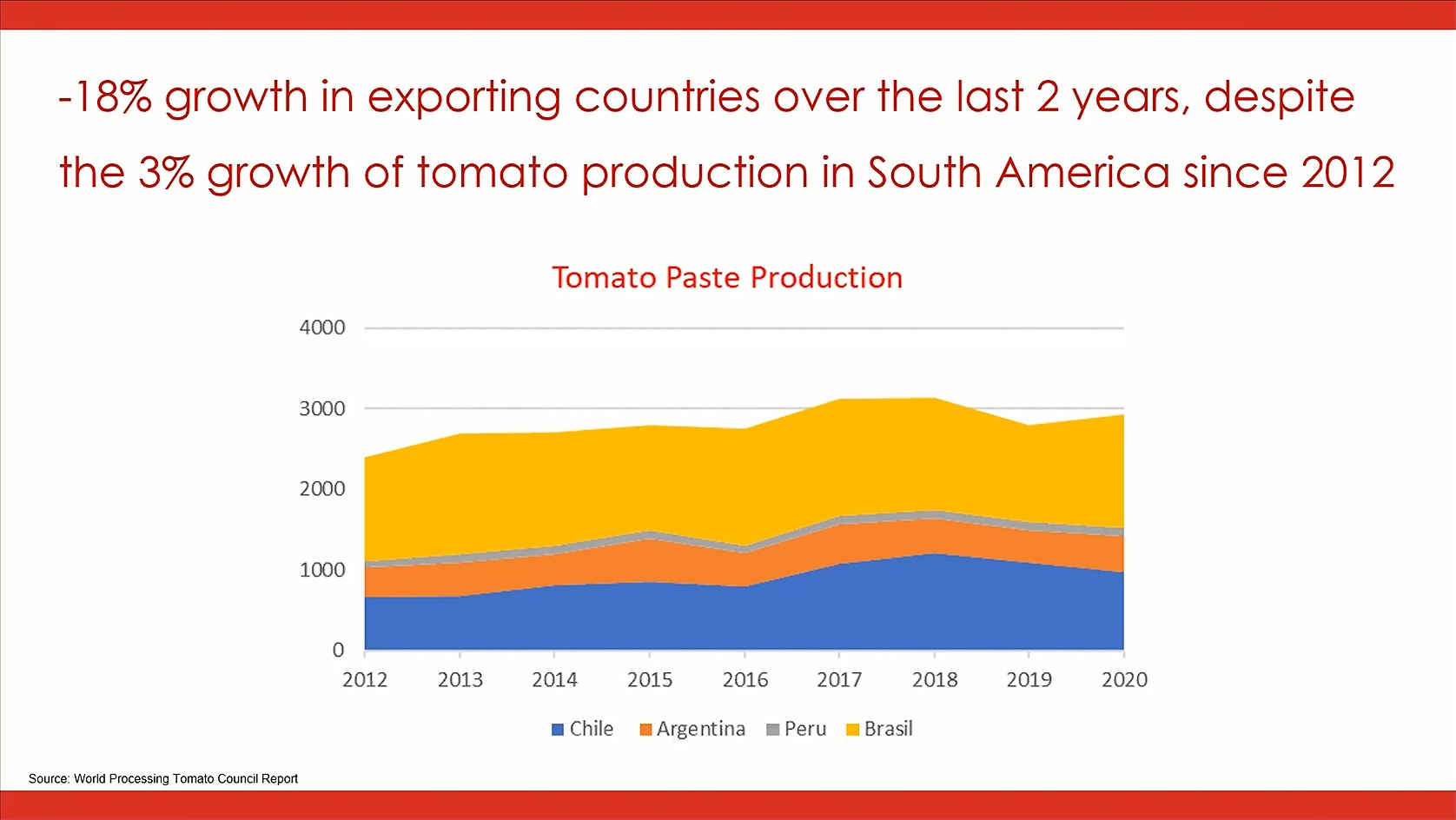

Like my colleagues in the different regions, we have seen the effects of the pandemic overall – we have seen an increased demand on the consumption of tomato paste, which is coupled with a decrease of production in 2020 in exporting countries of the region, and we are also seeing rather low levels of stocks.

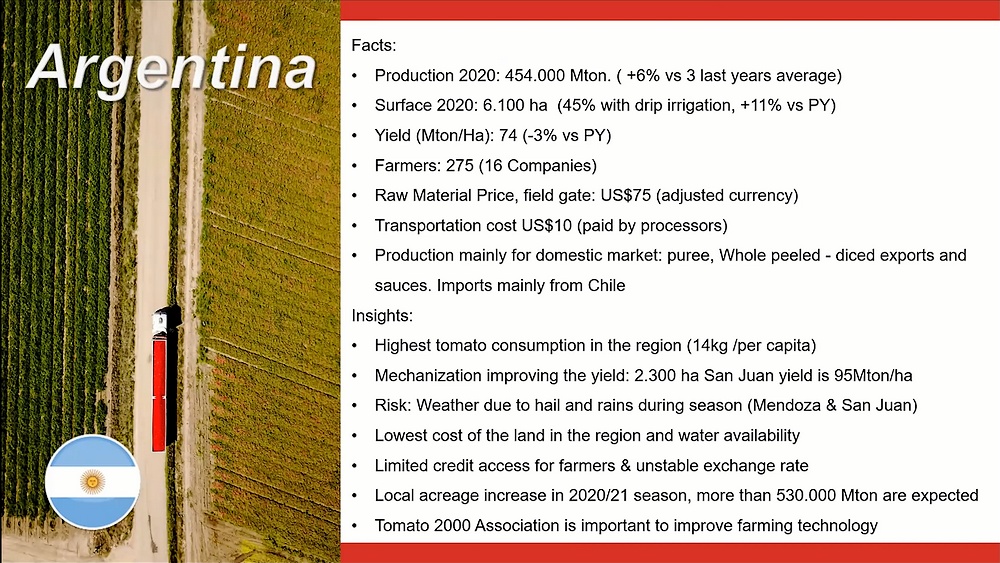

In Argentina, we have seen a production of 454 000 metric tonnes, which is an increase of about 6% against the average of the last few years, and an increase of planted surfaces against the previous year. However, we experienced a decrease in yields last year, down to 74 (mT/ha). We have seen the price of tomato at around 75 US dollars field gate. The production in Argentina is mainly intended for the domestic market and it is also the market where we see the highest consumption of tomato products in the region.

We have seen increasing yields in the San Juan area – 2 300 hectares – due to mechanization technology improvements, up to 95 mT/ha. The risks we are experiencing in Argentina are always due to the weather, with hail and rains during the season in Mendoza and San Juan. We have also seen the lowest costs in the region, and water availability, but the farmers have limited access to credit and there is a rather unstable exchange rate. For 2021, we see an increase of production to more than 530 000 mT.

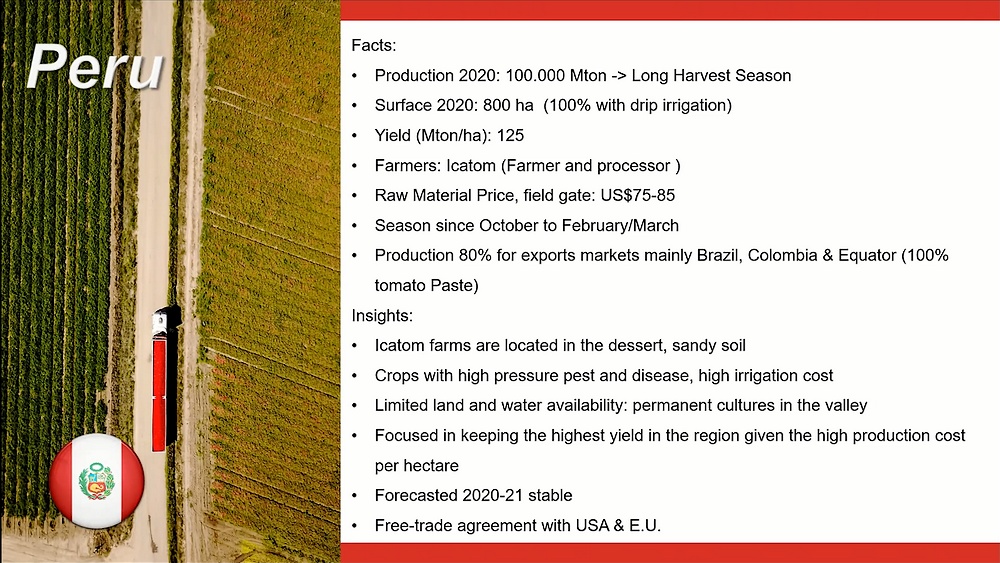

Now, if we look at Peru, production has been fairly stable over the last few years, at around 100 000 metric tonnes, with a field surface in 2020 of 800 hectares, which is 100% under drip irrigation, and a yield of 125 mT/ha. For farmers, it’s an integrated operation of growing and processing, with the raw material price ranging between 75 and 85 US dollars.

The season here is expected to stretch from October right until the end of February or the beginning of March.

Peru is an exporting country of tomato paste and we see that the forecast for next year should be fairly stable.

Brazil recorded a production in 2020 of 1.4 million metric tonnes, with planted surfaces of 14 500 hectares, which is a reduction of 10%, but with an estimated 20% increase in yields versus 2018. It’s a landscape with 125 to 150 farms, with each farmer having 115 to 135 hectares per farm. The raw material price in Brazil is 45 US dollars – I would say “currency adjusted” because of the evolution of currency over the year, and processors and farmers take that into consideration to make sure there is a sustainable business relationship.

There is an increase in Brix content versus previous years. Typically, the Brazilian market serves internal consumption and fulfills the internal market’s quality standards. They do import diced tomatoes, whole-peeled tomatoes and high quality standard paste from Chile and the US.

There is a high percentage of fields irrigated by central pivot aspersion, and less tomato paste consumed because of a reduction in the Brix content for governmental food regulations.

And we see for 2021 that there should be an increase of the surface areas planted with tomatoes in Brazil.

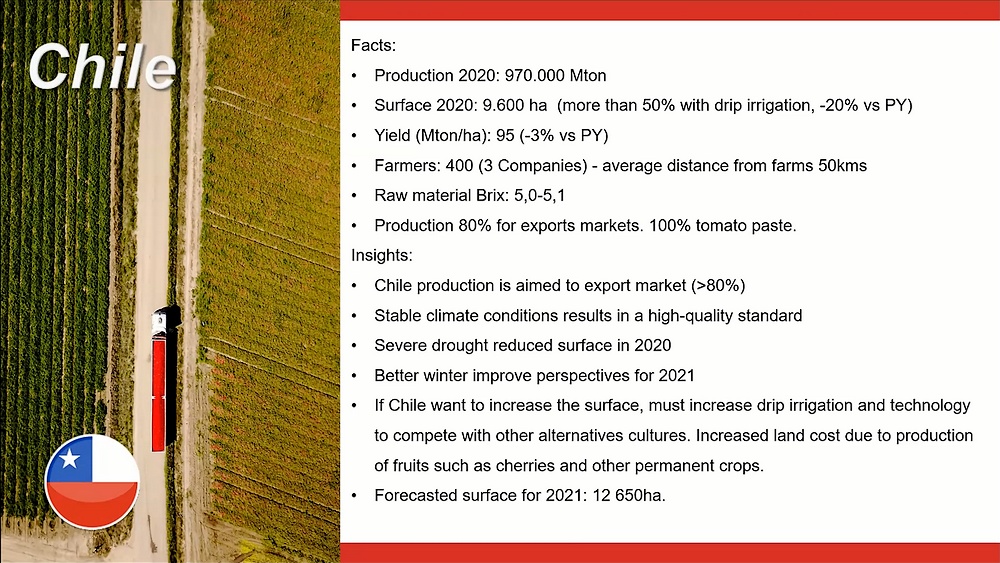

Now for Chile, we have a production of 970 000 metric tonnes, and planted surfaces of 9 600 hectares, with more than 50% watered by drip irrigation. That’s an increase over last year but still represents a 20% decrease over previous years. This is due to the weather conditions and the drought in the country. It has been occurring for ten years but had a severe impact over the past two years, mainly on this year’s harvest.

The yields are around 95 (mT/ha). Due to the drought, there has been an impact there, with a drop of about 3% versus last year.

About 400 farmers supply 3 companies in the country, and we typically have a current Brix of 5 to 5.1.

Chile is an exporting country, with more than 80% of the production going to foreign markets (100% tomato paste). Looking forward, what we can see is that there should be a better winter with improved perspectives for 2021, taking into consideration water availability, and we see a forecast of 12 650 hectares planted next year in Chile.

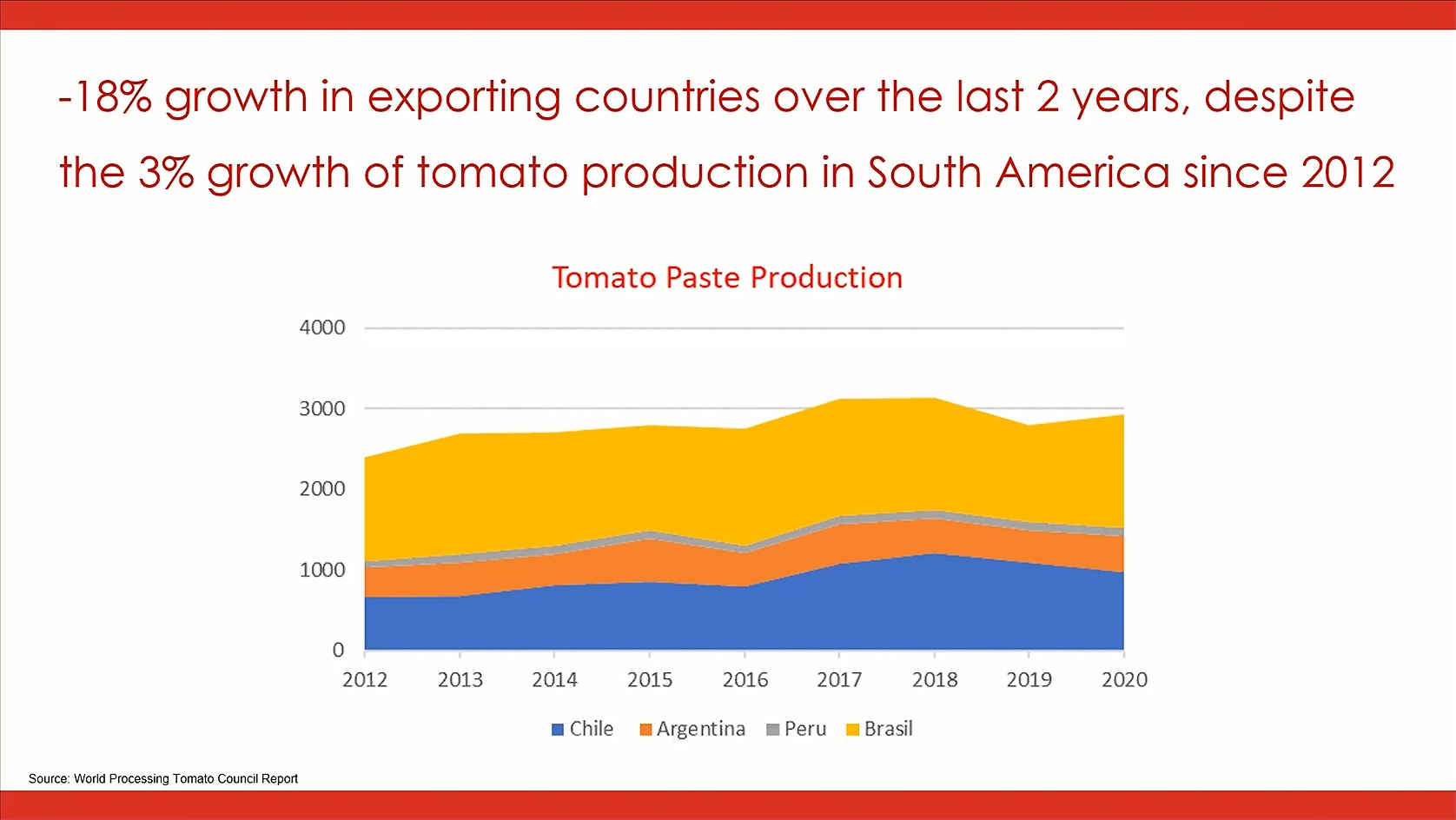

So, if we take into consideration what we are seeing right now, there is a growth in farming and production for next year in the countries that have strong consumption. If you look back, we have experienced a -18% drop over the last three years in exporting countries.

We are experiencing right now rather low stocks so we do expect, also for the sake of the sustainability of the business for the farmers and processors, a rebalancing of their value creation, despite an overall positive trend of growth in tomato production in South America since 2012.”

Further details in attached documents:

South America Tomato Production João Tavares Correia (Sugal) (.pdf)

Most of the other presentations from the Tomato News Online Conference will be transcribed during the coming weeks, but all slides are already available here.

The videos of all the presentations will also be released in a few weeks (they are for now reserved to webinar attendees).